DISTRIBUTIONS FROM TRADITIONAL IRA

advertisement

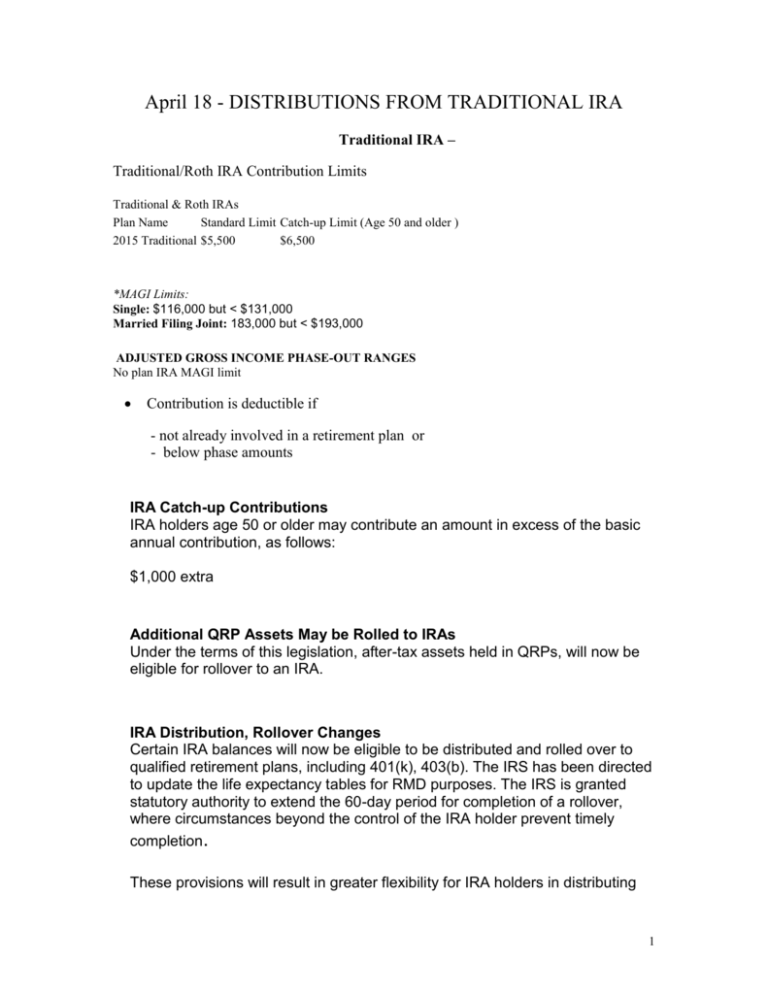

April 18 - DISTRIBUTIONS FROM TRADITIONAL IRA Traditional IRA – Traditional/Roth IRA Contribution Limits Traditional & Roth IRAs Plan Name Standard Limit Catch-up Limit (Age 50 and older ) 2015 Traditional $5,500 $6,500 *MAGI Limits: Single: $116,000 but < $131,000 Married Filing Joint: 183,000 but < $193,000 ADJUSTED GROSS INCOME PHASE-OUT RANGES No plan IRA MAGI limit Contribution is deductible if - not already involved in a retirement plan or - below phase amounts IRA Catch-up Contributions IRA holders age 50 or older may contribute an amount in excess of the basic annual contribution, as follows: $1,000 extra Additional QRP Assets May be Rolled to IRAs Under the terms of this legislation, after-tax assets held in QRPs, will now be eligible for rollover to an IRA. IRA Distribution, Rollover Changes Certain IRA balances will now be eligible to be distributed and rolled over to qualified retirement plans, including 401(k), 403(b). The IRS has been directed to update the life expectancy tables for RMD purposes. The IRS is granted statutory authority to extend the 60-day period for completion of a rollover, where circumstances beyond the control of the IRA holder prevent timely completion. These provisions will result in greater flexibility for IRA holders in distributing 1 and moving assets, both among IRAs and among various other retirement arrangements. As a result, IRAs will be more popular than ever as vehicles for accumulating, holding and directing taxpayers' retirement assets IRA Contributions * Return and possibly contribution is taxed deferred * If withdraw before 59.5 years old, withdrawal will be taxed and with a 10% penalty on withdrawal DISTRIBUTIONS FROM TRADITIONAL IRA * Withdrawals can be made before 59.5 without penalty (will be taxed) if - Disability - College Tuition - Purchase of first home ($10,000) - Payment of medical expenses - Medical insurance premiums - must receive unemployment for 12 wks - Death distribution to beneficiary * Withdrawals for Substantially Equal Amounts using the following methods - Life Expectancy Method - Amortization method - Annuitization Method SUBSTANTIALLY EQUAL PAYMENTS * Substantially equal payments must continue until age 59.5 or if started after age 54.5 they must last at least 5 years. * Amount of payment method cannot change without a retroactive imposition of a 10% penalty on all prior pay outs (unless you become disabled or die) All pay outs are taxed as income 2 Federal, State & Local (No FICA) * Between age 59.5 and 70.5 any amount can be withdrawn without penalty but will be taxed. SUBSTANTIALLY EQUAL AMOUNTS – Withdrawals before 59.5 without a 10% penalty Assume withdrawals are made on January 1 Assume 6% growth in portfolio per year A 45 year old man with $4 million in IRAs – balance from previous December 31. **** Life Expectancy Method Age Distribution amount 45 $4 million / 38.8 = $ 103,093 (38.8 factor from Single Life Table) - (37.8 = 38.8 factor reduced by 1) 46 $4,130,722 / 37.8 = $109,278 ($ 4million – 103,093) * 1.06 = $ 4,130,722 Must take payment each year until age 59.5 - Between 59.5 years to 70.5 take any amount of money from retirement plan or $0 - At age 70.5 each individual is required to take distributions **** Amortization Method – Distributions before age 59.5 Assume 45 year has IRAs worth $4 million (previous Dec 31) Assume a 6.5% return on the portfolio 38.8 N 6.5 I/Y -4,000,000 PV CPT PMT Must withdraw this amount until age 59.5 **** Annuization Method 3 Similar to amortization method except use factor from annuity tables REQUIRED MINIMUM DISTRIBUTIONS FROM TRADITIONAL IRAs, 401-K’s After age 70.5 it is required that a certain minimum amount must be removed from an individual’s Traditional IRA every year. * Must receive first distribution no later than April 1 of the calendar year following the year in which the individual turns 70.5. * If one takes less than the required amount, a 50% penalty is imposed on the difference between what was taken and the required minimum amount Minimum required distributions are based on the prior year-end balance of IRA. RMD – Required Minimum Distributions at age 70.5 If Draw Less Than RMD Then 50% Penalty on Amount Not Withdrawn RMDs AFTER AGE 70.5 Uniform Lifetime Table is normally used RMD is recalculated every year Assume a $5 million Balance on prior Dec. 31 and 6% growth rate RMD are taken on January 1 Age Balance 70 $5 million / 71 72 Factor RMD 27.4 = $182,482 (Uniform Lifetime Table) $5,106,569 / 26.5 = Recalculation $ / = 4 *** Use Uniform Lifetime Table with spouse beneficiary unless the spouse is more than 10 years younger than the owner, then use the Joint Life Table. - Assume spouse is the IRA beneficiary and the owner is 70.5 and the spouse is 55 years old. Age Balance Factor 70 $5 million / $160,771 71 $ $ 72 $ 31.1 = (Joint Life Table) / 30.1 = Recalculation RMD Required Beneficiary Distributions – If Owner Dies Before Age 70.5 If IRA owner dies before 70.5 years old the pay out to the beneficiary can be made two ways: - 5-year pay out. The IRA must be distributed to the beneficiary no later than the December 31st of the 5th year following the IRA owner's death. - Life Expectancy Payments. Payments start no later than December 31st of year following the IRA owner's death. Term certain method must apply if beneficiary is not surviving spouse - spouse can use term certain or recalculation method. This is default method. - Surviving Spouse Options. Surviving spouse beneficiary has same options as above plus 1) Leave IRA as is and take withdrawals and start taking RMDs (Required Minimum Distributions) when deceased spouse would have turned 70.5 2) Fresh start - roll the IRA over into his or her own IRA, then start taking Distributions at age 70.5. 5 If IRA Owner Dies Before 70.5 Years Old Non-spouse Beneficiary – - Take balance by 5th anniversary of year of death Single Life Expectancy Term Certain Spouse Beneficiary – - Fresh Start Wait and take owner would have began taking withdrawals at 70.5 years old Take Balance by 5th anniversary of year of death Single Life Expectancy Recalculation - - Example of withdrawals by non-spouse beneficiary if owner dies at age 69.5 Non-Spouse beneficiary is age 46 Age 46 Balance in IRA Previous Dec 31 $4,500,000 Factor / Withdrawal = 47 Factor - 1 RMD – Required Minimum Distributions at age 70.5 If Draw Less Than RMD Then 50% Penalty on Amount Not Withdrawn Assume a $5 million Balance on prior Dec. 31 and 6% growth rate RMD are taken on January 1. Required distributions to owner using Uniform Lifetime Table are Age Balance Factor 70 $5 million / 71 $ = (Uniform Lifetime Table) = Recalculation / RMD 6 72 $ *** Use Uniform Lifetime Table with spouse beneficiary unless the spouse is more than 10 years younger than the owner, then use the Joint Life Table. - Assume spouse is the IRA beneficiary and the owner is 70.5 and the spouse is 55 years old. Age Balance Factor RMD 70 $5 million / 31.1 = (Joint Life Table) 71 $ 72 $ $160,772 Recalculation AFTER IRA OWNER DIES & RMDs HAVE COMMENCED Nonspousal Beneficiary - After IRA dies the RMD to the beneficiary is based upon the beneficiary's individual life expectancy, starting no later than December 31st of the year following the year of death. Each RMD thereafter is based on that life expectancy less one. (Table below) Spousal Beneficiary - RMD for the spouse after the death of the IRA owner is based on the surviving spouse's life expectancy, starting no later than December 31st of the year following the year of death. This life expectancy is recalculated each year. The Spouse can always select fresh start. Death without a designated beneficiary - If the IRA owner has no beneficiary or has a trust or estate as beneficiary, RMDs are calculated using the deceased IRA owner's life expectancy, starting no later than December 31st of the year of death. Each RMD thereafter is based on that life expectancy less one year. Designating a Beneficiary - The beneficiary does not have to be determined until distributions to the designated beneficiary must begin. So, if there are a number beneficiaries, some may disclaim themselves. 7 Payout to Beneficiary at Death of Owner After RMD Has Commenced * Non-Spouse Beneficiary – Age 48 Owner Dies at 73 Age Balance Factor RBD 48 $5,295,756 / = $ (Single Life Expectancy Table) 49 Spouse As Beneficiary – Owner Dies at 73 * Spouse could roll over IRA into his or her own and begin RMD when he or she reaches 70.5 * Spouse could continue with owner IRA distributions * Spouse can use his or her single life expectancy recalculation method Spouse Distributions Using His Or Her Single Life Expectancy (Recalculation) Spouse is 58 years old Age Balance 58 $5,381,291 / 59 *** Factor 27.0 = (Single Life Table) $5,492,903 / 26.1 = Recalculation RBD $199,307 $ No Beneficiary (estate or charity are beneficiaries) and death of owner after age 70.5 - RMD is calculated over owner’s life had he or she lived (term certain) 8 The following table is used for determining the distribution period for lifetime distributions to an account holder. The above table is used regardless of whether or not the IRA owner has designated a beneficiary. Each year the life expectancy divisor is used recalculated each year. Example: Billy Bob turns 70.5 in 2012 and decides to start his RMDs. His IRA is worth $100,000 at the end of 2011. He has no beneficiary. What is the first RMD amount? - December 31, 2011 Billy Bob has $110,000 in the IRA , how much is the RMD in 2012? The Michael Douglas Rule: if the sole beneficiary is a spouse who is younger by a difference of more than 10 years, the Uniform Lifetime Distribution Table (above) is not used but instead the Table below which uses the actual joint life expectancies of the married couple is used. RMD withdrawals using the new life expectancy tables. To calculate your required annual withdrawal, divide the amount in your retirement savings by the number in the divider column. Age Divider 70 27.4 71 26.5 72 25.6 73 24.7 74 23.8 75 22.9 76 22.0 77 21.2 78 20.3 79 19.5 80 18.7 81 17.9 82 17.1 83 16.3 84 15.5 85 14.8 86 14.1 87 13.4 88 12.7 89 12.0 90 9 2012 Joint Life Expectancy Table Age of your beneficiary Your age 70 71 72 73 74 75 76 77 78 79 80 40 44.0 44.0 43.9 43.9 43.9 43.8 43.8 43.8 43.8 43.8 43.7 41 43.1 43.0 43.0 43.0 42.9 42.9 42.9 42.9 42.8 42.8 42.8 42 42.2 42.1 42.1 42.0 42.0 42.0 41.9 41.9 41.9 41.9 41.8 43 41.3 41.2 41.1 41.1 41.1 41.0 41.0 41.0 40.9 40.9 40.9 44 40.3 40.3 40.2 40.2 40.1 40.1 40.1 40.0 40.0 40.0 40.0 45 39.4 39.4 39.3 39.3 39.2 39.2 39.1 39.1 39.1 39.1 39.0 46 38.6 38.5 38.4 38.4 38.3 38.3 38.2 38.2 38.2 38.1 38.1 47 37.7 37.6 37.5 37.5 37.4 37.4 37.3 37.3 37.2 37.2 37.2 48 36.8 36.7 36.6 36.6 36.5 36.5 36.4 36.4 36.3 36.3 36.3 49 35.9 35.9 35.8 35.7 35.6 35.6 35.5 35.5 35.4 35.4 35.4 50 35.1 35.0 34.9 34.8 34.8 34.7 34.6 34.6 34.5 34.5 34.5 51 34.3 34.2 34.1 34.0 33.9 33.8 33.8 33.7 33.6 33.6 33.6 52 33.4 33.3 33.2 33.1 33.0 33.0 32.9 32.8 32.8 32.7 32.7 53 32.6 32.5 32.4 32.3 32.2 32.1 32.0 32.0 31.9 31.8 31.8 54 31.8 31.7 31.6 31.5 31.4 31.3 31.2 31.1 31.0 31.0 30.9 55 31.1 30.9 30.8 30.6 30.5 30.4 30.3 30.3 30.2 30.1 30.1 56 30.3 30.1 30.0 29.8 29.7 29.6 29.5 29.4 29.3 29.3 29.2 57 29.5 29.4 29.2 29.1 28.9 28.8 28.7 28.6 28.5 28.4 28.4 58 28.8 28.6 28.4 28.3 28.1 28.0 27.9 27.8 27.7 27.6 27.5 59 28.1 27.9 27.7 27.5 27.4 27.2 27.1 27.0 26.9 26.8 26.7 60 27.4 27.2 27.0 26.8 26.6 26.5 26.3 26.2 26.1 26.0 25.9 10 61 26.7 26.5 26.3 26.1 25.9 25.7 25.6 25.4 25.3 25.2 25.1 62 26.1 25.8 25.6 25.4 25.2 25.0 24.8 24.7 24.6 24.4 24.3 63 25.4 25.2 24.9 24.7 24.5 24.3 24.1 23.9 23.8 23.7 23.6 64 24.8 24.5 24.3 24.0 23.8 23.6 23.4 23.2 23.1 22.9 22.8 65 24.3 23.9 23.7 23.4 23.1 22.9 22.7 22.5 22.4 22.2 22.1 66 23.7 23.4 23.1 22.8 22.5 22.3 22.0 21.8 21.7 21.5 21.3 67 23.2 22.8 22.5 22.2 21.9 21.6 21.4 21.2 21.0 20.8 20.6 68 22.7 22.3 22.0 21.6 21.3 21.0 20.8 20.6 20.3 20.1 20.0 69 22.2 21.8 21.4 21.1 20.8 20.5 20.2 19.9 19.7 19.5 19.3 70 21.8 21.3 20.9 20.6 20.2 19.9 19.6 19.4 19.1 18.9 18.7 Source: IRS Joint and Last Survivor Table; 26 CFR Part 54 Section 401(a)(9)-9 ROTH IRA Roth IRA - contributions are not tax deductible. Money grows tax free and is not taxed when withdrawn if Income phase out MAGI – single $114,000-$129,000 Married filing jointly $181,000-$191,000 - cannot withdraw until age 59.5 - money must be in Roth IRA for at least 5 years - can pull out original contribution without penalty - do not have to withdraw at 70.5 years Roth IRA – * Eligible to make a regular contribution to a Roth IRA even if you participate in a retirement plan maintained by your employer. The contribution is not tax deductible on income tax return, but the return is not taxable if withdrawn after age 59.5. * Contributions can be as much $5,500 (If you're 50 or older by the end of the year, add another $1,000 beginning in 2006 – same Traditional IRA.) * There are just two requirements. 1) You or your spouse must have compensation or alimony income equal to the amount contributed. 11 Table I (Single Life Expectancy) (For Use by Beneficiaries) Age Life Expectancy Age Life Expectancy 0 82.4 28 55.3 1 81.6 29 54.3 2 80.6 30 53.3 3 79.7 31 52.4 4 78.7 32 51.4 5 77.7 33 50.4 6 76.7 34 49.4 7 75.8 35 48.5 8 74.8 36 47.5 9 73.8 37 46.5 10 72.8 38 45.6 11 71.8 39 44.6 12 70.8 40 43.6 13 69.9 41 42.7 14 68.9 42 41.7 15 67.9 43 40.7 16 66.9 44 39.8 17 66.0 45 38.8 18 65.0 46 37.9 19 64.0 47 37.0 20 63.0 48 36.0 21 62.1 49 35.1 22 61.1 50 34.2 23 60.1 51 33.3 12 24 59.1 52 32.3 25 58.2 53 31.4 26 57.2 54 30.5 27 56.2 55 29.6 Table I (continued) (Single Life Expectancy) (For Use by Beneficiaries) Age Life Expectancy Age Life Expectancy 56 28.7 84 8.1 57 27.9 85 7.6 58 27.0 86 7.1 59 26.1 87 6.7 60 25.2 88 6.3 61 24.4 89 5.9 62 23.5 90 5.5 63 22.7 91 5.2 64 21.8 92 4.9 65 21.0 93 4.6 66 20.2 94 4.3 67 19.4 95 4.1 68 18.6 96 3.8 69 17.8 97 3.6 70 17.0 98 3.4 71 16.3 99 3.1 72 15.5 100 2.9 73 14.8 101 2.7 74 14.1 102 2.5 75 13.4 103 2.3 76 12.7 104 2.1 13 77 12.1 105 1.9 78 11.4 106 1.7 79 10.8 107 1.5 80 10.2 108 1.4 81 9.7 109 1.2 82 9.1 110 1.1 83 8.6 111+ 1.0 14