M10 - day 1

advertisement

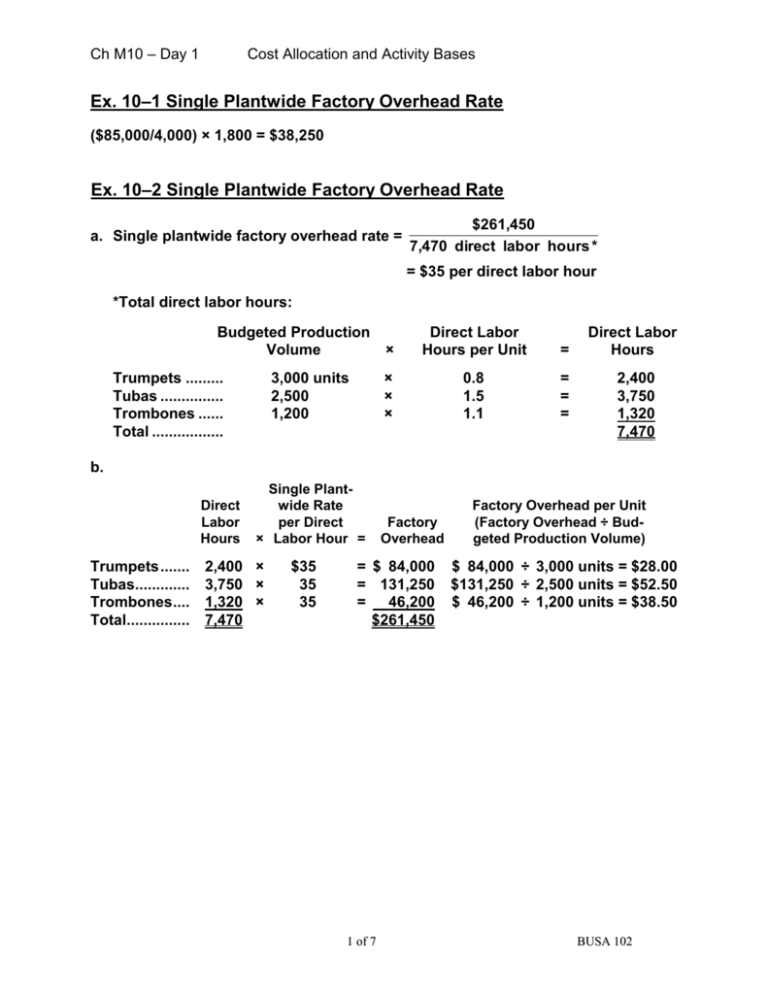

Ch M10 – Day 1 Cost Allocation and Activity Bases Ex. 10–1 Single Plantwide Factory Overhead Rate ($85,000/4,000) × 1,800 = $38,250 Ex. 10–2 Single Plantwide Factory Overhead Rate a. Single plantwide factory overhead rate = $261,450 7,470 direct labor hours * = $35 per direct labor hour *Total direct labor hours: Budgeted Production Volume Trumpets ......... Tubas ............... Trombones ...... Total ................. 3,000 units 2,500 1,200 × Direct Labor Hours per Unit = × × × 0.8 1.5 1.1 = = = Direct Labor Hours 2,400 3,750 1,320 7,470 b. Direct Labor Hours Trumpets ....... Tubas............. Trombones .... Total............... Single Plantwide Rate per Direct × Labor Hour = 2,400 × 3,750 × 1,320 × 7,470 $35 35 35 Factory Overhead = $ 84,000 = 131,250 = 46,200 $261,450 1 of 7 Factory Overhead per Unit (Factory Overhead ÷ Budgeted Production Volume) $ 84,000 ÷ 3,000 units = $28.00 $131,250 ÷ 2,500 units = $52.50 $ 46,200 ÷ 1,200 units = $38.50 BUSA 102 Ch M10 – Day 1 Cost Allocation and Activity Bases Ex. 10–3 Product Costs, Profitability Reports, Using Single OH Rate a. Single plantwide factory overhead rate = $528,000 13,200 processing hours * = $40 per processing hour The selling and administrative expenses are not factory overhead. *Total processing hours: Budgeted Production Volume (Cases) × Tortilla chips ... Potato chips .... Pretzels ............ Total ................. 20,000 60,000 18,000 98,000 Processing Hours per Case = 0.12 0.15 0.10 = = = × × × Processing Hours 2,400 9,000 1,800 13,200 b. Single Plantwide Factory OverProcessing head Rate per Hours × Processing Hour = Tortilla chips . Potato chips .. Pretzels .......... Total ............... 2,400 9,000 1,800 13,200 × × × = = = $40 40 40 2 of 7 Factory Overhead Factory Overhead per Case (Factory Overhead ÷ Budgeted Production Volume $ 96,000 $ 96,000/20,000 cases = $4.80 360,000 $360,000/60,000 cases = $6.00 72,000 $ 72,000/18,000 cases = $4.00 $528,000 BUSA 102 Ch M10 – Day 1 Cost Allocation and Activity Bases Ex. 10–5 Multiple Production Department Factory OH Rate Method a. Production department factory overhead rates: Pattern Department Total factory overhead............................... Direct labor hours ...................................... Departmental overhead rate ..................... $ ÷ $ 128,000 4,000 dlh 32.00/dlh Cut and Sew Department ÷ $ $260,000 5,000 dlh 52.00/dlh b. Product cost allocation: Small Glove Direct labor hours per unit— Pattern Dept. ............................. Pattern Dept. factory overhead rate ............................................ Pattern Department factory overhead ................................... Direct labor hours per unit— Cut and Sew Dept. .................... Cut and Sew Dept. factory overhead rate ............................ Cut and Sew Dept. factory overhead ................................... Total factory overhead per glove .. 3 of 7 Medium Glove Large Glove 0.02 0.04 0.08 × $32.00 × $32.00 × $32.00 $0.64 $1.28 $2.56 0.05 0.06 0.08 × $52.00 × $52.00 × $52.00 2.60 $3.24 3.12 $4.40 4.16 $6.72 BUSA 102 Ch M10 – Day 1 Cost Allocation and Activity Bases Ex. 10–6 Single & Multiple FOH Rates and Product Distortion a. Plantwide factory overhead rate: Budgeted factory overhead Plantwide allocation base = $850,000 5,000 direct machine hours = $170.00 per dmh Product costs: Desktop 1.25 × $170.00 $212.50 Total direct machine hours per unit .................... Plantwide factory overhead rate .......................... Factory overhead per unit .................................... Portable 2.0 × $170.00 $340.00 b. Department factory overhead rates: Production department overhead............. Direct machine hours ................................ Production department overhead rate ..... Assembly Department Testing Department $570,000 ÷ 3,000 dmh $ 190.00/dmh $280,000 ÷ 2,000 dmh $ 140.00/dmh Product cost allocation: Desktop Direct machine hours per unit— Assembly Department ................... Assembly Department factory overhead rate.................................. Assembly Department factory overhead ......................................... Direct machine hours per unit— Testing Department ....................... Testing Department factory overhead rate.................................. Testing Department factory overhead ......................................... Total factory overhead per unit ........... Portable 0.75 1.20 × $190.00 × $190.00 $142.50 $228.00 0.50 0.80 × $140.00 × $140.00 70.00 $212.50 112.00 $340.00 c. The factory overhead determined under the single plantwide factory overhead rate and multiple production department factory overhead rate methods are the same. This is because the ratio of direct machine hours used by each product from the two departments is the same. The desktop machine uses 0.75 direct machine hours in the Assembly Department and 0.50 hours in the Testing Department, or a ratio of 3:2. The portable computer uses 1.20 direct machine hours in the Assembly Department and 0.80 hours in the Testing Department, also for a ratio of 3:2. Thus, even though the two production department overhead rates are different, this is not sufficient for the plantwide rate to cause product cost distortion. Thus, Swell should consider remaining with the easier single plantwide rate method in this circumstance. 4 of 7 BUSA 102 Ch M10 – Day 1 Cost Allocation and Activity Bases Ex. 10– 7 Single & Multiple FOH Rates and Product Distortion a. Plantwide factory overhead rate: Budgeted factory overhead Plantwide allocation base = $825,000 5,000 direct labor hours = $165 per dlh Product costs: Total direct labor hours per unit ............... Plantwide factory overhead rate ............... Factory overhead per unit ......................... Gasoline Engine Diesel Engine 4 × $165 $660 4 × $165 $660 Fabrication Department Assembly Department $575,000 ÷ 2,500 dlh $ 230.00/dlh $250,000 ÷ 2,500 dlh $ 100.00/dlh b. Department factory overhead rates: Total production department factory overhead ................................................. Direct labor hours ......................................... Production department overhead rate ........ Product cost allocation: Gasoline Engine Direct labor hours per unit— Fabrication Department ................. Fabrication Department factory overhead rate.................................. Fabrication Department factory overhead ......................................... Direct labor hours per unit— ............... Assembly Department ................... Assembly Department factory overhead rate.................................. Assembly Department factory overhead ......................................... Total factory overhead per unit ........... 5 of 7 Diesel Engine 1 3 × $230.00 × $230.00 $230.00 $690.00 3 1 × $100.00 × $100.00 300.00 $530.00 100.00 $790.00 BUSA 102 Ch M10 – Day 1 Cost Allocation and Activity Bases Ex. 10–7 Single & Multiple FOH Rates and Product Distortion Concluded c. Management should select the multiple department factory overhead rate method of allocating overhead costs. The single plantwide factory overhead rate method indicates that both products have the same factory overhead of $660 per unit. This is because each product uses a total of 4 direct labor hours per unit. However, each product uses these 4 direct labor hours much differently. The gasoline engine consumes 1 hour in the expensive Fabrication Department and 3 hours in the less expensive Assembly Department. The opposite is the case for diesel engines. Thus, the multiple production department rate method avoids the cost distortions of the single plantwide rate method by accounting for the overhead in each production department separately. In this case, there are both production department rate differences across the departments and differences in the ratios of allocation-base usage of the products across the departments (1:3 vs. 3:1). These conditions will cause the single plantwide rate method to distort product costs. Prob. 10–1A Single Plantwide Factory OH Rate 1. a. b. Direct labor overhead rate: $1,404,000 = $540 per direct labor hour 2,600 direct labor hours Machine hour overhead rate: $1,404,000 = $300 per machine hour 4,680 machine hours 2. Automobile Bumpers Valve Covers Stamping Department .............................. 490 dlh Plating Department .................................. 260 Total direct labor hours ........................... 750 dlh Direct labor factory overhead rate .......... × $540/dlh Allocated factory overhead ..................... $405,000 450 dlh 290 740 dlh × $540/dlh $399,600 760 dlh 350 1,110 dlh × $540/dlh $599,400 420 mh 810 1,230 mh × $300/mh $369,000 710 mh 1,370 2,080 mh × $300/mh $624,000 Wheels a. Direct labor hours: b. Direct machine hours: Stamping Department .............................. 450 mh Plating Department .................................. 920 Total machine hours ................................ 1,370 mh Machine hour factory overhead rate ....... × $300/mh Allocated factory overhead ..................... $411,000 6 of 7 BUSA 102 Ch M10 – Day 1 Cost Allocation and Activity Bases Prob. 10–2A Multiple Production Dept. Factory Overhead Rates 1. Production department factory overhead totals ..................................... Activity base ............................................... Production department rate ...................... Stamping Dept. Plating Dept. $892,500 ÷ 1,700 dlh $ 525/dlh $511,500 ÷ 3,100 mh $ 165/mh 2. Automobile Bumpers Labor hours—Stamping Department ........................... Stamping Dept. factory overhead rate per labor hr. .. Stamping Department factory overhead ............................... Machine hours—Plating Department ........................... Plating Department factory overhead rate per mach. hr. Plating Department factory overhead ............................... Total factory overhead .............. Valve Covers Wheels 490 450 760 × $525 × $525 × $525 $257,250 $236,250 $399,000 920 810 1,370 × $165 × $165 × $165 151,800 $409,050 133,650 $369,900 226,050 $625,050 7 of 7 BUSA 102