CORRECTLY DRAWING THE ZERO ECONOMIC PROFIT GRAPH

advertisement

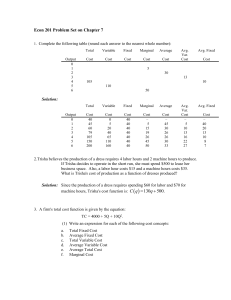

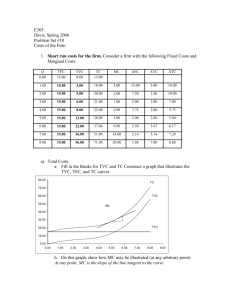

CORRECTLY DRAWING THE ZERO ECONOMIC PROFIT GRAPH FOR A MONOPOLISTICALLY COMPETITIVE FIRM Cyril Morong San Antonio College ABSTRACT Many principles of economics texts do not correctly draw the graph showing zero economic profit for a monopolistically competitive firm. The average total cost curve and the marginal cost curve are not consistent with each other. That is, they are not derived from the same total cost curve (as shown by numerical inspection of these curves). Also, the marginal revenue line is often not twice as steep as the demand line. Using a total cost curve of the form TC = fixed cost + aQ3 – bQ2 + cQ and a linear demand line, I find the general form equation for calculating the slope and intercept of both demand and marginal revenue for a chosen quantity. That quantity is such that P = ATC, MR = MC, the slope of marginal revenue is twice as steep as the demand line and both the ATC and MC lines are derived from the same total cost curve. These equations are used to generate the correct graph in a spreadsheet program. INTRODUCTION Principles of economics books usually contain a graph of a typical firm in monopolistic competition earning above economic profit. Then nearby or right next to it, there is a graph of the firm earning normal profit. As the story goes, the above normal profit caused more firms to enter the industry (which easily happens since free entry is assumed). For the typical firm this means that their demand curve shifts to the left as far as is necessary for profit to be driven down to zero or normal (meaning P = ATC). Sometimes demand is said to move down and part of this process could also involve demand getting more elastic. Once profit is zero, no more firms enter. But rarely do the textbook graphs list any numbers, so it is not easy to see if they are realistic. That is, the ATC curve may not be consistent with the MC curve. If they were consistent with each other, they would both be derived from the same total cost (TC) curve. There is usually not any indication that they are. The ATC in these graphs can be approximated at various quantities using a ruler or grid placed over the graph. Then multiplying this ATC times Q leaves TC which then allows for MC to be calculated. In many textbook graphs, the approximate numbers on the MC line are not consistent with or close to the numbers found in the TC approximation. That is how the ATC and MC lines are not consistent with each other. Other apparent problems include the MR line not being twice as steep as the demand line and ATC and MC being in different places in the above normal profit graph than they are in the normal profit graph. Even in the initial work by Chamberlin and Robinson, it does not appear that ATC and MC lines are consistent with each other. It also looks that way in the recent book The Monopolistic Competition Revolution in Retrospect. 1 ILLUSTRATION OF THE PROBLEM In Figure 1 below, as in many textbook cases, the case of zero profit is shown, but it is not clear if the graph is drawn correctly. There is no way to tell if ATC and MC are consistent with each other. FIGURE 1 P,C MC ATC P = ATC D MR Q Q There are no numbers to verify what MC and ATC actually are at various quantities. There is no table showing these numbers. But this is normally how it is done in the textbooks. So how do we know that if MC and ATC are consistent with each other, and MR is twice is steep as demand, ATC will be tangent to demand at the same Q where MC = MR? The next section uses a set of equations representing the typical firm which allows us to know the precise slope and intercept of demand and MR if we have MC and ATC curves that are derived from the same TC curve given a certain quantity. At that Q, profit will be zero. FINDING THE SOLUTION Suppose we have a TC function of the form (1) TC = F + aQ3 – bQ2 + cQ Where F is fixed costs. This function can lead to a TC curve that looks like the following in Figure 2 below: 2 FIGURE 2 C 40 35 TC 30 25 20 15 10 5 0 0 2 4 8 6 10 12 Q So the ATC will be (2) ATC = (F + aQ3 – bQ2 + cQ)/Q MC will be the derivative of TC, equation (1) (3) MC = 3aQ2 – 2bQ + C Then equations (4) and (5) are demand and MR: (4) P = I – SQ (5) MR = I – 2SQ That means that P – MR = I – SQ – (I – 2SQ) = SQ. Knowing this will be helpful in finding the solution. If we look at Figure 1 again, we can see that when profit is zero ATC – MC = P – MR is true. Then SQ = ATC – MC That means that (6) S = (ATC – MC)/Q 3 If we pick a Q, we can calculate MC and ATC. Plugging that into equation (6) would give us S. Let’s call the calculated S, S*. So we have the slope of demand. Re-arranging equation (4) leaves (7) I = P + SQ But since we will know S (what we called S*), we have (7a) I = P + S*Q We will also know that P = ATC. Whatever value we found for ATC can be used for P. That means that equation (7a) will give us the intercept of demand. Below is a numerical example (8) TC = 11 + 0.05Q3 - 0.5Q2 + 4Q Then (9) MC = 0.15Q2 - Q + 4 Suppose we pick Q = 4. If we plug that into ATC (5.55) and then MC (2.4), and then those numbers get plugged into equation (6), S* = 0.7875. Then we can assume that P = 5.55 since P must equal ATC to have a zero profit. Then the values for S*, P, and Q get plugged in to equation (7a) to find I. This is 8.7. Given all the values so far, both MC and MR = 2.4. So at Q = 4, ATC = P and MC = MR. Figure 3 illustrates this. By now the curves and lines should need no labels. The vertical line is a visual aid to see where MC crosses MR and ATC is tangent to demand. 4 Figure 3 12 10 8 6 4 2 0 0 2 4 6 8 5 10 12 14 16 REFERENCES Brackman, S & Heijdra, B.J. (Eds.) (2004). The Monopolistic Competition Revolution in Retrospect. New York: Cambridge University Press. Chamberlin, E.H. (1969, 8e). The Theory of Monopolistic Competition. Cambridge: Harvard University Press. Robinson, J. (1938). The Economics of Imperfect Competition. London: MacMillan. 6