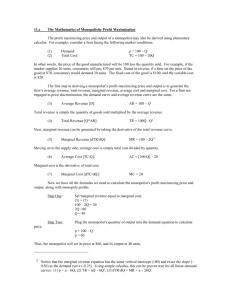

suppose inverse

advertisement

Problems Sheet I. Concentration, Monopoly and Prices Discrimination Industrial Economics Universidad Carlos III 1. Given the following percentage concentration measures in two different industries (A and B) % The largest 4 The “ 8 The “ 12 The “ 20 A 40 70 90 100 40 B 60 80 84 90 Total enterprises number:20 a) Draw up the concentration curves for the two industries (A and B) and arrange them in accordance with the concentration degree. b) If we use the concentration index of the largest 4 and 12 enterprises of each industry, what would the order (as per concentration degree) be reached? What don’t index desirable properties comply this measure? c) Draw up the concentration curve of an industry involves a number n of enterprises with the same size (and sales). But it might go up when a new enterprise break in , so they don’t meet all the Hannah and Kay criteria. Accordingly, it gives rise to a serious problem. Therefore this index has to be cautiously used. Comment. 2. In the light of Table I: a) Comment if the concentration degree in the British industry seems to you reduced or high and why. b) Arrange the indicated industries with an asterisk according to its concentration degree by using RC5 and the inverse of the producers number. Do the results coincide? Explain why and what of the two measures seem to you the best. d) In case you could draw the concentration curves of these industries Do you think that any of these would cross each other? Give some examples and argument your answer. c) The Herfindahl index measures the concentration in the industry d) In the light of the data what would you tell about the relative size of the sixth enterprise of the sugar sector? 3. Be P(q)= 52-2q the demand inverse curve of a goods recently introduced in the market and C(q)=90+5q2 its total production costs. Suppose the government made a prices regulation in such a manner than they have to be equal to the average costs. In this very case, a) What is the efficient number of enterprises (on the basis of minimal cost) in this industrial sector? Justify your answer. Along the time, the consumers worth better the goods (a larger portion of people know it) by resulting in an increase of the demand up to P(q)=55-2q. The fixed costs decrease and during this period their value is 62.5 b) Demonstrate the sector drops out to be a natural monopoly. 1 TABLE I INDUSTRIES (FOUR DIGITS) HIGHLY CONCENTRATED IN THE MANUFACTURES, UNITED KINGDOM 1 GROUP 1 (C5 > 95%) * Sugar * Margarine Gin * Cigarettes * Other manufactured tobacco * Petroleum derivate * Hydrocarbon derivated Halogens * Asphalt * Additives for liquid combustibles and oils * Telecommunication wires * Telegraph and Telephone installations * Tractors * Cars * Aeronautic Industry Refinement of precious metals * Artificial and synthetic fibres * Tyres and air chambers GROUP 2 (C5 > 90%) * Cornflakes for breakfast * Ice creams * Crisp * Pets feed * Coffee * Synthetic Rubber * Roller Bearing * Batteries and Accumulators * Internal combustion Machinery * Tins and Cans * Cement CONCENTRATION RATIO PRODUCERS TOTAL NUMBER 99.9 100.0 (7) 100. 0 (7) 98.8 100.0 (7) 99.9 7 9 7 8 7 9 100.0 (7) 95.1 7 28 95.3 98.9 14 13 95.7 98.2 100.0 (7) 95.4 96.4 11 20 7 14 8 91.4 90,9 94.7 94.4 90.6 91.9 92.4 90.8 91.4 91.5 93.0 16 29 10 39 20 12 15 19 20 57 10 1 Based in the billing of over 100 millions of pound in 1985, excluding some steel items mainly produced by the British Steel Corporation. The concentration ratio is the largest 5 companies sales ratios (even though in five indicated cases they referred to seven companies)”—“ means the data are not available. SOURCE: Census of Production, Summary Tables,197 2 4. A monopolist sells an homogeneous goods with facing a demand given by P= A-BQ. The monopolist fixes an unique price in the market. Demonstrate the monopolist will never sell a quantity higher than (A/2B) regardless the costs function. When will the monopolist production optimal quantity be A/2B?. 5. A monopolist comes up against a demand curve given by P=A-BQ being its costs function C=Q2. a) Calculate the quantity and the price that maximize the monopolist profits. b) From the social point of view what is the optimal quantity?. Calculate the well being loss due to the monopoly. c) What are the monopolist profits if it produces the socially optimal quantity? d) Let’s suppose the government restrict the monopolist to fix a price higher than Po, that is 0>Po>A. What is the effective demand curve the monopolist come up against? e) Demonstrate that there is a maximum price leading the monopolist to produce the optimal quantity from the social point of view (the one that the marginal cost is equal to price) 6. Be the monopolist costs function C(q)=2q and the demand the monopolist come up against D(p)=10-p a) Calculate the subsidy to the quantity produced by the monopolist if it is intended that this is the optimal quantity from the social point of view. (Suppose the government knows the demand and the costs conditions) b) Suppose that the government doesn’t know the marginal cost is equal to 2. But it advises the monopolist about the subsidy policy stressed in the paragraph (a) and is asked about its marginal cost c. Demonstrate the monopolist is prompted not to tell the truth. What is the c optimal notice for the monopolist? 7. Suppose a monopolist with constant marginal costs and lineal demand p=1-Q. Its demand landslide as result of the entry of a new group of consumers to the market. The tax income distribution and preferences of the new consumers are the same as the initial population. How will the monopolist optimal price change?. Make it up. 8. The inverse function of the market demand of a goods is p(x)=30-x. In the market a monopolist whose costs function C(x)=10x2+x exist. a) Find out the quantity offered by the monopolist, the market price and the corresponding profits. b) Define and calculate the Lerner market power index. Also, find out the demand resilience in comparison with the price. c) Let’s suppose the monopolist faces a lineal demand, p(x)=a-x and it produces with the costs (C(x)=cx Calculate in what ratio an unit increase will be apply on the unit costs in c at the balance price pm (this ratio will be given by dpm (c )/dc). 3 9. Be the demand inverse functions of two goods: P1=12-q1-eq2 P2=12-q2-eq1 Where e>1 a) For what values of e are the goods substitutive? Complementary? Independent? b) Be C1(q1)=2q1 and Cx(q2)=2q2 the production costs of the goods produced by a monopolist. Compare the Lerner index in each market with the inverse one of the demand resilience for e different value. c) Resolve for e=1/2 and e=-1/2. In what of the two cases are the prices higher? Why? 10. A monopolist has an unique consumer with demand function q=74q. Its marginal cost is equal to 0. a) What is the optimal fixed price on the basis of a lineal tariff? And based on a tariff in two parts? Compare the previous examples in terms of social welfare. Comment. b) Let’s suppose that there are two type of consumers with aggregated demands q1=66-p1 and q2=82-p2 at equal proportions and each equal to 0.5. Suppose that there is perfect arbitrage among the single flock consumers but not among the different type consumers. And, yet, the monopolist knows how to recognise the type of consumers that break in his outlet. What type of prices discrimination can the monopolist apply? Calculate the profits by explaining of the necessary steps to obtain the result. Answer the following question without any calculation. Will the welfare increase whether the government prohibit any sort of prices discrimination? c) Suppose the monopolist is unable to recognise the type of consumer that break in its outlet. As yet, no arbitrage among the single flock consumers exist. Nor among different type consumers? What type of prices discrimination could the monopolist apply?. Divide the optimal tariff in two parts? Calculate the monopolist profits? 11. Consider a monopolist that faces a lineal demand p=a-bx and produces with the costs C(x)=cx a) Demonstrate the demand resilience is a growing function in x. b) Compute the well being loss owing to the monopoly existence (compare the monopoly total surplus with the one of the perfect competitiveness. How does this relative loss change in respect to the parameter b? (Use a graph to draw up the changes in the excess). c) If the monopolist discriminate in first degree in prices, find out the consumer excess plus the producer excess and compare them with the perfectly competitive case. Is there welfare loss? d) Suppose that the monopolist faces the lineal demand p=90-x and produces with the total costs C(x)=2x+F, where F=90 is the fixed cost the monopolist has to apply if his produces a positive output. The Regulator Authority intend to reach the optimal TOP. It suggest the monopolist to follow the rule, p=marginal cost. Find the monopolist profits and the total excess. 4 e) Without regulation, what would the balance of monopolist be? Would the optimal TOP be reached? Calculate the difference in terms of welfare between the initial allocation (with regulation) and the alternative allocation 12. A monopolist comes up against two types of consumers. There are 100 identical consumers of each type. The production has cost 0. The individual demand function for a consumer of type I, I=1,2 are given by: D1(p)=1-0.02p D2(p)=1-0.04 p a) Suppose a monopolist has no information about the type of consumer and intend to practice a second degree discrimination by fixing a tariff in two parts such as T(q)=A+ pq. Calculate the A and p values as per tariff in two optimal parts. Calculate the consumers excess. b) Suppose that a new decoder (at 0 cost) has been developed with enabling the monopolist know the type of each consumer. As yet, the goods is as such manner than arbitrage among consumers is not possible. The monopolists intend to practice discrimination with fixing tariffs such as type Ti(q)=Ai+piq for consumers type I, I=1,2. Determine the Ai and pi optimal values. Does the well being maximize? c) Suppose the situation is the same as the case (b) except that the perfect arbitrage among the single flock consumers is possible, but not among consumers of different type. Calculate the price and the quantity sold in each market under a third degree discrimination. Compare the total excess of the cases (b) and (c). 13. A monopolist produces a goods x for two markets, the domestic, country a, and the export, country b. Both markets are segmented, that is, there is no arbitrage chance for consumers. The monopolist doesn’t know the goods assessment by each consumer (only knows he the each market total demand). Both country has the same currency (there is no exchanging rate). The monopolist faces two demands, one in each country that are, respectively: qa=100-pa qb=200-2pb And produces with a production costs: C1(q)=q a) In what market does a larger demand resilience occur? b) Find out the monopolist balance, how much he will produce and at what price in each country?. What type of price discrimination will the monopolist practice? c) Stress if does the resilience inverse rule in the prices policy applied by the monopolist complies. d) Give an example where the inverse resilience rule for a multiproduct monopolist does not comply. 14. Suppose that a goods monopolist sells consumers located in different regions of the country. The goods demand functions in each region are: Q1=1-p1 and q2=0.5-p2 And for the following case, suppose the production costs are equal to 0. a) If the monopolist has to charge an uniform price (lineal) in both regions, calculate the uniform price that enables to maximize the profits. b) Suppose the monopolist can adopt a third degree prices discrimination. Calculate the profits maximum driven prices in each region. 5 c) The third degree prices discrimination does it enable to increase or to decrease the mean welfare, in this very case, by the sum of the consumer and the producer excess? Is that an overall result when the monopolist uniform prices are compared with the third degree discriminator prices? 15. Consider a company that offers its product in two countries. The selling price in the domestic market is higher that in the foreign market. The company profits are distributed in the origin country. This practice is called “dumping” is pursued by the GATT and b some governments as well. a) What type of prices discrimination represents the “dumping” practice? The goal of this exercise is to analyse the “dumping” effects on the walfare and to determine who wins and who loss. Suppose that the company is a monopoly in both markets, that the costs are lineal C(q)=cq, the domestic demand function is q=1-p and the foreign demand es q=1-Bp where B>1. b) Demonstrate or refuse each of the following assertions for the proposed model: The consumers of the foreign country prefer the dumping at an uniform price in both countries whereas the origin country consumers prefer the uniform price. c) From the efficiency point of view dumping is good for the world wide economy (on the grounds that it gives rise to a Total Surplus higher than an uniform price). The efficiency in the foreign country increases by the dumping effect, as well. 16. Let’s suppose a market where the consumers has unit demand and they are heterogeneous. The utility of a consumer type q will be U=qs-p if he consumes a goods unit and O if he does not consume (s is the goods quality, p its price and q indicates the consumer preference for the quality). Suppose that for the 50% of consumers q=o and for the remaining 50% q=5 and the consumers number is equal to 10. The marginal cost of producing the goods is given by C(s)=ks2. a) What profits driven qualities and what prices would a monopolist choose if he might perfectly discriminate the two type of consumers? b) Having in mind that he cannot discriminate them, what qualities and prices do you choose? c) Compare and comment the differences among the final results in the sections (a) and (b) 17. In a market there are two types of consumers, i=1,2. The willing to pay a quantity q for the goods by the consumer type I is W(q)=t1V(q), I=1,2 where t1>t2. The ratio of consumers type 1 and 2 is ¼ and ¾, respectively. Being V(q)=4[4-(2-q)2]. a) Calculate the optimal tariff in two parts and the profits as per the optimal tariff in two parts. b) Compare the marginal prices and the consumer surplus shown in the above cases with the marginal prices on the grounds of perfect discrimination and uniform prices (consider only the case where both types of consumers break in the market). 6 Oligopoly and Entry Industrial Economics 1. Examine the following non cooperative game between two asymmetric companies where the companies can either collusion or compete according to la Cournot (non collusion) by in each case receiving the following payments: Player 2 Player 1 C 9,6 10,4 c Nc Nc 2,1 3,7 The companies receive different payments with the same strategies due to differences in its target functions (different attitudes to the risk) a) Find out the dominant strategies, if any, by both players. The Nash balance strategy unity. b) Consider an infinite turns of game. Describe the pair of “trigger” strategies of the supergame and explain how it is possible to get the pair of strategies (c,c) as a Nash balance of the game infinitely played . If we played the game a finite number , comment why the collusion is or not a Nash balance. 2. Two companies 1 and 2, compete in quantities in one market where an homogeneous goods is sold and they come up against a demand: P(q)=d-a Q; Q =x1+x2 The production costs are: C(xi)=cixi , i= 1,2 a) Determine the price and the two companies market share. What will the price margin be over the marginal cost for each of the companies?. Will the Lerner index be positive or null or negative as per certain positive values of the demand parameter, a>0, d>0?. b) When, c1=4.8, c2=4 and a=2/3, what would the necessary decrease in c2 be, by keeping c1 constant, what keep the company 1 away the market? 3. Consider a corporation as an homogeneous goods duopolist. The demand inverse curve is given by p = 10-Q where Q q1+q2. The companies produces with the same costs C(q) = 4q. Th companies compete in the market by choosing quantities. But, by historical reasons the company 1 is the first one in making decision about the goods to be produced and subsequently the company 2. a) Calculate the quantities to be produced by each company, the goods price and the profits of each company. b) What quantities would they produce, what would the goods price be and what profits each of the company would get if they compete by simultaneously choosing their quantities.? Would the industry aggregated profits be higher than the previous paragraph?. 7 c) The companies have realised that they could increase their profits by reaching an agreement that nullifies the historical events, What is the minimum money quantity that the leader company is willing to accept in order to quit its leadership in the industry? What is the maximum money quantity that the follower company is willing to invest in suggesting the leader quit his role? If the companies have the same negotiation power , what will each company profits be in the event that an agreement would be reached?. 4. Suppose a duopoly that sells an homogeneous item and compete according to la Cournot. Suppose the demand might be as follows: P=a-bQ (Q=q1+q2) And the costs functions are: C1=d+c1q1 and C2=d+c2q2 Demonstrate how for determine values of the parameters (a,b,c,d) a unique Nash balance exists. (q1*,q2*) for what: q1*=3(1/3b)(a-2c1+c2) Also demonstrate that: B1/ c1= (-4/3)q1* B2/ c2= (-4/3)q1* 5. Suppose an industry with three same companies and a demand function p=1-Q (where Q=q1+q2+q3)The marginal cost is = 0. a) Calculate the Cournot balance b) Demonstrate that if two of the three companies merger the profits of both companies decrease. Explain why. c) If the three companies merger, what would happen? 6. Suppose there are two companies in the market that produce perfect substitutive goods with costs C(q)=q2/2.The demand is p=1-Q (where Q=q1+q2) a) Calculate the Cournot balance. b) Suppose the company 1 has the opportunity to sell the same product in other market. The quantity sold in this market is x1 and so the company 1 costs are (q1+x1)2/2. The demand in the second market is p=a-x1. Consider the game where the two companies simultaneously choose their quantities (q1,q2,x1) Demonstrate that q1=(2-a)/7 and q2=(5+a)/21 for a relevant rank. 7. Suppose that there are n same companies in the industry. The production marginal cost is equal to 2. The homogeneous goods demand is given by D(p)=10-p. a) Suppose the companies compete on the basis of quantities. What is the market price and what quantity is sold by each company at that price? Demonstrate that each company profits decrease with n. b) Suppose the companies compete on prices. Calculate the price and the quantities to be sold by each company in the market. Why is it claimed that the competitiveness in prices is stronger than the competitiveness in quantities? c) Suppose that n=2 and both companies compete on prices. In order to reduce the deficit the government decides to levy a tax t=1 on goods unit sold b the company 1. (The company 2 does not pay taxes). Comment about the government decision. Will the government success in collecting enough taxes or not. Explain. 8 d) Suppose the two companies compete in quantities. What amount of money the government is managed to collect in accordance with the policy shown in the paragraph ( c). Propose an alternative tax policy that increases the gov. income. 8. Suppose that two companies compete in prices in an homogeneous industry. The goods demand is D(p) = 10-p. The two companies has the same technology with constant scale yields and their unit cost is equal to 1. a) If both companies perfectly know their presence in the industry will last 10 years, what is the unique perfect balance in subgames?. Explain. b) If, rather, both companies have the same concerns about the industry life is it possible that make up a stable cartel?. By guess (to take into consideration: Such a common concern about the industry life can be demonstrated that it is tantamount with a common discount factor for both companies. The largest is the concern the most valuable is the present for the company, and a more discount in the future is got. 9. Be an industry with a demand D(p) for which two companies compete A and B with respective marginal costs (Ca and Cb, being Cb>Ca and pm>Cb (where pM is the monopoly price for the demand D(p)). What are the unique Bertrand balance prices for the industry?. Demonstrate that this balance is unique. What are the respective sales volumes .of the companies A and B?. 10. Suppose an industry with two companies, L and S that produce an homogeneous output. The company L is the leader in the sector and therefore the two companies behave according the Stakelberg model, that is, L behave as a leader and S as follower. Suppose the inverse demand function, p(Q) is lineal and has the following function equation: P=1-ql-qs Where ql and qs are, respectively, the output by the leader and p is the market price. Also suppose that the costs function is: C(q1)=(1/2)qi I=L,S Calculate the quantity that the companies L and S will produce in balance and the market price. Compare this situation with the one get by the Cournot model and comment the difference between these two models. 11. Let’s consider a duopolistic market where the companies compete on the basis of Stacklberg (leader/follower). The leader company, A, has the advantage of initially offering the quantity that it want to the market. The follower company, B, observes the leader choice and subsequently it make decision about the quantity to offer. The costs are the same for both companies and are given for , Ci(q)=8q. The market demand function is lineal, p=20-x. a) Find out the profit functions for each company and the reaction function of the company B (Draw up a chart). b) Consider the situation where the leader company choose the strategy , xa=4 and the follower chose xb=4. Do this pair of strategies make up a perfect Nash balance in 9 subgames?. If the company A would decide to produce the quantity x a=5, would the previous Company B strategy be optimal? Comment the results. 12. Consider a market with two same companies. The demand function is given by D(p)=1-p. The marginal cost c is constant, 0<c<1 and equal for both companies. There are no fixed costs. a) Consider the following sequential game: Firstly, the company 1 decide the output (it is observed by the company 2), and after the company 2 make decision about its output. Calculate the balance. Compare the companies profits with the one of the game in which the companies simultaneously choose their output level. Is there any advantage to the fact of firstly moving in the sequential game? b) Consider the game in which the company 1 decides its price and after observing the price fix by its competitor, the company 2 choose its price. Once fixing the prices by both companies, the company fixing a lower price take up all the demand. If the prices are equal, each company shares the demand. Calculate the balance profits and compare them with the profits get in the Bertrand game in which the prices are simultaneously chosen. c) Consider the same game that the one in the previous paragraph except that the marginal cost of the company 1 c1 is lower than c2 <1. Be pm the monopoly price for the company 1. What is the balance when c>pm?. And on the contrary case c2 <pm? 13. “The theory about the oligopoly forecasts a positive relationship between the industry concentration and the measure in which the prices overrate the marginal costs” Explain and discuss. 14. Consider a duopoly in which the competence is based on a type Bertrand where the companies simultaneously decide their strategies. The company that choose the lower price has to supply the whole market and in case of both companies offer the same price, they proportionally share the market. The costs structure is the same for both and is given by C(xi)=2xi, where I=1,2. The market demand function is x=6-pFind out: a) The relation that stressed the company 1 profits whenever it fix a price lower than the company 2 price, p1<p2. b) What will the company 1 profit is when both companies fix the same price =p1=p2. c) Company 2 profits function. The strategy (p1,p2)=2,2 is it a Nash balance? d) Make arguments why a situation in which the companies fix the same price and in which this is higher that the average cost p1=p2>2 cannot be a Nash balance. 15. Be two goods. The demand inverse curve of the goods 1 is: P1=10-xi-gx2 And that of the goods 2 is: P2=10-x2-gx1 With –1<g<1. The production cost of each goods is equal to 0. 10 a) For what “g” value are the goods complementary? Substitutive?. When two companies compete by choosing the price, are these prices strategic complementary in all instances?. Give your comments. b) Suppose the two goods are produced by a monopolist. If g=5 calculate the optimal prices and the monopolist profit. c) The companies simultaneously choose the prices, each taken for granted the price of its competitor. If g=5 calculate the prices and the profits in balance. d) Suppose that the company 1 is leader in the industry and then firstly decides the price. Calculate the prices and the profits for both companies and compare them with the one get in the paragraph c. Is the company 1 interested in keeping its leader role? 16. Consider the case of a Bertrand duopoly, where the companies compete on the basis of prices and simultaneously decide the strategies. The company that fixes the lower price will have to supply the whole market: if both companies fix the same price, the market will proportionally be shared. The market demand function is: x = 10-p for the prices ranges <p<10 x =0 for the remaining prices The costs structures for both companies is C1(x1)=x1 and C2(x2)=4x2 a) Find out the profits functions for both competitors. b) How many companies operate in the market?. Find out the Nash balance in the game , the profits and outputs by both companies in balance. c) Suppose that the most inefficient company has the opportunity to improve its technology and to reduce the marginal cost up to 0.5. If it undertake this improvement the fixed expenses are equal to k. Find the K values for which the company 2 will decide to invest on new technology. 17. In a market with two companies, a and b, that sells an homogenous goods, face a lineal demand, p=a-bX where X is the industry total output. They face a production function type C(xi)=c xi. The government decide to fix a lineal tax T_t xi to the company b. How does the Nash-Cournot change after tax application. How do the reaction functions change? After tax fix, if the government decides to increase it in what ratio will this tax unit increase affect on an increase in the industry balance price? 18. Suppose a market with n companies in the following trigger strategy. To fix monopoly price for a period if the remaining companies fix the monopoly price for the previous period. To fix price equal to the marginal cost in other case and for the remaining of the periods. Calculate the discount rate assuring a stable collusion. Suppose the information about the competitors prices is ill-known and it is learnt every two periods (instead of each period) in such a manner that the companies react to the changes in their competitors strategies two periods after the change has occurred. How has the condition assuring the stable collusion changed?. 11 19. Imagine two same companies that operate in a market where they expect to compete according to Bertrand an infinite number of periods. Suppose the companies apply the following trigger strategy: To cooperate by fixing the monopoly price unless none of both companies deviate from this strategy, to fix their price equal to the marginal cost forever as from any of both companies change its strategy. We know the condition for that this strategy is sustainable is that the discount factor, d, is higher than ½. Suppose that the companies are prompted to compete not in one market but in two identical markets and the trigger strategy turns into : to cooperate by fixing the monopoly price in both markets unless none of both companies deviate from this strategy in any market, to fix their price equal to the marginal cost in both markets forever as from any of the two companies change its strategy in one or both markets. (That is, the sanction is applied on the two markets though the deceive strike on one single market). Taking into consideration what it will be the best strategy to be undertaken by any company that decides to deviate from the agreement, calculate and comment how will the condition be in order to get a stable balance under these new circumstances. 20. “The theory of limit price is a suitable way to measure the access barriers in one industry. Yet, it is an effective strategy to prevent the access”.Comment. 21. In an homogeneous goods industry there is a consolidated company that produces with a marginal cost equal to c. The demand function is D(p). A competitive company ponders to access to the industry. If it access their access cost is equal to K and its production marginal cost is equal to c. Suppose that the established company firstly choose its quantity. Afterwards, the potential would-be decide to access or not and choose its output level. Give the definitions of each blocked, impeded and accommodated access. Justify the existence of k values for which the access is blocked, impeded and accommodated. 22. In a homogeneous goods industry there is a consolidated company that produces with a marginal cost equal to 0. The demand is given by D(p)=10-p. A competitive firm ponders to access the industry and produce the same goods. The consumers will learn the existence of this new company only if this company decide to launch a promoting campaign. Its advertising costs increase the costs will increase proportionally pursuant to the quantity that outlines to sell the company , that is to say, to sell q units of the goods will incur in some equal advertising costs to kq where k>0. . Supposes that by historical reasons the established company always chooses its first quantity. Then, the potential would be decides to access or not and chooses at the same time its advertising campaign level and its quantity. a) Give the definitions of blocked , impeded and accommodated. b) Explain why in the above industry the advertising unit cost ,k, is the factor that determines the conditions for which the access is blocked, impeded or accommodated. For what k values the access is blocked? Impeded? Accommodated? 12 23. There are two companies with demand functions Di_=1-2pi+pj, i, j =1,2. The marginal cost of the company 2 (that access to the market) is equal to 0. The marginal cost of the company 2 (the previous existing one in the market) initially is equal to ½. Investing I=0,205 the existing company can afford to purchase the new technology and to reduce its marginal cost to 0. a) Consider the following temporary structure: the existing company select between to make or not the investment; ultimately the would be company observes the investment decision of the existing company; thus, the enterprises compete in prices. Demonstrate that based in a perfect balance the existing company does not make investment. b) Explain why the conclusion of the paragraph a) can be hurt if the would-be company has to sustain an entry fixed cost. Is it relevant the fact that the potential would-be make its access decision before or after the investment decision by the existing company?.( Reason your arguments intuitively ; the calculation is not necessary). 24. Frequently it is suggested that the predatory (or aggressive) prices fixing is an appropriate strategy to prevent the access of new competitors because it helps the established companies to forge the reputation of stringent companies. What has to do an established company to get its reputation? In which cases would it be reasonable to pursue this strategy? When will it less effective?. 25. Be a market with n companies that compete in prices. There is free entrance and exit. The entry fixed cost is “f” for all the companies. Be the demand Q=10-P. The production marginal cost is constant and equal to 1. a) Calculate the industry aggregated profits when there is n>1 in the market. b) How many companies produce and what is the aggregated output in balance. c) If the government decides to subside the entry f fixed costs for the enterprises what is the number of companies in the market n and the Q balance aggregated output in this very case? What is the number of companies that should the government subside?. 13 Differentation and Market Structure Industrial Economics 1. A consolidated company (the incumbent) has 50 petrol stations in different localizations (very far from one another in such a manner that the arbitrage is not possible by the consumers) where it sells the same type of petrol. The incumbent enterprise has no competitors in the 50 petrol stations where it operates. The distribution market and petrol sale free and now the incumbent company faces the entry threat of other company (the entrant) that intend to access to some (or all) the locations where the incumbent company has established its petrol stations. This situation is made up in a game where the entry firstly decide its strategy (its strategies scope is: to access or not) and then the incumbent company will decide its best strategy. If the potential competitor decides not to access, the incumbent company get profits of 5 ptas in each station and the potential competitor that decide not to enter get 1 pts. If the candidate decide to access to some of the localizations, the incumbent company might either accommodate to the access and to get profits of 2 pts (the same profits the entrant would get) or to practice a predatory (fight) policy in prices. In this case the incumbent and the competitor would get 0 ptas of profit each. Draw up the game in matrix form and comprehensively. What type of description do you prefer for this game? Describe the strategies involves in the Nash balance for the game in a localization and for the whole game (in 50 petrol stations). Find the perfect balance in the Nash subgame and give your comments about it is obtained. The strategy (not to enter, to fight) is a subgame balance?. 2. In a city avenue there is located an enterprise. Other company, the entrant, intend to introduce in this industry and for this purpose it has to decide the site. To the distance of the marginal consumer to any of the enterprises is called, di, and the costs of driving to the chosen enterprise fall on the consumer and are (t d2i) where t are the transport costs. The distance for the top of the street to the bottom is 1 and the consumers are uniformly scattered along the street. The competitiveness is of Bertrand type, that is, the companies already established will choose the price on works, pi, that maximize its profits in respect to the competitor price. Having in mind the established company is just at the bottom of the street . Resolve the game at the stage of prices competitiveness by thoroughly explaining the stages. How do you argument in order to answer the question about the location?. 3. In the main avenue of a city a company is located, the I, and in the same avenue it is located the competitor company, the 2. Both companies produce an homogeneous goods, x, and the consumers are uniformly distributed along the avenue, whose length is L=1, that it they are uniformly located within the range [0,1]. Each consumer consumes either a goods unit or none and they com up against the transport costs to arrive one of the companies (or shops) type, tdi2, where di is the distance from it is the consumer to the company I and where 1 >0. The companies fix, according certain sites ai (I= 1.2) a price on works pi. The only reason for which the goods are differentiated is due to the fact that the companies may be spotted on different sites along the avenue. Find the resulting 14 balance with resolving the game in the second stage, when they compete in prices and the companies sites are provided. 4. Often it is paradoxical that the companies instead of producing sensibly differentiated goods to different market segments offer goods with similar characteristics. These characteristics can refer not only to physical, design,etc. features, (i.e. in the likeliness in the broadcasting of different TV channels) but to localizations decisions. The following model help illustrate this type of behaviour. Suppose by the coast road there are two ice-creams seller. Both sell Frigo ice-cream and they have no possibility to differentiate each other in respect to the selling price of the products. Their single decision is to determine the site. The consumers are uniformly scattered by the beach and they will go to the nearest site. The sellers have to make decision about their site to maximize the customers number. The socially optimal spot, that is, what largely reduces the total walked distance if we represent the beach for a range [0,1] would be ¼ and 3/4. Reason why the ice-creams sellers have no incentives to keep this site (clues: these sites are not Nash why?) Where will they locate ultimately? Would you change your answer whether the swimmers trend to consume less ice-creams as long as the distance widen. 5. Consider the Lineal City horizontal differentiation model , the consumers are uniformly distributed within the segment [0,1]. The consumers has a transport cost td where d is the walked distance. All the consumers have a value s. The marginal cost of producing the goods is c. The fixed cost of installing a shop is f for each localization. a) How higher should s be so that a monopolist, located in ½ , should decide to fix a price at which all the consumers are served? (all of them decide to consume). b) Let’s suppose all the consumers are served (that is, s is high enough): If f=t/2 and the monopolist has to make a decision between one of two sites, how may localizations would he choose?. What will his profit be?. c) How many localizations would a social planner choose if f=t/2? (let you suppose the fixed social planner p=c). d) With the same fixed cost f=t/2, if the government decide to auction a licence to exploit the market in monopoly regime. How much would a company be willing to pay for this licence?. 6. A recent reform has deregulated the bus local companies in the United Kingdom in such a manner that competitor companies can break in any route and offer services at fixed timetables at any rate (the timetables must to be submitted to the regulatory office and any change has to be announced prior to 3 weeks). It has been guessed that any company will intend to fix their timetables to fetch the bus stop before their competitors do. What economic model would they use to analyse this situation? Within the used model context are you satisfied with the previous argument?. 15 7. In the Vertical Differentiation model shown in classroom: a) Suppose that a company access with a new product. b) Whose quality is higher than the maximum presently offered. What is the effect of the entry on the prices and on the operating enterprises ring in the market (sales >0)?. c) Suppose that the second ranked company in quality un-1 increase its quality up to get the highest quality Un. As long as Un-1 near Un , what happen with the prices and the Operating enterprises ring?. 8. Be the following game in two stages. In the first stage, each company decide either “to access” and pay an low irrecoverable but positive cost e> or “not break in”. In the second stage, if only access one of the two companies, it behave as a monopolist and if both have accessed, compete according to la Bertrand. Represent the game and explain the Perfect Balance in Subgames of this Game. Would you change the result if supposedly both companies access these compete according to Cournot? Derive some conclusions on the effects of the competitiveness strength on the market concentration. 9. In the Light of the Chart 1 a) Based on the figure (i) comment how the technology affects the market structure and what are the differences between an industry with an homogeneous product and other one with horizontally differentiated products. b) Based on the figure (ii) comment the effects that the endogen irrecoverable costs introduction have on the market structure. 16