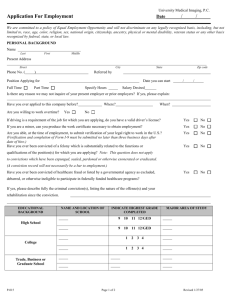

Env_Accounts_021910

advertisement