ARIMA Models

advertisement

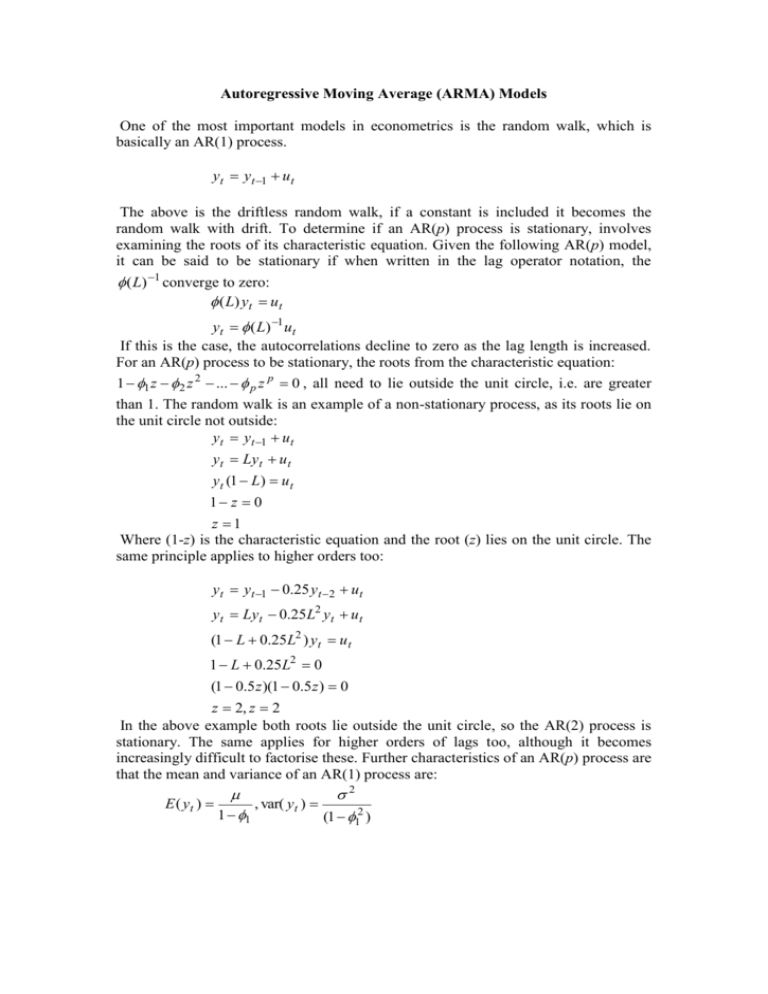

Autoregressive Moving Average (ARMA) Models One of the most important models in econometrics is the random walk, which is basically an AR(1) process. yt yt 1 ut The above is the driftless random walk, if a constant is included it becomes the random walk with drift. To determine if an AR(p) process is stationary, involves examining the roots of its characteristic equation. Given the following AR(p) model, it can be said to be stationary if when written in the lag operator notation, the ( L) 1 converge to zero: ( L) y t u t yt ( L) 1 ut If this is the case, the autocorrelations decline to zero as the lag length is increased. For an AR(p) process to be stationary, the roots from the characteristic equation: 1 1 z 2 z 2 ... p z p 0 , all need to lie outside the unit circle, i.e. are greater than 1. The random walk is an example of a non-stationary process, as its roots lie on the unit circle not outside: yt yt 1 u t yt Lyt u t yt (1 L) u t 1 z 0 z 1 Where (1-z) is the characteristic equation and the root (z) lies on the unit circle. The same principle applies to higher orders too: yt yt 1 0.25 yt 2 u t yt Lyt 0.25L2 yt u t (1 L 0.25L2 ) yt u t 1 L 0.25L2 0 (1 0.5 z )(1 0.5 z ) 0 z 2, z 2 In the above example both roots lie outside the unit circle, so the AR(2) process is stationary. The same applies for higher orders of lags too, although it becomes increasingly difficult to factorise these. Further characteristics of an AR(p) process are that the mean and variance of an AR(1) process are: 2 E ( yt ) , var( yt ) 1 1 (1 12 ) Box-Jenkins Methodology This is the technique for determining the most appropriate ARMA or ARIMA model for a given variable. It comprises four stages in all: 1) Identification of the model, this involves selecting the most appropriate lags for the AR and MA parts, as well as determining if the variable requires first-differencing to induce stationarity. The ACF and PACF are used to identify the best model. (Information criteria can also be used) 2) Estimation, this usually involves the use of a least squares estimation process. 3) Diagnostic testing, which usually is the test for autocorrelation. If this part is failed then the process returns to the identification section and begins again, usually by the addition of extra variables. 4) Forecasting, the ARIMA models are particularly useful for forecasting due to the use of lagged variables. The Box-Jenkins methodology is often referred to as more an art then a science, this lack of theory behind the models is one criticism of them, however they are used as an effective model for forecasting. Forecasting One of the most important tests of any model is how well it forecasts. This can involve either in-sample or out-of-sample forecasts, usually the out-of-sample forecasts are viewed as the most informative, as the data used for the forecast is not included in the estimation of the model used for the forecast. When assessing how well a model forecasts, we need to compare it to the actual data, this then produces a forecast vale, an actual value and a forecast error (difference between forecast and actual values) for each individual observation used for the forecast. Then the accuracy of the forecast needs to be measured, this can be done by: 1) Plot of forecast values against actual values 2) Use of a statistic such as the Mean Square Error (MSE) or RMSE (R stands for Root). 3) Use of Theil’s U coefficient, which in effect compares the forecast to a benchmark forecast. 4) The use of financial loss functions, where the % of correct sign predictions or direction change predictions are calculated. This is particularly important in fiancé, as if you can forecast the sign correctly, it usually means a profit can be made. When forecasting future values of a variable, it is often important to have a benchmark model, such as the random walk to compare the forecasts of the model with, if it can not beat the random walk it can be argued to be a relatively poor forecaster, the random walk often wins!