Financial Mathematics Exam Questions: Interest Theory

advertisement

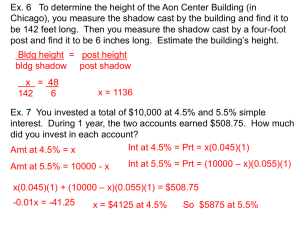

Non Interest Theory 1. 500 + 503 + 506+509 + … + 599 = 2. If x2 + 5x +8 = 16, calculate x. 3. 1 + 3+9+27+…+59,049 = Chapter 1 4. A fund is earning 6% simple interest. The amount in the fund at time zero is 10,000. Calculate the amount at the end of the 5th year. 5. A fund is earning 6% simple interest. The amount in the fund at the end of the 5th year is 10,000. Calculate the amount at the end of the 10th year. 9. Account A pays a simple rate of interest of 20%. Account B pays a compound interest rate of 5%. What year will the annual effective interest rate for Account A be equal to the annual effective interest rate for Account B? 13. Calculate the present value of $2000 payable in 10 years using an annual effective discount rate of 8%. 14. Calculate the accumulated value at the end of 3 years of 15,000 payable now assuming an interest rate equivalent to an annual discount rate of 8%. 15. Calculate the accumulated value at the end of 3 years of 250 payable now assuming an interest rate of 12% convertible monthly. 16. Calculate the present value of $1000 payable in 10 years using a discount rate of 5% convertible quarterly. 17. A deposit is made on January 1, 2004. Calculate the monthly effective interest rate for the month of December 2004, if: a. The investment earns an 4% compounded monthly; b. The investment earns an annual effective rate of interest of 4%; c. The investment earns 4% compounded semi-annually; d. The investment earns interest at a rate equivalent to an annual rate of discount of 4%; e. The investment earns interest at a rate equivalent to a rate of discount of 4% convertible quarterly. f. The investment earns 4% simple interest. 18. Investment X for 100,000 is invested at a nominal rate of interest of j, convertible semi-annually. After 4 years, it accumulates to 214,358.88. Investment Y for 100,000 is invested at a nominal rate of discount of k, convertible quarterly. After two years, Investment Y accumulates to 232,305.73. Investment Z for 100,000 is invested at an annual effective rate of interest equal to j in year 1 and an annual effective rate of discount of k in year 2. Calculate the value of Investment Z at the end of two years. 19. For each of the following, given A:, calculate B:. g. A: i=0.12 B: d(12) h. A: i(12) = 0.12 B: i(4) (6) i. A: d = 0.09 B: i 20. You are given that δ = 0.05. Calculate the accumulated value at the end of 20 years of $1000 invested at time zero. 21. You are given that δ = 0.05. Calculate the accumulated value at the end of 30 years of $1000 invested at time equal to 10 years. 22. You are given that δ = 0.05. Calculate the amount that must be invested at the end of 10 years to have an accumulated value at the end of 30 years of $1000. 23. You are given that δt = t/100. Calculate the accumulated value at the end of 10 years of $1000 invested at time zero. 24. You are given that δt = t/100. Calculate the accumulated value at the end of 15 years of $1000 invested at the end of the fifth year. 25. You are given that δt = t/100. Calculate the present value at the end of the 10 year of an accumulated value at the end of 15 years of $1000. 26. On July 1, 1999 a person invested 1000 in a fund for which the force of interest at time t is given by δt = .02(3 + 2t) where t is the number of years since January 1, 1999. Determine the accumulated value of the investment on January 1, 2000. 27. Calculate k if a deposit of 1 will accumulate to 2.7183 in 10 years at a force of interest given by: j. δt = kt for 0<t<=5 k. δt = .04kt2 for 5<t<=10 28. Christina invests 1000 on April 1 in an account earning compound interest at an annual effective rate of 6%. On June 15 of the same year, Christina withdraws all her money. How much money will Christina withdraw if the bank counts days: l. Using actual/actual method (ignoring February 29th) m. Using 30/360 method n. Using actual/360 method 29. Chris invests 1000 on Janaury15 in an account earning simple interest at an annual effective rate of 10%. On November 25 of the same year, Chris withdraws all her money. How much money will Chris withdraw if the bank counts days: o. Using exact simple interest (ignoring February 29th) p. Using ordinary simple interest q. Using Banker’s Rule 30. Ten years ago Rachel invested 10,000. Eight years ago, she invested another 10,000. Five years ago, she withdrew 12,000 to buy a car. Rachel has earned a nominal rate of interest of 10% compounded continuously. Now Rachel wants to buy a new BMW for 44,000. If Rachel uses all the money available in her account, how much additional money must Rachel borrow to buy her car? Chapter 2 6. Nora invests 1000 at an effective annual interest rate for 10 years. After 10 years, her investment has doubled. Calculate the annual interest rate earned by Nora. 7. Chris deposits 10,000 in a bank. During the first year the bank credits an annual effective rate of interest of i. During the second year, the bank credits an annual effective rate of interest of (i-.05). At the end of two years, Chris has 12,093.75 in the bank. Calculate i. 8. Brittany invests 5000 at 5% interest compounded annually. How long will it be until Brittany has 15,000? 10. Matt wants to have 1,000,000 at age 65 when he plans to retire. Matt is now 25 and can invest money at 10% annual effective interest. Calculate the amount that Matt must invest now to achieve his goal. 11. You are given that i = 0.0915. If the present value of 1 paid in n years plus the present value of 3 paid in 2n years is 2.5431, calculate n. 12. The present value of 5 payable in 10 years plus the present value of 90 payable in 20 years is 25. Calculate i. 31. Payments of 300, 500, and 700 are made at the end of years five, six, and eight. Calculate the point in time at which as single payment of 1500 is equivalent using the method of equated time. 32. Using the method of equated time, a payment of 400 at time t=2 plus a payment of X at time t=5 is equivalent to a payment of 400+X at time t=3.125. Calculate X. 33. A payment of 1 is made at the end of each year 21 through 40. Calculate the value of t using the method of equated time. 34. Melanie invests 1000 today. What annual effective interest rate will Melanie have to earn in order to have 2000 in 6 years? 35. Greg invests an inheritance of $100,000 at a constant force of interest of δ. After 12 years, Greg will have $250,000. Calculate δ. 36. Chris wants to have 6000 in 4 years. He invests 2000 now and 3000 in two years. What annual effective interest rate must Chris earn to achieve his objective? 67. An investment project has the following cash flows: Year 0 1 2 3 4 5 6 Contributions 100 200 10 10 10 5 0 Returns 0 0 60 80 100 120 60 a. Calculate the Net Present Value at 15%. b. Calculate the internal rate of return on this investment. 70. A fund has 10,000 at the start of the year. During the year $5000 is added to the fund and $2000 is removed. The interest earned during the year is $1000. Which of the following are true: i. The amount in the fund at the end of the year is $14,000. ii. If we assume that any deposits and withdrawals occur uniformly throughout the year, i is approximately 8.33%. iii. If the deposit was made on April 1 and the withdrawal was made on August 1, then i is approximately 7.74%. (a) (b) (c) (d) (e) Only Item i is true. Only Item i and ii are true Only Item i and iii are true All three Items are true The correct answer is not given by (a), (b), (c), or (d). 71. Which of the following are true? i. Time weighted rates of interest will always be higher than dollar weighted rates of interest. ii. Dollar weighted rate of interest provide better indicators of underlying investment performance than do time weighted rates of interest. iii. Dollar weighted rates of interest provide a valid measure of the actual investment results. (a) (b) (c) (d) (e) Only Item ii is true Only Item i and ii are true Only Item ii and iii are true All three Items are true The correct answer is not given by (a), (b), (c), or (d). 72. A fund has 1000 at beginning of the year. Half way through the year, the fund value has increased to 1200 and an additional 1000 is invested. At the end of the year, the fund has a value of 2100. a. Calculate the exact dollar weighted rate of return using compound interest. b. Calculate the estimated dollar weighted rate of return using the actual timing of the contributions and simple interest. c. Calculate the time weighted rate of return. 119. The rate of interest is 10% and the rate of inflation is 5%. A single deposit is invested for 20 years. Let A denote the value of the investment at the end of 10 years, measured in time 0 dollars. Let B denote the value of the investment at the end of 10 years computed at the real rate of interest. Find the ratio of A/B. Answers 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 18,683 1.275 or -6.275 88,573 13,000 12,307.69 7.177% 12.5% 22.517 years 16th year 22,094.93 3 7.177% 868.78 19,263.17 357.69 604.62 a. 0.0033333 b. 0.0032737 c. 0.0033059 d. 0.0034076 e. 0.0033557 f. 0.0032154 200,000 a. 0.112795 b. 0.121204 c. 0.094921 2718.28 2718.28 367.88 1648.72 2718.28 535.26 1046.03 6/145 = 0.0413793 a. 1012.05 b. 1012.05 c. 1012.21 29. a. 1086.03 b. 1086.11 c. 1087.22 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 14,346.43 6.73 240 30.5 12.246% 0.07636 6.6517% 1359.03 2059.00 5513.30 870.27 a. True b. False c. False d. False e. False f. True g. True h. True 20% 3.5265% 10 1/12 1/1.4 a. Fund A = 740.12 while Fund B = 776.40 b. Lisa has 1211.54 and Heather has 1299.12 5.0805 45,582.96 1835.43 15,914.19 41,470.22 6716.79 103,778 10 2050 a. 6866.52 b. 6846.27 8394.60 a. 10.44 b. 10 60. a. 4621.75 61. 62. 63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74. 75. 76. 77. 78. 79. 80. 81. 82. 83. 84. 85. 86. 87. 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. b. 5053.90 6000 38.25 45,561.83 a. 45,094.57 b. 44,518.36 216.74 160.84 a. -55.51 b. 7.49% 244.87 8977.47 C. E. a. 6.70% b. 6.66% c. 14.55% 1976.88 8863.25 8876.56 9409.16 87,724.16 69,430.92 10,000 6,500 68.06 80 74.07 8.1442% No Answer Provided 1000 690.29 4049.66 No Answer Provided 10.89% 2050 and 3388.80 163.30 and 274.18 9040.93 -31.45 10,472.28 7.1773% 12,464.76 9,319.06 99. 100. 101. 102. 103. 104. 105. 106. 107. 108. 109. 12,166.04 2,846.98 No Answer Provided No Answer Provided 13.84 a. 94,031.03 b. 95,902.37 c. 1,658.44 d. 94,243.93 e. 94,244.98 f. 94,235.70 12.30% convertible semi-annually 1 4.614 convertible semi-annually 6.4828% a. 902.88 b. 1081.11 110. 111. 112. 113. 114. 115. 116. 117. 118. 119. 120. 121. 122. 123. 124. 125. 126. 127. 128. 129. a. 902.88 b. 1111.18 2000 42 60.44 0.38 0.35 8% 0.46 987.5 1 43.49 45.69 4.84% 4.72% 0.007 5.5% 5 5.92 20 5.64