calculate assumption

advertisement

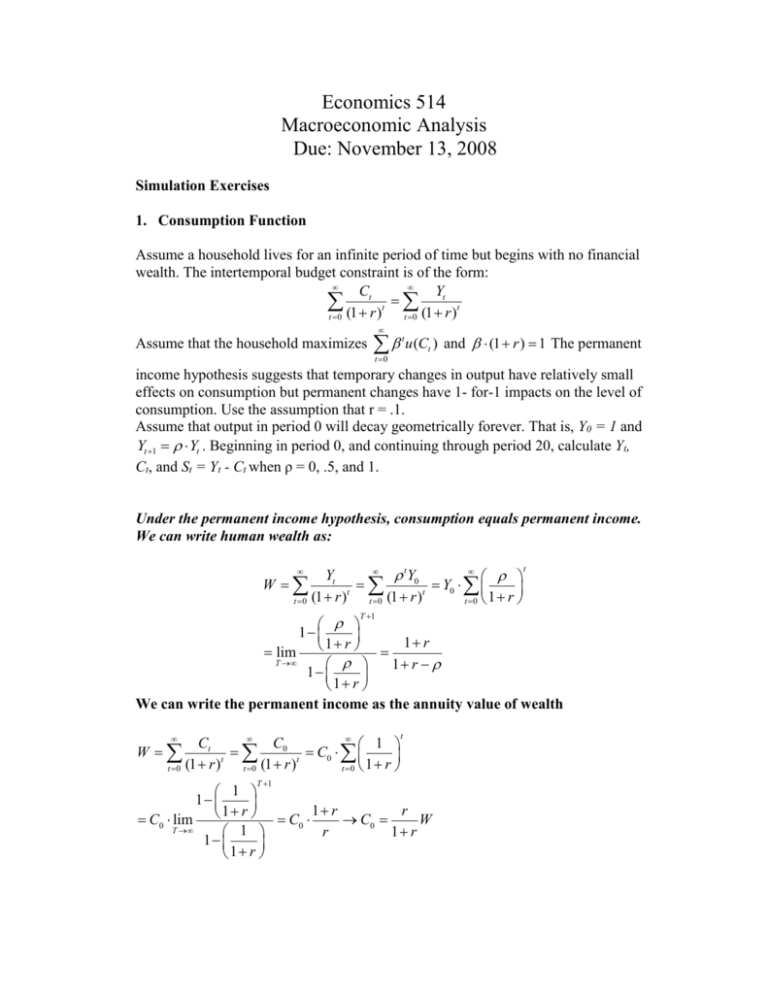

Economics 514 Macroeconomic Analysis Due: November 13, 2008 Simulation Exercises 1. Consumption Function Assume a household lives for an infinite period of time but begins with no financial wealth. The intertemporal budget constraint is of the form: Ct Yt t t t 0 (1 r ) t 0 (1 r ) Assume that the household maximizes u (C ) and (1 r ) 1 The permanent t t t 0 income hypothesis suggests that temporary changes in output have relatively small effects on consumption but permanent changes have 1- for-1 impacts on the level of consumption. Use the assumption that r = .1. Assume that output in period 0 will decay geometrically forever. That is, Y0 = 1 and Yt 1 Yt . Beginning in period 0, and continuing through period 20, calculate Yt, Ct, and St = Yt - Ct when ρ = 0, .5, and 1. Under the permanent income hypothesis, consumption equals permanent income. We can write human wealth as: Yt tY0 W Y 0 t t t 0 (1 r ) t 0 (1 r ) t 0 1 r T 1 t 1 1 r 1 r lim T 1 r 1 1 r We can write the permanent income as the annuity value of wealth W t 0 Ct C0 1 C 0 t t (1 r ) t 0 (1 r ) t 0 1 r T 1 t 1 1 1 r r 1 r C0 lim C0 C0 W T r 1 r 1 1 1 r Therefore in this case we write C0 ρ 0 .5 1 ρ=0 Y t=0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 r .1 1 r 1.1 C 1/11 1/6 1 C 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 S 0.909091 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 -0.090909 ρ=0.5 Y t=0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 1 0.5 0.25 0.125 0.0625 0.03125 0.015625 0.007813 0.003906 0.001953 0.000977 0.000488 0.000244 0.000122 6.1E-05 3.05E-05 1.53E-05 7.63E-06 3.81E-06 1.91E-06 C 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 S 0.833333 0.333333 0.083333 -0.041667 -0.104167 -0.135417 -0.151042 -0.158854 -0.16276 -0.164714 -0.16569 -0.166178 -0.166423 -0.166545 -0.166606 -0.166636 -0.166651 -0.166659 -0.166663 -0.166665 ρ=1 Y t=0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 C 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 S 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2. Consumption Function Assume a household lives for an infinite period of time, earns no income but begins with financial wealth, FW0 = 1. The intertemporal budget constraint is of the form: Ct FW0 t t 0 (1 r ) Assume that the household maximizes u (C ) and (1 r ) 1 . Beginning in t t t 0 period 0, and continuing through period 20, calculate Ct, and end of period wealth Bt = (1+r)*Bt-1 + Yt – Ct when r = 0, .1, and 2. t Ct C0 1 W C 0 t t t 0 (1 r ) t 0 (1 r ) t 0 1 r T 1 1 1 1 r r r r 1 r C0 lim C0 C0 W FW T r 1 r 1 r 1 r 1 1 1 r Therefore in this case we write C0 R .1 .2 2 r 1 r C 1/11 1/6 2/3 Note that the original question said r = 2. I meant .2, either answer is acceptable. t=0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 r = .1 B_t 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 0.909091 C 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 0.090909 r = .2 B_t 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 0.833333 C 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 0.166667 r =2 B_t 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 0.333333 C 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 0.666667 Empirical Work 3. Real Cost of Capital and Investment You want to check the sensitivity of investment in Japan to the real capital rental rate. Use quarterly Japanese data available here in to construct a capital rental rate series. Japanese Data http://home.ust.hk/~davcook/jpndata.xls a. Calculate inflation and investment goods inflation. Columns A and B contain price indices for output, Pt, and investment goods, PtI. Calculate inflation for each series as the continuous growth rate of each series. I t ln( Pt P ) tI ln( Pt I ) Pt 1 t 1 b. Calculate the real interest rate. For each period, use the nominal interest rate in Column E) as it and πt+1 from part a. rt = it - πt+1 (Note: This is a quarterly interest rate. Interest rates are usually cited in annual terms. The annualized interest rate is just 4 times the quarterly interest rate). c. Calculate the relative price of investment goods. Calculate the relative price of investment goods as the ratio of the investment index in column B) to the output PI price index in column A): ptI ( t ) Pt d. Calculate the capital rental rate. Assume that the quarterly depreciation rate is δ = .02. Use the above data to calculate the quarterly capital rental rate Rt r ( tI1 t 1 ) ptI . Compare this series with the series you would Pt t get if you assumed that the real price of investment goods was always equal to pI = 1: rt + δ. Calculate the average for both series over the period March-1971 to December-2000. e. Calculate the investment to capital ratio. i. Estimate the capital stock in the first quarter of 1970, t = 0. Assume in R that period, the marginal product of capital equals the average of t Pt Y1970:1 R . Use the information of output in K1970:1 P period 1970:1 from column C) along with the assumption that α = ⅓ to calculate K0. ii. Calculate an investment series recursively. Starting from period 0, use the investment series in column D) and the initial capital level calculated in section ii) to estimate the capital stock in every period. Kt+1 = (1- δ)Kt + It. I iii. Calculate the investment to capital ratio in each period t K t Y f. Calculate the output to capital ratio. ykt ( t ) Kt calculated in section d. g. Calculate the correlation between It Kt & Rt Pt on the one hand and between It & ykt over the period March-1971 to December-2000. Which seems to have Kt the stronger relationship? http://home.ust.hk/~davcook/japandata2008ak.xls Averages Average πt+1 πIt+1 r p It R/P r+δ I/K R/P Y/K I/K I/K R/P Y/K R/P 0.007603 0.005296 0.004516 0.816935 0.022078 0.024516 0.836935 0.022078 0.044516 Y/K 1 -0.03201 1 0.771141 0.06783 1 The correlation between capital productivity and investment is very strong. The relationship between the capital rental rate and investment is weak. 4. Precautionary Savings Estimate the effect of volatility on savings rates using Chinese provincial data. The following dataset has data on the average consumption and average disposable income (both in current dollars). Chinese Provincial Data http:\\home.ust.hk\~davcook\ChinaPrecautionaryData.xls a. Calculate the personal savings rate as Disposable Incomet ,i Consumption Expendituret ,i st ,i . Calculate the average Disposable Incomet ,i from 2000 to 2003. s i 1 2003 st ,i 4 t 2000 b. Calculate constant dollar disposable income. Download data on China’s price level from the UN website. UN Main Aggregates Database. Download the series “GDP, Implicit Price Deflators – National Currency”. Use the implicit price index divided by 100 as the price level, P. To get constant dollar disposable income for each year, YDt, divide the disposable income for a given year t, by Pt. YDt ,i c. Calculate the growth rate of real disposable income as gtYD ,i ln( YDt 1,i ). Calculate this for each province for each year. YD d. Calculate the mean g i iYD 2003 t 1993 1 2003 YD gt ,i and standard deviation 11 t 1993 YD 2 gtYD ,i g i 10 of real disposable income growth. e. Calculate the correlation between the standard deviation of income growth and the average savings rate. See http:\\home.ust.hk\~davcook\ChinaPrecautionaryData2008AK.xls Real Disposable Average Income Standard Growth Growth Deviation Beijing 0.108649 0.041684 Tianjin 0.093695 0.038047 Hebei 0.077771 0.028354 Shanxi 0.087768 0.032846 Inner Mongolia 0.095334 0.036285 Liaoning 0.074128 0.023503 Jilin 0.086982 0.036311 Heilongjiang0.083018 0.028592 Shanghai 0.099522 0.070686 Jiangsu 0.088085 0.030953 Zhejiang 0.10171 0.041006 Anhui 0.074959 0.033784 Fujian 0.089102 0.027363 Jiangxi 0.09187 0.04253 Shandong 0.086446 0.027532 Henan 0.087572 0.035022 Hubei 0.078268 0.042346 Hunan 0.072872 0.048791 Guangdong 0.070275 0.040106 Guangxi 0.073767 0.058043 Hainan 0.058592 0.06376 Sichuan 0.069189 0.027381 Guizhou 0.067612 0.037958 Yunnan 0.073315 0.03858 Shaanxi 0.079985 0.030327 Gansu 0.073393 0.053883 Qinghai 0.074588 0.031945 Ningxia 0.070932 0.04352 Xinjiang 0.073145 0.036673 Average 2000-2003 0.195561 0.23376 0.24325 0.229084 0.225107 0.181447 0.193345 0.241641 0.246553 0.250955 0.250708 0.217767 0.265104 0.28813 0.257252 0.245308 0.174534 0.187275 0.203909 0.226042 0.232955 0.181427 0.213471 0.203621 0.15941 0.180062 0.19248 0.164615 0.214015 Correlation < .02. There does not seem to be strong evidence for precautionary savings as a source of high Chinese savings at the firm level.