When analyzing a real-world project, it is important to consider the

advertisement

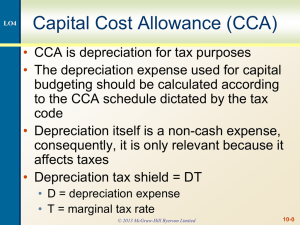

MBA 8124: Managerial Finance Warsaw School of Economics Notes on Real-World Capital Budgeting (Canada) Dr. D. Stangeland When analyzing a real-world project, we must consider the incremental cash flows and opportunity costs caused by the project. A major component of our analysis is the cash flows related to asset purchases and sales and the resulting tax effects. A. Capital Cost Allowance (CCA) The main tax effects resulting from an asset purchase or sale are due to CCA deductions. Similar to the use of depreciation (which is used to calculate a company’s income to be reported to shareholders), CCA is used for the calculation of taxable income for Revenue Canada. Each CCA deduction reduces taxable income and therefore reduces taxes. We must include the tax savings caused by CCA deductions as a positive component in a project’s NPV. Steps to calculate yearly CCA deductions and CCA tax shields: 1. Determine the asset class and relevant CCA rate. 2. Determine the first CCA deduction (assumed to be at the end of the first year). Revenue Canada imposes the “half-year rule” for the first CCA deduction. This results in only half the normal capital cost allowance. CCA1 = ½∙C∙d where C = initial cost of the asset d = CCA rate 3. Determine the undepreciated capital cost (UCC) remaining. UCC1 = C – CCA1 or, in general, UCCt = UCCt-1 – CCAt 4. Determine the next CCA deduction. (The “half-year rule” does not apply after the 1st CCA deduction.) CCA2 = UCC1∙d or, in general, CCAt = UCCt-1∙ d 5. Go to step 3 and continue. Note: Since only a percent of UCC is deducted each year as CCA, the UCC will never drop to zero. Thus, the CCA deductions will continue forever. The CCA tax shield each year is equal to the corporate tax rate, Tc, multiplied by the CCA deduction. I.e. CCA tax shieldt = CCAt∙Tc The present value of the perpetual CCA tax shields is given by: k 1 C d Tc 2 PVCCA Tax Shields 1 k k d where k = discount rate for CCA tax shields. If an asset is sold in a future time period n for an amount equal to Sn, then the UCC at that time is reduced by the sale price. This results in lower CCA deductions and lower CCA tax shields following the asset sale. If we expect our asset to be sold eventually in time period n, we must adjust our formula to reflect the lower expected CCA tax shields in the periods after the sale. Copyright © 1998 2000 David A. Stangeland MBA 8124: Managerial Finance Warsaw School of Economics Notes on Real-World Capital Budgeting (Canada) Dr. D. Stangeland The formula that follows is adjusted for the expected lost CCA tax shields caused by the expected asset sale in time period n. k 1 C d Tc S d Tc 1 2 PVCCA Tax Shields n k d 1 k k d 1 k n The table below shows the yearly CCA deductions and tax shields calculated over the first 20 years. On the left are the calculations assuming the asset is never sold; on the right are the calculations assuming the asset is sold for $100,000 in year 5. CCA tax shields assuming the asset is never sold CCA tax shields assuming the asset is expected to be sold Initial Cost of Asset (C) Asset Sold in year n $1,000,000 CCA rate (d) 40% Sale price (Sn) Corporate tax rate (TC) 45% Year (n) Discount rate (k) 15% $100,000 5 Note: UCC5 is reduced by the sale amount. CCA tax shield $90,000.00 Year CCA UCC 1 $200,000.00 $800,000.00 2 $320,000.00 $480,000.00 3 $192,000.00 $288,000.00 $86,400.00 4 $115,200.00 $172,800.00 5 $69,120.00 $103,680.00 6 $41,472.00 7 8 PV CCA tax shield $90,000.00 Year CCA UCC PV $78,260.87 1 $200,000.00 $800,000.00 $144,000.00 $108,884.69 2 $320,000.00 $480,000.00 $56,809.40 3 $192,000.00 $288,000.00 $86,400.00 $56,809.40 $51,840.00 $29,639.69 4 $115,200.00 $172,800.00 $51,840.00 $29,639.69 $31,104.00 $15,464.19 5 $69,120.00 $3,680.00 $31,104.00 $15,464.19 $62,208.00 $18,662.40 $8,068.27 6 $1,472.00 $2,208.00 $662.40 $286.37 $24,883.20 $37,324.80 $11,197.44 $4,209.53 7 $883.20 $1,324.80 $397.44 $149.41 $14,929.92 $22,394.88 $6,718.46 $2,196.28 8 $529.92 $794.88 $238.46 $77.95 9 $8,957.95 $13,436.93 $4,031.08 $1,145.88 9 $317.95 $476.93 $143.08 $40.67 10 $5,374.77 $8,062.16 $2,418.65 $597.85 10 $190.77 $286.16 $85.85 $21.22 11 $3,224.86 $4,837.29 $1,451.19 $311.92 11 $114.46 $171.69 $51.51 $11.07 12 $1,934.92 $2,902.38 $870.71 $162.74 12 $68.68 $103.02 $30.90 $5.78 13 $1,160.95 $1,741.43 $522.43 $84.91 13 $41.21 $61.81 $18.54 $3.01 14 $696.57 $1,044.86 $313.46 $44.30 14 $24.72 $37.09 $11.13 $1.57 15 $417.94 $626.91 $188.07 $23.11 15 $14.83 $22.25 $6.68 $0.82 16 $250.77 $376.15 $112.84 $12.06 16 $8.90 $13.35 $4.01 $0.43 17 $150.46 $225.69 $67.71 $6.29 17 $5.34 $8.01 $2.40 $0.22 18 $90.28 $135.41 $40.62 $3.28 18 $3.20 $4.81 $1.44 $0.12 19 $54.17 $81.25 $24.37 $1.71 19 $1.92 $2.88 $0.87 $0.06 20 $32.50 $48.75 $14.62 $0.89 20 $1.15 $1.73 $0.52 $0.03 $78,260.87 $144,000.00 $108,884.69 Sum of above PV's $305,927.88 Sum of above PV's $289,657.58 PVCCA tax shields using the above formula $305,928.85 PVCCA tax shields using the above formula $289,657.62 Note the summations are missing the CCA tax shields beyond year 20 and are thus slightly lower than the true amounts calculated with the PVCCA tax shields formula. Copyright © 1998 2000 David A. Stangeland Page 2 of 3 MBA 8124: Managerial Finance Warsaw School of Economics Notes on Real-World Capital Budgeting (Canada) B. Capital Gains Tax Dr. D. Stangeland If the asset is sold for an amount greater than its initial cost, a capital gain is said to occur. Capital Gain = Sales Price – Initial Cost When adjusting for the tax effects of the asset sale, the capital gain is treated separately. The UCC is reduced in the year of the sale by the initial cost, C, and an additional tax is applied to the capital gain. Capital Gains Tax = ½∙capital gain∙Tc The present value of any anticipated capital gains tax is subtracted from the project’s NPV. As noted above, when the asset is sold and a capital gain results, the gain is treated separately and UCCn is only reduced by C. We must therefore adjust the formula for PVCCA Tax Shields by replacing Sn with C. PVCCA Tax Shields (when Sn C) k 1 C d Tc C d Tc 1 2 k d (1 k ) k d ( 1 k )n C. The Project’s Net Present Value (NPV) The project’s NPV is the sum of the PV’s of all relevant cash inflows and outflows (including opportunity costs) caused by the project. The following formula may help summarize the project’s NPV calculation. PVincremental NPV = - initial cost + cash flows caused by the project* PVSalvage Value + PVCCA Tax Shields + or Expected Asset - PVCapital Gains Tax Sale Amount * The incremental cash flows include revenues less expenses, opportunity costs, side effects, working capital changes, etc., all expressed after any relevant tax effects. Copyright © 1998 2000 David A. Stangeland Page 3 of 3