MARKOWITZ INTERVIEW - American Finance Association

advertisement

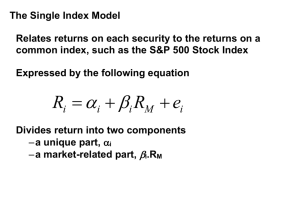

MARKOWITZ Interview at Rady School of Management at the University of California San Diego (edited for clarity and readability) I am Steve Buser, and on behalf of the American Finance Association, I welcome you to this first of a series of interviews with the founding contributors to the academic discipline of finance. Our hosts this evening are Dean Sullivan and the students of the executive MBA program at the Rady School of Management of the University of California, San Diego. The series is entitled “Masters In Finance”, and our first founding contributor is none other than Dr. Harry Markowitz. Dr. Markowitz is best known as the father of modern portfolio theory. But he has made a number of other contributions as well. In 1989 he received the John Von Neumann Prize for contributions in the area of operations research. In 1990 he shared the Nobel Prize in Economics for his contributions in portfolio theory and other areas. If that were not enough, Pension Magazine declared him not just the man of the year, and not just the man of the decade, but indeed the man of the century. So tonight I give you Dr. Harry Markowitz, the man of the century. BUSER: The cardinal rule of journalism is, do not bury the lead. So with that I will ask, what was it like to win the Nobel Prize? MARKOWITZ: It was great. It was a surprise. Jim Tobin got the prize a few years before. It was announced at that time that he got it for portfolio theory, period. It turns out he got it for many good works in macro economics. But at the time I thought, well that’s it. They have given the prize for portfolio theory, and I didn’t get it. I was at a meeting at the time, and I had given my paper the day before. When I heard the announcement I told my wife, Barbara, that I didn’t feel like going to the meeting that day. So we went for a long drive, it was down in Maryland, we went past farms with those white fences with the horses behind. We came to a little town with a department store and each of us had a big ice cream cone. When I finished my ice cream cone I said, okay, now I’m ready to go back. So it was a big surprise when the announcement came. BUSER: Do you remember where you were and the circumstances, how did you hear about it? 1 MARKOWITZ: We were in Japan. The Nobel committee didn’t know where we were, and we were sitting down to dinner. I was giving a course on portfolio theory for the math department at Tokyo University. The head of the math department called me and said, “You just won the Nobel Prize in Economics, and this fellow at the public television station would like to interview you.” BUSER: You mean you’ve already done one of these interviews? Where’s the tape? MARKOWITZ: Well it showed on Japanese television. That was a very short one. The head of the math department wasn’t a kidder, but we wanted to check for ourselves. Once an hour there would be news, in English, from the Armed Forces station. We heard that Markowitz, Sharpe and Miller had gotten the Nobel Prize. We called the guy at the public television station and he said he’d like to do an interview. I said, well I think I have a little time sometime tomorrow afternoon about 2:00 p.m. He says no, no, no, we want to be on the 9:00 o’clock news this evening. So he came out and everything moved very fast. BUSER: You mentioned you shared the prize with William Sharpe and Merton Miller. What was your reaction to learning that you were going to share the prize? MARKOWITZ: Well, the Nobel’s fine. I didn’t quite do a mental calculation. Nobody asked me that question so far. We sort of felt that Bill and I really had worked on the same thing, and Miller should have shared the prize with Modigliani. BUSER: So Franco owes you 1/6th of something ? MARKOWITZ: Yeah, but it’s too late. BUSER: You received your PhD from University of Chicago, and Dr. Miller was at the University of Chicago. But I guess did not overlap with you? MARKOWITZ: No. BUSER: Was there at least professional pride in the fact that it was a professor from your institution, your alma matter, that shared it with you? And then, of course, there was William Sharpe who worked very closely with you. So the three of you at least had some ties. MARKOWITZ: Right. Bill and I had worked together on things. And, a lot of Nobel Prizes have come from the University of Chicago. My Professor had gotten a Nobel Prize for work that had a certain kind of influence on portfolio theory. When this 2 idea came to me, I was a PhD candidate and was taking a course under T.C. Koopmans called Activity Analysis. He distinguished between efficient and inefficient allocations of resources. And I had efficient and inefficient portfolios. So the term efficient portfolio was the result of my taking a course under Koopmans. BUSER: Tell us a little bit more about how you got this idea for your dissertation topic. You were a graduate student at the time? MARKOWITZ: Right. I was at the stage where I had to pick a dissertation topic. So I went to my advisor, Professor Jacob Marschak. He was busy when I got there, so I waited in his ante room. There was another fellow in the ante room who turned out to be a broker waiting for Marschak. We chatted while we were there, and he suggested that I should maybe do a dissertation on the stock market. So I went in. BUSER: A stockbroker gave you the idea? MARKOWITZ: That’s right, a stockbroker. BUSER: A tip that paid off. MARKOWITZ: Yeah. Some biographer of mine said this was the best advice a stockbroker has ever given. And I agree. Anyway, I went in and told Professor Marschak, the guy out there suggested that I do a dissertation on the stock market. Professor Marschak was very receptive. I was a student member, and he was a former head and now currently a member of the Cowles Commission, as it was called at that time. Alfred Cowles had actually endowed the Cowles Commission with the hope that there would be econometric research done in the stock market. BUSER: I did not know that. MARKOWITZ: Well in fact there’s a book by him called Cowles Commission monograph 3, I think, that has a time series which then later linked up with the S&P 500. And he did early research about how good financial advisors were not when it came to prediction versus actual. So Marschak thought it was a good idea. He didn’t know the literature in finance so he sent me to a professor in the business school, Professor Marshall Ketchum. Professor Ketchum gave me a reading list. I went to the library and went through the reading list. The reading list included Graham and Dodd of course. And the next one of the readings was John Burr William’s Theory of Investment Value. When I was reading Williams in the library, it must have been in the afternoon in roughly 1950. I don’t know the exact date, but some afternoon in 1950, I was reading 3 John Burr Williams, and Williams said that the value of a security should be the present value of its future dividends. He understood that future dividends were uncertain. So he said it should be the expected value of future dividends. Now I thought to myself, well if you only are interested in the expected value of the return on a security you must be only interested in the expected value of the return on the portfolio as a whole. And if you are only interested in the expected value of the portfolio, you maximize that by putting all your money in one security, whichever has the highest expected value. And that’s not right. Everybody knows you are not supposed to put all your eggs in one basket. At that point it was obvious that people diversified because they are interested in avoiding risk as well as earning return. I was a budding young economist with two things, expected return and risk. So I drew a graph with expected return on one axis and risk on another axis. And I called that an efficient frontier, the very first efficient frontier. All this in that same day. BUSER: Oh, this is all happening in real time? MARKOWITZ: The notion of just using standard deviation or variance was the first idea that popped into my head, because that is a commonly used measure in statistics. I knew that the expected return on a portfolio is the weighted sum of the expected returns on individual securities. And I knew what the expected value of a weighted sum was. But I did not know what the variance of a weighted sum was. So I got a book off the library shelf, Uspensky, “Introduction to Probability”. I don’t remember the guy I met yesterday or the day before, but I remember Uspensky’s “Introduction to Probability”. I looked for the formula for the variance of the weighted sum. It had all those covariances in it, and I thought, this is wonderful! The riskiness of the portfolio depends on covariances. So that all happened in one afternoon. There was still a lot to do, like figure out how you actually compute efficient frontiers, but the basic idea was there in one afternoon. BUSER: You had an epiphany? MARKOWITZ: Right, epiphany, that’s right. BUSER: And without the benefit of any training in finance at all? MARKOWITZ: No. I had statistics and little linear programming from Koopmans, and I was well trained. BUSER: How about on the personal side. Did you have any experience as an investor? 4 MARKOWITZ: No, none. I was a poor student…I’m going to rephrase that…I wasn’t quite destitute, but I was improvised as a student. BUSER: I heard you describe elsewhere that at the time of your dissertation, there was some doubt not only that you might not win the Nobel Prize for the effort, but that you might not even get a PhD. At the risk of drudging up old painful memories, would you care to go through that for us? MARKOWITZ: That’s fine. It wasn’t a fun experience at the time, but it has been a fun experience to relive ever since. I was working at Rand Corporation in Santa Monica, and I had been on a trip for Rand in Washington, D.C. On the way back, I stopped off in Chicago to defend my dissertation. I remember landing at Midway Airport and thinking to myself, I know this field cold, not even Milton Friedman will give me a hard time. BUSER: Tempt not the devil. MARKOWITZ: So about five minutes into my defense, Friedman says, well Harry I’ve read this. I don’t find any mistakes in the math, but this is not a dissertation in economics, and we cannot give you a PhD in economics for a dissertation that is not in economics. He kept repeating that for the next hour and a half. My palms began to sweat. At one point he says, you have a problem. It’s not economics, it’s not mathematics, it’s not business administration, and Professor Marschak said, “It’s not literature”. So after about an hour and a half of that, they send me out to the hall, and about five minutes later Marschak came out and said congratulations Dr. Markowitz. BUSER: Well, on behalf of the American Finance Association, I would like to thank your committee for giving you a hard time. If they had not treated you so badly, and in particular if the economics profession had not been so slow to recognize you, then the finance profession might not have as great a claim on you as we allege that we now have. In particular, you elected to publish the first article from your dissertation in the Journal of Finance. I happened to have brought the issue with me, 1952. One of the interesting numbers on this particular issue is seven. This is volume seven, meaning it was only the 7th volume that the Journal of Finance had published. There is normally one volume per year. However I also brought with me the very first publication of the Journal of Finance which combines volumes one and two. It includes two years worth of proceedings from the annual meetings plus all of the articles that the profession produced in the two years of 1946 and 1947. By way of contrast, the single volume you elected to publish your Nobel Laureate address in is even bigger. At the risk of getting a hernia, 5 this is now going to be…this year’s volume… of the Journal of Finance. In addition, there are now many finance journals, as we all know. But at the time you elected to place your article in the Journal of Finance, it was really a very new and relatively untested journal. So I have to ask why? What made you think of the Journal of Finance? MARKOWITZ: It was a finance contribution, and I heard there was something called “The Journal of Finance”. Fred Westin was the publisher. I was at Rand, so I was in Santa Monica, and he was at UCLMARKOWITZ: I can’t remember whether that had any influence. It’s a complete blank, why I decided. But somehow it seemed to me that this little 1952 article was something that belonged in The Journal of Finance. It was about finance. BUSER: There is another name you have mentioned, who was also an editor. You might want to read the names of the two coeditors of the Journal of Finance. MARKOWITZ: Oh well, Marshall Ketchum. I didn’t know. That’s wonderful. I’m learning all sorts of things. BUSER: Stick with me kid, and you’ll do all right. So you had another connection there to the journal. And as I said, we are delighted that you elected to publish in the Journal of Finance. MARKOWITZ: I wonder if Marshall Ketchum suggested that. I have no idea. You know, it’s a complete blank. BUSER: In the movie version we’ll say he suggested it. MARKOWITZ: Right, absolutely right. We’ll clean it up. BUSER: You also elected to publish your Nobel address in the Journal of Finance. And by the time 1990 rolled around the Journal had advanced as we have indicated. I was one of the coeditors of the Journal at that time and can attest that we were receiving a thousand papers per year, about three a day. That is why I’m no longer one of the coeditors. And there are many more journals around, so there is a lot of competition for top papers. The economics journals were hot after the top papers as well. But the thing that strikes me about your decision to publish in the Journal of Finance was that until this time every presentation for the Nobel Prize in Economics had been published in the American Economic Review. Why did the three of you decide to honor the Journal of Finance? MARKOWITZ: Well, you folks requested it. BUSER: I told you not to say that. 6 MARKOWITZ: And it seemed perfect. I mean, I don’t know if AER requested it, but if the AER and AFA had both requested The Journal of Finance was the obvious choice. BUSER: We thank you. Because the AER had presumed, even if they did not request, they presumed. MARKOWITZ: Yeah? BUSER: Yeah and we got into a little trouble … but never mind … MARKOWITZ: Oh, oh. Did they presume that we would publish…? BUSER: Yes. MARKOWITZ: I didn’t realize that. BUSER: But we are delighted that you stuck with the Journal of Finance, which again strengthens our claim, the finance claim, to you although we have already said that the operations research people regard you as one of them, the economists regard you as one of them. I’m sure the statisticians regard you as one of them. I’m not sure about the literature people yet. MARKOWITZ: Certainly not the literature. It’s definitely not the literature people. BUSER: But you’ve still got a chance on the literature side. Tell us a little bit more about this topic of modern portfolio theory. I am intrigued by the title. When was the first time you heard that phrase, modern portfolio theory? MARKOWITZ: Many years later. I did not call it modern portfolio theory. I’m not sure who did. BUSER: You’re not sure who did? MARKOWITZ: No. BUSER: Well, it’s a little over 50 years old now. MARKOWITZ: Yes. And I am glad something 50 years old can be modern because I am 77 years old. BUSER: And you’re not modern any more? MARKOWITZ: Well, it would nice; it would be nice to think I was. BUSER: If we accept the designation of modern portfolio theory, then prior to 1952 was there something called classical portfolio theory, or more generally what was the state of the art regarding portfolio section in 1952? MARKOWITZ: Okay. Let’s go back to John Burr Williams. He said that if you are in doubt, if something’s uncertain, you should act according to the mean. I have an 7 article which I published in the Financial Analyst Journal, you’ll excuse the plug for another journal, on the early history of portfolio theory 1600 to 1960. BUSER: I just happen to have that with me as well. MARKOWITZ: I go into more detail than I can go into here. But what Williams said was that if something had risk in it, well you don’t have to really worry about that because with sufficient diversification you can eliminate the risk. Now if risks were independent, if returns were uncorrelated with each other, then if you diversify enough you can make the variance of the portfolio go away. But when risks are correlated, they don’t go away. There is something in Chapter 5 of my 1959 book called “The Law of the Average Covariance”. It says that if risks are correlated then if you equal-weight a portfolio, variance does not go to zero. Variance goes to the average covariance, and that can be very substantial. Even if correlations are just 0.1, 0.2, or 0.3 among all securities on the average, the variance of the portfolio can still be very substantial. So while Williams did believe in diversification, he thought that diversification would eliminate risk, and so your job was just A) to pick out whichever investments had the highest expected return, and B) diversify among lots of things, and then you would get the mean. So that was the basic difference between portfolio theory as it existed in 1952, prior to the simultaneous work of two people. In that year A.D. Roy published something called safety first investment. He also recommended action in terms of expected return and variance or standard deviation of a portfolio. But he recommended a specific portfolio, namely the portfolio whose expected return was as many standard deviations above some catastrophic level as possible. Instead, I presented an efficient frontier and said let the person choose. The difference between Roy and me, on the one hand, and the theorists that preceded us was they thought the law of large numbers would get rid of risk if you diversified enough. BUSER: You are very kind to Roy. First, I want to point out that his paper was published in 1952, but in July. MARKOWITZ: Oh was it? BUSER: Whereas yours came out in March. MARKOWITZ: Oh I never knew that. Okay. I’m learning all sorts of things. BUSER: And a second thing about Roy, when I read his work and your work at the same time, as a student, what struck me even then was that, as you have noted, prevailing theory emphasized expected return first. Once you did the best you 8 could with expected return, you diversified as best you could as a secondary strategy. Roy proposed reversing that logic. He wanted safety first and then subject to that safety constraint, do the best you can on expected return. You blended the two concepts very clearly, and proposed equal consideration of expected return and risk. Do the best you can on both, and whatever you do, do not choose an inefficient combination. So I think you’re selling yourself a bit short. MARKOWITZ: Well I think basically the reason Roy did not get the prize and I did BUSER: You don’t want to split it four ways? MARKOWITZ: No, no. You can’t. You can’t split it four ways. Three is as far as it’ll go. But the reason that Roy did not get the prize was that he did not do anything else in finance. That was his one and only contribution. He never showed up at a meeting, never as far as I know wrote another paper or anything like that. So by the time it came time to hand out the prizes Roy wasn’t on their radar screen and I was. BUSER: Again you are very generous. Your initial contribution not only beat him by three months, but I think was a stronger contribution as well. MARKOWITZ: Thank you. BUSER: By the way, the title of your paper on the early history of portfolio theory has a curious starting date. Do you remember what the starting date was? MARKOWITZ: 1600. BUSER: And do you remember the author of the original work? MARKOWITZ: I have a quote which I stole from William Shakespeare. Act one, scene one. Somebody says why are you sad? Is your business going bad? And he says, [reading from paper supplied] “My ventures are not in one bottom trusted, nor to one place, nor is my whole estate upon the fortune of this present year. Therefore my merchandise makes me not sad.” That means that not only did he know that you’re not supposed to put all your eggs in one basket, but that there are covariances in a BUSER: By the way, that wasn’t only your opinion of the state of portfolio theory at the time. There was also a paper by J.L. Leavens. Are you familiar with Leavens? MARKOWITZ: Yes, right. BUSER: He did a survey at the time, actually in 1945, about the state of portfolio theory, and you are quite right. Diversification was somewhere in there. It was just not very specific. 9 MARKOWITZ: I talk about Leavens in that early history paper. Leavens say that a lot of people talk about diversification but they do not tell you why it is good. He does an example to explain why it is good, but he uses the law of large numbers and comes to the conclusion that he can make risk disappear. Then he says in his next to last paragraph, of course this assumption that risks are independent is subject to question. There is the possibility all stocks in a given industry will go bad together. So you really have to diversify across many industries. There is also the possibility that all industries will go up or down, and so you cannot diversify completely. So in his next to last paragraph he intuitively understood that covariance counts. However his formal analysis still assumed BUSER: Many of the early writers must have intuitively understood because they must have diversified on their own. Although I am puzzled, as are you, that anyone would think you could eliminate risk. It doesn’t seem they could have invested very much, or gone through very many ups and downs of the market and still think they could eliminate all risk. MARKOWITZ: Or that somebody writing in the 1930s would think you can ignore things going up and down together, that you can assume independence after 1929 through 1932. BUSER: Perhaps they had short attention spans or perhaps they weren’t paid very well as professors and did not invest much. With respect to diversification, how many securities did you use to illustrate the basic principles? MARKOWITZ: Well I didn’t do any computation, but I remember Peter Bernstein commenting on the example I used, and since I had absolutely no experience with finance, it was a silly example. I think I said that if you put all your money in 60 railroads or something like that, it wouldn’t be well diversified. And he pointed out many years later that there weren’t 60 railroads around. So a pure theoretician should not give examples. By the time the 1959 book came out I presented a 10 security case, 9 risky securities plus cash. I had somebody collect time series on nine securities. I had actually planned a 25 security example--maybe that’s something you don’t know about— I thought that the way you got inputs was to ask security analysts or BUSER: You got your first tip from them also? MARKOWITZ: Right, well that too. Well that was a broker. So I wanted to use security analysts. These were actually the CFO and assistant CFO or something like that from Yale that filled out these forms. I was going to do a 25 security example, but we 10 could never get it to work. We did the ten security example on a 602A, which had a punch card reader. BUSER: Can you all hear that, a 602A? That was before you all were born. [speaking to an audience of MBA students] MARKOWITZ: Right. It read a deck of cards, and it had lots of wires that would sense where the punches were. The wires indicated where you wanted to pick up the numbers and what to add or subtract or multiply or transfer. And then you make a pass through the deck of cards and punch another deck of cards, and you make a pass through that deck of cards and you have another board. You’d sit there reading a book, and it would go chuggedy chug, chuggedy chug, and then finally it would stop. And that was how I got the first efficient frontier. BUSER: So going from nine securities to 25 securities was a remarkable computational feat, and you didn’t make it? MARKOWITZ: We didn’t make it, that’s right. So I figured the book would be fine without it. BUSER: Does that conclusion have anything to do with your deciding you had written everything there was to write about portfolio theory? MARKOWITZ: Well I said what I had to say, and I went on to work on other things. BUSER: We will get to the other things in a bit, but the part I find remarkable was that at precisely that point in time much of the finance profession was deciding that portfolio theory was the thing to be working on. I’d heard that your original paper launched a thousand dissertations. And by now I think it’s more than a thousand, including my own dissertation. But you did move on to other things. MARKOWITZ: This was about 1960. I don’t know whether there were a lot of dissertations actually in process during the 50s. BUSER: Not in the 50s, no. MARKOWITZ: I think they started in the 60s. BUSER: Right. After your 1959 book. MARKOWITZ: Well maybe after my 1959 book and after Bill Sharpe’s one factor model and after Bill Sharpe’s capital asset pricing model, then I think the wave hit. BUSER: And I am counting that as part of the wave, yes. MARKOWITZ: Okay. I think once that hit 11 BUSER: But you were on to other things. MARKOWITZ: I was on to other things. BUSER: One of the things you moved on to was Simscript. Would you care to define that for us? MARKOWITZ: Simscript was, and still is, a programming language that is particularly designed for programming asynchronous discrete event simulation models, like air force logistic systems or manufacturing systems. Those kinds of things. Rand was the first to finance the thing, and in its day it was very widely used. It is not as widely used now, but it was at one time widely used. BUSER: How about your work on sparse matrices? Can you define those for us? MARKOWITZ: I had the good fortune of going to Rand shortly before George Dantzig who was my mentor at Rand for many years. A group of us, Allan Manne and others, some at Rand, some outside of Rand, were working on very large linear programming models of economic capability, economy-wide capabilities. They were very aggregate models, on the one hand, but as linear programming models they were still very large for that day. I observed that while those models were very large, most of the coefficients in the models were zero. If you picked your pivots right you could invert these things by hand even though it took the computer a long time to do it. Well I couldn’t quite keep up with the computer, but the trick was to get the computer to use the sparsity. I coined the term sparse matrix, and then Bill Orchard-Hayes, who usually programmed for George Dantzig, programmed this for me and we published the first sparse matrix code. I am told that the Markowitz method of picking the pivots to keep the inverse sparse is still used in big production codes. So I claim that as one of my children. BUSER: What other work have you been doing since 1959? MARKOWITZ: Well those are the big things since 1959. The prize from the Operations Research Society was for Simscript, sparse matrices and portfolio theory. I haven’t done anything else which, so far, is recognized as a big block buster. But I keep busy. One of the things I am doing with some colleagues, Bruce Jacobs and Ken Levy, is that we are building a large asynchronous market model where there are entities like statisticians, portfolio analysts, investors and traders. The investors periodically recompute their efficient frontiers and place orders with traders. Prices are then set 12 endogenously by the order book with people trying to either pick up something from the book or put it on the book. It turns out that if you do not have any news coming in, any volatility is just due to the market itself. We have basically two kinds of investors. Those who tend to be price insensitive, and those who tend to be price sensitive. If you get the right mixture of those two kinds of investors, you can get volatility in the market that looks very much like real markets even when there is no news. I mean the guys at CNN could be telling all sorts of stories as this market goes up and down, but it is just the market itself. So this is great fun, and we will be putting that out. There is an article coming out describing that in the Journal of Portfolio Management. [“Financial Market Simulation” by Jacobs, Levy, and Markowitz appeared in the special 30th Anniversary Issue of the Journal of Portfolio Management in 2004.] Pretty soon we will have it on a Jacobs Levy Equity Management website so you can go in and change parameters such as how many investors you want, and various types of investors, and so do simulations yourself. So that is something that has been going on. BUSER: Very good. At this point we are going to open up the floor for questions. Do any of you have a question you would like to ask of Dr. Markowitz? And can you stand up and speak real loudly please? STUDENT#1: Dr. Markowitz. How do you feel about putting the Social Security funds into stock and diversifying? MARKOWITZ: I am in favor of that being an opportunity. I have worked with the Chilean pension system, and they have certainly done a lot better than I did with Social Security. There is a legitimate worry that some people won’t be able to handle it. So it should be an optional thing. But hopefully most young people should be able to handle it. BUSER: The question mentioned diversification. Should diversification be required? Or would you allow individuals to go pre-Markowitz and just chase expected return? MARKOWITZ: Yeah, that is a problem. Should they be allowed to pick individual stocks? In the Chilean system, there is good and bad. They can only invest in certain approved pension funds. These pension funds are not told what to invest in. However, they are told that if they perform too far below the median pension fund they will be penalized, and money will be taken out of their fees and put back into the fund. So that’s 13 good and bad. It keeps people from going off the deep end, but it also tends to make everybody invest in lock-step. Maybe the right thing would be to have people pick among a list of pension managers that offer sufficient diversification, but allow some variety as to whether individual managers are a little bit more aggressive or a little less, either higher on the frontier or lower on the frontier. So you raised some good questions. Takes some thought. STUDENT#2: Hi Dr. Markowitz. As our ability to collect large data sets, stream information in real time, and create large complex computations and models continues to increase exponentially, and as our economic models and our understanding of the markets continue to evolve, what do you see for the future of market prediction and modeling? MARKOWITZ: Well, I usually try to avoid predicting things. But I think one safe prediction is that the future will be uncertain just like the past and present. So we are in the information age, and we have all this information zipping around. Some of it gets into print, and a lot of it gets into databases. For example, we have a piece of information like the earnings of a company, which of course might be a lie. Or it might be a misprint. Or it might be an honest error. Or it might be even correct. I am not saying they are all lies but, you know, somehow we have to advise people on how to invest their 401(k)s despite the fact that it is an uncertain world. Not only is information about individual stocks uncertain, but the average return over the long run of stocks as compared to bonds is still subject to quite a bit of controversy. Some people look at the past and say, stocks did 10 percent on average before or after inflation. Other people say that during the same period the price earnings ratio increased considerably and you would not expect it to go up that much in the future. Therefore you will not have as much return in the future as in the past. So there’s a range of uncertainty as to what the stock market as a whole will do over the next many years. And I think that’s good. The world is uncertain and we have to continue to act in the face of uncertainty. STUDENT#3: Are there any financial modeling simulation experiments that are going on right now that you find interesting? MARKOWITZ: The experiment I am doing with Jacobs and Levy certainly interests me. I think it is perfectly reasonable for people to ask what about the real behavior of investors as distinguished from rational behavior. I do not necessarily subscribe to each article by the behavioral economists, but I think it is a reasonable 14 activity to pursue. I am especially interested in simulations that involve asynchronous time, which means that time does not go by steady increments necessarily and need not be continuous, but can advance to the most imminent event of various kinds. If you make assumptions about how people in the market behave, and put those assumptions inside the simulation, you can see whether behavioral theories at the micro level add up to observable market behavior. STUDENT#4: A lot of academic research has focused on the issue on how to define risk. You even suggested the measure of semi-variance in your 1959 book. You observed using variance as a risk measure assumes symmetry. For example, if there is a potential for a very large positive return, the variance of an asset might increase. But that is not to say that the probability of incurring a loss is higher for that asset. Where do you see future work on modeling risk going now that people are talking about things such as value at risk, skewness, fat tails, or even the entire probability distribution? Do you think that there is something that will turn out to be valuable and will become feasible as computing power improves? MARKOWITZ: Let me tell you what my view was, and has been from 1959 to approximately the present, about justifying mean and variance, or selecting among alternate criteria for measures of risk. As of 1959 I was convinced that the proper way a rational decision maker should act was to maximize expected utility using personal probabilities. In other words, I had been thoroughly brainwashed by Leonard J. Savage’s Foundations of Statistics. I say to approximately the present as I haven’t really stopped and decided what to think about some of the recent objections to expected utility such as that presented by our colleague Mark Machina. As a working hypothesis let me continue right to this moment, and will on to my dying day believe in expected utility and personal probability. So if I really believe in personal probability, what probability distributions are we talking about? And if I believe in expected utility, how come I’m out peddling mean and variance? As you say, in Chapter 9 of my 1959 book I propose semi-variance as an alternate to mean and variance. However in Chapters 10, 11, 12, and 13, I explain to the reader what expected utility and personal probability are. I then do some experiments where I say, suppose you only knew the mean and variance of a portfolio, how good would you do at guessing what expected utility was? If the probability distribution wasn’t spread out too much, for example, if most of the probability distribution was between a 30 15 percent loss and a 40 percent gain, then the quadratic approximation to the utility function was quite close and the mean variance guess is quite close to the actual expected utility. I once gave that response at Hebrew University and Marshall Sarnat said, let’s test Harry out. Let’s get lots of historical distributions of returns, and lots of utility functions and see if the quadratic guess is close. That effort resulted in the 1979 Haim Levy and Markowitz paper which reached the conclusion that for many historical distributions of returns, if you know mean and variance you can guess expected utility quite close. But if you look at the actual approximation, if you draw the quadratic approximation and the utility function, you see that the thing that makes this work is that, again, over a range from 30 percent loss to 40 percent gain the approximation is quite good. However, if you imagine a situation where somebody could lose more than 30 percent of a portfolio or could gain more than 40 percent on the portfolio, then the mean variance approximation breaks down. Is there is something we can replace it with which is convenient and understandable? People understand mean variance. They may understand it for the wrong reason, but you know they feel warm and fuzzy about mean variance and use it. So if you could get something else like mean and semi-variance, or value at risk-although value at risk is usually just mean and variance again. This is an exciting question that you asked. I don’t know the answer, but if I were starting all over I might want to do another dissertation in that field. STUDENT#5: I am wondering if there are any weaknesses in the current economic structure to bring about a catastrophe like we saw in 1929? MARKOWITZ: You know, we just don’t know. Every now and then I get a letter where somebody will say, I am with a brokerage firm, and I give financial advice based on the efficient frontier. I am having a discussion with another broker who also uses the efficient frontier to give financial advice. The guy thinks they should only use returns from 1950 onward, and his colleague thinks they ought to use the whole history from 1926 onward that is available, including 1929, 1930, and so on. I reply that I am not one to predict, but I feel that nature is picking from a probability distribution, and somewhere in that probability distribution there is another 1929. Maybe it doesn’t have exactly the same frequency as its historical frequency. But I would feel happier to do an analysis based on some kind of an estimate that there is a 1929 still in the bag. 16 STUDENT#6: Dr. Markowitz. One of the interesting things is that you used your background in statistics to work in other areas, like finance, which ultimately led to your Nobel Prize. In that spirit, do you have any advice for this generation as to how they should proceed in terms of finance? Are there any particular areas that you think should be associated with the world of finance, economics and statistics that might not be explored yet? MARKOWITZ: Yes. In the first place, as a practical matter if you’re going to be a professor of finance these days and publish in the best journals, like the Journal of Finance, you better know a lot of continuous time mathematics. And that, I must confess, is very difficult for me. I wasn’t taught it, and it was very hard for me to learn it. I am still not very good at it. I am not facile with lots of subjects that people publish these days. But you should be adept at that. On the other hand, while it is all very nice to have that facility, I hope you do not lose sight of philosophical issues when dealing with uncertainty. I recommend that you read Descartes’ first Meditation, Hume’s On Human Understanding, and certainly you have to read Leonard J. Savage’s Foundation of Statistics. You should know about those kinds of things. I think technique is great and important, and I am sorry I am having trouble keeping up with the big kids these days on all this continuous-time math. However I think we should also remember that the basic subject is how to deal with uncertainty. It is tricky enough to come up with an efficient frontier if you’ve got historical time series. But from a practitioner’s perspective, how do you deal with something that is totally new. And, in particular, China. Assume you are trying to advise people on what to invest in there. You have very risky investments where you do not know the expected returns, standard deviations or covariances. Well let me tell you what you’re supposed to do in theory, what Leonard J. Savage’s rational man would do, and then let me suggest approximately what you should do in practice. Savage would say that somehow you would make estimates of likely return and standard deviation and then do an expected utility analysis. I would do a mean variance analysis with those beliefs, and then somehow the result would reflect the fact that there is an investment opportunity but also a huge uncertainty. Presumably the answer would be to put a little here and a little there. So that is how it goes in theory. In practice, I just put a little here and a little there. 17 BUSER: I would second that and note that in the Merchant of Venice, the merchant was trading with China So not all your eggs in that one boat. MARKOWITZ: Right. STUDENT#8: Dr. Markowitz. In my first economics class I learned about Adam Smith and the famous invisible hand theory. Toward that end, do you believe that theory has played a part in how the morality of the securities industry has gone? In addition, how do you think that economists should assess risk in light of that morality? MARKOWITZ: I think markets need regulation. To a certain extent businessmen rely on each other’s word, but also they rely on laws which are appropriate. So subject to the constraint that there be reasonable laws and somebody there to enforce it, I do believe in the invisible hand, I do believe in Adam Smith, the division of labor and so on. Now you didn’t ask, but I will volunteer how portfolio theory fits into this, and then we’ll get back to your question about uncertainty. People are competing to serve the same market, or to find a market niche. However once somebody finds a market niche other people will come in and try to outdo them. That has two consequences. One is that everybody has to try very hard. As Adam Smith explained, the butcher, the baker and the candlestick maker all do good jobs so that you will come back to them. The other thing is that if you want to invest in one of those people, you do not know who is going to win. So the flip side of the invisible hand is the uncertainty that competition causes, and that is why we diversify our portfolios. I think that uncertainty has always existed and continues to exist. From the middle 1950s on there are new uncertainties that have to do with the possibility that the human race will wipe itself out, and that civilization as we know it will disappear. But ignoring that scenario I think the same uncertainty persists today as it did in Antonio’s time. So don’t trust all your goods in one bottom. BUSER: With that, Dr. Markowitz, we thank you very much and wish you a good evening. 18 Second Interview taped at the Office of Dr. Markowitz BUSER: Your work has had a remarkable impact on practice. What are your reactions to changes in the industry that have taken place? MARKOWITZ: I seem to have specialized in theoretical things which then became practical. One way to measure whether theoretical things in operations research in fact contribute to the theory of rational behavior under uncertainty is to see if they are used in practice. BUSER: Where did you get your interest in practice? You probably didn’t get that from your academic training in economics. MARKOWITZ: No, that is interesting. It was somehow an axiom in my system. I mean I don’t know where it came from, but all my life if nobody used a discovery, I wondered why it wasn’t used. It is sort of like in physics. If you have a hypothesis you test whether the hypothesis predicts something that the other theories can’t predict. In the case of operations research the goal is the development of a technique which somebody can actually use. BUSER: Were you trained in operations research or just in economics? MARKOWITZ: No, I picked up OR. I was trained in economics, and I got a degree in economics. I think operations research was already in existence in England someplace at the same time I was getting a degree in economics. But when I went to The Rand Corporation for my first job they were doing theoretical things which were supposed to actually help the Air Force. So maybe that is where it came from. BUSER: For years I thought of you as an applied micro economist, but I did not understand the extent. Now I am picturing you going to a grocery store looking for bananas and actually calculating marginal utilities as micro theory assumes. But if you do that, you are the only one I know who does. MARKOWITZ: Right. No, no. There’s a disutility to keeping records or doing calculations. I never charge my clients for my small travel expenses like taxis, because they pay me enough anyway and besides keeping track of taxis is a great disutility to me. BUSER: Okay, fair enough. So you have a cost perspective on this. MARKOWITZ: Right. 19 BUSER: But the field of portfolio selection has in fact become very applied. Did you ever anticipate in your wildest dreams that your work would have this kind of impact on the way people manage their investments? MARKOWITZ: Strangely yes and no. I guess now that I think about it, when I was sitting there in the library at the University of Chicago, where these ideas first arrived, I thought that people could actually use this. But to think that billions of dollars would be managed using this method, that really didn’t strike me. BUSER: At the time you did your work I think the custom was to buy individual stocks and perhaps hold five or ten if you wanted to diversify. MARKOWITZ: That was one of the things I read. As I said last night I got a reading list from Marshall Ketchum. Graham and Dodd was on the list as was John Burr Williams’ Theory of Investment Value. One of the other things on the reading list was Weisenberger’s Investment Companies. There were scores, if not hundreds, although not thousands of companies. BUSER: Not thousands? There weren’t more investment companies than there were securities as there are today? MARKOWITZ: Not as there are today, right. But there were lots. And they held lots of securities, and they subdivided their holdings. They had a sense of covariance. BUSER: Did you interpret existing investment companies as primarily diversification intermediaries? MARKOWITZ: Yeah, that’s what I thought. The practice was there, but the theory wasn’t. In other words, if you take John Burr Williams, it doesn’t imply the kind of behavior that these investment companies were following. BUSER: Part of your computational effort focused on linear constraints on portfolio choice and nonnegativity constraints. What is your reaction to the change in institutional structures, for instance securities lending programs, that make it easier to short sell securities, or options and futures contracts that make negative positions easier to execute today. MARKOWITZ: Even if the computer program is set up so that variables have to be nonnegative, you can still represent short sales. You just have two variables. One variable represents a long position, and the other variable represents a short position. That way short positions can be included as is assumed in CAPM, or in the more realistic way that shorts are constrained in the real world by virtue of Reg T. For example, the 20 paper “Portfolio Optimization with Factors, Scenarios, and Realistic Short Positions” by Jacobs, Levy, and Markowitz in Operations Research, July/August 2005, addresses optimizing portfolios that are subject to Reg T and contain both long and short positions. There are actually a couple of versions of CAPM. One is the Sharpe-Lintner CAPM which assumes that securities holdings are nonnegative but you can borrow or lend all you want at the risk free rate. The other CAPM probably dates back to Bill Sharpe. It is hard to track down exactly where this comes from, but this CAPM assumes your only constraint is the sum of the holdings equals one. Actually, that goes back to Roy. He was the one that made that assumption. He was a little apologetic about it. Now they don’t apologize. They just make the assumption. That assumes, for example, that if you have a weight of minus 5,000 and a weight of plus 5,001 that is feasible because the weights add up to 1. If you think that is realistic, call your broker and say, “I am sending you a thousand dollars. Would you please short a million dollars worth of …” and so on. Reg T says that if you think of a short as the negative of a long, then the sum of the longs plus the absolute value of the shorts must be less than or equal to 2. There are two choices when you are dealing with nonnegative variables. I don’t want to get into technical details, but if you want to see the technical details get my 1987 book on Mean Variance Analysis and look in Chapter 2. It explains how to represent both of those kinds of shorts with nonnegative variables. BUSER: The bottom line, I guess, is that you think this can be implemented. MARKOWITZ: Yes. In other words, you can make a portfolio of any of those kinds of securities, and the method of using linear constraints with linear equalities and nonnegative variables turns out to be very flexible as the linear programming folks have shown. We have a linear programming type constraint set, but we have different objectives. BUSER: You mentioned the CAPM. What is your reaction to using the market portfolio as a dominant portfolio strategy in combination with risk free borrowing or lending? MARKOWITZ: First let me say two things. The CAPM is a thing of beauty. With a little poetic license it turns out some very neat results. That is thing one. Thing two, you will be talking with Bill Sharpe pretty soon, and Bill Sharpe and I have had a long 21 and lasting friendship. One of the fun things about this long and lasting friendship has been a long lasting argument about the CAPM. I may be the only one in the profession who still has reservations about the market portfolio. Let me illustrate on the blackboard. Suppose you make all the other assumptions of CAPM, like everybody’s a mean variance optimizer, everybody acts rationally and everybody has the same beliefs, but you give up the assumption that anybody can borrow all they want at the risk free rate, or can short sell without limit and use the proceeds, not just for collateral and collect a bit of the interest on it, but can actually take the proceeds from the short and buy long. If you cannot give your broker a thousand bucks, short a million dollars and take the million plus a thousand and buy long, if you don’t make either of those two assumptions, then it turns out that the market portfolio is not necessarily an efficient portfolio, and in fact is typically not. I’ll give you an example of why that’s not true. I’ll use an example in which there’s no shorting and no borrowing, that’s the easiest to draw a picture of. But it also works if you allow shorting but the Reg T kind of constraint on shorting. It has to do with whether or not you hit a boundary as you move along the efficient frontier. [The following example is from the Markowitz article on “Market Efficiency: A Theoretical Distinction and So What?” Financial Analysts Journal 2005. September 2005 pp.1-14. Dr. Markowitz recommends that you read the article and skip to the next question.] Let me show you a simple example of that. Let X1 denote the fraction invested in the first security. I’ll plot that on the horizontal axis. Let X2 denote the fraction invested in security two and plot that on the vertical axis. This will be a three security example but you just have to remember that X3 is equal to 1 minus X1 minus X2. Add the constraint that X1 is nonnegative, X2 is nonnegative, and X3 is nonnegative. That means that you have to be in this triangle which has these points as their vertices. If you are below the line, X2 is negative, if you are left of the axis, X1 is negative, and if you are above here, X3 is negative. So you got to be on or in the triangle. Somewhere on this page is a portfolio with minimum variance. It might be here, or it might be there. You get the same conclusions but I have to draw it someplace, so I’ll put it here for example. 22 From CAPM theory we know that if this were the only constraint the set of portfolios which minimize variance for various levels of expected return would all lie in a straight line. So somewhere in this plane there is a straight line that represents the set of all portfolios with minimum variance for a given level of expected return. In one of these directions expected return decreases, and in one of these directions expected return increases. It could be either, but we’ll say expected return increases in this direction. So the set of efficient portfolios goes from the minimum variance point out forever along that line. This is the way the set of efficient portfolios looks if this is the only constraint. Now suppose you can’t let X2 be negative. At the X2 boundary you can no longer continue on this line. In general, for any system of linear constraints, the set of mean variance efficient portfolios is piecewise linear. It goes in one straight line until it hits a boundary, and then it goes in another straight line, and so on. Each corner point corresponds to a new set of active variables. Lines connecting corner points are called efficient segments and represent mean variance efficient portfolios that share a common set of active variables. CAPM is a special case with just one corner portfolio, and it has just one efficient segment that keeps going forever. In the more general case the efficient frontier looks like this. [Indicating a piecewise linear figure.] Suppose there are some old guys, like us, who want a fairly conservative portfolio, and there are some younger guys who want a fairly aggressive portfolio. The market will be on a straight line between their portfolios. The market will just be an average weighted by our respective wealths. So the market will be somewhere like that. [Indicating an intermediate point.] But the market is not an efficient portfolio for the CAPM guy or for us. If you look in my 1987 book, Chapters 11 and 12, you will see examples where the market has roughly maximum variance for its expected return rather than minimum variance for its expected return. It is also not true that expected returns are linearly related to beta, as measured against the market. To see that suppose you ask if the expected return for these three securities are linearly related to the covariance between the return for the security and the return for a given portfolio. The only time the answer is yes is for a portfolio that is efficient in the CAPM sense. So it is not true that expected returns are linearly related to beta as measured against the market. So CAPM is a lovely theory, but it takes a little 23 poetic license to get neat conclusions. One should remember that if you don’t take those particular poetic licenses you don’t get the same conclusions. BUSER: Is there a role then for institutional fund managers to attempt to solve this constraint problem for individuals through specialized mutual fund? MARKOWITZ: The big problem is how to estimate return distributions. But if we all had the same means, variances and covariances then in this example there should be three mutual funds. There should be one here, one here, and one here. [Indicating one for each corner portfolio.] These guys will mix between these two funds. These guys will mix between those two funds, and the guy who offers the market portfolio won’t make any money in this world with nonnegativity constraints. BUSER: But if an institution could solve the constraint problem, and get them in effect a negative value for X2… [The following answer is also from the Market Efficiency: A Theoretical Distinction and So What? article. Dr. Markowitz again recommends moving on to the next question.] MARKOWITZ: Let me change the question a bit. Suppose there was one guy who could make X2 negative. Suppose he has access to a warehouse where they keep securities. He goes in the middle of the night and he “borrows” the securities and he sells them. And as long as he covers before the auditors come in 30 days, it’s okay. So as we move out this direction, we have higher expected return and higher volatility, and he’s obviously a risk taking kind of guy. So he can choose a portfolio here. He could have that portfolio if he wanted it. Now one question you surely want to ask is the following. Since this is inefficient and this is efficient, shouldn’t he go short the market and long the efficient portfolio, and won’t he drive away the inefficiencies that way. Well if in fact he goes short this and long that, then he will be on a straight line between the market and this portfolio. And because he is short this and long that, he will actually be out further. So that is not an efficient portfolio for him. He should just forget about the market. He is not going to short the market. Now if we add him to the mix, what happens to the equilibrium? Well it’s going to be somewhere between here and here. If it is down here that can’t be an equilibrium because it has a negative amount. In this economic equilibrium the supply and demand market solution is going to happen somewhere up here, and it’s not going to 24 be efficient. It could get close, but it won’t be mean variance efficient. It won’t be CAPM efficient in any case. You could maybe get a little closer to this particular efficient portfolio but…Anyway, so approximately a hundred percent of equilibrium theory is built on the assumption that you can short and use the proceeds, and I think there is a great field of daisies to be picked if you drop that assumption. BUSER: Okay, if we do drop that assumption, what would be your advice for someone just starting out with, say, $100,000 to invest? MARKOWITZ: There are two versions of that question. The straightforward one is if you just have 100,000 and nobody is offering you any special services like are now being offered the 401(k) participants, what should you do? In that case, I would put some in a broadly diversified investment company. That has been my routine answer for the last 50 years. But maybe now I would switch to an ETF or an index fund. BUSER: Maybe? Or do you prefer the index fund? MARKOWITZ: I think so. I would look at the costs, but I would go passive. BUSER: And how broad is broad? S&P 500? Dow Jones Wilshire 5000? MARKOWITZ: I would go with the more the merrier, but the S&P 500, or the spiders, are good enough. BUSER: Are you thinking of the market model idea, or is there something else? MARKOWITZ: Now that’s a good point. Here I am advising the market portfolio, and I say the market portfolio is not efficient. BUSER: Do you want to change your answer? MARKOWITZ: Right…No… That’s my answer, and I stick with it. Let’s go back. I want to make sure I said that you put part of your money into the spiders or index fund and part of your money into something less volatile. To determine the mix you should look at a picture of the S&P 500 since 1926, or something like that. And, if push comes to shove, I’d say maybe you ought to a have a little small cap, so maybe the 3,000 or the 5,000. BUSER: One of the broader indices? MARKOWITZ: Yeah, one of the broader indices. As a practical matter, if it is just the person by themselves without an advisor, then this is better than they are likely to do otherwise. It’s certainly better than having them listen to the television set, or having them invest in whatever did really well last month or last year. 25 BUSER: Or whatever did really poorly? MARKOWITZ: Yeah, maybe, or even having them invest in whatever did poorly, right. BUSER: Over the years, a lot of strategies have been associated with your name. I recently came across one rule for determining the allocation between risk-free and risky assets. I am virtually certain this strategy should not be attributed to you because I believe you have always claimed that that is a subjective matter. The rule states that you are supposed to take your age and subtract that number from 120 to determine the percentage investment in risky assets. MARKOWITZ: Yeah, that is not my rule. BUSER: You do not subscribe to any particular guidance as to how much money you should keep in relatively safe assets versus risky assets. MARKOWITZ: No. I do not have a set number. I think there is methodology around which will help you choose a number, but that will vary from person to person. BUSER: And not necessarily be indexed by age or circumstance? MARKOWITZ: And not necessarily be indexed by age or by circumstance. There are studies that show that if you end up at retirement time, at age 65, and you put all your money into bonds or cash, you’re going to have a lot of trouble if you live to 85 or something like that. So these 401(k) advisory services now do Monte Carlo simulations to see how well you would do if you followed various strategies, both up to retirement time and beyond retirement time. I think that can contribute to good decisions. BUSER: Are you talking about a tax advantage? Or, is there something beyond tax advantage? MARKOWITZ: It’s not only tax advantage. Let’s go back to an earlier question where I said I would give you two answers to the question of what somebody should do with 100,000 bucks. One answer was with advisor, and one was without advisor. I said that without an advisor an investor should look at a chart of the long term performance of a broad index and decide how much to put in the broad index and how much to put in cash. I lean toward spiders because they are more liquid than some of the others, but a broad index would be good. But maybe an investor can do even better with an advisor. I want to say Gary Brinson, okay? So what does that mean? What is it code for? Well it is code for thinking in terms of asset classes. For example, we have found that on the average over the long run, 26 small caps tend to have higher return than big caps. And emerging markets have somehow managed to have very high returns on average, but they also are tremendously volatile, and so on. So if you ask what combinations of asset classes, subject to realistic constraints, are efficient for the plunger, and which are efficient for the widow and orphan, you get a frontier. But we don’t necessarily use historical means and variances. When I helped advise people I noticed that if you plot historical means against historical standard deviations they fall on a fairly straight line. CAPM says that if you plot expected returns against betas they will fall on a straight line. However when we plotted expected returns against standard deviations, they fell on a fairly straight line except that emerging market return was higher than the line. We said that bothers us, and we just moved it back down to the line and said, “Okay that’s our estimate”. We’ll put in some constraints, we don’t want to stick our neck out too much. That is what I am saying when I think an advisor can come up with asset class mixes some of which more suitable to one kind of investor and some are more suitable to another kind of investor. One thing that is exciting to me has to do with the history of using mean-variance analysis in an asset class context. That started out being used primarily by institutional investors. They would invest in asset classes, either passively, or by trying to find managers that could outperform the benchmarks. Then in about 1990 Randy Moore founded something called Frontier Analytics which computed asset class frontiers. They peddled the software to financial advisors, and they tell me there are 25 to 30 thousand of these little subscriptions out there for financial advisors who are generating frontiers for individuals. Then of course there is the business which Bill Sharpe created. Bill Sharpe has made many contributions, most of which I don’t argue with him about. Fortunately we have this one thing we can argue about. That’s very pleasant. But one of his great contributions was Financial Engines for providing 401(k) advice. In addition I happen to consult for a firm called Guided Choice, which is a rival. We conduct mean-variance analysis, subject to realistic constraints, and we come up with the asset class portfolios. I think that is how Bill does it. That is certainly how we do it. We then implement the model for some combination of the actual investment companies permitted by the particular pension plan. So I think that those applications are useful. 27 BUSER: Now if you had someone who could tell you what the world market portfolio really was in terms of all these asset classes, is that information an individual investor should be aware of? MARKOWITZ: Well it certainly wouldn’t be bad to know about it, but I think there are better alternatives. If you have the widow and orphan, the guy getting close to retirement, and the businessman that doesn’t need the money anyway but would like to make as much as possible, then I don’t think the proper solution for all three is to just combine the world portfolio with either borrowing or lending. I think there is a better efficient frontier for them. BUSER: So you are not a believer in a super separation theorem. MARKOWITZ: No I’m not. The super separation theorem happens under special assumptions. BUSER: Moving on to your background, while I haven’t talked to him yet, I have read where Professor Sharpe credits you with pointing him in the particular direction that led to his share of the Nobel Prize. Is your recollection similar to his? MARKOWITZ: Well, I was working at The Rand Corporation, we figure about 1960, so it was after the 1959 book was out. A young man presented himself at my door, at Rand and said, “I also work at Rand Corporation. My name is Bill Sharpe and I am trying to get a PhD at UCLMARKOWITZ: My Professor, Fred Westin, said why don’t you ask Harry? They had read my 1952 article, and Fred Westin suggested that Bill come over and ask me for a suggestion about a dissertation topic. One of the problems that bothered me in the book was that there were so many covariances. With even 500 securities it would mean 500 squared divided by two covariances. That is too many to have a team estimate them one at a time. I suggested essentially the one factor model on pages 97 to 100, roughly, in my 1959 book. So Bill and I talked about the problem of too many covariances and the one factor model. That led to his 1963 article about the simplified model of portfolio analysis, something like that. But I had no input to his ground breaking, earth shaking, 1964 article about CAPM. BUSER: You didn’t suggest that he look at the market implications? MARKOWITZ: No. That was his ideMarkowitz: One of many of his ideas. BUSER: All right. Well if a new PhD want-to-be were to show up at your office and have similar interests and similar enthusiasm. What direction would you point? 28 MARKOWITZ: Well, first I’d find out whether he wants - BUSER: - to win the Nobel Prize? Did I add that part of the question? MARKOWITZ: Oh, well, then you have to do something new. I can start him in some direction, but he will have to find a whole new dimension. The right one will find a whole new dimension that will get him the Nobel Prize. But what gets published these days is work on continuous-time models. Bob Merton is wonderful with this kind of model. So if he is going to get published in the best journals, like the Journal of Finance, he should learn continuous-time mathematics at a rigorous level. On the other hand, in terms of something new that is fun, I was showing you earlier today the output of this asynchronous market model where we could have thousands of investors of different types, and maybe some day when we go to super computers we could have hundreds of thousands or millions of investors, and they could be following different kinds of decision rules. As I showed you, depending on the balance between those who are essentially following price sensitive and price nonsensitive strategies, you can get very wild markets, or very tame markets, or markets that look like real markets with no news or anything like that. I think that is an exciting direction which I hope to persuade people to follow. BUSER: I was fascinated. MARKOWITZ: Well thank you. BUSER: You have made a number of phenomenal contributions and won all kinds of awards including the Nobel Prize. Of all the papers you have read that other people wrote - so excluding your own contributions - are there any papers that you secretly wish you had written and could tack onto your vita? MARKOWITZ: Well, yeah, that’s interesting. Are we talking about finance specifically? BUSER: Finance if there’s one that comes to mind, but if another one comes to mind in a different area, feel free to mention that. MARKOWITZ: If somebody asked me what they should read from any field, I would say, Descartes’’ first Meditation, and Hume’s Essay on Human Understanding. But getting a little closer to home, I think Leonard J. Savage’s Foundations of Statistics is one of the great pieces of all times. Of course George Dantzig’s, simplex algorithm or the solution to the traveling salesman problem. There are all sorts of things. Lots of great works. 29 BUSER: As a twist on the last question, looking forward are there any particular unsolved problems or puzzles that you wish you had solved or hope that you can solve in the future. Again, it doesn’t have to be finance, finance is one that comes to mind, but any field. MARKOWITZ: Well the big problem in finance is illiquidities. You know with continuous time or no continuous time, if you have perfectly liquid markets then we can somehow find optimum solutions, or approximations to optimum solutions. But when there are illiquidities, and changing probability distributions, and so on, then problems get really hard. I have this Financial Analyst Journal article on “Single-Period Mean Variance Analysis in a Changing World” that offers a hypothesis about a heuristic that I think would help out there. Maybe somebody else will get a great insight into the problem. Going back to your original question about what do I wish I could do, I would like to add to the great monumental works on programming by Ralph Gomory and others. Perhaps somebody of that caliber would have some insight into the illiquidity problem and advance our knowledge beyond just a next best heuristic. BUSER: You have had a phenomenal career in research, teaching and consulting. If for some reason that hadn’t panned out, so your committee had absolutely refused to give you a degree, and no one would hire you in that field, what would have been your back up choice for a career? MARKOWITZ: Oh that’s interesting. That’s funny. I never was good at backup choices. For example, I only applied to the University of Chicago. Usually people apply to lots of places, but my family had always spoken as if I were going to go to the University of Chicago, and I didn’t apply to anyplace else. When I was in high school I read philosophers like Hume, and I read science like physics and astronomy at a popular level, you know, the A-B-C of relativity kind of thing. When I applied to the University of Chicago, they said my marks weren’t very good. That was because I didn’t do some of the repetitive homework like the exercises in algebrMarkowitz: Homework in algebra was very repetitive, and I just typically didn’t do it, except for the last problem that the A students couldn’t get. They would come to me and I would solve it for them. So I’d do well on the test, but I didn’t do very well on the overall course. I wrote to the University of Chicago and told them the kind of things I had read, and they wrote back saying they usually didn’t take people who were that far down in the 30 standing in their high school. But they would allow me to take the entrance test. When I took the entrance test not only did they let me into the University of Chicago, they said I didn’t have to take the survey course for the physical sciences because I had already learned as much as they would teach in that course. At that time, the University of Chicago gave a bachelor of philosophy after completing two years of survey courses. When I got to the end of the two years I had to decide what department or division I wanted to go into. I had forgotten that I really liked physics and astronomy. I had taken an economics course recently that seemed to titillate me with both the math and the rigor. So I went into economics. END 31