WORD

advertisement

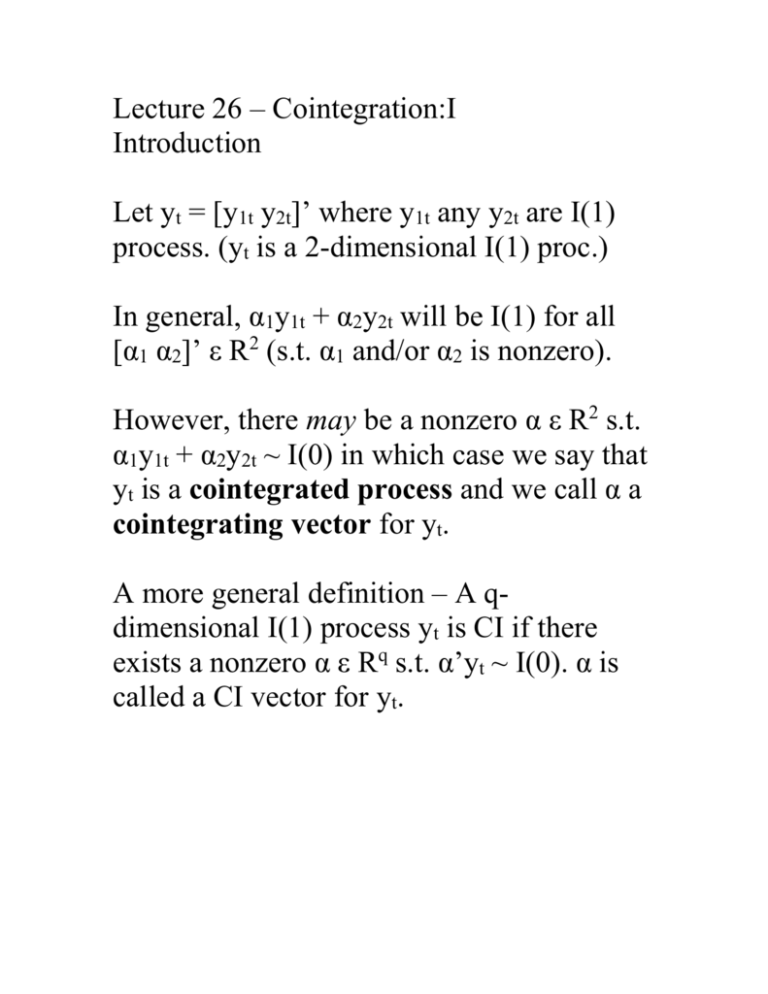

Lecture 26 – Cointegration:I Introduction Let yt = [y1t y2t]’ where y1t any y2t are I(1) process. (yt is a 2-dimensional I(1) proc.) In general, α1y1t + α2y2t will be I(1) for all [α1 α2]’ ε R2 (s.t. α1 and/or α2 is nonzero). However, there may be a nonzero α ε R2 s.t. α1y1t + α2y2t ~ I(0) in which case we say that yt is a cointegrated process and we call α a cointegrating vector for yt. A more general definition – A qdimensional I(1) process yt is CI if there exists a nonzero α ε Rq s.t. α’yt ~ I(0). α is called a CI vector for yt. Examples: 1. It may be that Ct , real consumption per capita, and It, real disposable income per capita are each I(1) but for some α and some β ε (0,1), Ct = α + βIt + ut, where ut is a zero-mean I(0) process. In this case, Ct and It are cointegrated with cointegrating vector [1 –β]. 2. Let et denote the (log) nominal exchange rate in period t (foreign currency units per unit of home currency), let pt denote the (log) home country price level and let pt*denote the (log) foreign price level. Unit root tests applied to each of these series suggest that they are I(1) series. Economic theory suggests that the (log) real exchange rate et + pt* - pt should be I(0). So, we might expect et, pt*, and pt to be cointegrated with cointegrating vector [1 1 -1]. Note that both of these examples assume longrun equilibrium conditions that imply cointegration if the component variables are I(1). Although each series individually can wander around like an I(1), economic theory implies that in this case there is a linear combination of these series that cannot wander around. In other words, if economic time series are typically I(1) series, then the equilibrium conditions provided by economic theory suggest that cointegrating relationships among these series will be common. Other examples: 3. Money Demand: (M/P)t, it, Yt 4. P. Ireland (JME, 1979) : Barro-Gordon time consistency model of central bank behavior implies that if the unemployment rate is I(1) then the inflation rate is also I(1) and the two are cointegrated. Some Econometric Issues: Suppose yt and xt are I(1) and not cointegrated. Then there is not a stable long-run relationship between these two series (though there may be a stable relationship between their first differences). If, on the other hand, yt and xt are cointegrated then there exists a unique β0 and β1 such that yt – β0 – β1xt = εt ~ I(0) The OLS estimator of β from the regression of y on 1, x is a super-consistent estimator (even if y and x are jointly determined, i.e., even if E(xtεt) is nonzero. 1. However, standard inference procedures cannot be applied to the cointegrating regression (and the proper inference procedures will depend on whether the x’s are exogenous,…) 2. If yt and xt are I(1), the proper specification of a VAR form for (yt , xt) will depend on whether y and x are cointegrated. (More later) Suppose that yt is a q-dimensional CI process. By definition, there must be at least one nonzero α in Rq s.t. α’yt ~ I(0). Can there be more than one CI vector? Note that if α is a CI vector then so is cα for any nonzero real number c. (α1y1t + α2y2t ~ I(0) implies that 2α1y1t + 2α2y2t ~ I(0).) The more interesting question, how many linearly independent CI vectors can there be for yt? We know that there cannot be more than q linearly independent q-dimensional vectors so there cannot be more than q linearly independent CI vectors. There cannot be q linearly independent CI vectors. Suppose α(1),…,α(q) are linearly independent q-dim vectors s.t. α(i)’yt ~ I(0) for i = 1,…,q. Let A’ = [α(i)’] be the qxq matrix whose i-th row is α(i)’. Then A’yt = ut where ut is a q-dimensional I(0) process. (Why?) So, yt = (A’)-1ut ~ I(0), which is a contradiction. If the q-dimensional process yt is cointegrated then it can have as few as one linearly independent CI vector and as many as q-1. The number of linearly independent CI vectors is called the CI rank of yt. In the money demand example suppose that the money demand function is one cointegrating relationship among M/P, i, and Y. Suppose that the monetary authority uses a money supply rule in which the real money supply depends upon real GDP. The money supply rule provides a second CI relationship among M/P, i, and Y. (Can there be a 3rd?) If r is the CI rank of yt the CI vectors for an rdim subspace of Rq called the CI space. If yt is an n-dimensional I(1) process – 1. Are the elements of y cointegrated? 2. What is the cointegrating rank of y? 3. What is the CI space?