Final Exam, Version 1

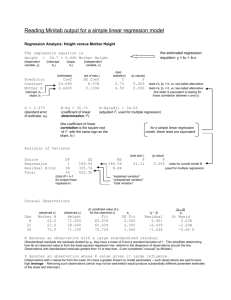

advertisement

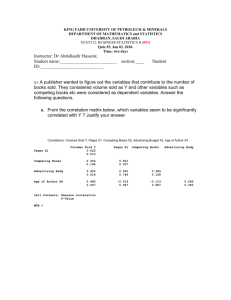

COR1-GB.1305.03 FINAL EXAM This is the question sheet. There are 10 questions, each worth 10 points. Please write all answers in the answer book, and justify your answers. Good Luck! In questions 1-6, we consider annual data from the International Monetary Fund on the G7 countries, spanning the years 2002-2011 (n=70). The response variable (y) is the inflation rate (percent) The two explanatory variables are: X1=Percent Change in GDP (from previous year) X2=Unemployment Rate (percent of total labor force) Figure 1 provides a fitted line plot for the regression of y on X1. Figure 2 provides a fitted line plot for the regression of y on X2. Fig 1: Fitted Line Plot for Inflation vs. ChangeGDP Inflation = 1.575 + 0.1514 ChangeGDP S R-Sq R-Sq(adj) 4 1.12248 7.9% 6.5% Inflation 3 2 1 0 -1 -2 -7.5 -5.0 -2.5 0.0 ChangeGDP 2.5 5.0 1) Consider a simple regression of y on X1. The corresponding Minitab output is given below. Regression Analysis: Inflation versus ChangeGDP The regression equation is Inflation = 1.58 + 0.151 ChangeGDP Predictor Constant ChangeGDP Coef 1.5754 0.15136 S = 1.12248 SE Coef 0.1539 0.06282 R-Sq = 7.9% T 10.24 2.41 P 0.000 0.019 R-Sq(adj) = 6.5% Analysis of Variance Source Regression Residual Error Total DF 1 68 69 SS 7.315 85.677 92.993 MS 7.315 1.260 F 5.81 P 0.019 A) Is there a strong linear relationship between Inflation and ChangeGDP? Explain. (2 points). B) Is there evidence at the 1% level of significance of a positive linear relationship between Inflation and ChangeGDP? (4 points). C) Provide an interpretation of the estimated slope in the model. (2 points). D) Provide an interpretation of the value of S in the Minitab output, in terms of inflation and GDP. (2 points). Fig 2: Fitted Line Plot for Inflation vs. Unemployment Inflation = 0.9394 + 0.1157 Unemployment S R-Sq R-Sq(adj) 4 1.15078 3.2% 1.7% Inflation 3 2 1 0 -1 -2 3 4 5 6 7 8 Unemployment 9 10 11 2) Consider a simple regression of y on X2. The corresponding Minitab output is given below. Regression Analysis: Inflation versus Unemployment The regression equation is Inflation = 0.939 + 0.116 Unemployment Predictor Constant Unemployment Coef 0.9394 0.11568 SE Coef 0.5658 0.07764 S = 1.15078 R-Sq = 3.2% T 1.66 1.49 P 0.101 0.141 R-Sq(adj) = 1.7% Analysis of Variance Source Regression Residual Error Total DF 1 68 69 SS 2.940 90.052 92.993 MS 2.940 1.324 F 2.22 P 0.141 A) In 2011, Germany had an unemployment rate of 6.558 percent. What is the fitted value for this data point? (2 points). B) Can we think of the fitted value in A) as a forecast for inflation in Germany in 2012? Explain. (4 points). C) Based on the Minitab output here and in question 1), if you could use just one of Unemployment or Change in GDP as an explanatory variable, which one would you use and why? (4 points). 3) Here are the results for a multiple regression of y on X1 and X2. Regression Analysis: Inflation versus ChangeGDP, Unemployment The regression equation is Inflation = 0.526 + 0.169 ChangeGDP + 0.145 Unemployment Predictor Constant ChangeGDP Unemployment Coef 0.5264 0.16897 0.14541 SE Coef 0.5620 0.06225 0.07504 S = 1.10041 R-Sq = 12.8% T 0.94 2.71 1.94 P 0.352 0.008 0.057 R-Sq(adj) = 10.2% Analysis of Variance Source Regression Residual Error Total DF 2 67 69 SS 11.862 81.130 92.993 MS 5.931 1.211 F 4.90 P 0.010 A) Based on the output here and in Question 2), when does Unemployment seem to be more helpful for describing Inflation: when Unemployment is used by itself, or when Unemployment is used in conjunction with ChangeGDP? (7 points). B) Show how S=1.10041 above is obtained from other numbers in the Minitab output. (3 points). 4) A) Provide an interpretation of the coefficient of Unemployment in the multiple regression. (5 points). B) Construct a 95% confidence interval for the true coefficient of Unemployment in the multiple regression. (5 points). 5) The n=70 values of ChangeGDP used in the regressions above had a sample mean of 1.2008 and a sample standard deviation of 2.1512. A) Is there evidence at the 5% level of significance that the population mean of ChangeGDP is positive? (5 points). B) For a t-test to be valid, the observations need to be independent. Is it reasonable to assume that the observations of ChangeGDP are independent? (5 points). 6) Based on the multiple regression above, Figure 3 plots the residuals vs. the year of observation. Does Figure 3 reveal any problems with the model? Fig 3: Resids vs Year For Multiple Regression 3 2 RESI1 1 0 -1 -2 -3 2002 2003 2004 2005 2006 2007 Year 2008 2009 2010 2011 7) A) In the sampling lab, 54 class members each selected a sample of size 5 from a population with mean μ=11.24 and standard deviation 9.11. You each calculated a sample mean for the five values in your sample. The average of all of the x values was 13.09, which is larger than the population mean by 1.85. Assuming that the samples were taken at random (and that the x values are independent of each other) what is the probability that the average of the x values would differ by at least 1.85 in either direction from the true population mean? (Hint: You may need to get an approximation to this probability: If you are off the chart in Table 5, try using Table 6 to get a rough answer.) (7 points). B) Provide an interpretation of the probability you computed in Part A). Focus on the question as to whether the samples were indeed independent random samples. (3 points). 8) Suppose you run a simple regression in Minitab, based on a data set with n=10. If Minitab’s p-value corresponding to the estimated slope in the regression is .05, then what is the value of the t-statistic for the slope? (Assume that the estimated slope is negative.) 9) If P(AB) > P(A)+P(B) then show that A, B cannot be complements of each other. 10) A sample of size 15 from a normal population yields a sample mean of 3.1 and a sample standard deviation of 5.2. Test the null hypothesis H 0 : 2 versus the alternative hypothesis H A : 2 at the 5% level of significance.