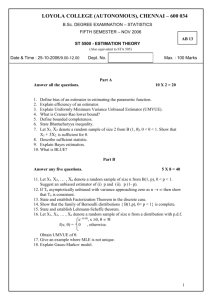

Lecture 10 - Nonlinear Regression Models

advertisement

Lecture 10 –

Estimating Nonlinear Regression Models

References:

Greene, Econometric Analysis, Chapter 10

Consider the following regression model:

yt = f(xt, β) + εt t = 1,…,T

xt is kx1 for each t, β is an rx1constant vector, εt is an

unobservable error process and f is a (“sufficiently

well-behaved”) function - f: RkxRr →R. So, each y is

a (fixed) function of x and β plus an additive error

term, ε.

2

Example: yt 1 xt t

The estimation problem: given f, y1,…,yT, and

x1,…,xT, estimate β.

The solution: estimate β by LS (NLS), ML, or GMM.

The “problem”? In contrast to the linear regression

case, the FOCs are nonlinear and so, in general,

numerical methods must be applied to obtain

(consistent) point estimates. Also, the avar matrice of

β-hat will have a slightly more complicated form.

Nonlinear models are commonly encountered in

applied economics – largely because advances in

computational mathematics and desktop/laptop

computer technology have made solving nonlinear

optimization problems more feasible and more

reliable.

Nonlinear Least Squares (NLS)

Choose β-hat to minimize the SSR –

SSR( ˆ )

T

(y

t 1

t

f ( xt , ˆ )) 2

FOCs –

g ( ˆ )

f ( xt , ˆ )

ˆ

( yt f ( xt , ))

0

t 1

T

which form a set of r nonlinear equations in the r

unknowns, ˆ1 ,..., ˆr . [In the case where f is linear in

the β’s, the derivative vector df/dβ = [ x1t…xrt], r =

k.]

2

y

x

Example: t

1 t t

g ( ˆ )

T

ˆ x ˆ2 )[ x ˆ2 ˆ ˆ x ˆ2 1 ]' 0

(

y

t 1t t 2 1t

t 1

Computing the NLS Estimator –

In general, these FOCs must be solved numerically

to find the NLS estimator of β, ̂ NLS . (E.g., the GaussNewton procedure described in Greene, 10.2.3.)

Some issues –

-

choice of algorithm

selecting an initial value for β-hat

convergence criteria

local vs. global min

Asymptotic Properties of the NLS Estimator –

If

the x’s are weakly exogenous

the errors are serially uncorrelated and

homoskedastic

the function f is sufficiently smooth

the {xt,εt} process is sufficiently well-behaved

then

T 1 / 2 ( ˆT , NLS ) N (0, 2 Q 1 )

D

where

σ2 = var(εt)

Q p lim( 1/ T )QT ,

T

QT [f ( xt , ˆT ) / ][f ( xt , ˆT ) / ' ]

t 1

The NLS estimator is (under appropriate conditions),

consistent, asymptotically normal and asymptotically

efficient.

Inference: For large samples act as though

ˆNLS ~ N ( ,ˆ 2QT 1 )

T

ˆ (1 / T ) ˆt2

2

1

If the disturbances are heteroskedastic and/or serially

correlated the NLS estimator will be consistent but

not asymptotically efficient. Also, the correct form of

the asymptotic variance matrix of the NLS estimator

requires a heteroskedasticity and/or autocorrelation

correction. Heteroskedasticity and HAC estimators of

the variance-covariance matrix of ε can be used if the

exact forms of the heteroskedasticity and

autorcorrelation are not know.

If the form of the heteroskedasticity and/or serial

correction is known up to a small number of

parameters (e.g., εt is known to be an AR(1) process

with unknown ρ) then nonlinear GLS or (quasi)maximum likelihood will be asymptotically efficient

estimators.

Example – GNLS

Suppose E(εε’) = Σ. Then the GNLS estimator of β is

the value of ˆ that minimizes the weighted SSR:

[y-f(x, ˆ )]’ Σ-1[y-f(x, ˆ )]

If Σ then it can be replaced with a consistent

estimator to obtain the FGNLS estimator. (What

consistent estimator of Σ?)

If the regressors are correlated with the errors, none

of these estimators is consistent (even if the errors are

homoskedastic and serially uncorrelated). A

consistent, semi-parametrically efficient estimator

that does not rely on knowledge of the form/existence

of heteroskedasticity/autocorrelation and allows for

endogenous regressors: Nonlinear GMM

In addition, GMM provides a semi-parametric

alternative to MLE for nonlinear models that do not

fit the nonlinear regression format.

GMM in the nonlinear regression model –

Consider the population moment conditions:

E[wt(yt – f(xt,β))] = 0 for all t

where wt is an instrument vector.

The GMM estimator: choose ˆ to make the

corresponding sample moments

1 T

wt ( yt f ( xt , ˆ ))

T 1

close to zero. As in the linear case, this will

involve minimizing an optimally weighted

quadratic form in these moments.

GMM in a more general nonlinear setting Hansen and Singleton’s (Econometrica, 1982)

Consumption-Based Asset Pricing Model

At the start of each time period t, a representative

agent chooses consumption and saving to maximize

expected discounted utility:

E[ U (ct i ) t ] , U (ct )

i

ct 1

i 0

,0<γ<1

At the start of t, the agent can allocate income to

purchase the consumption good or N assets with

maturities 1,2,…,N according to the sequence of

budget constraints

N

N

j 1

j 1

ct p j ,t q j ,t rj ,t q j ,t j wt

where

pj,t = price of a unit of asset j (i.e., an asset that

matures in t+j) in period t

qj,t = units of asset j purchased in period t

rj,t = payoff in period t of asset j purchased in t-j

wt = labor income in period t

Unknown parameters in this model- δ,γ

The optimal consumption path must satisfy the

sequence of Euler equations:

E[ j (rj ,t j / p j ,t )(ct j / ct ) 1 t ] 0

Let zt be any vector in Ωt. Then the Euler equations

imply the following set of moment conditions which

form the basis for estimating δ and γ by GMM –

E[ j (rj ,t j / p j ,t )(ct j / ct ) 1 zt ] 0

for all t and j=1,...N

GMM: Choose δ and γ to make the j sample

moments

1 T

(rj ,t j / p j ,t )(ct j / ct ) 1 zt , j = 1,…,N

T 1

j

close to zero.

The alternative – MLE: specify the joint distribution

for {(rj,t+j/pj,t+j,ct+j/ct), j = 1,2,…,N} then maximize the

corresponding likelihood function subject to the

Euler equations. (See, e.g., Hansen and Singleton,

JPE, 1983).