Notes 26 - Wharton Statistics Department

advertisement

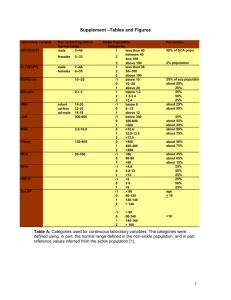

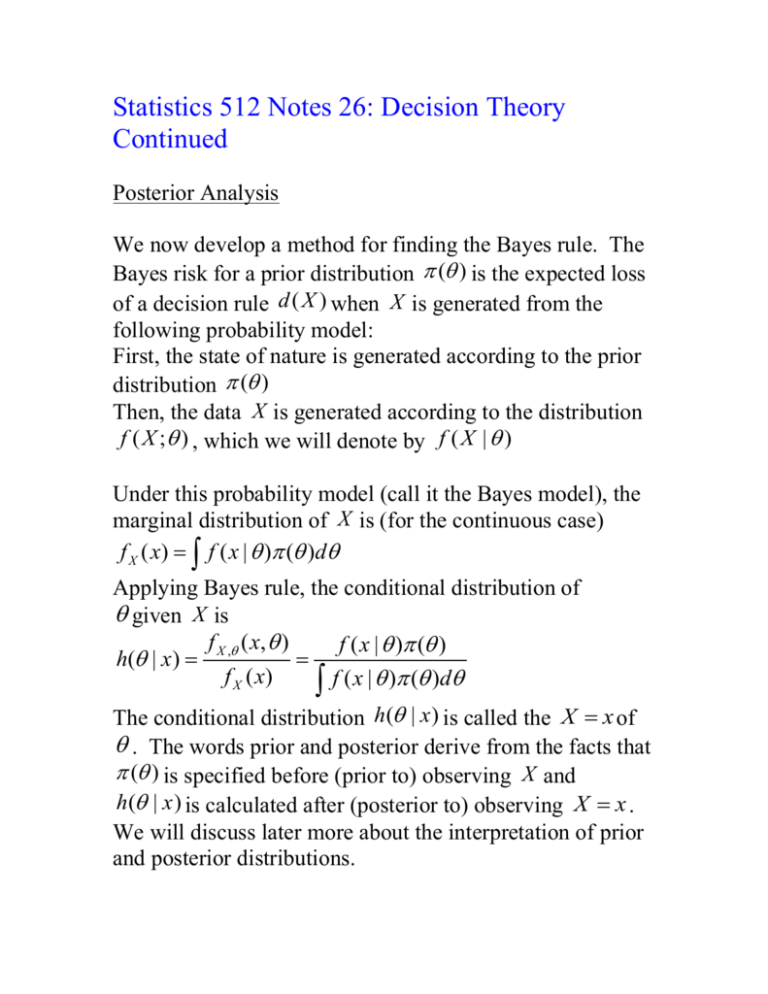

Statistics 512 Notes 26: Decision Theory Continued Posterior Analysis We now develop a method for finding the Bayes rule. The Bayes risk for a prior distribution ( ) is the expected loss of a decision rule d ( X ) when X is generated from the following probability model: First, the state of nature is generated according to the prior distribution ( ) Then, the data X is generated according to the distribution f ( X ; ) , which we will denote by f ( X | ) Under this probability model (call it the Bayes model), the marginal distribution of X is (for the continuous case) f X ( x) f ( x | ) ( )d Applying Bayes rule, the conditional distribution of given X is f ( x, ) f ( x | ) ( ) h( | x) X , f X ( x) f ( x | ) ( )d The conditional distribution h( | x ) is called the X x of . The words prior and posterior derive from the facts that ( ) is specified before (prior to) observing X and h( | x ) is calculated after (posterior to) observing X x . We will discuss later more about the interpretation of prior and posterior distributions. Suppose that we have observed X x . We define the posterior risk of an action a d ( x ) as the expected loss, where the expectation is taken with respect to the posterior distribution of . For continuous random variables, we have Eh ( | X x ) [l ( ), d ( x))] l ( , d ( x))h( | X x)d Theorem: Suppose there is a function d0 ( x) that minimizes the posterior risk. Then d0 ( x) is a Bayes rule. Proof: We will this for the continuous case. The discrete case is proved analogously. The Bayes risk of a decision function d is B(d ) E ( ) [ R( ), d ] E ( ) [ E X (l ( , d ( X )) | ] l ( , d ( x)) f ( x | ) dx ( ) d l ( , d ( x)) f x , ( x, ) dxd l ( , d ( x)) h( | x) d f X ( x) dx (We have used the relations f ( x | ) ( ) f X , ( x, ) f X ( x)h( | x) ) Now the inner integral is the posterior risk and since f X ( x) is nonnegative, B(d ) can be minimized by choosing d ( x) d 0 ( x) . The practical importance of this theorem is that it allows us to use just the observed data, x , rather than considering all possible values of X to find the action for the Bayes rule d ** given the data X x , d ** ( x) . In summary the ** algorithm for finding d ( x) is as follows: Step 1: Calculate the posterior distribution h( | X x) . Step 2: For each action a , calculate the posterior risk, which is E[l ( , a) | X x] l ( , a)h( | X )d * The action a that minimizes the posterior risk is the Bayes ** * rule action d ( x) a Example: Consider again the engineering example. Suppose that we observe X x2 45 . In the notation of that example, the prior distribution is (1 ) .8 , (2 ) .2 . We first calculate the posterior distribution: f ( x | ) (1 ) h(1 | x2 ) 2 2 1 i 1 f ( x2 | i ) (i ) .3*.8 .3*.8 .2*.2 .86 Hence, h(2 | x2 ) .14 We next calculate the posterior risk (PR) for a1 and a2 : PR(a1 ) l (1 , a1 )h(1 | x2 ) l ( 2 , a1 )h( 2 | x2 ) 0 400*.14 56 and PR(a2 ) l (1 , a2 )h(1 | x2 ) l ( 2 , a2 )h( 2 | x2 ) 100*.86 0 86 Comparing the two, we see that a1 has the smaller posterior risk and is thus the Bayes rule. Decision Theory for Point Estimation Estimation theory can be cast in a decision theoretic framework. The action space is the same as the parameter space and the decision functions are point estimates d ( X ) ˆ . In this framework, a loss function may be specified, and one of the strengths of the theory is that general loss functions are allowed and thus the purpose of estimation is made explicit. But the case of squared error loss is especially tractable. For squared error loss, the risk is R( , d ) E d ( X 1 , , X n ) 2 2 ˆ E Suppose that a Bayesian approach is taken and the prior distribution on is ( ) . Then from the above theorem, the Bayes rule for squared error loss can be found by minimizing the posterior risk, which is E ( ) [( ˆ)2 | X x] . We have E ( ) [( ˆ)2 | X x] Var ( ) ( ˆ) | X x E ( ) ( ˆ) | X x Var ( ) | X x E ( ) | X x ˆ 2 The first term of this last expression does not depend on ˆ ˆ ˆ and the second term is minimized by E ( ) | X x . Thus, the Bayes rule for squared error loss is the mean of the posterior distribution of , ˆ h( | X )d . Example: A (possibly) biased coin is thrown once, and we want to estimate the probability of the coin landing heads on future tosses based on this single toss. Suppose that we have no idea how biased the coin is; to reflect this state of knowledge, we use a uniform prior distribution on : g ( ) 1, 0 1 Let X 1 if a head appears, and let X 0 if a tail appears. The distribution of X given is x 1 , f (x | ) 1 , x 0 The posterior distribution is f ( x | ) 1 h( | x) f ( x | )d In particular, 2 h( | X 1) 1 2 d 0 h( | X 0) (1 ) 1 1 2(1 ) (1 )d 0 Suppose that X 1 . The Bayes estimate of is the mean of the posterior distribution h( | X 1) , which is 1 2 (2 ) d 0 3 ˆ1 The Bayes estimate in the case where X 0 is 3. Note that these estimates differ from the classical maximum likelihood estimates, which are 0 and 1. Comparison of the risk functions of the Bayes estimate and the MLE: The risk function of the above Bayes estimate is 2 2 2 1 2 E ˆBayes P ( X 0) P ( X 1) 3 3 2 2 1 2 (1 ) 3 3 1 1 1 2 9 3 3 The risk function of the MLE ˆMLE X is 2 2 2 E ˆMLE 0 P ( X 0) 1 P ( X 1) 0 (1 ) 1 2 2 2 (1 ) The following graph shows the risk function of the Bayes estimate and the MLE – the Bayes estimate is the solid line and the MLE is the dashed line. The Bayes estimate has smaller risk than that of the MLE over most of the range of [0,1] but neither estimator dominates the other. Admissibility Minimax estimators and Bayes estimators are “good estimators” in the sense that their risk functions have certain good properties; minimax estimators minimize the worst case risk and Bayes estimators minimize a weighted average of the risk. It is also useful to characterize bad estimators. Definition: An estimator ˆ is inadmissible if there exists another estimator ˆ ' that dominates ˆ , meaning that R( ,ˆ ') R( , ˆ) for all and R( ,ˆ ') R( , ˆ) for at least one If there is no estimator ˆ' that dominates ˆ, then ˆ is admissible Example: Let X be a sample of size one from a N ( ,1) distribution and consider estimating with squared error loss. Let ˆ( X ) 2 X . Then R( ,ˆ) E [(2 X ) 2 ] Var (2 X ) E [2 X ] 2 4 2 The risk function of the MLE ˆMLE ( X ) X is R( ,ˆMLE ) E [( X ) 2 ] Var ( X ) E [ X ] 2 1 Thus, the MLE dominates ˆ( X ) 2 X and ˆ( X ) 2 X is inadmissible. Consider another estimator ˆ( X ) 3 . We will show that ˆ is admissible. Suppose not. Then there exists a different estimator ˆ ' with smaller risk. In particular, R(3, ˆ ') R(3, ˆ) 0 . Hence, 0 R(3, ˆ ') (ˆ ' 3) 2 1 exp ( x 3) 2 / 2 dx . 2 Thus, ˆ '( X ) 3 and there is no estimator that dominates ˆ . Even though ˆ is admissible, it is clearly a bad estimator. In general, it is very hard to know whether a particular estimate is admissible, since one would have to check that it was not strictly dominated by any other estimate in order to show that it was admissible. The following theorem states that any Bayes estimate is admissible. Theorem (Complete Class Theorem): Suppose that one of the following two assumptions holds: (1) is discrete and d * is a Bayes rule with respect to a prior probability mass function such that ( ) 0 for all . (2) is an interval and d * is a Bayes rule with respect to a prior density function g ( ) such that ( ) 0 for all and R ( , d ) is a continuous function of for all d . Then d * is admissible. Proof: We will prove the theorem for assumption (2). The proof is by contradiction. Suppose that d * is inadmissible. There is then another estimate, d , such that R( , d *) R( , d ) for all and with strict inequality for some , say 0 . Since R( , d *) R( , d ) is a continuous function of , there is an 0 and an interval h such that R( , d *) R( , d ) for 0 h 0 h Then, 0 h R( , d *) R( , d ) ( )d R( , d *) R( , d ) ( )d 0 h 0 h ( )d 0 0 h But this contradicts the fact that d * is a Bayes rule because a Bayes rule has the property that B(d *) B(d ) R( , d *) R( , d ) ( )d 0 . The proof is complete. The theorem can be regarded as both a positive and negative result. It is positive in that it identifies a certain class of estimates as being admissible, in particular, any Bayes estimate. It is negative in that there are apparently so many admissible estimates – one for every prior distribution that satisfies the hypotheses of the theorem – and some of these might make little sense (like ˆ( X ) 3 for the normal distribution above).