The Equity Implications of Taxation: Tax Incidence (ch19)

advertisement

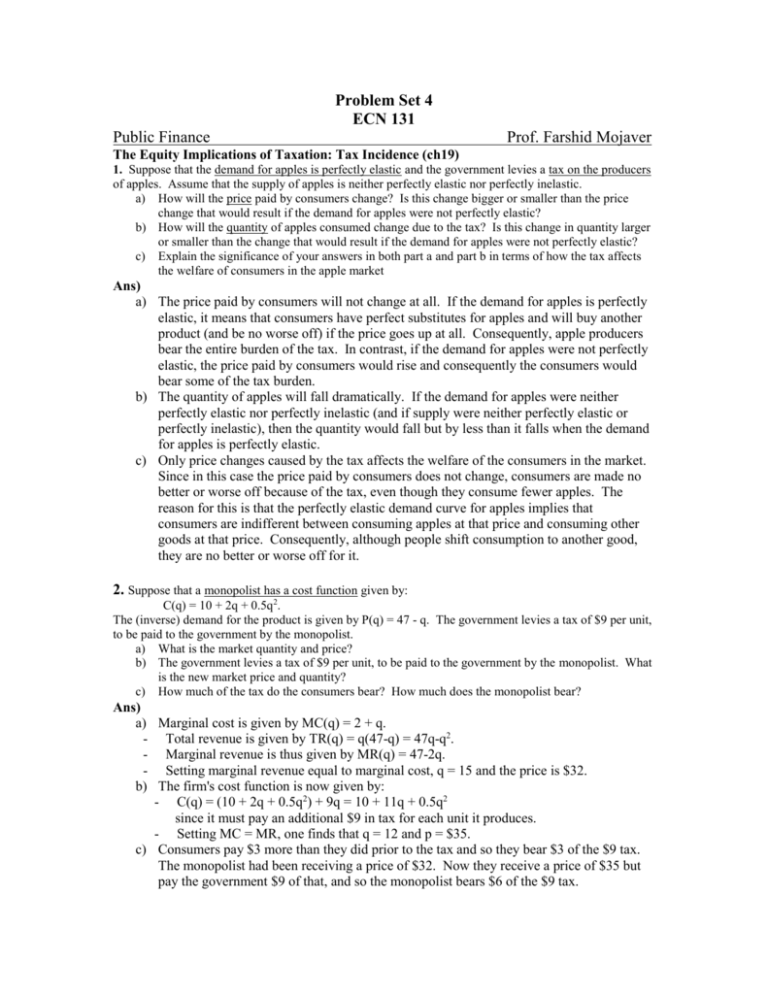

Problem Set 4 ECN 131 Public Finance Prof. Farshid Mojaver The Equity Implications of Taxation: Tax Incidence (ch19) 1. Suppose that the demand for apples is perfectly elastic and the government levies a tax on the producers of apples. Assume that the supply of apples is neither perfectly elastic nor perfectly inelastic. a) How will the price paid by consumers change? Is this change bigger or smaller than the price change that would result if the demand for apples were not perfectly elastic? b) How will the quantity of apples consumed change due to the tax? Is this change in quantity larger or smaller than the change that would result if the demand for apples were not perfectly elastic? c) Explain the significance of your answers in both part a and part b in terms of how the tax affects the welfare of consumers in the apple market Ans) a) The price paid by consumers will not change at all. If the demand for apples is perfectly elastic, it means that consumers have perfect substitutes for apples and will buy another product (and be no worse off) if the price goes up at all. Consequently, apple producers bear the entire burden of the tax. In contrast, if the demand for apples were not perfectly elastic, the price paid by consumers would rise and consequently the consumers would bear some of the tax burden. b) The quantity of apples will fall dramatically. If the demand for apples were neither perfectly elastic nor perfectly inelastic (and if supply were neither perfectly elastic or perfectly inelastic), then the quantity would fall but by less than it falls when the demand for apples is perfectly elastic. c) Only price changes caused by the tax affects the welfare of the consumers in the market. Since in this case the price paid by consumers does not change, consumers are made no better or worse off because of the tax, even though they consume fewer apples. The reason for this is that the perfectly elastic demand curve for apples implies that consumers are indifferent between consuming apples at that price and consuming other goods at that price. Consequently, although people shift consumption to another good, they are no better or worse off for it. 2. Suppose that a monopolist has a cost function given by: C(q) = 10 + 2q + 0.5q2. The (inverse) demand for the product is given by P(q) = 47 - q. The government levies a tax of $9 per unit, to be paid to the government by the monopolist. a) What is the market quantity and price? b) The government levies a tax of $9 per unit, to be paid to the government by the monopolist. What is the new market price and quantity? c) How much of the tax do the consumers bear? How much does the monopolist bear? Ans) a) Marginal cost is given by MC(q) = 2 + q. - Total revenue is given by TR(q) = q(47-q) = 47q-q2. - Marginal revenue is thus given by MR(q) = 47-2q. - Setting marginal revenue equal to marginal cost, q = 15 and the price is $32. b) The firm's cost function is now given by: - C(q) = (10 + 2q + 0.5q2) + 9q = 10 + 11q + 0.5q2 since it must pay an additional $9 in tax for each unit it produces. - Setting MC = MR, one finds that q = 12 and p = $35. c) Consumers pay $3 more than they did prior to the tax and so they bear $3 of the $9 tax. The monopolist had been receiving a price of $32. Now they receive a price of $35 but pay the government $9 of that, and so the monopolist bears $6 of the $9 tax. 3. In the market for Thneeds1, the demand curve is: Q=50-3P and the supply curve is: Q=2P. Assume for now that there are no externalities or pre-existing market distortions, so these represent the true social marginal benefit and marginal cost curves. The government decides to raise revenue by taxing consumers 5/3 for every Thneed purchased. i) Graph the supply and demand curves, and indicate how the curves shift after implementation of the tax. Label deadweight loss, tax revenue, consumer and producer surplus. Show the price paid by consumers and the price received by producers, and use these to indicate the burden borne by each party due to the tax. ii) Calculate the change in consumer and producer surplus from the tax. Also, using the pre-tax market price, and the prices paid by consumers and received by producers, calculate the “burden” of the tax borne by each party (i.e. how much of the 5/3 tax is paid by consumers, how much is paid by producers). iii) Check your answer by using the formulas for change in producer and consumer price as provided in the appendix to chapter 19. (Note: to use the formulas, you will first have to calculate the elasticity of supply and demand) iv) Using your diagram from (a), calculate the deadweight loss from the tax. Then, use the formula for deadweight loss as provided in the appendix to chapter 20 to confirm your answer. v) Intuitively, why is there deadweight loss from a tax? That is, what exactly does deadweight loss represent? Ans) 3.i) Demand : Q = 50 – 3P Supply : Q = 2P Taxing on consumers: 5/3 per unit D0 Before-tax Demand Curve: Q = 50 – 3P D1 After-tax Demand Curve : Q = 50 – 3(P+5/3) = 45 – 3P Before-tax market Equilibrium: Q = 50 – 3P = 2P ⇒ P* = 10, Q* = 20 After-tax market Equilibrium: Q = 45 – 3P = 2P ⇒ Pp** = 9 (Price received by producer) Pc** = 9 + 5/3 = 32/3 (Price received by consumer) Q** = 18 (See Graph below) ii) Before-tax Consumer Surplus: CSold = 1/2 * 20 * (50/3 – 10) = 200/3 After-tax Consumer Surplus: CSnew = 1/2 * 18 * (50/3 – 32/3) = 54 Change in Consumer Surplus: △CS = 38/3 Before-tax Producer Surplus: PSold = 1/2 * 20 * 10 = 100 After-tax Producer Surplus: PSnew = 1/2 * 18 * 9 = 81 Change in Producer Surplus: △PS = 19 Consumer tax burden = (9 – 10) + 5/3 = 2/3 Producer tax burden = (10 – 9) = 1 Total tax burden = Consumer tax burden + Producer tax burden = 2/3 + 1 = 5/3 1 What’s a “thneed”? “A Thneed’s a Fine-Something-That-All-People-Need.” Theeds are made from Truffala Trees, of course. P 50/3 15 Before-tax consumer surplus(Bold) After-tax consumer surplus(Shadowed Area) S Tax Revenue (Shadowed Area) Deadweight loss (Shadowed Trianagle) 10.67 10 9 D0 D1 0 18 20 45 50 Q Before-tax producer surplus(Bold) After-tax producer surplus(Shadowed Area) iii) Please note that Producer price has gone from done from 10 to 9 so 1 is the absolute value of change iv) Tax Revenue: TaxR = 5/3 * 18 = 30 Dead Weight Loss: DWL = 1/2 * 2 * 5/3 = 5/3 (i.e., the area of the triangle) (or DWL = (CSold + PSold) – (CSnew + PSnew + TaxR) = 500/3 – 165 = 5/3) Pleas note that DWL is a loss. 5/3 represents the absolute value of the change v) In this example, deadweight loss represents inefficiency from efficient trades that should have occurred, but were prevented due to the tax. Inefficiency is measured by the difference between social marginal benefit and social marginal cost curves at the new market outcome – so in this case, since the marginal benefit is greater than the marginal cost at the new outcome, efficient trades are prevented from occurring. Deadweight loss could also occur if too many trades are induced due to the tax – i.e. if the social marginal cost curve is above the social marginal benefit curve at the new market outcome. This could occur if one good is subsidized rather than taxed, or if there are positive production/consumption externalities yet the market is taxed. 4. According to estimates by Goolsbee (1998), purchases on the Internet are highly sensitive to tax rates, and applying existing sales taxes to such purchases would substantially reduce the number of online buyers and the amount of online spending. What are the implications for the incidence of a tax levied on Internet sales? Ans) Since the elasticity of demand of purchasing on the Internet is very high, we can expect that the tax would be burdened mostly to the seller than online buyer if the elasticity of supply of the seller were not so high. Furthermore, empirically, the competitions among the providers of the online sales are very intensive (that is the supply market is quite similar to the perfect competition market), we know that the elasticity of demand and supply are both very high, so we can expect that if we increase sales tax rate on the online market then the market equilibrium quantity would be fallen dramatically. 5. One of the biggest economic and social issues nowadays in South Korea is the surging of house prices. For example, the price of an apartment in Seoul about 1000 sq. ft. large was 600 thousand dollars one month ago, but it is now over 800 thousand dollars. These kinds of surging of house prices have been happened intermittently, but too often. These surging of house price are blamed for the main reason of aggravating economic inequality. For these reasons, Korean government has introduced several types of taxes. (1) Property Tax; The owner of the real estate has to pay 1-3% of the total value of the real estate every year. (2) Capital Gain Tax; The owner of the real estate has to pay 36-50% of the total capital gain of the real estate when he or she sells the real estate. (3) Income tax; The owner of the real estate has to pay 9-36% of the total rent income. (4) Acquisition Tax; The owner of the real estate has to pay 1% of the total value of the real estate when he or she acquires the real estate. (5) Registration Tax; The owner of the real estate has to pay 1-2% of the total value of the real estate when he or she buy and register the real estate as their property. Although these kinds of taxes are aimed to burden the rich people who have the real estate, however there are also many criticisms on them related to the tax incidence. Explain how the tax incidence problem can be related to these taxes. What kind of tax would be most desirable to avoid tax incidence problem do you think? What kind of tax would be most desirable to solve the inequality problem do you think? Ans) This question is a really discussion type question because there is no clear cut answer. However, we can think about each of the taxes and apply our intuition. The Property tax of 1-3% does not seem to be that large (in fact, some leftist argue that it should be 5%), but its burden is not that small. Suppose that you have a 1000 sq. ft. apartment in Seoul that costs about 600-800 thousand dollars (mortgage is not popular in Korea). On average the property tax would be over $10,000 a year. The problem of property tax is on that much of its burden could be transferred to the house buyer (or tenant). Think about why the house price (or rent) has been increased rapidly. The supply is not keeping up with the increase in demand. Yes, there is more demand than supply. If this is true, it means that the buyer may take much more burden of the property tax than the owner. It’s a tax incidence problem. This tax incidence problem can be also applied similarly to the income tax. If the demand of house is less elastic than supply (actually, it is always true when the price of house is soaring up), then the much of the income tax burden could be also transferred to the buyer. So, we can see if excess demand for house exists (i.e., the more demand than supply and thus the price of house is soaring up), then the raising of property and income tax rates would not be good solution. How about the other taxes such as Capital Gain tax, Acquisition Tax, and Registration Tax? Note that all these taxes increase transaction cost. Thus, these kinds of taxes can make lock-in effect and the supply of house would be shrunk more if these tax rates are increased. So, the price of house can be increasing more! So, one of the best way could be outside of our world of taxes. Why don’t you encourage Korean Construction Company to construct new houses more? If there is not enough land in Seoul, then why don’t you build some new towns in a suburb of Seoul? About three weeks ago, I heard that Korean government introduced new policy to stabilize the housing price. It was a kind of pricecap rule on the new-built houses. That is, any Construction Company can not sell their new-built houses over the price-cap (Of course this price-cap should be less than the previous market price). Yes, of course, this is an exactly opposite way to encourage building new houses! 6. The city of Malaise is considering a 10% tax on the revenues of all hotels/motels inside the city limits. Although not completely different from hotels and motels in the nearby suburbs, the ones in Malaise have a distinct advantage in their proximity to the interesting sights and convention centers. So individuals will pay some premium to stay in Malaise rather than to stay nearby. Furthermore, all land is used equally well by hotels/motels and other forms of business; any Malaise land not taken by a hotel/motel is readily absorbed by other forms of business. Mayor Maladroit calls you in to advise him on the incidence of such a tax. He is particularly concerned with who will bear this tax in the short run (e.g., one month) and the long run (e.g., five years). (a) What is the incidence of the tax in the short run? Answer intuitively, and use a diagram if possible. (b) What is the long-run incidence? Once again, use a diagram if possible. (Suppose hotels/motels in the suburbs are not good substitute.) (c) How would your analysis in b change if hotels/motels in the suburbs were perfect substitutes for those in Malaise? What would happen to tax revenues (For example suppose that there is new light rail connecting the city center to the suburbs) Ans) a) In the short run, the city hotels and motels will share the burden of the tax with their guests. From the description of the town, it appears that demand for lodging near the city center is relatively inelastic, so the businesses will be able to increase their rates without losing many customers. However, the supply of hotel and motel space is likely to be fairly inelastic too, particularly in the short run. It takes some time for hotels and motels to be built, particularly if there is little vacant land left in the city. Graphically, both demand and supply will be steep: In the short run, this tax yields very little quantity change, but significant price change. b) In the long run, the number of hotel and motel rooms can be increased, thus supply is more elastic. In the long run the tax incidence will fall primarily on the inelastically demanding guests. The price kept by the firms is close to the original price. c) The availability of an untaxed substitute in the suburbs would make demand more price elastic. This elasticity would have two effects on the market. First, the firms would be able to shift the lion’s share of the tax burden to the consumers, because if they did, visitors to the area would simply stay in the suburbs. Second, the number of rooms rented would fall, so the revenue raised by this tax would decline. 7. Keeping economic efficiency constant, make an argument for and against higher marginal tax rate on higher income people (say over $250,000). What is the nature of your argument above is it normal (value ridden) or positive (observation how things are rather than how they should be).