called cointegrating vector

advertisement

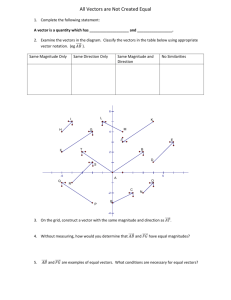

FAME Cointegration Most economics variables have trend, either deterministic or stochastic and can lead to spurious regressions Model looks good in terms of summary stats but difficult to evaluate We have talked about taking differences of SP to make them stationary From the differenced series can use ARIMA models to evaluate SP or with stationary variables can carry out regression analysis One serious problem using first differences is that can not recover long-run properties of the data First differences can measure short run properties 1 But, a rather new concept called Cointegration looks at the levels of each series not differences. Say we have two series 𝑦𝑡 𝑎𝑛𝑑 𝑥𝑡 in level form So both not stationary (draw Fig 1) Both 𝑦𝑡 𝑎𝑛𝑑 𝑥𝑡 have trend but not sure ~I(1) or ~I(2) in addition two series drift apart overtime This implies that the difference between the series is not stable. (draw Fig 2) In Fig 2 variables drifting together over time Each series could be ~I(1) and perhaps the difference 𝑦𝑡 − 𝑥𝑡 is stationary! The idea that differences between two SP in levels is stationary defines the concept of cointegration 2 For two SP processes 𝑦𝑡 𝑎𝑛𝑑 𝑥𝑡 are cointegrated of order (d, b) where 𝑑 ≥ 𝑏 ≥ 0 If a) 𝑥𝑡 , 𝑦𝑡 ~ 𝐶𝐼(𝑑, 𝑏) 𝑖𝑓 𝑥𝑡 , 𝑦𝑡 ~𝐼(𝑑) b) there exists a linear combination 𝛼1 𝑥𝑡 + 𝛼2 𝑦𝑡 ~ 𝐼(𝑑 − 𝑏) The vector 𝛼1 , 𝛼2 called cointegrating vector Now, what is interesting for econometrics is when (d – b) = 0 because this says that there exists a cointegrating vector that makes the linear combination between 𝑦𝑡 𝑎𝑛𝑑 𝑥𝑡 stationary. Moreover it defines the long run relationship between 𝑦𝑡 𝑎𝑛𝑑 𝑥𝑡 E.g. say 𝑦𝑡 𝑎𝑛𝑑 𝑥𝑡 both ~I(1) and long run relationship 𝑦𝑡∗ = 𝛽𝑥𝑡 3 If the cointegrating vector is [𝛽, −1] ~ 𝐶𝐼(𝑑, 𝑏) 𝑜𝑟 ~𝐶𝐼(1, 1) Then deviations of 𝑦𝑡 − 𝑦𝑡∗ from Long Run path are ~I(0) And [𝛽, −1] defines the long run relationship Now, 𝑦𝑡 − 𝑦𝑡∗ = 𝑦𝑡 − 𝛽𝑥𝑡 = 𝜇𝑡 is called error correction mechanism ECM. Think of it as forcing the model to maintain the long run relationship between 𝑦𝑡 𝑎𝑛𝑑 𝑥𝑡 . Lets extend basic regression model and write the model in stationary variables Δ𝑦𝑡 = 𝛽1 Δ𝑥𝑡 + 𝛽2 𝐸𝐶𝑀𝑡−1 + 𝜀𝑡 4 Each argument is ~I(0), so reasonable model which includes both short run and long run properties. 𝛽1 defines short run relationship and 𝛽2 speed of adjustment to deviations from the long run trend. Testing for cointegration Engle and Granger first method for testing Idea is that if cointegrated then error terms should be stationary, so from the long run model test the errors for stationary properties using D-F statistic But a bit of a problem, how to write the model 5 𝑦𝑡 = 𝑏01+ 𝑏11 𝑥𝑡 + 𝜀𝑡1 𝑜𝑟 𝑥𝑡 = 𝑏02 + 𝑏12 𝑦𝑡 + 𝜀𝑡2 large samples it does not matter get same result but in small samples get different results. Problem just gets worse with more than two variables. Johansen test is a procedure that allows multiple variables and multiple cointegrating vectors and can test The test relies on the relationship between rank of a matrix and its characteristic roots. 6 Technical procedure but really a multivariate generalization of the DF test. Enders provides a useful description (page 386) In the single variable case 𝑦𝑡 = 𝑎1 𝑦𝑡−1 + 𝜀𝑡 𝑎𝑛𝑑 𝑠𝑢𝑏𝑡𝑟𝑎𝑐𝑡 𝑦𝑡−1 Δ𝑦𝑡 = (𝑎1 − 1)𝑦𝑡−1 + 𝜀𝑡 𝑖𝑓 𝑎1 − 1 = 0 unit root --nonstationary but if 𝑎1 − 1 < 0 𝑠𝑡𝑎𝑡𝑖𝑜𝑛𝑎𝑟𝑦 Now, if N variables 𝑋𝑡 = 𝐴𝑖 𝑋𝑡−1 + 𝜀𝑡 , 𝑋 𝑖𝑠 (𝑥1𝑡 , 𝑥2𝑡 , ⋯ 𝑥𝑁𝑡 )′ 𝑎𝑛𝑑 𝜀 = (𝜀1𝑡 , 𝜀2𝑡 , ⋯ 𝜀𝑁𝑡 )′ 𝐴1 𝑖𝑠 𝑛 ∗ 𝑛 𝑚𝑎𝑡𝑟𝑖𝑥 Then Δ𝑋𝑡 = −(𝐼 − 𝐴1 )𝑋𝑡−1 + 𝜀𝑡 = (𝐴1 − 1)𝑋𝑡−1 + 𝜀𝑡 = Π𝑋𝑡−1 + 𝜀𝑡 The rank of (A1 -1) = number of cointegrating vectors If rank = 0 all Δ𝑋 are unit root, no cointegration If rank = N full rank all variables are stationary 7 Could add a drift term for trend The model can be generalized to allow for higher – order auto-regressive process Number of distinct cointegrating vectors = number of significant characteristic roots of Π . Two tests for determining significant roots Trace test 𝜆𝑡𝑟𝑎𝑐𝑒 = −𝑇 ∑𝑛𝑖=𝑟+1 𝑙𝑛 (1 − 𝜆̂𝑖 ) 𝜆̂𝑡 estimated values of characteristic roots 𝑇 number of observations Ho number of cointegrating vectors ≤ 𝑟 Ha : Ho not true 8 Max test 𝜆𝑚𝑎𝑥 = −𝑇𝑙𝑛(1 − 𝜆̂𝑟+1 ) Ho number of cointegrating vectors = 𝑟 Ha : number of cointegrating vectors =r+1 9