LETTERS

February 22, 2013, 4:42 p.m. ET

Minimum-Wage Hike Will Help Some but

Hurt Others

Regarding your editorial "The Minority Youth Unemployment Act" (Feb. 16): It was

pure political theater and pandering for President Obama to throw the minimum wage

into his State of the Union address. The topic is just another diversion from the serious

business of creating jobs, reducing debt, reforming the tax system and tackling Medicare.

The work of economist David Neumark reveals that a 10% increase in the minimum

wage will decrease employment of minority teenagers receiving the minimum wage by

6.6%. However, few families, few full-time workers and few minority young adults are

impacted.

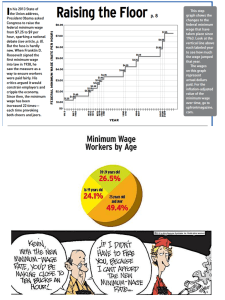

According to the March 2, 2012 report of the Bureau of Labor Statistics on the

characteristics of minimum-wage workers (MWWs) there are only 3.83 million hourly

workers (from a total of 73.9 million hourly workers) who are paid at the minimum wage

or less. About 43.2% work in food service where tips are excluded in the minimum-wage

status determination. The number of MWWs who are full-time workers with families is

less than 1.4 million.

Minorities account for 14.61 million hourly workers and 823,000 of the MWWs. It is

estimated that fewer than 250,000 of the 823,000 minorities are teens. So if a 24% rise in

the minimum wage is instituted, a 16% decrease in minority teen employment will occur

and a 9.4% decrease in total minority employment will occur. This will decrease minority

teen income by $450 million and all minority income by $860 million. However, the total

MWWs who don't lose their jobs will have a total increased income of $9.4 billion.

Ron Dudley

Sanibel, Fla.

Missing from this discussion is the "wage push" that must occur when the lowest wage

earners receive a government-mandated 24% pay increase. Why shouldn't full-time

employees who are being paid $10 to $15 an hour expect a similar wage adjustment?

This increase in labor cost will further curtail additional hiring. Additionally, my business

routinely employs seasonal employees (mostly high-school and college-age kids) at wage

rates well above the minimum wage because we strive to achieve exactly what President

Obama stated he wants to attain by increasing the minimum wage—a stable workforce

with increased productivity. It is terrific news that the government now needs to dictate

this basic principle to business owners.

Peter Edwards

President

Zeb's General Store, Inc.

North Conway, N.H.

Michael Saltsman's "The $9 Minimum Wage That Already Exists" (op-ed, Feb. 14) about

the minimum-wage proposal by President Obama and the Earned Income Tax Credit

(EITC) is fundamentally flawed. Perversely, the EITC subsidizes companies (and

government institutions) which underpay employees. The current system revolving

around the ETIC isn't based on market forces and promotes a tax structure through which

taxpayers in effect subsidize companies and governments (especially local and state) that

are unwilling to pay employees a living wage. Too much attention by far is paid to

business interests and not nearly enough to people. Paying less than a living wage means

that more will be spent on food stamps, health-care subsidies and other transfer

payments. A cruel irony indeed.

Michael Stout

Columbia, S.C.

A more productive solution to raising employment and earnings would be to cut the

minimum wage for teenagers to about $2 an hour. Then it would be worthwhile for an

employer to take an ignorant and unskilled youngster of uncertain reliability and train

him or her. Eventually, that person may become an employee worth the $7.25 an hour or

more.

Hank Landa

Wauwatosa, Wis.

A version of this article appeared February 23, 2013, on page A12 in the U.S. edition of

The Wall Street Journal, with the headline: Minimum-Wage Hike Will Help Some but

Hurt Others.

Copyright 2012 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this

material are governed by our Subscriber Agreement and by copyright law. For nonpersonal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-8430008 or visit

www.djreprints.com