future value and present value formulas

advertisement

TESTBANK

BUSINESS FINANCE

FINANCE 300

JAMES T. LINDLEY

PROFESSOR OF FINANCE

FALL 2009

DEPARTMENT OF ECONOMICS AND FINANCE AND

INTERNATIONAL BUSINESS

COLLEGE OF BUSINESS ADMINISTRATION

THE UNIVERSITY OF SOUTHERN MISSISSIPPI

JAMES T. LINDLEY

PROFESSOR OF FINANCE

DEPARTMENT OF ECONOMICS AND FINANCE

& INTERNATIONAL BUSINESS

COLLEGE OF BUSINESS

OFFICE: 314-H Greene Hall

PHONE 266-4637

FAX: 266-4639

EMAIL: jlindley@comcast.net

WEB SITE

http://ocean.otr.usm.edu/~w300881/

TABLE OF CONTENTS

PROBLEMS

CHAPTER

1-22

23-76

77-93

94-115

116-120

121-130

131-147

148-151

4 & 5

7

8

9 & 10

11

13

3 & 4

24

FUTURE VALUE AND PRESENT VALUE FORMULAS

FORMULAS AND CALCULATOR STROKES

(TEXAS INSTRUMENTS BA II PLUS SOLAR)

Sum * (1 K) n

FUTURE VALUE OF A SUM

FUNCTION

KEY STROKE

Interest Rate Per Period

Time Periods

Initial Investment

Future Value

I/Y

N

PV (change to negative number)

CPT--FV

1

PRESENT VALUE OF A SUM

Sum * ( 1 K ) n

FUNCTION

KEY STROKE

Interest Rate Per Period

Time Periods

Future Value

Present Value

I/Y

N

FV

CPT--PV

FUTURE VALUE OF AN ANNUITY

FUNCTION

Present Value

Interest Rate Per Period

Time Periods

Payment

Future Value

PRESENT VALUE OF AN ANNUITY

FUNCTION

Future Value

Interest Rate Per Period

Time Periods

Payment

Present Value

(1 K) n 1

Payment *

K

KEY STROKE

ZERO

I/Y

N

PMT

CPT--FV

1

Payment *

KEY STROKE

ZERO

I/Y

N

PMT

CPT—PV

1

1

(1 K) n

K

FIND PAYMENT FOR LOAN PV =

1

Payment *

FUNCTION

KEY STROKE

Interest Rate Per Period

Time Periods

Future Value

Loan Amount

Payment

1

(1 K) n

K

I/Y

N

FV (FV is zero)

PV (PV Number is negative)

CPT—PMT

FIND INTEREST RATE ON LOAN

FUNCTION

KEY STROKE

Time Periods

Future Value

Loan Amount

Payment

Interest Rate Per Period

N

FV (FV is zero)

PV (PV Number is negative)

PMT

CPT--I/Y

FIND TIME PERIOD ON LOAN

FUNCTION

Future Value

Loan Amount

Payment

Interest Rate Per Period

Time Periods

KEY STROKE

FV (FV is zero)

PV (PV Number is negative)

PMT

I/Y

CPT--N

FIND AMOUNT OF ON LOAN

FUNCTION

Future Value

Payment

Interest Rate Per Period

Time Periods

Loan Amount

KEY STROKE

FV (FV is zero)

PMT

I/Y

N

CPT--PV (PV Number will be negative)

1 (K/m)m

Effective annual rate

WHERE

1

K = Nominal Yearly Rate Of Interest m = Portion Of The Year

n = number of years

2

1. A rich aunt promises you $35,000 exactly 5 years after you graduate from college.

What is the value of the promised $35,000 if you could negotiate payment upon

graduation? Assume an interest rate of 12 percent. [$19,859.94]

2. Thirty years ago, Wayne McConnell bought ten acres of land for $500 per acre in

what is now downtown Phoenix. If this land grew in value at a 10 percent per annum

rate, what is it worth today? [$87,247]

3. You have been fortunate enough to win $10,000,000 in the lottery. You discover that

you can be paid an amount per year over ten years or take the discounted value of

the $10,000,000 today assuming a rate of discount equal to the T-Bill rate of 6.5%.

What amount could you receive today? {$5,327,260]

4. Houston McNutt placed $50,000 in a mutual fund 7 years ago. Today the fund is

worth $100,000. What rate of interest has he earned? [10.4%]

5. How long will it take the $2,000 that Ed Earl Stout placed in an account to double in

value if it is earning a rate of 7.2%? [10 years]

6. You purchased gold as an investment 5 years ago at $267 an ounce. Today, gold is

selling for $300 an ounce. What is the rate of return on your investment? [2.36%]

7. Ross Warden placed $1000 into an account that earns a nominal 5%, compounded

quarterly, what will it be worth 5 years from today? [$1282.04]

8. You place $5,000 in your credit union at an annual interest rate of 12 percent

compounded monthly. How much will you have in 2 years if all interest remains in the

accounts? [$6,348.67]

9. Betty Walker has $5,436 in an account that has been paying an annual rate of 10%,

compounded continuously, since she deposited some funds 10 years ago, how much

was the original deposit? [$1,999.79]

10. Suppose Clayton Delaney has $2 million in a 2-year account paying a 6% nominal rate,

compounded annually. Another bank offers Clayton an account for 2 years paying a

6% nominal rate, but compounded bimonthly (that is, 6 times a year). If he moves his

account, how much additional interest will he earn over the 2 years? [$6,450.06]

3

11. According to a local department store, the store charges its customers 1% per month

on the outstanding balances of their charge accounts. What is the effective annual

rate on such customer credit? Assume the store recalculates your account balance

at the end of each month. [12.68%]

12. Suppose that a local savings and loan association advertises a 6 percent annual rate of

interest on regular accounts, compounded monthly. What is the effective annual

percentage rate of interest paid by the savings and loan? [6.17%]

13. You have the opportunity to buy a perpetuity paying $1,000 annually. Your demanded

rate of return on this investment is 15%. You would be essentially indifferent to

buying or not buying the investment if it were offered at what price? [$6,666.67]

14. If you buy a factory for $250,000 and the terms are 20% down, the balance to be

paid off over 30 years at a 12% rate of interest on the unpaid balance, what are the

30 equal annual payments? [$24,828.73]

15. You want to set up a trust fund. If you make a payment at the end of each year for

twenty years and earn 10% per year, how large must your annual payments be so that

the trust is worth $100,000 at the end of the twentieth year? [$1,745.96]

16. Starting on January 1, 1987, and then on each January 1 until 1996 (10 payments), you

will make payments of $1,000 into an investment which yields 10 percent. How much

will

your investment be worth on December 31 in the year 2006?

[$45,468.85]

17. Visser Distributors is financing a new truck with a loan of $24,000 to be repaid in 5

years with monthly installments at a yearly rate of 7.65%. What will monthly

payment be? [$482.62]

18. Your bank has offered you a $15,000 loan. The terms of the loan require you to pay

back the loan in five equal annual installments of $4,161.00. The first payment will

be made a year from today. What is the effective rate of interest on this loan?

[12.00%]

19. The new-car dealer offers you a new car and financing. She says the payments will be

$400 per month for five years and the rate is 8.8%. What is the price of the car?

[$19,360]

4

20. Find the present value for the following income stream if the interest rate is 12

percent and the payments occur at the end of each year. [$5,001.74]

YEARS

CASHFLOW

1-4

$ 500

5-10

$ 800

11-15

$1,200

21. Find the present value of the cash flows shown using a discount rate of 8 percent.

Assume that each payment occurs at the end of the year. [$1,166.80]

YEAR

CASHFLOW

1-4

$100/yr.

5

200

6

300

7-15

100/yr.

16

400

22. The present value (t = 0) of the following cash flow stream is $5,979.04 when

discounted at 12% annually. What is the value of the MISSING (t = 2) cash flow?

[$2,999.93]

0

1

2

3

4

---|---------|----------|----------|----------|----$0

$1,000

$?

$2,000 $2,000

CREDIT RATE DETERMINATION

.02 365 /( 30 10)

1

.01 365 /( 40 10)

1

1 .01

TRADE CREDIT

2/10/NET 30 = 1

1

.

02

TRADE CREDIT

1/10/NET 40 = 1

****************************************************************************

23. Tide Inc. has a $200,000 loan from its bank at a nominal interest rate of 13 percent.

The bank demands a compensating balance of 20 percent, but will pay 8 percent

interest on the compensating balance. What is the effective interest cost of this

loan? [14.25%]

5

24. Your boss wants to know the effective interest rate on a loan that requires a 10

percent compensating balance, has a 12 percent interest rate, and the lender takes

the interest payment out of the loan proceeds at the beginning. [15.38%]

25. The Kane Corporation plans to place an order with a new supplier. Kane has been

offered terms of 2/10, net 45 from the day the supplies are received. The cost of

borrowing from the bank is 15 percent on an annual basis. What is the difference in

interest rates between borrowing from the bank and taking the supplier’s terms?

[8.45%]

26. You are going to place an order with a new supplier. You have been offered terms of

2/10, net 60 from the day you receive your supplies. Cost of borrowing from the

bank is 20 percent (annual rate). What is the best course of action in paying the

supplier? [Discount = 15.89% < 20%]

27. GTD Manufacturing needs a $100,000 loan to finance its inventory. It can open a line

of credit with a local bank at a 13 percent interest rate. However, the firm must also

maintain a 10 percent compensating balance. What is the effective interest rate on

the loan? [14.44%]

28. CBT Inc. is borrowing $8,000 from a bank at 20 percent annual interest for six

months and the lender takes the interest payment out of the loan proceeds at the

beginning. What will be the effective annual rate of interest the firm will pay?

[23.46%]

29. The Ohio Corporation is contemplating a substantial loan from the bank. A $5 million

loan is available at the prime rate of 18 percent, but also has a 20 percent

compensating balance requirement. What is the effective cost of the loan? [22.5%]

30. The Oklahoma Company has an outstanding bank loan of $400,000 at an interest rate

of 12 percent. The company is required to maintain a 20 percent compensating

balance in its checking account. What is the effective interest cost of the loan?

Assume that the company would not normally maintain this average amount. [15%]

31. The Connor Company is having a cash liquidity problem. The financial controller wants

to stop taking trade discounts and delay payment as much as possible. Their major

supplier offers credit terms of 2/10, net 40. What is Connor's cost of credit if the

firm does not take this discount? [27.86%]

6

32. The Omaha Company currently purchases an average $10,000 per day of raw

materials on credit terms of net 30. The firm expects sales to increase substantially

next year and anticipates that its raw material purchases will increase to an average

$12,000 per day. If Omaha stretched its accounts payable an extra 15 days beyond

the due date next year, how much additional short-term credit will be generated?

[$240,000]

33. Cornhusker Inc., has a revolving credit agreement with its bank. The firm can borrow

up to $2 million under the agreement at an annual interest rate of 9 percent. The

firm is required to maintain a 15 percent compensating balance on any funds

borrowed under the agreement and to pay a 0.5 percent commitment fee on the

unused portion of the credit line. What would be the effective annual percentage

cost to the firm of borrowing $250,000 under the terms of the credit agreement?

[14.71%]

34. Iowa Co. buys on terms of 2/15, net 30. It does not take discounts, and it typically

pays 35 days after the invoice date. Net purchases amount to $720,000 per year.

What is the approximate percentage cost of the non-free trade credit? [44.59%]

35. Montana Manufacturing Company has been approached by a commercial paper dealer

offering to sell an issue of commercial paper for the firm. The dealer indicates that

Montana could sell a $5 million issue maturing in 180 days at an interest rate of 7.5

percent per annum (deducted in advance). The fee to the dealer for selling the issue

would be $7,500. Find Montana's effective annual interest cost of this commercial

paper financing. Assume a 365 day year. [8.12%]

36. Michigan Motors has won a contract to supply certain engine parts for Chrysler.

Previously its manufacturing division had averaged $8,000 of purchases a day (on

terms net 20). The division simultaneously doubled purchases and negotiated

extended credit terms of net 30. How much additional trade credit will be

spontaneously generated by these measures? [$320,000]

37. Beene Inc. has credit terms of 1/15, net 45 from its supplier, but is able to stretch

its payables and pay in 60 days with no penalty. What is the annual cost of trade

credit to Beene? [8.49%]

38. The cost of short-term credit to a local business is 20 percent. The firm has trade

credit offerings from three suppliers. The credit terms are: (A) 2/10/30, (B)

4/15/40, (C) 5/20/50. Which of these alternatives would you recommend? [(A)

44.59% (B) 81.49 (C) 86.65% Use Short-Term Credit]

7

39. You plan on working for 10 years and then leaving for the Alaskan 'back country.' You

figure you can save $1,000 a year for the first 5 years and $2,000 a year for the

last 5 years. In addition, your family has given you a $5,000 graduation gift. If you

put the gift and your future savings in an account paying 8% compounded annually,

what will your 'stake' be when you leave for the wilderness 10 years hence?

[$31,147.50]

40. Your grandmother is thrilled that you are going to college and plans to reward you at

graduation in 4 years with a Porsche. She would like to set aside an equal amount at

the completion of each of your college years from her meager pension. If her

account earns 12 percent and a new Porsche will cost $50,000, how much must she

deposit each year? Assume her first deposit is in exactly one year. [$10,461.72]

41. On January 1, 1985, a graduate student developed a financial plan which would provide

enough money at the end of his graduate work (January 1, 1990) to open a business

of his own. His plan was to deposit $8,000 per year, starting immediately, into an

account paying 10% compounded annually. His activities proceeded according to plan

except that at the end of his third year he withdrew $5,000 to take a Caribbean

cruise, at the end of the fourth year he withdrew $5,000 to buy a used Camaro, and

at the end of the fifth year he had to withdraw $5,000 to pay to have his

dissertation typed. His account, at the end of the fifth year, will be less than the

amount he had originally planned on by how much? [$16,550]

42. Tillie Thompson has been saving money or the last two years. She made deposits of

$1,000 on January 1, 1998, and July 1, 1998, in a savings account paying 10.5%

compounded semiannually. On January 1, 1999, she made a third deposit of $1,000,

and the bank increased the interest rate paid on savings accounts to 11.5%. She

made a fourth $1,000 deposit on July 1, 1999. How much will be in Ms. Thompson’s

account on January 1, 2000? [$4,591.63]

43. Your 69-year old aunt has savings of $35,000. She has made arrangements to enter

a home for the aged upon reaching the age of 80. Before going into the home, she

wants to decrease the account balance by a constant amount each year for ten years,

with a zero balance remaining. How much can she withdraw each year if she earns 6

% annually on her

savings? Her first withdrawal would be one year from today.

[$4,755.37]

8

44. You have agreed to pay a creditor $5,000 one year hence, $4,000 two years hence,

$3,000 three years hence, $2,000 four years hence, and a final payment of $1,000

five years from now. Due to budget considerations you would like to make five equal

annual payments to satisfy your contract. If the agreed upon interest is 5%

effective per year, what should the equal annual payments be? [$3,097.43]

45. You have purchased a new sailboat and have the option of paying the entire $8,000

now or making equal, annual payments for the next 4 years, the first payment due one

year from now. If your time value of money is 7 percent, what would be the largest

amount for the equal, annual payments that you would be willing to undertake?

[$2,361.83]

46. Herman has just turned 35 years old and wishes to provide for his old age. Suppose

he invests $1,000 per year at an effective rate of 5 percent per year for the next

25 years, with the first deposit beginning one year hence. Beginning one year after

his last $1,000 deposit he starts withdrawing $X per year for the next 20 years.

How large must $X be in order to use up all of his funds? [$3,829.74]

47. Mr. Lewis age 29, wants to begin planning for his retirement at age 65. Upon retiring,

he wants to be able to withdraw $15,000 per year on each birthday for 10 years.

The first withdrawal will be on his 66th birthday. He will receive a large inheritance

on his 30th birthday in two weeks, and he wants to know how much he needs to invest

on that day to be able to attain his retirement income. He will invest the money in an

account paying 10 percent annual interest for the life of the investment. How much

does he need to deposit on his 30th birthday? HINT: (The interest earned between

his 65th and 66th birthday is already incorporated in the calculation of the PV of

the payout.) [$3,280]

48. John Roberts is retiring one year from today. How much should John currently have

in a retirement account earning 10 percent interest to guarantee withdrawals of

$25,000 per year for 10 years? [$153,615]

49. You have just had your thirtieth birthday. You have two children. One will go to

college 10 years from now and require four beginning-of-year payments for college

expenses of $10,000, $11,000, $12,000, and $13,000. The second child will go to

college 15 years from now and require four beginning-of-year payments of $15,000,

$16,000, $17,000, and $18,000. In addition, you plan to retire in 30 years. You want

to be able to withdraw $50,000 per year (at the end of each year) from an account

throughout your retirement. You expect to live 20 years beyond retirement. The

first withdrawal will occur on your sixty-first birthday. What equal, annual, end-ofyear amount must you save for each of the next 30 years to meet these goals, if all

savings earn a 15 percent annual rate of return? [$3,123.10]

9

50 On December 1, 1999, Otto VanAuto borrowed $15,000 for his new car. The loan

terms were: 48 month loan, payments beginning January 1, 2000, 11% interest.

However, as a marketing promotion, a monthly payment will not be required on the

month of his birthday, May. What will be the monthly payment for the loan? How

much larger is this payment than a standard 48-month loan? [Monthly Payment =

$423.44 : Difference = $35.76]

51. Digger O'Dell is the local friendly undertaker. His business has improved since he

adopted his new motto, "I will be the last man to ever let you down." Given his

expanded business, he wishes to build a new establishment financed with a shortterm mortgage. He can borrow for eight years at 9 percent. He will pay monthly

payments on the $50,000 he will borrow. Determine his monthly payment and

develop an amortization schedule for the first four months. [Monthly Payment =

$732.51]

10

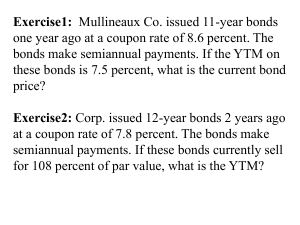

BOND FORMULAS

ANNUAL BOND PRICE =

1

M

1

C

(1 K)n +

n

(1 K )

K

1

M

SEMIANNUAL BOND PRICE = C / 2 1 (1 K)n +

n

(1 K )

.5

(1 K) 1

WHERE

K = Yearly Rate Of Interest

n = Number Of Years

C = Coupon Payment (COUPON RATE X MATURITY VALUE)

M = Maturity Value

FORMULAS AND CALCULATOR STROKES

(TEXAS INSTRUMENTS BA II PLUS SOLAR)

BOND PRICE ANNUAL BOND

FUNCTION

KEY STROKE

Interest Rate Per Period

Time Periods

Coupon Payment

Maturity Value

Bond Price

I/Y

N

PMT

FV

CPT--PV

BOND YIELD ANNUAL BOND

FUNCTION

KEY STROKE

Time Periods

Coupon Payment

Maturity Value

Bond Price

number)

Interest Rate Per Period

N

PMT

FV

PV (change to negative

CPT--I/Y

11

BOND FORMULAS

BOND PRICE SEMIANNUAL BOND

FUNCTION

KEY STROKE

(1) Convert Yearly Rate To Semiannual Rate

(A) Change rate from percentage to decimal (% rate/100)

(B) Add one (1) and take square root X

(C) Subtract one

(D) Change rate from decimal to percentage (decimal rate*100)

(2) Multiply number of years by two

(3) Divide coupon payment by two

Interest Rate Per Period [number from step (1D)]

I/Y

Time Periods (number from step 2)

N

Coupon Payment (number from step 3)

PMT

Maturity Value

FV

Bond Price

CPT--PV

BOND RATE SEMIANNUAL BOND

FUNCTION

KEY STROKE

(1) Multiply number of years by two

(2) Divide coupon payment by two

Time Periods (number from step 1)

N

Coupon Payment (number from step 2)

PMT

Maturity Value

FV

Bond Price (change to negative number)

PV

Semiannual Rate

CPT—I/Y

Convert Semiannual Rate To Yearly Rate

(A) Change semiannual rate from percentage to decimal (% rate/100)

(B) Add one (1) and square X2

(C) Subtract one

(D) Change rate from decimal to percentage (decimal rate*100)

12

52. USM bonds pay an annual coupon rate of 10%. They have 8 years before maturity.

The maturity value is $1,000. The yield to maturity (market interest rate) on these

class of bonds is 10%. Determine the price of these bonds. [$1,000]

53. What is the value of a government bond which pays semiannual payments of $50

(coupon rate of 10%) and has a maturity value of $1,000 if the annual market

interest rate is 10% and the bond has 20 years until maturity? [$ 1,020.78]

54. Calculate the price change in a semiannual municipal bond with a coupon rate of 9%

and 10 years to maturity when the market rate of interest increases from 8.25% to

10.75% [$ 151.96]

55. The Banzai Auto Company has experienced a market re-evaluation lately due to a

number of lawsuits. The firm has a bond issue outstanding with 15 years to maturity

and a coupon rate of 8% (paid semiannually). The required rate has now risen to

12.25%. At what price can these securities be purchased on the market? [$

730.35]

56. Liddy Corporation has bonds that pay an annual coupon rate of 8% and a maturity

value of $1,000. The yield on comparable new bonds is 9.5% The bonds have 7 years

before they mature. Determine the value of one of Liddy's bonds. [$925.76]

57. Hamblin Inc. has bonds that pay an annual coupon rate of 11% and a maturity value of

$1,000. The yield in the market for this risk class of bonds is 10.5 %. The bonds

have 18 years before maturity. How much would one Hamblin bond be worth on the

market? [$1,039.73]

58. RFK, Inc., plans to issue bonds with a par value of $1,000 and 10 years to maturity.

These bonds will pay $45 every 6 months. Current market conditions are such that

the bonds will be sold to net $952.05. If RFK is in the 34% tax bracket, what is its

AFTER-TAX cost of debt? (The after-tax cost of debt is equal to the interest rate

times [1 – tax rate], and it recognizes the tax deductibility of interest.) [6.6%]

59. What is the semiannual coupon payment on a corporate bond which has semiannual

payments if the price of the bond is $1,141.57, the interest rate is 7.75%, and there

are 8 years left until the bond matures. (Assume a maturity value of $1,000).

[$50]

60. Adeline Corporation just issued a zero coupon bond with a life of 15 years. The face

value of these bonds is $100,000 and the market rate is 9.6%. What would be the

price of these bonds? {25,283.76]

13

61. Golden bonds pay a semi-annual coupon rate of 10%. They have 8 years before

maturity. The maturity value is $1,000. The yield to maturity (market interest rate)

on these class of bonds is 10%. Determine the price of these bonds. [$1,013.02]

62. Joe Don Brigham has a choice of buying bonds that pay annual coupons at a rate of

9.4% per year with a life of 10 years or bonds that pay a coupon rate of 9.1% per

year with semiannual payments and a life of 8 years. The market rate for both bonds

is 14%. Which bond will sell at the highest price? If he has $1,000,000 to invest in

these bonds, approximately how many annual bonds could he purchase and how many

semiannual bonds could purchase? [Price annual = 760.06; Price semiannual =

786.99 Annual bonds purchased would be 1,315.69 while semiannual bonds purchased

would be 1,270.67]

63. You are the owner of 100 bonds issued by Georgia Corporation. These bonds have 8

years remaining to maturity, an annual coupon payment of $80, and a par value of

$1,000. Unfortunately, Georgia Corp. is on the brink of bankruptcy, and the

creditors, including yourself, have agreed to a postponement of the next 4 interest

payments. The remaining interest payments will be made as scheduled. The

postponed payments will accrue interest at an annual rate of 6% and will be paid as a

lump sum at maturity 8 years hence. The required rate of return on these bonds,

considering their substantial risk, is now 28%. What is the present value of each

bond? [$266.91]

64. Calculate the yield to maturity (on an annual basis) of an 8% coupon, 10 year bond

that pays interest semiannually if its price is now $787.17. [12%]

65. Commonwealth Company has 100 bonds outstanding (maturity value = $1,000). The

required rate of return on these bonds is currently 10%, and interest is paid

semiannually. The bonds mature in 5 years, and the coupon rate on these bonds is 4%

per bond. What is the price of the bond? [$776.25]

66. Assume that you own 100 bonds, $1,000 par value, with a total face value of

$100,000. These bonds have a 4% coupon, pay interest semiannually, and have 5

years remaining until they mature. New bonds with the same risk and maturity

provide yields to maturity of 14%. You are considering selling your bonds and

depositing the proceeds in a savings account which pays interest at a rate of 6%,

compounded annually. If you do make the transaction, you will liquidate the savings

account by making 5 equal withdrawals, the first coming 1 year from now. How large

will each annual withdrawal be? [$15,700]

14

67. A major auto manufacturer has experienced a market re-evaluation lately due to a

number of lawsuits. The firm has a bond issue outstanding with 15 years to maturity

and a coupon rate of 8% (paid semiannually). The required rate has now risen to 16%.

At what price can these securities be purchased on the market? [$571.14]

68. The current market price of a Johnson Company bond is $1,305.28. A 10% coupon

interest rate is paid semi-annually, and the par value is equal to $1,000. What is the

YTM (yield to maturity on an annual basis) if the bonds mature 10 years from today?

[6%]

69. Recently, JFK, Inc., filed bankruptcy papers. The firm was reorganized as PQ, Inc.,

and the court permitted a new indenture on an outstanding bond issue to be put into

effect. The issue has 10 years to maturity and a coupon rate of 10%, paid annually.

The new agreement allows the firm to pay no interest for 5 years and then at

maturity to repay principal and any unpaid interest (no interest on the unpaid

interest). If the required return is 20%, what should such bonds sell for in the

market today? [$362.44]

70. Calculate the yield to maturity (on an annual basis) of an 8% coupon, 10 year bond

that pays interest semiannually if its price is now $787.17 [12%]

71. Robert Baron is considering two 5 year bonds. One pays a coupon rate of 10% and is

tax-exempt and the other pays a coupon rate of 13% and is fully taxable for Bob at a

34% tax rate. If the tax-exempt bond sells for $1000, at what maximum price must

the taxable bond sell for in order to induce Robert to purchase it instead of the taxexempt (par value is $1000)? NOTE: There is capital gain at end. [$ 931.77]

72. Ford and GM have similar bond issues outstanding. The Ford bond has interest

payments of $80 paid annually and

matures in the year 2007 (20 years from

today). The GM bond has interest payments of $80 paid semiannually and also

matures in the year 2007. If the required rate of return (kd ) is 12%, what is the

difference in current selling price of the two bonds? [$17.42]

73. Easton, Inc., has two bond issues outstanding, both selling for $701.22. The first

issue has a coupon rate of 8% and 20 years to maturity. The second has an identical

yield to maturity as the first but only 5 years until maturity. Both issues are payable

annually. What is the interest payment on the second issue? [$37.12]

15

74. Mary Parker was left some bonds (face value $1,000,000) by her late husband

Norman. She has recently become engaged to Slick Jones, who wants her to cash in

the bonds and use the money to 'live like royalty' for a couple of years in Monte

Carlo. The 10% bonds mature on January 1, 2019, and it is now January 1, 1999.

Interest on these bonds is paid annually on December 31 each year and new bonds

issued by the same company with the same maturity are currently showing a 12%

coupon rate. If Mary sells her bonds now and puts the proceeds in an account paying

10% compounded annually, what would be the largest equal annual amounts they could

withdraw for two years beginning January 1, 2000? [$490,114.03]

75. The Athletic Association has decided to build new bleachers for the baseball field.

Total costs are estimated to be $1 million, and financing will be through a bond issue

of the same amount. The bond will have a coupon rate of 8%, and the Association

must set up a reserve to pay off the loan by making equal annual payments in an

account paying 6% annually. The interest-accumulated amount in the reserve will be

used to retire the entire issue at its maturity date (20 years). The Association plans

to meet the payment requirements by selling season tickets at $10 net profit per

ticket. Approximately how many tickets must be sold each year to meet the interest

and principal retirement requirements? [10,718 Tickets]

16

STOCK VALUE FORMULAS

GORDON DIVIDEND MODEL (PRICE)

D1

P0

Re g

GORDON DIVIDEND MODEL (RETURN)

Re

WHERE

Re = Yearly Rate Of Return

P0 = Price Of Stock At Time Zero

D1 = Expected Dividend = D0 (1 + g)

g = Growth Rate of Stock

CAPITAL ASSET PRICING MODEL (CAPM)

R e R f (R m R f)

CAPM

WHERE

Re = Yearly Rate Of Return

Rf = Risk Free Rate

= Beta

Rm = Return On Market

17

D1

P0

g

76. A share of JTL, Inc., stock paid a dividend of $1.50 last year, and the dividend is

expected to grow at a constant rate of 4% in the future. The appropriate rate of

return on this stock is believed to be 12%. What should the stock sell for today?

[$19.50]

77. A share of JTL, Inc., stock paid a dividend of $1.50 last year, and the dividend is

expected to grow at a constant rate of 4% in the future. The appropriate rate of

return on this stock is believed to be 12%. What would be the price of one share of

JTL stock 1 year from today? [$20.28]

78. Suppose a firm is facing a rather difficult financial future in which it expects to

experience an indefinite period of contraction with earnings (and dividends)

decreasing at an annual rate of 5%. If the last dividend was $1.00 and the stock

price is $10 per share, what is the return expected by investors who buy this stock?

[4.5%]

79. SOS, Inc., has experienced a recent resurgence in business as it has gained new

national identity. Management is forecasting rapid growth over the next 4 years

(annual rate of 15%). After that, it is expected that the firm will revert to its

historical growth rate of 2% annually. The last dividend paid was $1.50 per share,

and the required return is 10%. What is the current price per share, assuming

equilibrium? [$29.56]

80. SOS, Inc., has experienced a recent resurgence in business as it has gained new

national identity. Management is forecasting rapid growth over the next 4 years

(annual rate of 15%). After that, it is expected that the firm will revert to its

historical growth rate of 2% annually. The last dividend paid was $1.50 per share,

and the required return is 10%. What will be the equilibrium price of SOS stock at

the end of the second year (P2)? [$31.88]

81. The Crapola Company has decided to make a major investment. The investment will

require a substantial early cash out-flow, and inflows will be relatively late. As a

result, it is expected that the impact on the firm's earnings for the first 2 years will

be a negative growth of 5% annually. Further, it is anticipated that the firm will then

experience 2 years of zero growth after which it will begin a positive annual

sustainable growth of 6%. If the firm's cost of capital is 10% and its current

dividend (D0) is $2 per share, what should be the current price per share?

[$38.48]

18

82. The ACE Auto Parts Company has just recently been organized. It is expected to

experience no growth for the next 2 years as it identifies its market and acquires its

inventory. However, ACE will grow at an annual rate of 5% in the third and fourth

years and, beginning with the fifth year, should attain a 10% growth rate which it

will sustain thereafter. The last dividend paid was $0.50 per share. ACE has a cost

of capital of 12%. What should be the present price per share of ACE common stock?

[$20.84]

83. The ACE Auto Parts Company has just recently been organized. It is expected to

experience no growth for the next 2 years as it identifies its market and acquires its

inventory. However, ACE will grow at an annual rate of 5% in the third and fourth

years and, beginning with the fifth year, should attain a 10% growth rate which it

will sustain thereafter. The last dividend paid was $0.50 per share. ACE has a cost

of capital of 12%. What should be the price per share of ACE stock at the beginning

of the third year (P2)? [$25.08]

84. AT&E, Inc., a large conglomerate, has decided to acquire another firm. Analysts are

forecasting that there will be a period (2 years) of extraordinary growth (20%)

followed by another 2 years of unusual growth (10%), and that finally the previous

growth pattern of 6% annually will resume. If the last dividend was $1 per share and

the required return is 8%, what should the market price be today? [$72.76]

85. The BB Company has fallen on hard times. Its management expects to pay no

dividends for the next 2 years. However, the dividend for Year 3 (D3) will be $1.00

per share, and it is expected to grow at a rate of 3% in Year 4, 6% in Year 5, and

10% in Year 6 and thereafter. If the required return for BB Co. is 20%, what is the

current equilibrium price of the stock? [$6.34]

86. The Teetertotter Company is expecting both earnings and dividends to grow by 5%

in Year 1, 0% in Year 2, 5% in Year 3, and 10% in Year 4 and thereafter. The

required return on Teetertotter is 15%, and the equilibrium price (P0) is $49.87.

What is the expected value of the next dividend (D1)? [$2.85]

87. Negative Limited is expected to grow for four years at a rate of 50 percent. After

four years, the product fad is expected to decline, and Negative will grow at a

negative growth rate of 5 percent. Negative currently pays a dividend of $1.00 per

share and stockholders have a required rate of return of 18 percent. What should

be the market value for a share of Negative Limited stock? [$18.34]

88. GWK Corp. stock is currently paying a dividend of $2.00 per share (D0 = $2) and is in

equilibrium. The company has a growth rate of 5% and beta equal to 1.5. The

19

required rate of return on the market is 15%, and the risk-free rate is 7%. GWK is

considering a change in policy which will increase its beta coefficient to 1.75. If

market conditions remain unchanged, what new growth rate will cause the common

stock price of GWK to remain unchanged? [6.76%]

89. Thomas, Inc., has just paid a dividend of $2.00. Its stock is now selling for $48 per

share. The firm is half as volatile as the market. The expected return on the

market is 14% and the yield on T-Bills is 11%. If the market is in equilibrium, what

rate of growth is expected? [8%]

90. EMBA, Inc., has a beta coefficient of 0.7 and a required rate of return of 15%. The

market risk premium is currently 5%. If we expect the inflation premium to increase

2 percentage points and EMBA to add assets to his firm that will increase the beta

by 50%, what will be EMBA's new required rate of return? [18.75%]

91. USA Paper's stock is currently in equilibrium selling at $30 per share. The firm has

been experiencing a 6% annual growth rate. Earnings per share (E0) were $4.00 and

the dividend payout ratio is 40%. The risk-free rate is 8% and the market risk

premium is 5%. If systematic risk increases by 50%, all other factors remaining

constant, the stock price will increase/decrease by how much? [$7.33 (Decrease)]

92. You are given the following data:

(1) The risk-free rate is 0.05. (2) The required return on the market is 0.08.

(3) The expected growth rate for the firm is 0.04. (4) Beta is 1.3.

(5) The last dividend paid was $0.80 per share.

Now assume the following changes occur:

(1) The inflation premium decreases by the amount of 0.01.

(2) An increased degree of risk aversion causes the required return on the market

to go to 0.10 after adjusting for the changed inflation premium.

(3) The expected growth rate increases to 0.06. (4) Beta rises to 1.5.

What will be the change in price per share assuming the

stock was in equilibrium before the changes? [-$4.87 (Decrease)]

20

CAPITAL BUDGETING FORMULAS

PAYBACK = THE NUMBER OF YEARS TO RECOVER THE INVESTMENT DOLLARS

NPV

= NET PRESENT VALUE

OF OUTFLOW

n

NPV

=

=

PRESENT VALE OF INFLOW - PRESENT VALUE

CFt

t

t 0 (1 K)

WHERE

n = number of periods

t = an index number indexing from 0 to n

CF = the amount of each t numbered cashflow

K = the rate of interest in each time period t

IRR

= INTERNAL RATE OF RETURN

IRR

= NPV = 0

21

93. Ferrari of Ohio is considering the purchase of land and the construction of a new

plant. The land, which would be bought immediately, has a cost of $100,000 and the

building, which would be erected at the end of the year, would cost $500,000. It is

estimated that the firm's after-tax cash flow will be increased by $100,000

beginning at the end of the second year and this incremental flow would increase at a

10% rate annually over the next 10 years. What would be the payback period

(approximately)? [6 years]

94. The R&E King Company wishes to know the NPV at a discount rate of 10 percent, and

the IRR for a project with the following cash flows? [NPV = 30.05; IRR = .12]

YEAR

0

1

2

3

CASH OUTFLOW

$ 1000

----

CASH INFLOW

-$ 500

600

106

95. Given the Daniel Company's net cash flows, determine the NPV at 20% cost of

capital and the NPV at 30% cost of capital plus determine the IRR of the following

project: [NPV @ 20% = -65.65 NPV @30% = 90.78

IRR = 24%]

TIME

0

1

2

3

NET CASH FLOW

$ 1,520

-1,000

-1,500

500

96. As the capital budgeting director for Harding Industries, Inc., you are evaluating

the construction of a new plant. The plant has a net cost of $4.921 million in year 0,

and it will provide net cash inflows of $1 million in year 1, $1.5

million in year 2,

and $2 million in years 3 through 5. As a first approximation, you may assume that

all cash flows occur at year-end. What is the plant's approximate IRR? [IRR =

19%]

22

97. Calculate the internal rate of return of the following flow stream of the Hero

Corporation. [IRR = 14%]

YEAR

CASHFLOW

0

-10,000

1

2,780

2

3,617

3

4,010

4

3,500

98. As the DCB for Midterm Corporation, you are evaluating two mutually exclusive

projects with the following net cash flows. If Midterm's cost of capital is 15%,

which of the machines (if either) would the firm accept? [NPV A = -$832.97 NPV B

= -$1,439.03 BOTH NEGATIVE]

YEAR

0

1

2

3

4

PROJECT X

-$100,000

50,000

40,000

30,000

10,000

PROJECT Z

-$100,000

10,000

30,000

50,000

60,000

99. MTM Inc., is considering the purchase of a new machine which will reduce

manufacturing costs by $16,000 annually. MTM will use the straight-line method to

depreciate the machine over its five year life, and the IRS requires the firm to apply

a salvage value of $12,000 on the machine for tax purposes. The firm expects to be

able to reduce working capital by $15,000 when the machine is installed. The firm's

marginal tax rate is 34% and it uses a 12% cost of capital to evaluate projects of

this nature. If the machine costs $60,000, what is the NPV of the project's cash

flows? [$3,130.15]

100. After a disastrous ski season last year, Valley, Inc., is considering the installation of

a snow machine. The machine has an invoice price of $100,000, and it will cost

$10,000 to install the machine. It is estimated that the machine will increase

revenues by $25,303 annually, although operating expenses other than depreciation

will also increase by $5,000. The machine will be depreciated on a straight-line basis

over its useful life (10 years) to a zero salvage value. If the tax rate on ordinary

income is 34%, what is the project's IRR (approximately)? [IRR = 9%]

.

23

101. Two projects being considered are mutually exclusive and have the following

projected cash flows. If the required return on these projects is 10%, which would

be chosen and why? [NPV A = $9,231 NPV B = $11,782; CHOSE B]

YEAR

0

1

2

3

4

5

PROJECT A

-$50,000

15,625

15,625

15,625

15,625

15,625

PROJECT B

-$50,000

0

0

0

0

99,500

102. Tyler Products, Inc., requires a new machine to produce a part for a heat generator.

Two companies have submitted bids, and you have been assigned the task of choosing

one of the machines. Cash flow analysis indicates the following. If the required

return on these projects is 10%, which would be chosen and why? What is the

internal rate of return for each machine? [(A) IRR = 18% (B) IRR = 24%]

YEAR

0

1

2

3

4

MACHINE A

-$1,000

0

0

0

1,938

MACHINE B

-$1,000

417

417

417

417

103. Tyler Products, Inc., requires a new machine to produce a part for a heat generator.

Two companies have submitted bids, and you have been assigned the task of choosing

one of the machines. Cash flow analysis indicates the following. If the cost of

capital for Tyler Products is 5%, which of the machines (if either) would be accepted

and why? [NPV A $594.40 NPV B $478.66 A Is Superior To B]

YEAR

0

1

2

3

4

MACHINE A

-$1,000

0

0

0

1,938

MACHINE B

-$1,000

417

417

417

417

104. Tyler Products, Inc., requires a new machine to produce a part for a heat generator.

Two companies have submitted bids, and you have been assigned the task of choosing

one of the machines. Cash flow analysis indicates the following. If a net present

24

value profile were developed for these two investments, at what discount rate would

the profiles cross? [10%]

YEAR

0

1

2

3

4

MACHINE A

-$1,000

0

0

0

1,938

MACHINE B

-$1,000

417

417

417

417

105. Missouri Metals, Inc. is considering the replacement of its existing lathe, which cost

$200,000 at the time of purchase five years ago, and which now has a remaining life

of five years with no salvage value. It can be sold currently for $100,000. A new,

more operationally efficient lathe costs $300,000 and has a useful life of five years

with a salvage value of $50,000. It is expected to reduce operating costs by

$66,000 annually. The firm's required rate of return for replacement decisions is

12%. Assume straight-line depreciation and a tax rate of 34 percent. What is the net

present value of this decision? [$22,164.05]

106. Gold-Black, Inc., is considering replacing its old bottling machine with a new, more

efficient machine. Assuming a 34% tax rate, straight-line depreciation, and a 6%

required rate of return, what is the NPV of this replacement decision? Relevant data

for this decision are given below. [$17,921.56]

OLD

NEW

INITIAL COST

$ 60,000

$ 80,000

CURRENT AGE

20 YRS

0

REMAINING USEFUL LIFE

10 YRS

10 YRS

SALVAGE VALUE-YEAR 10 $

0

$ 10,000

MAINTENANCE COSTS

$ 15,000/YR $ 3,000/YR

REQUIRED INCREASE IN

WORKING CAPITAL

$ 2,000

$ 6,000

CURRENT MARKET VALUE $ 25,000

$ 80,000

25

107. Davis & Associates is considering the purchase of a new pizza oven. The original

cost of the old oven was $30,000. The machine is now 5 years old and has a current

market value of $5,000. The oven is being depreciated over a 10 year life toward a

zero estimated salvage value on a straight line basis. Management is contemplating

the purchase of a new oven whose cost is $25,000 and whose estimated salvage value

is zero. Expected cash savings from the new oven are $7,000 a year (before tax).

Depreciation is on a straight line basis over a 5 year life, and the cost of capital is

10%. Assume a 34% tax rate. What is the net present value of the new machine?

[$3,491.17]

108. Heel & Sole, Inc., is considering the purchase of a new leather-cutting machine to

replace an existing machine that has a book value of $3,000 and can be sold for

$1,500. The estimated salvage value of the old machine in 4 years is zero. The new

machine will reduce costs (before tax) by $7,000 per year; that is, $7,000 cash

savings over the old machine. The new machine has a 4 year life, costs $14,000, and

can be sold for an expected $2,000 at the end of the fourth year (it will be

depreciated to a book value of $2,000). Assuming straight-line depreciation for both

machines, a 34% tax rate, and a cost of capital of 16%, find the NPV. [$4,182.91]

109. Corleone, Inc., is a fast-food establishment that needs to purchase new fryolators.

If the machines are purchased, they will replace old machines purchased 10 years ago

for $100,000, being depreciated on a straight line basis to a zero salvage value (20

years depreciable life). The old machines can be sold for $120,000. The new

machines will cost $200,000 installed and will be depreciated on a straight line basis

to a zero salvage value in 10 years. It is expected that there will be increased

revenues of $28,000 per year and increased cash expenses of $2,500 per year. If

the firm's cost of capital (k) is 10% and the tax rate is 34%, what is the NPV of the

machine? [$30,950.38]

110. DC, Inc., has a stamping machine which is 5 years old and which is expected to last

another 10 years. It has a book value of $100,000 and is being depreciated by the

straight line method to zero. Allstate Industries has demonstrated a new machine

with an expected useful life of 10 years (scrap value $50,000) that should save DC

$38,000 a year in labor and maintenance costs. The firm's tax rate is 34%, and the

new machine will cost $200,000. The market value of the old machine is $15,000 and

a $11,000 increase in working capital will be needed to support the new machine. If

DC's cost of capital is 9.5%, should the replacement be made? [$25,660.58]

111. You have been asked by the CEO of Gadsden Co. to evaluate the proposed acquisition

of a new machine. The machine's price is $50,000, and it will cost $12,000 to

26

transport and install. It will be depreciated by the straight line method over its 5

year useful life to a $10,000 salvage value. The machine will increase revenues by

$11,000 per year, and it will decrease operating costs by $20,000 per year. Also,

the machine will allow the firm to reduce inventories by $5,000. If the firm's cost

of capital is 12%, and its marginal tax rate is 34%, what is the new machine's NPV?

[$32,337.34]

112. The UOA Mining Company is planning to open a new strip mine in Western Alabama.

The net investment required to open the mine is $10 million. Net cash flows are

expected to be +$20 million at the end of year 1 and +$5 million at the end of year 2.

At the end of year 3 UOA will have a net cash OUTFLOW of $17 million to cover the

costs of closing the mine and reclaiming the land. If the required rate of return is 30

percent, what is the net present value of the investment decision? [$605,370.96]

113. Magnum, Inc., purveyor of surveillance equipment, uses a weighted average cost of

capital of 13% to evaluate average risk projects, and adds/subtracts 2 percentage

points to evaluate projects of greater/less risk. Currently two mutually exclusive

projects are under consideration. Both have a cost of $200,000 and last 4 years.

Project A, a riskier-than-average project, will produce yearly cash flows of $71,104.

Project B, of less than average risk, will produce cash flows of $146,411 annually in

years 3 and 4 only. Which project(s) should Magnum select? [NPV A = $3000.38

NPV B = $3499.92 Select B]

114. Frankenstein Inc., is considering the development of one of two mutually exclusive

new models. Each will cost $5,000. The cash flow figures (after-tax profits plus

depreciation) for each project are shown below:

PERIOD

1

2

3

PROJECT A

$2,000

2,500

2,250

PROJECT B

$3,000

2,600

2,900

Model B, which has an energy-saving sod roof, is considered a high-risk project, while

Model A is of average risk. The firm adds 2 percentage points to arrive at a riskadjusted cost of capital when evaluating a high-risk project. The cost of capital used

for average risk projects is 12%. Calculate the NPVs for Models A and B. [NPV A =

$380.21 NPV B = $1,589.61]

27

BREAKEVEN, OPERATING AND FINANCIAL LEVERAGE

P Q FC VC Q

P Q FC VC

P Q FC - UNIT VC (Q)

BREAKEVEN

EBIT =

EBIT =

WHERE

P = Price

Q = Quantity

FC = Fixed Costs

VC = Variable Costs

DEGREE OF OPERATING LEVERAGE (DOL)

DOL

Q P V

Q P V F

WHERE

P = Price

Q = Quantity

FC = Fixed Costs

VC = Variable Costs

DEGREE OF FINANCIAL LEVERAGE (DFL)

DFL EBIT

EBIT

I

WHERE

EBIT = Earnings Before Interest and Taxes

I = Interest

DEGREE OF COMBINED LEVERAGE (DCL)

DCL Q P V

Q P V F I

DCL DFL * DOL

WHERE

P = Price

Q = Quantity

I = Interest

FC = Fixed Costs

VC = Variable Costs

28

115. The Aquarium Company will produce 55,000 10-gallon aquariums next year. Variable

costs will equal 40% of sales while fixed costs total $110,000. At what price must

each aquarium be sold for the company to obtain an EBIT of $95,000? [$6.21 Per

Unit]

116. Gulf Vineyards is considering two alternative production methods for making wine.

One uses an authentic, hand- operated oak wine press, the other an automated

aluminum machine. It is estimated that the variable cost per bottle will amount to

$2.00 under the former method and $0.50 under the latter. If the new machine is

purchased, fixed operating costs will equal $150,000 and interest charges $80,000.

Fixed operating costs of $25,000 will be incurred should the company decide to use

the old press. Assume sales (in units) will be 100,000 bottles under the automated

method. What sales price per unit would cause Gulf to be indifferent between the

two methods if expected sales are 75,000 units under the labor intensive method?

[$4.20 Per Unit]

117. The Stone Company has identified two methods of producing its playing cards. One

method involves using a machine having a fixed cost of $10,000 and variable costs of

$1.00 per deck of cards. The other method would use a less expensive machine

(fixed cost = $5,000), but it would require greater variable costs ($1.50 per deck of

cards). If the selling price per deck of cards will be the same under each method, at

what level of output will the two methods produce the same net operating income?

[10,000 Units]

118. JTL Publishers sells finance textbooks for $7 each. The variable cost per book is

$5. At current annual sales of 200,000 books, the publisher is just breaking even. It

is estimated that if the authors' royalties are reduced, the variable cost per book

will drop by $1. Assume authors' royalties are reduced and sales remain constant;

how much more money can the publisher put into advertising (a fixed cost) and still

break even? [$200,000]

119. Octacycles, Inc., currently sells 75,000 8-wheelers annually. At this sales level, its

net operating income (EBIT) is $4 million and the degree of combined leverage is 2.0.

The firm's debt consists of $10 million in bonds with a 9% coupon. The firm is

considering the implementation of a new production method that will entail an

increase in fixed costs, resulting in a degree of operating leverage of 1.8. Being

concerned about the total risk of the firm, the Chief Executive wants to maintain

the degree of combined leverage at 2.0. If EBIT remains at $4 million, what amount

of bonds must be retired to accomplish this? [$5,555,556]

29

MEAN, VARIANCE, COVARIANCE AND PORTFOLIO

MEAN

=

X =

n

XiPi

i1

WHERE Pi IS THE PROBABILITY OF Xi OCCURRING

VARIANCE

2

=

=

STANDARD DEVIATION

COVARIANCE =

BETA

=

=

CORRELATION =

n

Xi X

2

i1

=

Pi

.5

n

2

Xi X Pi

i1

=

n

Xi X Yi Y Pi

COV X, Y =

i1

COV M, S

σ

2

M

COV X, Y

=

σX σ Y

COEFFICIENT OF VARIATION

MEAN OF PORTFOLIO

=

=

σ X/ X

WX X W YY

STANDARD DEVIATION OF A PORTFOLIO

σP

=

W 2

X

X2 W Y 2 Y2 2 W X W Y COV X, Y

30

.5

THE FOLLOWING INFORMATION REFERS TO THE NEXT FIVE QUESTIONS.

THE MOMBO INVESTMENT FUND HAS THE FOLLOWING DATA AND WISHES TO

ANSWER THE FOLLOWING QUESTIONS:

STOCK BLUE

5%

0%

8%

1%

STOCK RED

0%

4%

3%

2%

120. What is the expected return on STOCK BLUE?

[11.0%]

121. What is the standard deviation for STOCK BLUE?

[ 4.64%]

122. What is the coefficient of variation of STOCK BLUE returns?

[.42]

123. What is the covariance of STOCK BLUE returns with STOCK RED returns?

(Percent Squared)]

[ 4.25

124. What is the correlation coefficient between the STOCK BLUE returns and STOCK

RED returns? [.62]

THE FOLLOWING DATA PERTAINS TO THE NEXT FIVE QUESTIONS.

STOCKS A AND B HAVE RETURNS AND PROBABILITY DISTRIBUTIONS AS GIVEN

BELOW.

STOCK A

6%

10%

4%

8%

STOCK B

8%

2%

6%

8%

125. Calculate the expected returns for Stocks A and B. [Stock A = 7.0%

Stock B =

6.0%]

126. What are the standard deviations of expected returns for Stocks A and B? [Stock

A = 2.24% Stock B = 2.45%]

127. Compute the covariance between Stocks A and B.

31

[-3.00 (Percent Squared)]

128. Find the correlation coefficient between Stocks A and B.

[-0.55]

129. Suppose you want to hold a portfolio composed of 50% of Stock A and 50% of Stock

B. What will be the expected return (mean) and risk (standard deviation) of your

portfolio? [Portfolio Return = 6.5% Standard Deviation = 1.12%]

32

FINANCIAL ANALYSIS RATIOS

PROFITABILITY

1. Gross Profit Margin

Gross Profit

2. Return on Total Assets

Or

3. Return on Common Equity

Or

4. Operating Profit Margin

5. Net Profit Margin

(Sales CGS)

Sales

Net Income (After Tax)

Total Assets

Net Income X

Sales

Total Assets

Sales

Net Income (After Tax)

Stockholder' s Equity

Return on Investment

[1 ( Debt / Assets) ]

Net Operating Income (EBIT)

Sales

Net Income (After Tax)

Sales

6. Operating Income Return on Investment

7. P/E Ratio

(Assets)

Net Operating Income (EBIT)

Total Assets

Price Per Share of Stock

Net Income / Number OfShares

33

FINANCIAL ANALYSIS RATIOS

ASSET UTILIZATION (Efficiency Ratios)

1. Receivable Turnover

2. Average Collection Period

Credit Sales

Accounts Receivable

Accounts Receivable

Annual Credit Sales / 365

3. Inventory Turnover

Sales

Inventory

4. Fixed Asset Turnover

Sales

Net Fixed Assets

5. Total Asset Turnover

Sales

Total Assets

DEBT UTILIZATION (LEVERAGE RATIOS)

1. Debt To Total Assets

2. Times Interest Earned

3. Fixed Charge Coverage

Total Debt (Liabilities)

Total Assets

EBIT

Annual Interest Expense

Income Before Fixed Charges & Taxes

Fixed Charges

34

FINANCIAL ANALYSIS RATIOS

LIQUIDITY RATIOS

1. Current Ratio

Current Assets

Current Liabilities

Current Assets - Inventory

Current Liabilites

2. Quick Ratio

MISCELLANEOUS RATIOS

Dividends

Net Income

1. Dividend Payout Ratio

2. ROE

Total Assets

Net Income (After Tax)

Sales

X

X

Sales

Total Assets

Total Equity

Total Assets

Total Equity

=

Equity Multiplier

Net Income (After Tax)

Sales

=

35

Profit Margin

130. If Hampshire, Inc., has sales of $2 million per year (all credit) and an average

collection period of 35 days, what is its average amount of accounts receivable

outstanding (assume a 365 day year)? [$191,781]

131. Calculate the market price of a share of FDR, Inc., given the following information:

[$75.00]

Stockholders' equity = $1,250;

price/earnings ratio = 5;

shares outstanding = 25;

market/book ratio = 1.5.

market/book ratio = market value equity/book value equity

132. Ensewmow, Inc., has earnings after interest deductions but before taxes of $300.

The company's before-tax times interest earned ratio is 7.00. Calculate the

company's interest charges. [$50.00]

133. If ZZ Co. has total interest charges of $10,000 per year, sales of $1 million, a tax

rate of 34%, and a net profit margin of 6%, what is the firm's times interest earned

ratio? [10.09 Times]

134. The Jupiter Company has determined that its return on equity is 15%. Management

is interested in the various components that went into this calculation. However, the

accountants have misplaced the profit margin ratio. As a finance wizard, you know

how to calculate the profit margin, given following information: total debt/total

assets = 0.35, and total asset turnover = 2.8. What is the profit margin? [3.48%]

135. Given the following information, calculate the market price per share of Perkins, Inc.

[$4.00]

Net Income

= $200,000

Earnings per share

= $2.00

Stockholders' equity (Book Value) = $2,000,000

Market/Book ratio

= 0.20

Market/Book ratio = (market value of common stock/

book value of common stock)

36

136. Assume that Calhoun Corporation is 100% equity financed. Calculate the return on

equity given the following information: [52.8%]

1.

2.

3.

4.

5.

Earnings before taxes = $2,000

Sales = $5,000

Dividend payout ratio = 60%

Total asset turnover = 2.0

Applicable tax rate = 34%

137. The Cigar Company is a relatively small, privately owned firm. In 1986 Cigar had an

after-tax income of $15,000, and 10,000 shares were outstanding. The owners were

trying to determine the equilibrium market value for Cigar's stock, prior to taking

the company public. A similar firm that is publicly traded had a price/earnings ratio

of 5.0. Using only the information given, estimate the market value of one share of

Cigar's stock. [$7.50]

37

ADDITIONAL FUNDS NEEDED (AFN)

IF THE FIRM IS AT 100% CAPACITY, FOLLOW THIS FORMULA

Additional

Required

Spontaneou s

Increase In

Funds

Increase Increase In Retained

Needed

In Assets

Liabilities

Earnings

AFN A/S0 (Δ S) L/S0 (Δ S) (M)S1 (1 d)

WHERE

DS = Change in Sales S S0

A = Assets

1

S0 = Old Sales

L = Spontaneous Liabilities

M = Profit Margin

d = Dividend Payout Ratio

S1 = New Sales

****************************************************************************

IF THE FIRM IS AT LESS THAN 100% CAPACITY, FOLLOW THIS FORMULA

Additional

Spontaneou s

Increase In

Partial

Funds

Increase Increase In Retained

Needed

Liabilities

Earnings

In Assets

AFN CA/S0 (Δ S) L/S0 (Δ S) (M)S1 (1 d)

WHERE

CA = CURRENT ASSETS

= INCREASE IN FIXED ASSETS NEEDED TO ACCOMMODATE INCREASE

IN SALES

TO DETERMINE Ω

FULL CAPACITY SALES = CURRENT SALES/CURRENT CAPACITY PERCENTAGE

DIFFERENCE = NEW SALES S1 - FULL CAPACITY SALES

IF ANSWER IS NEGATIVE, Ω WILL BE ZERO. IF ANSWER IS POSITIVE,

= DIFFERENCE * (FIXED ASSETS/FULL CAPACITY SALES)

38

It is important to remember that the increase in fixed assets may be zero if the

increase in sales still leaves the firm at less than full capacity.

138. The Thorne Company is trying to determine an acceptable growth rate in sales.

While the firm wants to expand, it does not want to use any external funds to

support such expansion due to the particularly high rates in the market now. Having

gathered the following data for the firm, find the maximum growth in sales it can

sustain without using external funds. [4.76%]

Capital intensity ratio

= 1.2

(total assets/ total sales)

Profit margin

= 10%

Dividend payout ratio

= 0.5

Current sales

= $100,000

Spontaneous liabilities = $10,000

139. C. D. Dennis Inc. has the following balance sheet:

Current assets

$ 5,000

Net fixed assets 10,000

Total assets

_________

$15,000

Accounts payable $ 1,000

Accruals

1,000

Long-term debt

5,000

Common equity

8,000

________

Total claims

$15,000

Fixed assets are fully utilized. Current sales are $10,000. Next year they expect

sales to increase by 50%. The profit margin is expected to continue to be .10. The

firm will not pay dividends next year. What is next year's external (additional)

funding requirement? [$5,000]

140. Robin Inc. has the following balance sheet:

Current assets

$ 5,000

Net fixed assets 10,000

Total assets

_______

$15,000

Accounts payable $ 1,000

Accruals

1,000

Long-term debt

5,000

Common equity

8,000

______

Total claims

$15,000

Fixed assets are utilized at 75%. Current sales are $10,000. Next year they expect

sales to increase by 50%. The profit margin is expected to continue to be .12. The

39

firm will not pay dividends next year. What is next year's external (additional)

funding requirement? [$950]

141. Pete's Pizza Inc. had the following balance sheet last year:

Cash

$800

Accounts receivable

450

Inventory

950

Net fixed assets

34,000

______

$36,200

Accounts payable

Accrued wages

Notes payable

Mortgage

Common stock

Retained earnings

$350

150

2,000

26,500

3,200

4,000

_______

$36,200

Pete has just invented a new pizza which he expects to double sales and increase

after-tax net income to $1,000. Since most of his business is take-out, he believes

he can handle the increase without adding any fixed assets. How much outside

capital will he need if he pays no dividends? [$700]

142. JEFFCO has the following balance sheet:

Cash

$ 10

Accounts receivable 10

Inventory

10

Fixed assets

90

_____

$120

Accounts payable

Notes payable

Long-term debt

Common stock

Retained earnings

$10

20

40

40

10

_____

$120

Fixed assets are being used at 80% of capacity. Sales for the year just ended were

$200. Sales are expected to grow at a rate of 5% next year. The profit margin is

5% and the dividend payout ratio is 60%. What will be the outside funding

requirement? [-$3.20 (surplus)]

40

143. JAS Corporation's December 31, 1986 balance sheet is givenbelow:

Cash

$10

Accounts receivable 25

Inventory

40

Net fixed assets

75

Total assets

____

$150

Accounts payable

Notes payable

Accrued wages and

taxes

Long-term debt

Common equity

Total claims

$15

20

15

30

70

_____

$150

Sales during 1986 were $100, and they are expected to rise by 50% to $150 during

1987. Also, during 1986, fixed assets were being utilized to only 85% of capacity;

that is, JAS could have supported $100 of sales with fixed assets that were only

85% of the actual 1986 fixed assets. Assuming that JAS' profit margin will remain

constant at 5% and that the company will continue to pay out 60% of its earnings as

dividends, what amount of non-spontaneous external funds will be needed during

1987? [$40.11]

144. The Karma Company has a balance sheet showing the following account amounts as of

December 31, 1986:

Cash

$10

Accounts receivable 40

Inventory

50

Net fixed assets

100

_____

$200

Accounts payable

Accruals

Notes payable

Bonds payable

Common stock

Retained earnings

$15

5

20

20

20

120

_____

$200

Last year (1986) the firm generated sales of $2,000 with a profit margin of 10%

and a dividend payout ratio of 50%. It has been operating its fixed assets at 80% of

capacity. It expects to increase sales by $750 with a decrease in the profit margin to

3% and an increase in the dividend payout ratio to 60%. What will be the needs for

external funds for Karma? [$7.00]

41

145. Queens Manufacturing Company has decided to acquire a new pressing machine and

is trying to decide between leasing and buying alternatives. The machine can be

purchased from the manufacturer for a delivered price of $85,000. The machine

will be depreciated over a 6 year period to a zero salvage value although the firm

estimates that it could be sold for a minimum of $5,000 at the end of the 6 years.

Alternatively, the manufacturer has offered a financial lease at $17,000 per year

for the 6 years with all operating, maintenance, and insurance expense to be borne

by the lessee. The first lease payment is at T0. The firm's before-tax interest

rate on long-term debt is 10 percent, all depreciation is straight-line, and the tax

rate is 34 percent. What is the NAL (Net Advantage of Leasing)? [NAL = $1,785]

146. Highlights Illuminating has decided to acquire a lighting display to use at automobile

exhibitions during the next 4 years. The display can be purchased or it can be leased

for a 4-year period. If purchased, the lighting display will require a $10,000 outlay

and Highlights Illuminating

anticipates that maintenance will be $800 per year

payable at the beginning of the year. The display has an expected $1,000 market

value at the end of the 4-year period. The company will use straight-line

depreciation to a zero salvage value with a 4-year life for tax purposes. Highlights

Illuminating is in the 34 percent marginal tax bracket and has a 16 percent weighted

average cost of capital. No investment tax credit is available. Lumenescence Leasing

offers to lease the lighting display to Highlights for $3,785 annually, with payments

at the beginning of each of the 4 years. Lease payments include maintenance.

Highlights Illuminating's financial manager calls the company's commercial bank and

is told by a loan officer that the company can borrow up to $10,000 for 4 years at an

effective interest rate of 8 percent annually. What is the NAL (Net Advantage of

Leasing) in this case? [NAL = -$838.93]

147. Gomez Enterprises has decided to renovate an old production facility and equip it

with all new machinery. Gomez can borrow the entire $5 million it needs to purchase

the machinery at 12 percent from a bank, to be amortized over five years. The

machinery will be depreciated to zero value using straight-line over its six year life.

If purchased, maintenance will cost $50,000 per year for six years payable at the

beginning of the year. As an alternative to purchasing the machinery, Gomez is

considering leasing it. The lease payments are to be $1,000,000 per year for six

years, and each payment is to be made in advance. Gomez estimates that it can

purchase the equipment at the end of the lease period for $200,000. Gomez has a

34 percent marginal tax rate. Maintenance is included in the lease. What is the NAL

(Net Advantage of Leasing)? [NAL = $467,729.58]

42

148. Noah Boatworks has decided to expand its current production facilities. The

expansion will require the purchase or lease of $400,000 of new equipment. To

finance the new equipment, Noah can either lease it or purchase it. The following

information concerning the two alternative financing methods is to be used to make

the lease versus purchase decision. That is, what is the NAL (Net Advantage of

Leasing)? Estimated maintenance cost on the equipment is $25,000 per year payable

at the beginning of the year. Noah must pay for maintenance regardless of the

financing method selected. If the equipment is purchased, Noah can borrow the

necessary funds at 15 percent interest and the loan will be amortized over a five

year period. The equipment will be depreciated to zero on a straight-line basis. The

lease arrangements call for payment of $95,000 to be paid at the beginning of each

of the next five years. The lessor will permit Noah to purchase the equipment at the

end of the lease at its fair market value. Noah estimates that value to be $30,000.

Noah has a 34 percent marginal tax rate. [NAL = $22,394.80]

43