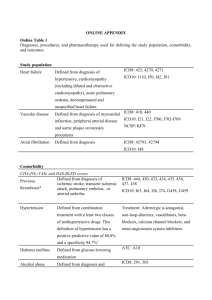

Ch 7

Econ 201 Problem Set on Chapter 7

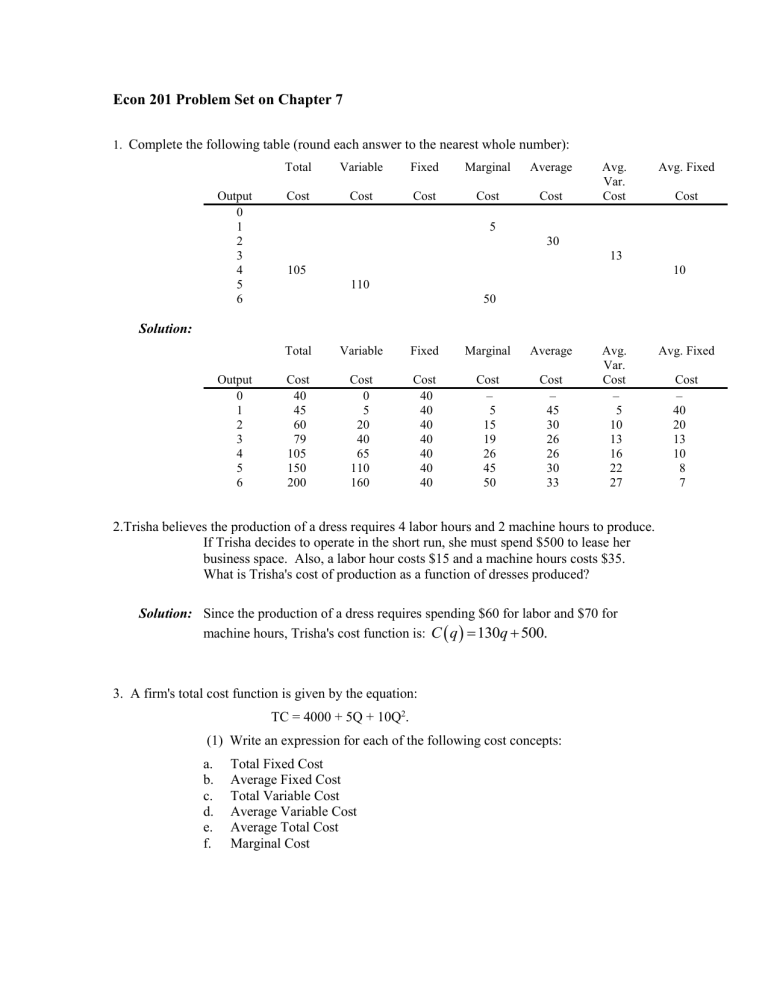

1. Complete the following table (round each answer to the nearest whole number):

Output

0

1

2

3

4

5

6

Total

Cost

105

Variable

Cost

110

Fixed

Cost

Marginal Average

Cost

5

50

Cost

30

Avg.

Var.

Cost

13

Avg. Fixed

Cost

10

Solution:

Output

0

1

2

3

4

5

6

Total

Cost

40

45

60

79

105

150

200

Variable

Cost

0

5

20

40

65

110

160

Fixed

Cost

40

40

40

40

40

40

40

Marginal Average

Cost

–

5

15

19

26

45

50

Cost

–

45

30

26

26

30

33

Avg.

Var.

Cost

–

5

10

13

16

22

27

2.Trisha believes the production of a dress requires 4 labor hours and 2 machine hours to produce.

If Trisha decides to operate in the short run, she must spend $500 to lease her business space. Also, a labor hour costs $15 and a machine hours costs $35.

What is Trisha's cost of production as a function of dresses produced?

Avg. Fixed

Cost

–

40

20

13

10

8

7

Solution: Since the production of a dress requires spending $60 for labor and $70 for machine hours, Trisha's cost function is:

130 q

500.

3. A firm's total cost function is given by the equation:

TC = 4000 + 5Q + 10Q 2 .

(1) Write an expression for each of the following cost concepts: a.

Total Fixed Cost b.

Average Fixed Cost c.

Total Variable Cost d.

Average Variable Cost e.

Average Total Cost f.

Marginal Cost

(2) Determine the quantity that minimizes average total cost. Demonstrate that the predicted relationship between marginal cost and average cost holds.

Solution:

PART (1) a.

TFC

4000 b.

AFC

4000

Q c.

TVC

TC

TFC

TVC

5 Q

10 Q

2 d.

AVC

TVC

Q

5Q

10Q

2

Q

5

10 Q e.

ATC

TC

Q

Q

2 f.

MC 5 20Q

PART (2)

ATC is minimized where MC is equal to ATC.

Equating MC to ATC

2

Q

2

5Q

20Q 2

4000

10Q

2

Q 2

400

Q

20

ATC is minimized at 20 units of output. Up to 20, ATC falls, while beyond 20

ATC rises.

MC should be less than ATC for any quantity less than 20.

For example, let Q = 10:

MC = 5 + 20(10) = 205

ATC

4000

5

10

2

505

10

MC is indeed less than ATC for quantities smaller than 20.

MC should exceed ATC for any quantity greater than 20.

For example, let Q = 25:

MC = 5 + 20(25) = 505

ATC

4000

5

10

2

25

415

MC is indeed greater than ATC for quantities greater than 20.

4.Davy Metal Company produces brass fittings. Davy's engineers estimate the production function represented below as relevant for their long-run capital-labor decisions.

Q = 500L 0.6

K 0.8

,

where Q = annual output measured in pounds,

L = labor measured in person hours,

K = capital measured in machine hours.

The marginal products of labor and capital are:

MP

L

= 300L -0.4

K 0.8

MP

K

= 400L 0.6

K -0.2

Davy's employees are relatively highly skilled and earn $15 per hour. The firm estimates a rental charge of $50 per hour on capital. Davy forecasts annual costs of $500,000 per year, measured in real dollars. a.

Determine the firm's optimal capital-labor ratio, given the information above. b.

How much capital and labor should the firm employ, given the $500,000 budget? Calculate the firm's output

Solution: a.

MP

L

MP

K

300L

0.4

K

0.8

400L

0.6

K

0.2

300

K

0.8

L 0.4

L

0.6

400

K

0.2

MRTS

K

0.8

300

L

0.4

L

0.6

400

K

0.2

0.75

K

0.8

L

0.4

K

0.2

L

0.6

MRTS

0.75

K

L

Equate to w r

0.75

K

L

15

50

.

15

50

0.75

K

L

K

0.4; K = 0.4L

L

0.3

b.

C = 500,000

C = wL + rK

500,000 = 15L + 50K

K = 0.4L from optimal ratio

500,000 = 15L + 50(0.4L)

500,000 = 15L + 20L

500,000 = 35L

L = 14,285.71 or 14,286 hours

Substitute to solve for K.

500,000 = 15(14286) + 50K

500,000 = 214,290 + 50K

285,710 = 50K

K = 5714.20 or K = 5714

Q = 500(14,286) 0.6

(5,714) 0.8

Q = 157,568,191

5.A paper company dumps nondegradable waste into a river that flows by the firm's plant. The firm estimates its production function to be:

Q = 6KW,

where Q = annual paper production measured in pounds, K = machine hours of capital, and W = gallons of polluted water dumped into the river per year. The marginal products of capital and labor are given as follows:

MP

K

= 6W MP

W

= 6K

The firm currently faces no environmental regulation in dumping waste into the river. Without regulation, it costs the firm $7.50 per gallon dumped. The firm estimates a $30 per hour rental rate on capital. The operating budget for capital and waste water is $300,000 per year. a.

Determine the firm's optimal ratio of waste water to capital. b.

Given the firm's $300,000 budget, how much capital and waste water should the firm employ? How much output will the firm produce?

Solution: a.

MP

W

= 6K

MP

K

= 6W

MRTS

6K

6W

K

W

Rate of water charge to price of capital:

P

W

P

U

7.5

.25

30

Equating MRTS to ratio of input prices

K

W

0.25, K = 0.25W

b.

C = P

W

W + P

K

K

300,000 = 7.50W + 30K

recall K = 0.25W

300,000 = 7.5W + 30(0.25W)

300,000 = 7.5W + 7.5W

W = 20,000 gallons

K = 0.25W

K = 0.25(20,000)

K = 5000

Q = 6(5000)(20,000)

Q = 600,000,000