TIME VALUE OF MONEY

TIME VALUE OF MONEY

Future Values and Compound Interest

Interest is the price paid for the use of borrowed money

You have $100 invested in a bank account. Suppose banks are currently paying an interest rate of 6 percent per year on deposits. So after a year, your account will earn interest of $6:

Interest = interest rate × initial investment

= .06 × $100 = $6

You start the year with $100 and you earn interest of $6, so the value of your investment will grow to $106 by the end of the year:

Value of investment after 1 year = $100 + $6 = $106

Notice that the $100 invested grows by the factor (1 + .06) = 1.06. In general, for any interest rate r, the value of the investment at the end of 1 year is (1 + r ) times the initial investment:

Value after 1 year = initial investment × (1 + r )

= $100 × (1.06) = $106

What if you leave this money in the bank for a second year? Your balance, now $106, will continue to earn interest of 6 percent. So

Interest in Year 2 = .06 × $106 = $6.36

You start the second year with $106 on which you earn interest of $6.36. So by the end of the year the value of your account will grow to $106 + $6.36 = $112.36.

In the first year your investment of $100 increases by a factor of 1.06 to $106; in the second year the $106 again increases by a factor of 1.06 to $112.36. Thus the initial $100 investment grows twice by a factor 1.06:

Value of account after 2 years = $100 × 1.06 × 1.06

= $100 × (1.06) 2

= $112.36

If you keep your money invested for a third year, your investment multiplies by 1.06 each year for 3 years. By the end of the third year it will total $100 × (1.06) 3

= $119.10, scarcely enough to put you in the millionaire class, but even millionaires have to start somewhere.

Clearly for an investment horizon of t years, the original $100 investment will grow to $100 ×

(1.06) t

. For an interest rate of r and a horizon of t years, the future value of your investment will be

Future value of $100 = $100 * (1 + r) t

Notice in our example that your interest income in the first year is $6 (6 percent of $100), and in the second year it is $6.36 (6 percent of $106). Your income in the second year is higher

1

because you now earn interest on both the original $100 investment and the $6 of interest earned in the previous year. Earning interest on interest is called compounding or compound interest. In contrast, if the bank calculated the interest only on your original investment, you would be paid simple interest.

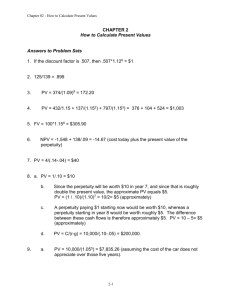

Table 1 illustrate the mechanics of compound interest. Table 1 shows that in each year, you start with a greater balance in your account—your savings have been increased by the previous year’s interest. As a result, your interest income also is higher. Obviously, the higher the rate of interest, the faster your savings will grow.

Table- 1: Compound Interest

Year Balance at start of year Interest earned during year Balance at End of year

1 100 .06 × 100.00 = 6.00 106.00

2

3

106

112.36

.06 × 106.00 = 6.36

.06 × 112.36 = 6.74

112.36

119.10

4

5

119.10

126.25

.06 × 119.10 = 7.15

.06 × 126.25 = 7.57

126.25

133.82

3

4

1

2

Table-2 shows that a few percentage points added to the (compound) interest rate can dramatically affect the future balance of your savings account. For example, after 10 years

1,000 TL invested at 10 percent will grow to 1,000 × (1.10) 10

= 2,594 TL. If invested at 5 percent, it will grow to only $1,000 × (1.05)10 = $1,629.

Table-2: Future Value of 1 TL

Number of Years 5% 6%

Interest Rate Per Year

7% 8% 9% 10%

1,050

1,103

1,060

1,124

1,070

1,145

1,080

1,166

1,090

1,188

1,100

1,210

5

10

20

30

1,158

1,216

1,276

1,629

2,653

4,322

1,191

1,262

1,338

1,791

3,207

5,743

1,225

1,311

1,403

1,967

3,870

7,612

1,260

1,360

1,469

2,159

4,661

10,063

1,295

1,412

1,539

2,367

5,604

13,268

1,331

1,464

1,611

2,594

6,727

17,449

2

Manhattan Island

Almost everyone’s favorite example of the power of compound interest is the sale of

Manhattan Island for $24 in 1626 to Peter Minuit. Based on New York real estate prices today, it seems that Minuit got a great deal. But consider the future value of that $24 if it had been invested for 374 years (2000 minus 1626) at an interest rate of 8 percent per year:

$24 × (1.08) 374 = $75,979,000,000,000

= $75.979 trillion

Perhaps the deal wasn’t as good as it appeared. The total value of land on Manhattan today is only a fraction of $75 trillion.

Though entertaining, this analysis is actually somewhat misleading. First, the 8 percent interest rate we’ve used to compute future values is quite high by historical standards. At a 3.5 percent interest rate, more consistent with historical experience, the future value of the $24 would be dramatically lower, only $24 × (1.035)374 = $9,287,569! Second, we have understated the returns to Mr. Minuit and his successors: we have ignored all the rental income that the island’s land has generated over the last three or four centuries.

Present Values

Money can be invested to earn interest. If you are offered the choice between $100,000 now and $100,000 at the end of the year, you naturally take the money now to get a year’s interest.

The main principle is:

A dollar today is worth more than a dollar tomorrow

We have seen that $100 invested for 1 year at 6 percent will grow to a future value of 100 × 1.06 = $106. Let’s turn this around: How much do we need to invest now in order to produce $106 at the end of the year? Financial managers refer to this as the present value (PV) of the $106 payoff.

Future value is calculated by multiplying the present investment by 1 plus the interest rate,

.06, or 1.06. To calculate present value, we simply reverse the process and divide the future value by 1.06:

PV=

FV

( 1

i ) n

FV * (

( 1

1 i ) n

106

1 , 06

100

What is the present value of, say, $112.36 to be received 2 years from now? Again we ask,

“How much would we need to invest now to produce $112.36 after 2 years?” (İnterest rate=%6)

3

PV=

FV

( 1

i ) n

FV * (

( 1

1 i ) n

112 , 36

( 1 , 06 )

2

100

In this context the interest rate r is known as the discount rate and the present value is often called the discounted value of the future payment.

Example : Suppose you need $3,000 at the end of 2 years to buy a new computer. The interest rate is 8 percent per year. How much money should you set aside now in order to pay for the purchase?

PV=

FV

( 1

i ) n

FV * (

( 1

1 i ) n

3000

( 1 , 08 ) 2

$ 2572

The expression in the formula 1/(1 + r) t is called the discount factor. It measures the present value of $1 received in year t. These factors for different interest rates and time are calculated and dispalyed in the present value tables. Then, the formula can be changed as:

PV=FV*PVF

%,n

PVF

%,n is the value of present value tables for given interest rate and time.

Table 3: Present value of 1 TL

Number of Years 5% 6%

Interest Rate Per Year

7% 8% 9% 10%

1

2

0,952 0,943 0,935 0,926 0,917 0,909

0,907 0,890 0,873 0,857 0,842 0,826

3

0,864 0,840 0,816 0,794 0,772 0,751

4

5

10

0,823

0,784

0,792

0,747

0,763

0,713

0,735

0,681

0,708

0,650

0,683

0,621

0,614 0,558 0,508 0,463 0,422 0,386

20

0,377 0,312 0,258 0,215 0,178 0,149

30

0,231 0,174 0,131 0,099 0,075 0,057

Try using Table 3 to check our calculations of how much to put aside for that $3,000 computer purchase. If the interest rate is 8 percent, the present value of $1 paid at the end of 2 year is $.857. So the present value of $3,000 is:

PV=FV*PVF

%8,2

=3000*0,857= $2572

4

Example: In 1995 Coca-Cola Enterprises needed to borrow about a quarter of a billion dollars for 25 years. It did so by selling bonds, each of which simply promised to pay the holder $1,000 at the end of 25 years.1 The market interest rate at the time was 10 percent.

How much would you have been prepared to pay for one of the company’s bonds?

To calculate present value we multiply the $1,000 future payment by the 25-year discount factor:

PV=FV*PVF

%10,25

=1000*0,092= $ 92

Example: Kangaroo Autos is offering free credit on a $10,000 car. You pay $4,000 down and then the balance at the end of 2 years. Turtle Motors next door does not offer free credit but will give you $500 off the list price. If the interest rate is 10 percent, which company is offering the better deal?

FINDING THE INTEREST RATE

For example , when Coca-Cola borrowed money for 25 years, it did not announce an interest rate. It simply offered to sell each bond for $129. Thus we know that

FV= 129* (1+r)

25

$129 × (1 + r) 25

= $1,000

(1 + r) 25 = $1,000/129= 7.75

(1 + r) = (7.75) 1/25 = 1.0853 r = .0853, or 8.53%

Example : your investment adviser promises to double your money in 8 years. What interest rate is implicitly being promised? (answer: %9,05)

Example : Suppose that your auto dealer gives you a choice between paying $15,500 for a new car or entering into an installment plan where you pay $8,000 down today and make payments of $4,000 in each of the next two years. Which is the better deal? Assume that the interest rate you can earn on safe investments is 8 percent.

ANNUITY

The term annuity is used in finance theory to refer to any terminating stream of fixed payments over a specified period of time. Examples of annuities are regular deposits to a savings account, monthly home mortgage payments and monthly insurance payments.

PRESENT VALUE OF ANNUITY

Present value of t-year annuity = payment * annuity factor

5

PVA

A *

( 1

( 1

i ) n i ) n

* i

1

( 1

( 1

i ) n i ) n

1

* i

is annuity factor and can be found in present value tables for any given interest rate and time combination.

Example

: Kangaroo offers an “easy payment” scheme of $4,000 a year at the end of each of the next 3 years. What is perent value of payments? (Interest rate is %10)

PVA

A *

( 1

( 1

i i ) n

) n

1

* i

4000

(

( 1

1

0

0 , 1 )

, 1 )

3

3

*

0

1

, 1

4000 * 2 , 48685

$ 9947 , 41

If you solve this question by using present value tables;

PVA= A*PVFA

%,n

= 4000*2,487= $ 9948

Example : If you get 1000 TL consumer loan from bank for 12 months and monthly interest rate is %2, what will be montly equal payments?

PVA= A*PVFA%,n

1000=A*10,575

A= 94,56 TL

Example : In May 1992, a 60-year-old nurse plunked down $12 in a Reno casino and walked away with the biggest jackpot to that date—$9.3 million. We suspect she received unsolicited congratulations, good wishes, and requests for money from dozens of more or less worthy charities, relatives, and newly devoted friends. In response she could fairly point out that her prize wasn’t really worth $9.3 million. That sum was to be paid in 20 annual installments of

$465,000 each. What is the present value of the jackpot? The interest rate at the time was about 8 percent.

The present value of these payments is simply the sum of the present values of each payment.

But rather than valuing each payment separately, it is much easier to treat the cash payments as a 20-year annuity. To value this annuity we simply multiply $465,000 by the 20-year annuity factor:

PVA= A*PVFA%,n

PVA= 465,000* 9,818= 4,565,370 TL

That “$9.3 million prize” has a true value of about $4.6 million.

6

How Much Luxury and Excitement Can $96 Billion Buy?

Bill Gates is reputedly the world’s richest person, with wealth estimated in mid-1999 at $96 billion. We haven’t yet met Mr. Gates, and so cannot fill you in on his plans for allocating the

$96 billion between charitable good works and the cost of a life of luxury and excitement

(L&E). So to keep things simple, we will just ask the following entirely hypothetical question:

How much could Mr. Gates spend yearly on 40 more years of L&E if he were to devote the entire $96 billion to those purposes? Assume that his money is invested at 9 percent interest.

The 40-year, 9 percent annuity factor is 10.757. Thus

Present value = annual spending × annuity factor

$96,000,000,000 = annual spending × 10.757

Annual spending = $8,924,000,000

Warning to Mr. Gates: We haven’t considered inflation. The cost of buying L&E will increase, so $8.9 billion won’t buy as much L&E in 40 years as it will today. More on that later.

Example: If you buy a 5 years bond, you will get $100 coupon payments for each year. The nominal value of bond is $1000. So how much should you pay for bond the most? (Discount rate is %12)

FUTURE VALUE OF ANNUITY

FVA

A *

( 1

i ) n i

1

( 1

i ) n i

1

is annuity factor and can be found in present value tables for any given interest rate and time combination.

Example : you are setting aside $3,000 at the end of every year in order to buy a car. If your savings earn interest of 8 percent a year, how much will they be worth at the end of 4 years?

FVA

A *

( 1

i ) n i

1

3000 *

( 1

0 , 08 )

4

0 , 08

1

3000 * 4 , 506

13 , 518

Let’s solve it by using present valu tables:

7

FVA= A*FVFA

%,n

= 3000*4,506= $13,518

Saving for Retirement

In only 30 more years, you will retire. Suppose you believe you will need to accumulate

$500,000 by your retirement date in order to support your desired standard of living. How much must you save each year between now and your retirement to meet that future goal?

Let’s say that the interest rate is 10 percent per year. You need to find how large the annuity in the following figure must be to provide a future value of $500,000:

FVA= A*FVFA

%,n

500,000=A* FVFA

%10,30

500.000=A* 164,494

A= $3040

If the number of year is 50;

FVA

A *

( 1

i ) n i

1

500.000=A*1163,9

A=$429,59

NET PRESENT VALUE

NPV=PV inflow

-PV outflow

INTERNAL RATE OF RETURN

The internal rate of return (IRR) is a rate of return used in capital budgeting to measure and compare the profitability of investments.

IRR is a interest rate in which NPV is equal zero.

PV inflow

=PV outflow

PAYBACK PERIOD

A project’s payback period is the length of time before you recover your initial investment or is the period of time required for the return on an investment to "repay" the sum of the original investment.

- We choose the project which has less payback period.

- We choose the project which has the biggest NPV or IRR.

This suggests two rules for deciding whether to go ahead with an investment project:

1. The NPV rule. Invest in any project that has a positive NPV when its cash flows are discounted at the opportunity cost of capital.

8

2. The rate of return rule. Invest in any project offering a rate of return that is higher than the opportunity cost of capital.

PROJECT EVALUATION

Example: There are four projects. Evaluate the projects according to methods which considers the time value of money (NPV and IRR etc.) and which doesn’t consider the time value of money (payback period). Also, decide that which one is better.

Proje Yatırım

A

Tutarı

Cash Flow

1 2 3 4 5 6 7 8 9 10

(1000) 250 250 250 250 250 250 250 250 250 250

B

C

(2000) 2000 100 100 100 - - - - - -

(2000) 400 400 400 400 400 400 400 400 400 400

3

4

1

2

Payback period:

For Project A= 4 years

For Project B= 1 Year

For Project C= 5 Years

B<A<C

We choose the project which has less payback period. Then Project B is better.

NET PRESENT VALUE:

NPV=PV inflow

-PV outflow

For Project A

PV inflow

= A*PVFA

%15,10

PVA= 250*5,019= 1255

Yıl

For Project B

0

NPV=1255-1000= +255 TL

Cash Flow

(2000)

PV Factor for %15

(1,00)

Present Value

(2000)

2000

100

0,870

0,756

1740

75,6

100

100

0,658

0,572

NPV=

65,8

0,572

-61,4

9

For Project C

PV inflow

= A*PVFA

%15,10

PVA= 400*5,019= 2007,6

NPV=2007,6-2000= +7,6 TL

NPVa>NPVc>NPVb, Then The best one is Project A.

INTERNAL RATE OF RETURN

PV inflow

=PV outflow

For Project A

PVA= A*PVFA

%?,10

1000= 250* PVFA

%?,10

PVFA

%?,10

= 4

For i=%21, PVFA is 4,054

For i=%22, PVFA is 3,923

If you increase the interest rate %1 (%21-%22), PVFA will decrease 0,131 (4,054-3,923).

Then how much should we increase the interest rate to decrease the PVFA 0,054 (4,054-

4).

For %1 increase

For ? increase

PVFA will decrease 0,131

PVFA will decrease 0,054

?= (1*0,054)/0,131

?= 0,41

İKO= 21+0,41= %21,41

For Project C

PVA= A*PVFA

%?,10

2000= 400* PVFA

%?,10

PVFA

%?,10

= 5

For i=%15, PVFA is 5,019

For i=%16, PVFA is 4,833

If you increase the interest rate %1 (%15-%16), PVFA will decrease 0,186 (5,019-4,833).

Then how much should we increase the interest rate to decrease the PVFA 0,019 (5,019-

5).

For %1 increase

For ? increase

PVFA will decrease 0,186

PVFA will decrease 0,019

10

?= (1*0,019)/0,186

?= 0,1

İKO= 15+0,1=

%15,1

Yıl

For Project B

Cash Flow

0

1

2

3

(2000)

2000

100

100

PV Factor for Present Value PV Factor

%15

(1,00) (2000) for %12

(1,00)

0,870

0,756

0,658

1740

75,6

65,8

0,893

0,797

0,712

Present

Value

(2000)

1786

79,7

71,2

4 100 0,572 0,572 0,636 63,6

NPV= -61,4 NPV= +0,5

If you decrease the interest rate %3 (%15-%12), NPV will increase 61,9 (-61,4-0,5). Then how much should we decrease the interest rate to increase the NPV 61,4 in order to make the NPV zero.

For %3 decrease

For ? decrease

NPV will increase 61,9

NPV will increase 61,4

?= (3*61,4)/61,9

?= 2,98

İKO= 15-2,98= %12,02

IRRa>IRRc>IRRb, Then The best one is Project A.

11