midterm_2014

advertisement

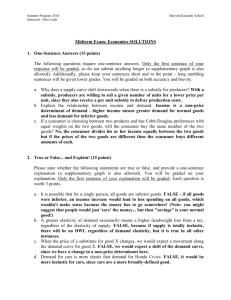

Summer Program 2014 Instructor: Akos Lada Harvard Kennedy School Midterm Exam: Economics To be handed back on August 4th, 2014 in class. Instructions: a. b. c. d. e. f. g. h. i. This is a take-home exam. WRITE NEATLY. Please write your name clearly on your exam and STAPLE all pages before turning it in. You may use any materials you wish, but are encouraged to do the exam without use of outside sources as much as possible. Please work on your exams individually. I have no way to enforce this, but it is truly in your best interest that I get an accurate picture of your knowledge at this stage of the course. This includes no use of studio lab instructors. Throughout you should assume linear demand and supply curves, and “shifts” should be considered to be parallel shifts unless otherwise noted. If you are unclear on other assumptions, please contact Syon. The exam is meant to take 120 minutes, and I encourage you to limit your time on it to 120 minutes. It is graded out of 100 points as you will see. If a question is not clear to you, you may contact me via e-mail (alada@fas.harvard.edu). Good Luck! Summer Program 2014 Instructor: Akos Lada Harvard Kennedy School 1. One-Sentence Answers (15 points) The following questions require one-sentence answers. Only the first sentence of your response will be graded, so do not submit anything longer (a supplementary graph is also allowed). Additionally, please keep your sentences short and to the point - long rambling sentences will be given lower grades. You will be graded on both accuracy and brevity. Each question is worth 3 points. a. Why does a supply curve shift downwards when there is a subsidy for producers? b. Explain the relationship between income and demand. c. If a consumer is choosing between two products and has Cobb-Douglas preferences with equal weights on the two goods, will the consumer buy the same number of the two goods? 2. True or False... and Explain! (15 points) Please state whether the following statements are true or false, and provide a one-sentence explanation (a supplementary graph is also allowed). You will be graded on your explanation. Only the first sentence of your explanation will be graded. Each question is worth 3 points. a. It is possible that for a single person, all goods are inferior goods. b. A greater elasticity of demand necessarily means a higher deadweight loss from a tax, regardless of the elasticity of supply. c. When the price of a substitute for good X changes, we would expect a movement along the demand curve for good X. d. Demand for cars is more elastic that demand for Honda Civics. e. Producer surplus rises when there is an increase in supply, holding all else constant. 3. Short Problems Below you will find two short problems, each worth 15 points. Points for each subsection of the problem are stated. a. Cigarette Contradiction? (15 points) Suppose the U.S. government administers only two programs that affect the market for cigarettes. Firstly, media campaigns and labeling requirements are aimed at making the public aware of the dangers of cigarette smoking. Secondly, the Department of Agriculture maintains a price support program for tobacco, which includes guaranteeing Summer Program 2014 Instructor: Akos Lada Harvard Kennedy School tobacco farmers a selling price that is above the equilibrium market price (including paying them for any excess supply). Answer the following questions using appropriate graphs. Be specific about determinants of demand and supply affecting the outcomes. i. What does the awareness campaign do in the cigarette market? (3 points) ii. What does the price floor for tobacco do in the cigarette market? (5 points) iii. Are these two programs at odds with each other with respect to the goal of reducing cigarette consumption? (3 points) iv. What is the combined effect of these two programs on the price of cigarettes? (4 points) b. Low-Skill Labor (15 points) Use the following graph to answer the next four questions. This question asks to explore a new application of the supply and demand model, to the question of the minimum wage. Note that the supply of labor in the graph below refers to workers, and the demand for labor in the graph below refers to firms hiring those workers. Low-Skilled Labor Market Wage ($/worker) Supply P B A C D S J R K N Government Regulated Wage O Q H L E 4 M 6 Demand 8 Quantity (millions of workers) For all questions related to the above graph, assume the market wage preceded the regulated wage. i. How many more low-skill workers will seek jobs after the government establishes a minimum wage than did before the minimum wage? (4 points) ii. Which of the following statements is true concerning the diagram presented above? Choose one and explain briefly. (5 points) A. The government regulated price is a price ceiling and there will be 4 million low-skilled job seekers without jobs once the ceiling has been established Summer Program 2014 Instructor: Akos Lada Harvard Kennedy School B. The government regulated price is a price ceiling and there will be 2 million low-skilled job seekers without jobs once the ceiling has been established C. The government regulated price is a price floor and there will be 4 million low-skilled job seekers without jobs once the floor has been established D. The government regulated price is a price floor and there will be 2 million low-skilled job seekers without jobs once the floor has been established iii. Fill in the blanks (using the letters in the graph above, which represent areas of respective regions of the graph as shown): Once the regulated wage is established, the low-skilled laborers’ economic surplus will change from ______ to ________. (4 points) iv. Fill in the blank (using the letters in the graph above, which represent areas of respective regions of the graph as shown): According to the above diagram, the deadweight loss associated with the government establishing a minimum wage will be _______. (2 points) 4. Long Problem (40 points) In Birani, there is a robust and perfectly competitive market for cassava leaves, a food product. The supply curve for cassava leaves is given by QS = 110P, and the demand curve for cassava leaves is given by QD = 10000 – 90P, where price is in Biranis/kg and quantity is in kgs of cassava leaves. a. Calculate the equilibrium price and quantity. (3 points) b. What is consumer surplus? Producer surplus? Social surplus? (3 points) c. What is the price elasticity of demand at equilibrium (use the point elasticity or the midpoint method)? (3 points) d. What is the price elasticity of supply at equilibrium (use the point elasticity or the midpoint method)? (3 points) Now suppose the government considers imposing a 8 Birani/kg tax on cassava leaves, to be imposed on producers. e. Compute: i. ii. iii. iv. The new quantity transacted and price with the tax (4 points) The new consumer and producer surpluses (4 points) The revenue for the government from this tax (4 points) The new social surplus and DWL (3 points) f. Relate your answers to parts (c) and (d) to the changes in price, consumer, and producer surplus caused by the tax. (3 points) Summer Program 2014 Instructor: Akos Lada Harvard Kennedy School g. Now suppose that there is evidence that cassava leaf consumption effectively immunizes those who consume it from a local tropical illness, Birani Fever. For our purposes you may assume that this immunization takes the form of a 2 Birani/kg positive externality of consumption for any kg consumed. Assume further that the tax discussed earlier remains in place. Compute: i. The socially optimal quantity of cassava leaves (5 points) ii. The deadweight loss in the post-tax equilibrium, given the externality (5 points)