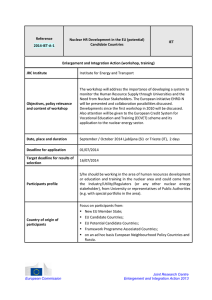

2. Capital Costs of Nuclear Power Generation

advertisement

June 17, 2003

MINATOM EXPORT CONTROL BEHAVIOR:

ECONOMIC FACTORS & MOTIVATIONS

Michael T. Maloney & Oana Diaconu

John E. Walker Department of Economics

Clemson University

Second Report to:

Lawrence Livermore National Laboratories

Sub-Contract B529375

COSTS ANALYSES AND METHODOLOGY RELATED TO NUCLEAR ELECTRIC

GENERATION

1. Introduction

The purpose of this research is to model the economics of the commercial nuclear

activities of Minatom. In our first report, we outlined the various commercial nuclear

export activities of Minatom with some commentary about the economics. In our

discussions with LLNL and with DOE, it was decided that we should focus on nuclear

generation activities. This report gives a summary of our analysis on two points

concerning nuclear electric generation: capital cost estimation and infrastructure factors

affecting levelized cost estimates.

As we noted in our last report, Minatom’s revenues from nuclear construction

projects abroad amounted to $424 million in 2001, about 17 percent of Minatom’s export

income. They were the third biggest source of export revenues after uranium products

and services (49.7%) and exports of nuclear fuel assemblies (18.7%).1 The forecast for

2002 was $900 million.

However, most of the “Atomstroyexport” nuclear construction abroad (Iran, India

and China) is “still accomplished through the credits given by the RF Government (the

repayment of which from the customers is either delayed or bounded by particular

additional conditions).”2 The state budget funding for these activities was $140 millions

in 2001 and another $250 million was budgeted for 2002.3

Minatom has commissioned power plants, research reactors and other nuclear

objectives in Bulgaria, former Eastern Germany, Finland, Hungary, Slovakia, Czech

Republic and China.4 It started a nuclear reactor in Cuba, at Jurangua, in 1983, but the

project was stopped in 1992 due to lack of funds and finally cancelled in 2001.The

1

International Business Relations Corporation, Department of Nuclear Energy and Nuclear Fuel

Cycle, Foreign Trade Policy and Authorized foreign trade entities of the Ministry of Russian Federation

for Atomic Energy, Annual Analytical Survey, Issue #1, Moscow 2003, pages 7 and 17-21.

2

Ibid., p. 87. Emphasis added.

3

See Maloney & Diaconu, “Is Nuclear Power Viable in Russia,” Electricity Journal, JanuaryFebruary, 2003, pp. 80-87, and “Commercial Initiatives in the Russian Nuclear Sector & the Nuclear

Nonproliferation Interests of the United States,” The Nonproliferation Review, Summer 2003.

4

Several former Soviet Union republics have Soviet design nuclear reactors: Armenia, Ukraine,

Lithuania, Armenia and Kazakhstan. They do not show up as being constructed by Russia, however.

Contact Information: Mailing: 223 Sirrine Hall, Clemson University, Clemson SC 29634-1309; phone: 864.656.3430;

email: maloney@clemson.edu; web: <www.clemson.edu/~maloney>

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

facility was more than 50percentage complete.5 It began the construction of 4 VVER 440

nuclear reactors at Zarnowiec in Poland but the construction was stopped in 1990. It has

conducted feasibility studies and design development for a nuclear desalination and

power plant in Lybia and for a nuclear power plant in North Korea, but none of the

projects have been carried on. Currently it has nuclear reactor business going on in

Slovakia, China, Iran, India and Ukraine and has plans to expand its business in

Kazakhstan, Syria, Burma, Vietnam, Egypt and eventually Turkey.

We see two major questions in the nuclear construction business initiatives of

Minatom:

1) Is it possible that Minatom is making money on nuclear power plant

construction given the price that it is charging for this work?

2) Are countries investing in nuclear power making economically efficient

decisions?

In this report we offer analysis of two points that contribute to our understanding of these

questions. Here we review and compare the capital cost estimates of nuclear power that

have been reported from many different sources. We also analyze country-specific

infrastructure that contributes to the efficiency of nuclear power.

The basic conclusions reached in this report are the following:

A) There is a great deal of variance in the forecast capital cost of nuclear power

plants. This is true not just for Russian construction but also for costs of other

reactors such as the Canadian and French models. Nonetheless, it is clear that

Russian units are typically forecast to have lower costs than the rest of the

competition, suggesting that Russia is consistently low-bidding. This

difference is somewhere between 15 and 25 percent, which is approximately

consistent with the notion that Minatom does not price design costs into its

bids and accounts only minimally for contingencies and interest during

construction.

B) Cost estimates such as those reported in a Finish study favorably comparing

nuclear power to other generation are based on assumptions that have to be

considered unattainable for many, and maybe even most countries. Electricity

cost per kWh is inversely proportional to load factor. The historical, worldwide average load factor for nuclear power plants is around 70 percent. Based

on the observed operation of their electricity systems, none of the countries

that are considering introduction of nuclear technology (in particular, Iran,

Egypt, and Turkey) can hope to do better than this average load factor for

nuclear power plants. This makes nuclear power very likely to be an

uneconomic source of generation.

Dalia Acosta, “Cuba Cancels Nuclear Plant Construction,” Tierramerica, archivo,

<www.tierramerica.net/2001/0211/acent.shtml> and Jonathan Benjamin Alvarado, “Nonissue: Cuba's

Mothballed Nuclear Power Plant,” July 1998, Center for International Policy, Washington D.C.

5

2

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

2. Capital Costs of Nuclear Power Generation

A nuclear power generator incurs three types of costs: capital costs (construction

costs including research development), operating costs (fuel and operation and

maintenance), and decommissioning costs. The storage and/or processing of the spent

fuel can be included in either decommissioning or fuel costs.

Nuclear capital generation has high capital costs and low generation costs.

Expressed as $/kWh capital costs represent about two thirds of nuclear energy costs while

fuel and other operating expenses are about one third.6 For coal fired and gas generation,

on contrast, fuel accounts for more than one half of the generation costs and capital cost

accounts for about one third. Thus, the competitiveness of nuclear power generation

relative to fossil fuel generation rests decidedly on how high nuclear construction costs

are relative to the prices of fossil fuels.

The capital costs of nuclear generation units are comprised of land acquisition and

site preparation, equipment and installation, interest cost during the construction and

nuclear decommissioning plant costs. Contingencies for cost overruns are also included.

A typical breakdown of estimated nuclear power capital cost for a pressurized

water reactor is shown in Table 1.

Obviously the choice of the discount rate and the construction time will affect the

total capital cost of the plant through the interest during construction component. The

typical construction cost for a nuclear unit is 5-9 years. Longer construction times caused

by regulatory delays have often been blamed for the escalation of construction costs of

nuclear power plants in the past two decades, and are largely responsible for the demise

of nuclear power in the United States.

Table 1. Break Down of Construction Costs for

Nuclear Generator

Item

Percent of Cost

Civil engineering and building

21%

Design and consultancy cost

15%

Nuclear steam supply system

13%

Turbine generator

12%

Other electrical plant

9%

Other mechanical plant

8%

Contingencies

Total Excluding Interest

Interest during construction

22%

100%

28%

Source: Thomas (1988), p. 40.

6

S.D. Thomas, The realities of nuclear power, Cambridge University Press, 1988, p. 39. Estimates

from Diaconu & Maloney (2002) find the ratio of capital costs to total for nuclear power in Russia to be 78

percent and 67 percent in the United States. The U.S. estimate is based on the construction costs of pre1970 nuclear power plants, inflated to 2002 dollars.

3

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

The estimates are also sensitive to the discount rate used. In the international

practice 10 percent is considered a reasonable rate although for some developing

countries a higher rate might be appropriate.7 For the purpose of the comparison

presented in this study, we will use 10 percent across the board. At a 10 percent discount

rate, interest cost during construction represents 25-30 percent of the total construction

cost of a nuclear unit.8

Although not included in the table above, the decommissioning costs are typically

included in capital cost estimates. Decommissioning cost amounts to 2 percent of the

cost. Some studies apply a lower discount rate for decommissioning and waste

management reflecting a long run rate of return expected to be earned on the funds set

aside for these purposes. For most of the data coming from the Organization for

Economic Cooperation and Development (OECD) study (see below), the

decommissioning and waste management have been discounted at the interest rate.

Particular to nuclear power plant construction, cost structure is a high level of

constant costs, independent of plant size or life of the plant, for the project

implementation. Activities, such as site approval, information and public relations,

training the operation and maintenance personnel, licensing and activities of the supplier

such as safety analysis, documentation and project management, can represent as much as

30 percent of the total capital cost of a one unit nuclear power plant of 1200MW

according to some sources.9 However, this percentage seems exaggerated based on U.S.

experience.

Construction cost is related with the number of units to be built on a site. “The

cost reduction is calculated to be 10 percent for a site with two units and 20 percent for a

site having 4 units provided that the construction interval is less than 2 years.”10 A similar

phenomenon exists for scale effects in the size of the unit. That is, there is roughly a 20

percent cost saving as plant size increases. This estimate is based on the scale factors

observed in U.S. construction costs across all types of generators.

2.1.

Data on Capital Cost of Nuclear Power Generation

Much of the data on capital cost of nuclear power generation comes from the

United States. Capital cost expenditures are available for existing plants on FERC Form 1

distributed by the U.S Department of Energy. We used these data extensively in our early

research. Outside the United States, estimates of the capital costs are much harder to

7

The methodology of choosing the discount rate is ill-defined in policy discussions. We use a

financial economics approach wherein the discount rate is based on the business risk of the venture. While

it may be difficult to precisely determine the inherent business risk, 10 percent seems reasonable and 5

percent is highly questionable. In the calculation of capital cost, the interest rate determines the cost of

funds during construction. In the calculation of levelized cost, the interest rate is the discounting factor for

revenues throughout the life of the plant.

8

Bertel, Evelyne, and Geoffrey H.Stevens, Comparative Costs of Generating Electricity, OECD

Nuclear Energy Agency, France, at 11th Pacific Basin Nuclear Conference (PBNC), Banff, 1998.

9

Ferroni, Ferrucia, Hans-Jürgen Kirchhof, and Juan B. Heredia, Review of Cost Reduction

Measures for Nuclear Electricity, Electrowatt Engineering Ltd, Switzerlant, PBNC, 1998.

10

Ferroni, et al., (1998).

4

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

come by and are much less detailed. With few exceptions we were unable to find unit

level open source data on capital costs internationally.

Data are available in a study done by the OECD on the cost of electricity across

countries for all types of generation.11 Their data was obtained by circulating a

questionnaire to OECD member countries and non-OECD participant countries through

the International Atomic Energy Agency (IAEA). The study is comprehensive and has

been updated several times.

The following quote summarized the scope of the study and the definition of

some of the terms:

The questionnaire asked for information on all types of base-load power plants expected

to be commercially available for commissioning by 2005-2010, except hydropower

plants (...) The technologies for which information could be provided included, primarily,

state of the-of-the art power plants (category A) as their performance and costs, based

upon ordered plant prices, quotation or detailed paper analysis are considered to be well

established. Cost information was sought also on technologies under development that

are expected to be commercially available by 2010 (category B plants)(…) Thirteen

countries provided cost estimates for nuclear power plants including three reactor types:

pressurized water reactors (PWR); boiling water reactors (BWR); and pressurized heavy

water reactors (PHWR). The size of the nuclear units ranges from 455 MWe to 1460

MWe. Three countries, France, Japan and China, estimated nuclear fuel cycle costs

corresponding to a closed cycle with reprocessing and recycling, while the other

countries provided costs estimates corresponding to an open cycle with direct disposal of

spent fuel.12

Table 2 summarizes the data found in the OECD study. The data provided in the

study are rather generic. Although the size and the technology on which the estimate is

based are specified, the name of the power plant or of the site is not. In part, this is due to

the fact that some of the estimates assume a construction program of several reactors

(e.g., France, 10 units; Korea, 6; and Russia, 5). Another reason for scarcity of plant data

is that, in many countries, especially those that have started the process of liberalizing the

power sector, capital cost information is considered commercially sensitive.

The only specification about the source of the estimate is whether the estimate is

based on the ordered plant (O), on a planned plant (P) for which a paper study exist, if the

source is a quotation (Q), or on a feasibility study (FQ). For some countries, several

characteristics of the plant (capacity and number of units on site) allow us to guess the

name of the actual power plant on which the estimation was based but such identification

is speculative. For the estimates for which the number of units on site were provided we

assume that the economies of multi-unit siting were taken into account.

Besides the OECD/IEA study, there are several studies on specific countries that

provide some information on the domestic capital cost of nuclear generation.

Unfortunately, again, for most of them plant level data is missing. We identified the units

to the extent it was possible. Many of the studies actually base their estimates on OECD

data. These studies are referenced in the notes of Table 3.

11

Organization for Economic Cooperation and Development (Paris), Nuclear Energy Agency,

International Energy Agency, Projected Costs of Generating Electricity, Paris, 1998.

12

OECD/IEA (1998), p. 22.

5

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

We pulled together the data from all of these sources and transformed the

estimates into 2002 U.S. dollars. Whenever we have multiple sources, we try to discuss

the differences between estimates. However there are several reasons for cautions in

comparing the country data.

As the authors of the OECD/IEA (1998) remarked, transforming data into U.S.

dollars using the existing exchange rate may seriously distort the estimates, especially the

one referring to non-OECD, developing countries. 13 Exchange rates do not necessarily

reflect purchasing power parity. That is, purely domestic construction (steel, concrete,

labor, etc.) in one country may be identical to that in another country, but the exchange

rates may be different. This means that a foreign investor seeking to build plants in the

two countries would face different costs, but domestic investors in the separate countries

would face identical costs.14 It is also true that exchange rates may be distorted by

currency controls and fixed exchange rates that are not supportable in real transactions.

A number of other factors besides the imperfect conversion in a common unit of

currency may cause the estimates to vary both across, within countries and among

projects such as:15

a) Differences in technology. As Thomas (1988) pointed out, for example, “in the

UK the nuclear steam supply system for an AGR was estimated to cost nearly

four times as much per kilowatt as that required for a PWR.”16

b) Differing cost components. Countries that have mass-production facilities and

highly standardized reactors, like France, may be able to manufacture the reactor

components cheaper.

c) Differences in regulatory requirements.

d) Economies of scale and multi-unit siting not accounted for in the data.

Many of the estimates on the capital cost of nuclear power plants have proved to

be underestimates. Caution should be exercised especially in judging the data based on

planned or under construction plants.

13

OECD/IEA (1998).

We do not think of this as a serious issue because the fact is that with nuclear power, there is

almost always international investment. Moreover, the main point of this research is to investigate the

economics of Russian nuclear export activities. Exchange rates and not purchasing power parity is the main

driver.

15

See Thomas (1988), p. 39.

16

Ibid., p. 39.

14

6

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

Table 2. Nuclear Power Plant Specifications in OECD/IEA Study

Country

Reactor

Type / Fuel

Cycle

Option

Units

in

Project

Canada

PHWR/OT

Total

Units

at

Site

Net

Capacity

(MW)

Net

Thermal

Eficiency

(%)

Cooling

Tower

Site

Cost

Estimation

Source

/ Date

2

665

31.2

No

New

O/96

PHWR/OT

2

881

31.2

No

New

Q/96

Finland

BWR/OT

1

1000

33.0

No

New

P/96

France

PWR/CC

1

4

1460

33.0

Yes

New

Q/96

Japan

ABWR/CC

1

4

1303

33.0

No

New

P/96

Korea

PWR/OT

1

2

1000

35.1

No

New

O/95

Spain

PWR/OT

1

1000

34.0

Yes

New

P/96

Turkey

PWR/OT

1

1000

34.5

Yes

New

P/95

Brazil

PWR/OT

1

1229

34.6

No

Existing

Q/95

China

PWR/CC

2

592

29.6

No

New

P/96

PWR/CC

2

935

32.2

New

FS/96

PHWR/OT

2

665

29.1

No

New

FS/96

India

PHWR/OT

2

455

29.0

No

Existing

P&O/97

Romania

PHWR/OT

1

5

707

31.0

No

Existing

P&O/95-97

Russia

VVER/OT

1

5

604

33.3

No

Existing

Q/96

United

States*

PWR/OT

1

1300

32.0

Yes

New

P/96

Brazil*

PWR/OT

1

1229

35.0

No

New

P/96

3

Notes: * Category B technologies: under development and projected to be available by 2010. Reactor types: PWR pressurized light

water reactor; PHWR, pressurized heavy water reactor; VVER, Russian pressurized light water reactors; BWR, boiling water reactor;

ABWR, advanced boiling water reactor. OT and CC referrers to the fuel cycle option chosen. OT is an open fuel cycle or “once

through” and CC means “closed cycle”. “Units in project” column refers to the number of units included in the cost estimate.

Source: OECD/IEA (1998), p. 46.

2.2.

Comparisons of Capital Costs Estimates for Nuclear Generation

Capital cost estimates from all available open sources are presented in Table 3.17

The cost estimates represent all expenditures and encumbrances at the start of

commercial operation, including interest cost during construction. Where the source gave

17

Because the data includes only the most recent available estimates on nuclear generation capital

costs there are some notable absence in the data. Germany, for example, had a quite successful nuclear

program that was halted in the late 80’s (last reactor, NECKARWESTHEIM-2 came on line in 1989). Data

on the cost of the latest nuclear German reactors is not available.

7

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

a construction only or so-called overnight cost, we added expected construction interest

and decommissioning, usually using the OECD assumptions as discussed earlier. The

numbers are in 2002 U.S. dollars.

Overall the database contains 31 cost estimates from different sources on 15

countries.18 The most detailed data available is on China where we have 9 cost estimates

from 3 sources.

The capital costs vary between $1500/kW (an estimate for a Russian VVER in

India, at Kudankulam) and $3768/kW (our estimate for a U.S. PWR) with an average at

about $2500/kW. Net capacity varies between 455MW and 1460MW per unit.

Most of our estimates are on pressurized light water reactors PWR (14), followed

by pressurized heavy water reactors PHWR (9, mostly Canadian), Russian pressurized

light water reactors VVER (5), one boiling water reactor BWR and one advanced boiling

water reactor ABWR. BWRs are the most expensive reactors in our sample with an

average cost $3176/kW, but there are only three estimates and the average is driven by

the very expensive Japanese ABWR. The least expensive are the Russian VVER (average

$1988/kW) constructed domestically or abroad (in China and India) although the

estimates for domestic construction are significantly higher than the estimates for reactors

abroad. The OECD estimate of the domestic Russia units is significantly higher than

other estimates. The average for PWR units is $2656/kW. This falls to $2570/kW if the

highest estimate (based on early U.S. experience) is thrown out. The average for PHWR,

which are mostly Canadian construction, is $2457/kW.

Countries with the lowest capital cost per kW (first quartile) are China, with an

average capital cost of $2238/kWh and India with $2136/kW. However the averages are

mostly drawn by the very low cost of the reactors built in both countries by Russia. In

China, if we drop the estimates for the Russian reactors, the country average capital cost

becomes $2383/kW. The country average for imported technologies (4 French reactors

and 2 Canadians) is $2467/kW, very close to the sample average. In India, the average

without the Russian built reactors is $2454, again close to the sample average.

The most expensive reactors (last quartile) are in United States, Japan, Spain, UK

and Finland. The numbers range between $2871/kW, the OECD estimate for a planned

Finnish reactor, and $3768, our estimate extrapolated from the early United States

experience.

Right in the middle are the estimates for French and Korean reactors and for two

Canadian built Chinese reactors. Brazil and Argentina estimates are also very close to

average but the cost for Argentina is most likely grossly underestimated as the actual cost

for the specific plant itself.19

For both Canadian and French reactors, reported costs for domestic reactors are

similar to those of exported reactors. Canada, for example, has a capital cost of

$2455/kW for its domestic reactors, and about $2400/kW for its exported reactors (to

China and Romania). France’s estimates for domestic construction are $2523/kW while

18

There is one plant for which there are two separate cost estimates.

The construction of Atucha 2 started in 1981 and has been halted several times since. It is

uncertain when and whether the reactor will be finished. For a reactor with a construction period that

stretched over more than 20 years the estimate we have is unrealistically low. The estimate was obtained by

adding 35 percent for interest during construction and decommissioning to an overnight capital cost

estimate of $1800/kW provided by EPOA (2000).

19

8

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

the reactors exported to China cost $2385/kW on average. The lower cost of the French

technology in China could be due to the fact that China typically undertakes part of the

reactor construction.20 For Russia, on the other hand, the domestic capital cost is at least

$2266/kW while the exported reactors average $1665/kW.

For the countries on which we have estimates from different sources, the

estimates do not converge. China’s estimates vary between $1620/kW for the 1000 MW

Russian VVER to $2747/kW for the 2 unit 665 MW PHWR.21 The discounts at which

Russia seems to sell its reactors abroad only partially accounts for the low cost of the 2

VVER reactors. Russia will receive $2.4 billion for the two units. While Russia is

supplying the technology and the reactor itself, China is responsible for construction and

installation. Russia is financing the $1.3 billion loan at 4 percent. Based on our estimates,

Russia may be enjoying a modest profit on its construction activities in China eroded,

however, by the financial obligations of the contract.22 If China is able to supply such a

significant share of the construction at such low cost, the question is why it does not do it

for the rest of reactors it buys from abroad? It may be that the significantly higher capital

costs of the Canadian and French reactors include a payment for the technology transfer

while the Russian price does not.

The estimates vary even more for India. The cost of the two 1000 MW VVER

reactors that Russia is building at Kudankulam is as low as $1500/kW. This number is

based on news reports that place the total cost of the project at $3 billion. It is probably

appropriate to discount this estimate because we do not know what it comprises (e.g.,

construction interest may be excluded). The OECD country estimate for PWHR reactors

is $2719/kW while another country estimate places the capital cost at $2189/kW.23 It is

obvious that Russia is selling the VVER reactors at a significant discount, based both on

the capital cost estimates for VVERs in Russia and based on the competitive supply

prices of other nuclear units.

Notable also is the difference between OECD and WNA estimates in Finland.

OECD estimates that the capital cost of BWR technology in Finland is $2871/kW while a

WNA country estimate of capital cost (including the initial fuel load!) is $1637/kW.24

The same study however states that the 1000MW reactor planned to be built in Finland in

the next few years is going to cost between $1870/kW and $2670/kW.25 We have no

20

The financing cost of the reactor in developing countries should be higher, however than for the

domestic reactors. Both France and Canada have a history of undertaking debatable financing arrangements

with developing countries. For an interesting account of these issues see, for example, “The Candu

Syndrome” by David H. Martin, Nuclear Awareness Project for the Campaign for Nuclear Phase Out,

1997, at <www.ccnr.org/turkey_syndrome.html>.

21

As estimated by CEPO(1998).

22

See Maloney & Diaconu (2002).

23

EPOI (1998) gives only the base cost. We obtained the total capital cost by assuming that

interest during construction and decommissioning represent 25 percent of the base cost as they are in the

IEA/OECD study.

24

Risto Tarjanne & Sauki Rissanen “Nuclear Power: Least Cost Option for Baseload Electricity

in Finland”, The Uranium Institute Twenty Fifth Annual International Symposium 2000, <www.worldnuclear.org>, Table 1, p. 8. The paper states that the capital cost of a nuclear plant in Finland is 1749 Euros

(2000) per kW. We have transformed it into 2000 U.S. dollars assuming as the authors do an exchange rate

1 Euro=$.90. Then we inflated the number to 2002 U.S. dollars.

25

The reactor is expected to cost between 1.75 and 2.5 billion euros in 2000 prices. Capacity of

the reactor is not yet decided. It depends on the reactor that will be selected. "In March 2003 tenders were

9

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

explanation for the extremely low number in the study cited by WNA. It does include

construction interest.

Table 3. Capital Costs of Nuclear Power Generation

Country & Plant

Net

Name

Source Estimate

Capacity

Technology

$ / kW

Operational

CHINA

Daya Bay (1&2)

CEPO (1998)1

944

Qinshan II

IEA/OEC (1998)2

610

Qinshan III (1&2)

CEPO (1998)

665

Qinshan III (1&2)

665

Qinshan III (1&2)

IEA/OECD (1998)

WNA contract value

(1996)3

Lingao (1&2)

CEPO (1998)

930

Lingao (1&2)

Tianwan 1&2

Tianwan 1&2

IEA/OECD (1998)

CEPO (1998)4

NTI(2001)5

930

1000

1000

French

PWR

Chinese

PWR

Canadian

PHWR

Canadian

PHWR

Canadian

PHWR

French

PWR

French

PWR

VVER

VVER

INDIA

n/a

Tarapur 3&4

Kudankulam 1&2

EPOI (1998)6

IEA/OECD (1998)

M&D (2003)7

n/a

455

1000

IEA/OECD (1998) &

EPOK (1999)8

FINLAND

n/a

n/a

Loviisa/Olkiluoto

2285

1994

1872

2002

2747

2002

2402

2002

2496

2002

2182

2002, 2003

2691

1875

1640

2002, 2004

2004, 2005

2004, 2006

PHWR

PHWR

VVER

2189

2719

1500

n/a

2006, 2007

2007, 2008

1000

PWR

2501

2002

IEA/OECD (1998)

WNA (2003)9

WNA (2003)10

1000

n/a

1000

BWR

n/a

n/a

2871

1637

2270

2005-2010

2005-2010

2007

RUSSIA

n/a

n/a

IEA/OECD (1998)

D&M (2003)11

604

1000

VVER

VVER

2709

2266

n/a

n/a

UNITED STATES

n/a

n/a

M&D (2003)

IEA/OECD (1998)

1000

1300

PWR

PWR

3768

2285

n/a

n/a

665

KOREA

Yonggwang 5&6

submitted by three vendors for four designs: Framatome ANP: European Pressurized Water Reactor (EPR)

of 1500 MWe and the SWR-1000 (a BWR) of 1200 MWe, General Electric: European Simplified Boiling

Water Reactor (ESBWR) of 1390 MWe, and Atomstroyexport: VVER-91/99 of 1060 MWe.

(Westinghouse did not bid its AP-1000 PWR or its BWR-90+) The EPR is the new standard design for

France, the two BWRs are both undergoing design certification in the United States, and two of the VVER91 units are being built in China" WNA, Nuclear Power in Finland, April 2003.

10

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

FRANCE

n/a

IEA/OECD (1998)

1460

PWR

2523

n/a

CANADA

n/a (2 units)

Darlington (1&2)

IEA/OECD (1998)

IEA/OECD (1998)

665

881

PHWR

PHWR

2638

2272

n/a

1990, 1992

JAPAN

Shika-2

IEA/OECD (1998)

1303

ABWR

3481

2006

IEA/OECD (1998) and

EPOB (2000)12

1229

PWR

2610

2001

745

PWR

2475

n/a

BRAZIL

Angra 2

ARGENTINA

Atucha 2

EPOA (2000)13

SPAIN

n/a

IEA/OECD (1998)

1000

PWR

3272

n/a

TURKEY

n/a

IEA/OECD (1998)

1000

PWR

2600

n/a

ROMANIA

Cernavoda 1

Cernavoda 2

IEA/OECD (1998)

n/a 14

707

707

PHWR

PHWR

2304

2348

1996

2007

GREAT BRITAIN

Sizewell B

Hinkley C

KU (1995) 15

KU (1995)

1155

1175

PWR

PWR

3097

3028

1995

n/a

11

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

Notes:

Where plant names could be reasonably inferred, they are listed.

1. William Chandler, Guo Yuan, Jeffrey Logan, Shi Yingyi, Zhou Dai "China's Electric Power Options. An Analysis of

Economic and Environmental Costs,” [CEPO] Advanced International Studies Unit, Pacific Northwest National Laboratory

[PNNL], June 1998 See p. 43 for capital cost estimate on China's Power Plants.

2. International Energy Agency (IEA), Nuclear Energy Agency and Organization for Economic Cooperation and

Development (OECD) "Projected costs of generating electricity"), Paris 1998, p. 54-55.

3. WNA News Briefings, 20-26 November 1996, <www.world-nuclear.org> citing Reuters, November 15, 1996.

4. Range: 1730 to 2020.

5. Russia: General Nuclear Exports Developments, November 28, 2001, <www.nti.org>.

6. Shukla, P.R., Debyany Ghosh, William Chandler, Jeffrey Logan, "Electric power options in India," [EPOI] Pew Center on

Global Climate Change, October 1999, p. 26.

7. Michael T. Maloney and Oana Diaconu , “Analysis of Privatization of Russia’s Nuclear Ministry on the Nuclear

Nonproliferation Objectives of the United States”, Special Report, Strong Thurmond Institute, 2001,

<www.clemson.edu/~maloney/papers/cudoereport.pdf>, citing news reports.

8. Jin-Gyu Oh, Jinwoo Kim, Jeffrey Logan, Sung Bong Yo, Willian Chandler, Dong-Seok Roh

"Electric Power Options in Korea", Pew Center on Global Climate Change, October 1999, p. 37 and OECD (1998). EPOK

uses the same estimate as OECD as the base construction cost. Consequently, I consider their overall capital cost estimate

identical (10% discount rate).

9. Risto Tarjanne & Sauki Rissanen “Nuclear Power: Least Cost Option for Baseload Electricity in Finland”, The Uranium

Institute Twenty Fifth Annual International Symposium 2000, <www.world-nuclear.org>, Table 1, p. 8.

10. Nuclear energy in Finland, April 2003, <www.world-nuclear.org>. Range: from 1870 to 2670.

11. Oana Diaconu and Michael T. Maloney “Is nuclear power viable in Russia?" The Electricity Journal, January/February

2003, p. 82. The estimate is based on OECD estimate scaled up to 1000MW, the size of the standard unit being built by

Russia today using an average cost elasticity of -0.2. That is for each 10 percent increase in size, capital cost per MW goes

down by 2 percent.

12. Roberto Schaeffer, Jeffrey Logan, Alexandre Salem Szklo, William Chandler, Joao Carlos de Souza Marques "Electric

Power Options in Brazil", Pew Center on Global Climate Change, May 2000.

The base capital cost in this study is $1600/kW (1997 $US), very close to IEA/OECD $1550/kW. We consider the overall

estimates for capital cost identical.

13. Daniel Bouillle, Hilda Dubrovsky, William Chandler, Jeffrey Logan, Fernando Groisman "Electric Power options in

Argentina", Pew Center on Global Climate Change, May 2000, p. 16.

14. This estimate was recorded in our database, but the source has been lost.

15. Anne Ku "Modeling Uncertainty in Electricity Capacity Planning", Unpublished Thesis, London Business School,

February 1995, p. 203. She cites two studies for the source of her data OECD/NEA (1989), "Projected Costs of generating

Electricity from Power Stations for Commissioning in the Period 1995-2000," for the estimate on Sizewell and OECD/NEA,

IEA and UNIPEDE (1988) "Electricity Generation Costs: Assessment Made in 1987 for Stations to be Commissioned in

1995", Sorento Congress, May 5- June 3 for the estimate on Hinkley.

2.3.

Implications of the Results

We draw the following conclusions from the comparison of the cost estimates

shown above. There is a great deal of variance in the forecast capital cost of nuclear

power plants. This is true not just for international Russian construction but also for costs

of other reactors such as the Canadian and French models. The French units have a mean

of $2386/kW with a standard deviation of $270; the Canadian models have a mean of

$2548/kW with a standard deviation of $178.

Nonetheless, it is clear that Russian units are typically forecast to have lower costs

than the rest of the competition. If we look only at the estimates for Russian units

installed in foreign countries, the average is $1672/kW. This is probably biased

downward because of the one observation for the Indian facilities based on simple news

reporting. Even so, if we go with the highest of these estimates, $1875/kW cited by

PNNL, the number is still 21 percent lower than the French cost and 26 percent lower

than the Canadian.

The suggestion is that Russia is consistently low-bidding. This difference is

somewhere between 15 and 25 percent. Based on the cost breakdown presented in Table

1, this range is roughly consistent with the notion that Minatom does not price design

costs into its bids and anticipates minimal contingencies.

12

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

3. Analysis of Load Factors at Nuclear Power Plants

The analysis presented in the last section also speaks to the issue of levelized cost.

Levelized cost is the calculation of the per kWh price that the power plant must receive

throughout its life in order to pay back the construction and operating cost. Levelized cost

is based on the capital cost of the machine as we have discussed in section 2 above. It

also depends on the operating costs (e.g., maintenance, fuel, etc.), the forecast life,

discount rate, and load factor.26

Table 4 shows a simple comparison of levelized cost estimates based on

alternative assumptions. In the first case we use assumptions that seem to us to reflect the

true state of operation of nuclear power plants. We call these the baseline assumptions.

We use a life of 30 years because historically, most plants have required substantial

capital improvements to continue operation past that point. We use a capital cost estimate

that is around the cost reported for French units. We price fuel at the cost paid by U.S.

utilities; the same is true for maintenance. Alternatively, we show the “best-case”

assumptions used in the Finish study.27 The effect on cost is dramatic. A conservative

estimate of the cost of nuclear generation is nearly three times higher than the cost

estimated on best-case scenarios.

Table 4. Levelized Cost Comparison for Nuclear Power

Assumptions

Factors:

Baseline

Best-Case

Plant Life (years)

30

40

Discount Rate

0.1

0.05

Load Factor

0.8

0.9

Capital Cost ($/kW)

2400

1637

Fuel cost ($/MWh)

6.0

2.9

Maintenance Cost ($/MWh)

9.0

3.4

Implied Cost

Levelized Capital Cost ($/MWh)

Full Cost of Power ($/MWh)

36.3

51.3

12.1

18.4

It is possible that a best-case scenario is appropriate for Finland. We know that

Finland has experienced favorable performance from its existing nuclear power plants

and that the electrical system overall operates efficiently. However, it is romantic to make

26

Load factor is the amount of power produced by a generator divided by the engineering capacity

of the unit. Usually load factors are stated for a year. The calculation, then, is the total kilowatt hours of

power generated by the unit divided by the capacity of the unit in kilowatts times the number of hours in

the year.

27

Risto Tarjanne & Sauki Rissanen “Nuclear Power: Least Cost Option for Baseload Electricity in

Finland”, The Uranium Institute Twently Fifth Annual International Symposium 2000, <www.worldnuclear.org>, Table 1, p. 8.

13

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

similarly sanguine estimates for less developed countries.28 In this section we offer an

analysis of one of the most important factors affecting levelized cost, load factor, and link

it to the operating efficiency observed for the electric system as a whole. From this

analysis we are able to make forecasts of the expected cost of nuclear power even for

those countries that have not yet adopted nuclear generation technology.

3.1.

Load Factor Effects

In our earlier work, we assumed a baseline scenario for load factors in Russia of

79 percent. However, nuclear power plants worldwide have not historically enjoyed load

factors this high, nor has Russia. Since levelized capital cost is inversely proportional to

load factor, the relationship between the two is a significant factor in determining the true

cost effectiveness of nuclear power. A 10 percent decrease in load factor, say, from 79

percent to 71 percent, increases capital cost by 10 percent.

The worldwide historical experience in load factor is 69.4 percent for reactors

currently operating and 68.3 percent for all commercial reactors.29 These numbers are

capacity weighted averages by machine by year. The following two tables show the

worldwide experience by year and by country. By year, load factors have been

improving. Load factors were 50 to 60 percent in the early 1970s. They have increased to

around 80 percent today. Even so, there is still a wide range of operating performance

across countries. Even looking at the most recent experience, countries such as Finland,

Belgium and Switzerland that operate in the high 80s and low 90s of load factor are offset

by countries like India which is in the 50s.

Many things can affect load factor for an electric generator. For nuclear plants, in

particular, age is important. Because of the complexity of the machinery and controls, it

is common for nuclear plants to operate at less than full power when they first come

online. Indeed, on average it takes nuclear power plants 9 months from first powering the

reactor until commercial operation, and 10 percent of the time it takes more than a year.

Even in the first year of operation, the reactor is will not run at full power or be

synchronized to the grid all the time. Age also works against reactors. On average, the

older they get, the lower their load factors.

We capture these many factors in the following statistical analysis. We use

multiple regression to model the load factor at each plant as a function of the

characteristics of that plant. Plant characteristics include the age of the plant and the

length of the construction period. We use {0,1} dummy variables to take account of the

period from the reactor startup and the first year of commercial operation, the first year of

commercial operation, and the last year of commercial operation for reactors that have

been shut down. In addition, we include dummy variables for each country and year pair.

28

As a side note on age, of the commercial nuclear power plants that operated for 5 or more years

and were subsequently shut down, the average age is 20 years, not 30, and the maximum life is 35.

Moreover, no nuclear power plant has yet enjoyed 40 years of service.

29

Data on design, construction, and operating characteristics of nuclear power plants worldwide is

available from the International Atomic Energy Agency (IAEA) through its Power Reactor Information

System (PRIS).

14

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

Table 5. Load Factors for Nuclear Power Plants—

World Wide Experience by Year

Year

All Reators

Currently Operating

1970

0.53

0.53

1971

0.56

0.56

1972

0.54

0.52

1973

0.55

0.53

1974

0.54

0.51

1975

0.58

0.56

1976

0.60

0.58

1977

0.59

0.58

1978

0.61

0.62

1979

0.58

0.59

1980

0.57

0.57

1981

0.59

0.59

1982

0.59

0.59

1983

0.61

0.62

1984

0.62

0.63

1985

0.66

0.66

1986

0.65

0.66

1987

0.64

0.67

1988

0.65

0.66

1989

0.65

0.67

1990

0.66

0.69

1991

0.68

0.70

1992

0.68

0.70

1993

0.70

0.71

1994

0.70

0.71

1995

0.71

0.73

1996

0.72

0.73

1997

0.71

0.73

1998

0.74

0.75

1999

0.77

0.77

2000

0.78

0.78

2001

0.80

0.80

2002

0.85

0.85

15

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

Table 6. Load Factors for Nuclear Power Plants—By Country

Country

All Reactors Currently Operating

Since1996

Armenia

0.52

0.54

0.53

Argentina

0.74

0.74

0.81

Belgium

0.82

0.82

0.89

Bulgaria

0.53

0.53

0.53

Brazil

0.35

0.35

0.55

Canada

0.70

0.76

0.77

Switzerland

0.84

0.84

0.88

China

0.73

0.73

0.76

Czech Republic

0.79

0.79

0.84

Germany

0.73

0.76

0.86

Spain

0.77

0.78

0.88

Finland

0.86

0.86

0.93

France

0.65

0.67

0.72

United Kingdom

0.67

0.66

0.74

Hungary

0.83

0.83

0.87

India

0.45

0.45

0.56

Italy

0.37

Japan

0.72

0.72

0.80

South Korea

0.82

0.82

0.86

Kazakhstan

0.20

Lithuania

0.48

0.48

0.43

Mexico

0.69

0.69

0.75

Netherland

0.79

0.79

0.92

Pakistan

0.29

0.29

0.34

Romania

0.75

0.75

0.75

Russia

0.64

0.64

0.62

Sweeden

0.71

0.71

0.76

Slovenia

0.72

0.72

0.83

Slovak Republic

0.71

0.71

0.69

Taiwan

0.79

0.79

0.83

Ukraine

0.62

0.63

0.68

United States

0.67

0.68

0.82

South Africa

0.62

0.62

0.78

As noted above, we expect operation before the plant enters its commercial phase

to be characterized by relatively low load factors. This same phenomenon is likely to be

true in the first and last years of commercial operation because the plant does not operate

for the whole year. Age, in and of itself, is likely to be negatively related to load factors

at least after some point. We allow for a varying age effect by including a squared term.

We also test to see if there is a size effect; that is, we check to see if big plants are

generally more efficient than small ones. We include the length of the construction period

on the hypothesis that plants delayed in construction are not likely to run as well as those

16

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

that are finished in a timely fashion.30 Finally, a dummy variable for plants that have been

shut down gives a differential in operating efficiency between operating and closed

facilities.

Table 7. Regression of Load Factor on Plant Characteristics

Independent Variables:

Coefficient

Age of the Power Plant

-0.004

Length of Construction Period

-0.009

Prior to Commercial Operation*

-0.351

First Year of Commercial Operation*

-0.200

Plant has been Shut Down*

-0.070

Last Year of Operation*

-0.255

F-stat

Classification Variables for Country and Year

22.81

R-squared

.491

No. of Observations

9331

t-stat

-8.31

-9.86

-24.33

-21.22

-10.36

-10.91

d.f.

(776, 9330)

Notes: (*) denotes {0,1} dummy variable. Age in years from time of commercial operation. “Prior to

Commercial Operation” is a dummy variable for years from reactor startup and time of commercial operation.

The estimates shown in Table 7 conform to our expectations. Age, holding

constant for the first and last years of commercial operation is everywhere negative. The

quadratic term proved to be statistically insignificant; the estimated effect is everywhere

negative. Operating efficiency declines at nearly one-half of a percent per year. Prior to

commercial operation, plants operate at load factors 35 percent lower than after they

begin commercial production. Also, load factors are 20 percent lower in the first year and

25 percent lower in the last year of commercial operation. Finally, shutdown plants were

7 percent less efficient in each year of the their commercial lives compared to plants that

are still running.

The effects associated with these variables hold constant general effects

associated with nuclear power plant operation in each year in each country. In other

words, we estimate a country and time specific factor of performance which essentially

averages operating efficiency for each country for each year. We assume that the startup,

shutdown, age, and construction experiences are common across countries and time.

However, we imagine that on top of these, there are country-specific factors. We allow

these to vary by time as well. In essence what we have is a yearly average of operating

efficiencies across all of the nuclear power plants in service in each country.

3.2.

Country Rankings

Table 8 shows the estimated country effects derived from the regression analysis

presented in Table 7. These estimated effects are load factors for the average reactor in

each country over its commercial life under the assumption of best-case construction and

30

There are several reasons why this might be true. Regulatory delay could have resulted in

mandated changes in design. Construction delays could have resulted from design flaws. Economic delays

could lead to redesign difficulties. Our estimate is the average over all of these.

17

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

startup. They represent the relative operating efficiencies across countries. Table 8 shows

the effects averaged over the years 1996 through 2002.31

Table 8. Average Load Factor Experience by Country

Country

Load Factor

Country

Armenia

0.53

Japan

Argentina

0.81

Korea, South

Belgium

0.90

Kazakhstan

Bulgaria

0.54

Lithuania

Brazil

0.69

Mexico

Canada

0.77

Netherlands

Switzerland

0.91

Pakistan

China

0.72

Romania

Czech Republic

0.84

Russia

Germany

0.87

Sweden

Spain

0.90

Slovenia

Finland

0.95

Slovak Republic

France

0.75

Taiwan

United Kingdom

0.80

Ukraine

Hungary

0.89

United States

India

0.62

South Africa

Load Factor

0.79

0.85

0.26

0.44

0.81

0.85

0.34

0.81

0.62

0.77

0.85

0.72

0.84

0.69

0.89

0.80

Notes: Load factor is based on regression analysis in Table 7, and averaged for years 1996 on. Estimates are

the average experience in each country under the assumption of a 30 commercial life and best-case

construction record.

Again we see a wide range of operating efficiencies. For the most part, the

relative rankings between countries change little from the raw data, though there are a

few interesting differences. Brazil, which seemed pathetic in the raw data, looks a little

better in these estimates. But, India and the eastern European countries including Russia

still bring up the rear while Finland, Belgium, and Switzerland are at the top.

An important question involving these operating efficiencies is, how much can be

attributed to the design and operation of the plants themselves and how much is due to

the overall electricity system of the country itself? This question is important in an

analysis of the cost of nuclear power because design and operational inadequacies are

potentially resolved if and when new plants are constructed, whereas inefficiencies

systemic to the countrywide electricity system are much less likely to be remedied. We

approach this question by examining the operating efficiency of the electricity system in

each country.

31

Data for most countries goes only through 2001.

18

Maloney & Diaconu

3.3.

LLNL Project: Sub-Contract B529375

Line Losses

The best measure of the operating efficiency of a country’s electricity system

available to us is line losses. Line losses represent electricity that is generated but lost in

the movement of power from the generator to the ultimate consumer. It is energy that is

dissipated in the transmission and distribution system.

More electric power is lost when power moves across low voltage lines than it

does at high voltage. For instance, in the United States, most of the large generation units

and especially the nuclear power plants are tied into the electrical system or grid through

500,000 volt lines. This power moves throughout the system to substations where the

voltage is reduced and reduced until it reaches households at 220 volts. Obviously, the

farther power moves along higher voltage lines in its path from generator to home, the

lower will be the line losses.

Country by country data on electricity generation, consumption, and line losses

from transmission and distribution were obtained from the World Bank.32 The data

include generation by type of fuel as well as total generation. The data are annual from

1992 through 2000. The average line loss percentage is shown in Table 9 for the

countries for which data are available.

The line loss data seem reasonable in the large. Developed countries typically

have lower line losses than underdeveloped ones. Even so, there are some outliers. One

way of examining these data is to relate the line losses to other characteristics of the

electrical system. We do this by estimating a regression of line losses on various

characteristics of the electricity system. Specifically, we regress line losses on the

percentage of exports, electricity consumption per capita, electricity consumption divided

by the area of the country, and area itself.

Exports are expected to be associated with lower line losses because exports are

almost always accomplished over high voltage transmission lines. Also, it seems

reasonable to believe that the transmission system will be of higher quality in countries

that have more exports. Across our sample the average export percentage is 5 with a

standard deviation of 10.33 Electricity consumption per capita and per square mile are

likely associated with lower line losses simply because they are indicators of more

intense electricity use.

32

The Energy Information Administration of the U.S. Department of Energy reports international

data from which line losses can be calculated. However, for more than half of the observations, the line loss

percentage is exactly 7. EIA cautions on the accuracy of these data; we second.

33

Export percentage is kilowatt hours of electricity exports divided by generation plus imports.

These data come from EIA-DOE.

19

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

Table 9. Electricity Line Losses in Transmission and Distribution by Country

Line

Line

Loss

Loss

Country

Percent

Country

Percent

Albania

48.7

Germany

4.0

Algeria

17.2

Ghana

0.8

Angola

21.8

Greece

7.5

Argentina

17.0

Guatemala

16.3

Armenia

32.2

Haiti

47.4

Australia

6.8

Honduras

23.9

Austria

6.3

Hong Kong, China

13.1

Azerbaijan

15.6

Hungary

12.9

Bahrain

4.7

Iceland

6.6

Bangladesh

17.7

India

20.7

Belarus

13.7

Indonesia

12.2

Belgium

5.0

Iran, Islamic Rep.

12.5

Benin

71.5

Ireland

8.7

Bolivia

21.1

Israel

4.2

Bosnia & Herzegovina

18.2

Italy

7.4

Brazil

16.7

Jamaica

10.4

Brunei

2.6

Japan

3.6

Bulgaria

14.0

Jordan

9.8

Cameroon

18.8

Kazakhstan

14.9

Canada

7.2

Kenya

18.4

Chile

9.0

Korea, Rep.

4.7

China

7.0

Kyrgyz Republic

24.4

Colombia

22.2

Latvia

29.4

Congo, Dem. Rep.

4.2

Lebanon

15.1

Congo, Rep.

38.6

Lithuania

14.0

Costa Rica

7.6

Luxembourg

25.4

Croatia

18.3

Malaysia

8.4

Cuba

18.0

Malta

10.8

Cyprus

5.6

Mexico

14.1

Czech Republic

7.6

Moldova

25.0

Denmark

5.7

Morocco

4.3

Dominican Republic

27.1

Mozambique

29.9

Ecuador

22.9

Myanmar

34.2

Egypt, Arab Rep.

12.1

Nepal

21.4

El Salvador

13.9

Netherlands

4.3

Estonia

16.7

Netherlands Antilles

12.4

Ethiopia

10.0

New Zealand

11.3

Finland

4.0

Nicaragua

26.4

France

5.9

Nigeria

32.4

Gabon

10.3

Norway

7.3

Georgia

19.8

Oman

14.5

Country

Pakistan

Panama

Paraguay

Peru

Philippines

Poland

Portugal

Qatar

Romania

Russian Federation

Saudi Arabia

Senegal

Singapore

Slovak Republic

Slovenia

South Africa

Spain

Sri Lanka

Sudan

Sweden

Switzerland

Syrian Arab Republic

Taiwan, China

Tajikistan

Tanzania

Thailand

Trinidad And Tobago

Tunisia

Turkey

Turkmenistan

Ukraine

United Arab Emirates

United Kingdom

United States

Uruguay

Uzbekistan

Venezuela

Vietnam

Yemen, Rep.

Zambia

Zimbabwe

Line

Loss

Percent

24.4

21.2

1.8

16

15.5

11.8

9.9

6.6

11.3

10.2

8.5

13.6

4.4

7.2

5.4

7.6

9.2

18.2

25.5

7

5.9

26.3

5.2

12.3

18.5

8.7

9.1

10.3

16.6

11.2

13.6

9

8.3

6.7

17

8.9

21

19.1

22.1

2.8

11.6

Notes: Data from the World Bank. Means of annual observations, 1992 through 2001.

The results of this regression are shown in Table 10. The equation explains 30

percent of the variation in line losses across time and places. All variable behave as

expected. The coefficient on the percentage of exports can be interpreted to say that a 10

percentage point increase in exports decreases line losses by 1.2 percentage points, so the

effect is not huge. The effect of electricity consumption per capita is statistically

significant, but also quite modest in its impact. The coefficient says that a 10 percent

increase in consumption per capita decreases line losses by .3 percent. Finally, electricity

consumption per square mile is trivial. The main point of this regression is simply to

20

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

show that line losses are systematically related to the electricity system, which gives us

some confidence about the quality of the data.

Table 10. Regression of the Percentage Line Losses on Country-Wide Electricity

System Characteristics

Independent Variables:

Coefficient

t-stat

Percentage of Exports

-0.12

-5.19

Electricity Consumption Per Capita*

-0.03

-11.31

Electricity Consumption Per Square Mile*

-3.75E-3

-1.83

Intercept

.41

27.93

R-squared

.31

No. of Observations

1074

Notes: (*) denotes logs.

Our main goal is to relate the quality of the electricity system to load factors for

nuclear generators. The results of this analysis are presented in Table 11. Here we regress

our estimated load factors on the line loss percentage. Several specifications are given.

Table 11. Regressions of the Estimated Load Factors for Nuclear Generators on

Country-Wide Line Losses

Coefficient / (t-stat)

Independent Variables:

(a)

(b)

(c)

Line Loss Percentage

-1.69

(-11.49)

Percentage of Exports

R-squared

No. of Observations

-1.66

(-5.07)

-0.18

(-1.83)

Electricity Consumption Per Capita*

Intercept

-1.40

(-6.20)

0.03

(1.85)

0.90

(52.29)

.33

275

0.66

(4.83)

.34

273

0.90

(22.36)

.46

32

Notes: (*) denotes logs. Specification (c) is country averages over the years for which line loss data are available.

Specifications (a) and (b) are based on pooled time series and cross sectional observations. The number of

observations differs because of data availability on electricity exports.

The results shown in Table 11 demonstrate with a reasonable degree of precision

that load factors at nuclear power plants are significantly related to the overall quality of

the electricity system as measured by the percentage line losses. The estimated

coefficient says that a 1 percentage point increase in line losses is associated with a 1.5

percentage point decrease in load factor. The estimated coefficient varies by a statistically

insignificant amount based on specification. The specification based on the average of the

annual observations for each country assures us that the statistical significance of the

effect is not spuriously inflated by autocorrelation. Inclusion of the other variables in the

regression does not affect the result, nor are they significant predictors of nuclear

generator load factors.

21

Maloney & Diaconu

3.4.

LLNL Project: Sub-Contract B529375

Application of the Results

Given our estimated relation between nuclear power plant operating efficiency

and the overall efficiency of the electric system, it remains only to predict the values for

countries of interest. Table 12 shows the actual and predicted values of load factor for all

countries currently operating nuclear power plants and for three countries that are

considering nuclear generation: Egypt, Iran, and Turkey.

In comparing the predicted values for countries with nuclear power plants in

operation, notice that there is some variation between the actual and predicted values.

The model does not explain all variation (as shown by the R-squared statistic), but it is

correct on average. It is interesting to note that two countries of interest, China and India,

both have predicted values that are very similar to the actual ones. For India, the

predicted and observed operating efficiencies are below par. The actual and predicted

load factor for China is only slightly below the benchmark level.

For the three countries that are considering nuclear power, our forecast of

operation efficiencies are all also below par. By our estimates, both Egypt and Iran can

both expect nuclear power to be around 11 percent more expensive than that based on

even a conservative scenario. Turkey can expect nuclear power to be 20 percent more

expensive.

Table 12. Predicted Nuclear Power Plant Load Factors Based on

Country-wide Line Losses

Load Factor

Line Loss

Predicted Load

Country

Experience

Percent

Factor

Argentina

0.85

0.17

0.61

Armenia

0.53

0.32

0.36

Belgium

0.87

0.05

0.81

Brazil

0.47

0.17

0.62

Bulgaria

0.53

0.14

0.66

Canada

0.74

0.07

0.78

0.77

0.07

China

0.78

Czech Republic

0.82

0.08

0.77

Finland

0.93

0.04

0.83

France

0.71

0.06

0.80

Germany

0.84

0.04

0.83

Hungary

0.89

0.13

0.68

0.53

0.21

India

0.55

22

Maloney & Diaconu

Japan

Kazakhstan

Korea, South

Lithuania

Mexico

Netherlands

Pakistan

Romania

Russia

Slovakia

Slovenia

South Africa

Spain

Sweden

Switzerland

Taiwan

Ukraine

United Kingdom

United States

Selected

Countries

Egypt

Iran

Turkey

LLNL Project: Sub-Contract B529375

0.77

0.35

0.84

0.42

0.79

0.85

0.37

0.79

0.61

0.74

0.80

0.72

0.86

0.75

0.90

0.81

0.67

0.80

0.83

0.04

0.15

0.05

0.14

0.14

0.04

0.24

0.11

0.10

0.07

0.05

0.08

0.09

0.07

0.06

0.05

0.14

0.08

0.07

0.84

0.65

0.82

0.66

0.66

0.82

0.49

0.71

0.73

0.78

0.81

0.77

0.74

0.78

0.80

0.81

0.67

0.76

0.78

0.12

0.13

0.17

0.69

0.69

0.62

Notes: Load factor experience is our measure of the operational performance on average in

each country for nuclear power plants over thirty years of commercial life assuming a bestcase construction record. These numbers differ slightly from the earlier table because they are

averaged over the years for which line loss data is available.

4. Summary & Conclusions

This document reports our investigation of two aspects of the business

environment in which Minatom operates. As we stated in the introduction, we see two

major questions in the nuclear construction business initiatives of Minatom: (i) Is it

possible that Minatom is making money on nuclear power plant construction given the

price that it is charging for this work? (ii) Are countries investing in nuclear power

making economically efficient decisions? To help answer these question, we have

examined the various estimates of construction cost for nuclear power plants, and we

have looked at country-specific factors affecting the operating efficiency of nuclear

power plants.

The basic conclusions reached in this report are the following:

1) There is a great deal of variance in the forecast capital cost of nuclear power plants.

This is true not just for Russian construction but also for costs of other reactors such

as the Canadian and French models. Nonetheless, it is clear that forecast cost of

Russian units installed internationally is typically lower than the rest of the

competition. This suggests that Russia is consistently low-bidding. The difference

between the price Russia is charging and the price charged by competitors in the

23

Maloney & Diaconu

LLNL Project: Sub-Contract B529375

international construction industry runs somewhere between 15 and 25 percent. This

is roughly equivalent to the technology component in the cost structure plus minimal

accounting for contingencies and interest charges during construction.

2) The capital cost of electricity per kWh is inversely proportional to load factor. Hence,

a ten percent decrease in load factor translates approximately into a ten percent

increase in the full price of electricity. The historical, worldwide average load factor

for nuclear power plants is around 70 percent; this compares to assumed load factors

of between 80 and 90 percent used in nuclear power plant cost projections. We think

that this is an important factor in assessing the economic efficiency of new nuclear

generation projects, such as those in Iran, India, China, and proposed projects in

Egypt and Turkey.

We search for factors that are systematically linked to load factors at nuclear power

plants. The objective is to link the factors associated with the operating efficiency of

the electricity system of a country to load factor so that we can more accurately

predict the expected load factor for a proposed nuclear power plant. We find that

countrywide nuclear power plant load factors are systematically linked to the line

losses experienced within each country. Our estimates say that a 1 percentage point

increase in line losses is associated with a 1.5 percentage point decrease in load

factor.

Based on this, we are able to forecast load factors for nuclear power plants even for

countries that are not yet employing nuclear generation technology. For three such

countries of interest, Egypt, Iran, and Turkey, we forecast nuclear power plant load

factors much lower than the baseline assumptions. This very likely makes nuclear

power an uneconomic source of generation for these countries.

24

![The Politics of Protest [week 3]](http://s2.studylib.net/store/data/005229111_1-9491ac8e8d24cc184a2c9020ba192c97-300x300.png)