Inventory Management Homework Answers - MGMT4102

advertisement

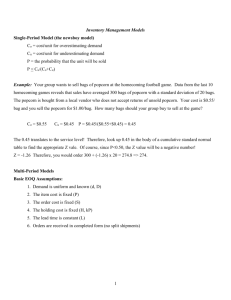

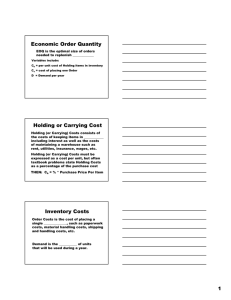

Answer to Homework Chapter 12 Inventory Management MGMT4102, J. Wang P. 498 - . Problems #3. Given: Cost of goods sold = $3,000,000 in last year, Avg. inventory = $250,000. $3,000,000 12 (turnovers ) . #250,000 number of weeks in a year 52 weeks in a year 4.33 weeks ; (b) Weeks of supply = number of turnovers 12 turnovers Or Weeks of supply = avg. inventory $250,000 $250,000 4.33 weeks . cost of goods sold per week $3,000,000 $57,692.3 52 (c) Days of supply = (5 days/week)*4.33 weeks = 21.65 days. (a) Inventory turnover = #4. (continuation of #3) If sales increase by 20%, i.e., sales increase to 3,000,000(1+20%)=$3,600,000, then $3,600,000 (a) Inventory turnover = 14.4 (turnovers ) . #250,000 number of weeks in a year 52 weeks in a year 3.61 weeks ; (b) Weeks of supply = number of turnovers 14.4 turnovers Or Weeks of supply = avg. inventory $250,000 $250,000 3.61 weeks . cost of goods sold per week $3,600,000 $69,230.77 52 1 #9. Given: D = 5,200 units of heat sinks per year; H = $3 per unit per year; S = $50 per order; Item cost = $12 per unit; Current order quantity Q = 1,300 units per order. Q 1,300 650 (units ) . 2 2 D 5,200 (b) Number of orders to place in a year = 4 (orders / year ) . Q 1,300 (c) Total annual holding cost = (average inventory)*H= 650*3 = $1,950. (d) Total annual ordering cost = (number of orders/year)*S = 4*$50 = $200. (e) Total annual inventory cost = (total annual holding cost) + (total annual ordering cost) = $1,950 + $200 = $2,150. (a) Average inventory = #10. (continuation of #9) Order quantity is changed to Q=650 units per order. The other data are same as in #9. Q 650 325 (units ) . 2 2 D 5,200 (b) Number of orders to place in a year = 8 (orders / year ) . Q 650 (c) Total annual holding cost = (average inventory)*H= 325*3 = $975. (d) Total annual ordering cost = (number of orders/year)*S = 8*$50 = $400. (e) Total annual inventory cost = (total annual holding cost) + (total annual ordering cost) = $975 + $400 = $1,375. (a) Average inventory = #11. (continuation of #9) Given data are as in Problem #9. 2DS 2 * 5200 * 50 173,333.33 416.33 (units/ord er) . H 3 Q 416.33 208.17 (units) . (b) Average inventory = 2 2 D 5,200 12.49 (orders / year ) . (c) Number of orders to place in a year = Q 416.33 (d) Total annual holding cost = (average inventory)*H= 208.17*3 = $624.51. (e) Total annual ordering cost = (number of orders/year)*S = 12.49*$50 = $624.50. (f) Total annual inventory cost = (total annual holding cost) + (total annual ordering cost) = $624.51 + $624.50 = $1,249.01. (a) Q EOQ 2 #12. Given: D = 5,200 units of bags of plant food per year; H = $5 per unit per year; S = $10 per order; A year has 52 work weeks; Lead time = L = 1 week. 2 DS 2 *1560 *10 6,240 79 (units/ord er) . H 5 (b) Total annual inventory cost = (total annual holding cost) + (total annual ordering cost) Q D 79 1560 = H S *5 *10 197.5 197.46 394.96 . 2 Q 2 79 (c) Reorder Point = (weekly demand)(lead time in week) = d * L 1560 = *1 30 *1 30 (units) . 52 (a) Q EOQ 3 #20. Annual usage cost is calculated by (annual demand)(unit price) for each item. The results are shown in the table below (the columns “ordering cost” and “holding cost” are omitted since they are not relevant to ABC analysis). Annual Unit Annual usage of cost Item # demand price of goods (units$) (units) ($) 101 500 0.5 250 102 1,500 0.2 300 103 5,000 1.0 5,000 104 250 4.5 1,125 105 1,500 1.2 1,800 201 10,000 0.75 7,500 202 1,000 1.35 1,350 203 1,500 0.2 300 204 500 0.8 400 205 100 2.5 300 The results of sorting the above table on “annual usage of cost of goods” in descending order are given in the table below. % of annual usage and cumulative % are also calculated for the purpose of classifying the items into A, B, C classes. Annual usage % of Class % of Cumulative Class of cost of Item # Annual annual % Classification Usage usage goods (units$) 201 7,500 41.04% 41.04% A 68.4% 103 5,000 27.36% 68.40% A 105 1,800 9.85% 78.25% B 202 1,350 7.39% 85.64% B 23.4% 104 1,125 6.16% 91.80% B 204 400 2.19% 93.99% C 102 300 1.64% 95.63% C 203 300 1.64% 97.27% C 8.21% 101 250 1.37% 98.64% C 205 250 1.37% 100.01% C Total 18,275 100.01% 4 #22. Given: There are 250 work days in a year; Average daily usage = d = 8 units of rolls of tape, with standard deviation =3 units, So, annual demand D = 8*250 = 2,000 units of rolls per year; H = $0.30 per roll per year; S = $10 per order; Lead time = L = 2 days. 2DS 2 * 2000 *10 13,333.33 365.15 (rolls/ord er) . H 0.3 (b) Given service level is set at 97%, i.e., 97% of chance or 97% of confidence that no stockout would occur during the lead time period. The corresponding z-value (number of standard deviations) is figured out from the table in Appendix B p.671, which is z=1.88. (a) Q EOQ So, safety stock = SS = z = 1.88*3 = 5.64 rolls. And Reorder Point = R = d*L+SS = 8*2+5.64 = 21.64 rolls. (c) Safety stock = SS = 1.88*3 = 5.64 rolls, as calculated in (b). (d) If the service level is set at 99%, i.e., 99% of chance or 99% of confidence that no stockout would occur during the lead time period. The corresponding z-value is figure out form the table in Appendix B p.671, which is z=2.33. So, safety stock = SS = z = 2.33*3 = 6.99 rolls. And Reorder Point = R = d*L+SS = 8*2+6.99 = 22.99 rolls. (e) Safety stock = SS = 2.33*3 = 6.99 rolls, as calculated in (d). 5 #23. Producing plant food in 50-pound bags. There are 50 work weeks in a year. Weekly demand d=100,000 pounds or d=2,000 bags per week. So, annual demand D = 2,000*50 = 100,000 bags/year. Production capacity p = 250,000 pounds or p = 5,000 bags per week. Setup cost S = $200 for each time starting a batch. Holding cost = $0.55 per bag per year. Currently, the batch size is Q = 1,000,000 pounds = 20,000 bags. Note: In using the formulas, the labels of parameters must be consistent. In the following calculations, we use “bag” to count the amount of plant food all the time. (a) Maximum inventory level = Imax d 2000 Q1 20,0001 20,000 * 0.6 12,000 (bags) . p 5000 (b) Total cost = TC = I D 100,000 12,000 S max H * 200 * 0.55 Q 2 20,000 2 = 1,000 + 3,300 = $4,300. #24. (continuation of #23) (a) EPQ = Q = 2 DS d H 1 p 2 *100,000 * 200 2000 0.551 5000 40,000,000 11,009.6 (bags/batc h) 0.55 * 0.6 d 2000 (b) I max Q1 11,009.61 11,009.6 * 0.6 6,605.76 (bags) . p 5000 I D 100,000 6,605.76 S max H * 200 * 0.55 (c) Total cost = TC = Q 2 1,009.6 2 = 1,816.6 + 1,816.58 = $3,633.18. (d) Penalty cost or opportunity cost of using the current batch size 20,000 bags is: $4,300 - $3,633.18 = $666.82. 6 #30. Given: Monthly demand = 20,000 units of jars, So, annual demand D = 20,000*12 = 240,000 units / year. Ordering cost S=$30/order for both Supplier A and Supplier B. Annual holding cost is 30% of the unit price. (a) For Supplier A. The given price policy with volume discount is: Unit Price Quantity $ 1 – 2499 3.00 2500 – 3499 2.90 3500 – 4999 2.80 5000 or more 2.70 (a-1) We start with the lowest possible price, which is $2.70. Suppose unit price is $2.70. So, holding cost is H=$2.70*30% = $0.81/unit/year. 2DS 2 * 240,000 * 30 4,216 (units/ord er) . H 0.81 Since Q=4,216 is less than 5,000, the unit price $2.70 is not feasible, and this Q is not feasible. Q EOQ (a-2) Try next lowest possible price, which is $2.80 per unit. Now, holding cost is H=$2.80*30% = $0.84/unit/year. 2DS 2 * 240,000 * 30 4,140 (units/ord er) . H 0.84 Since Q=4,140 is within the price bracket of unit price $2.80 as we assumed, this solution is feasible. Q EOQ (a-3) If ordering quantity is lower than the EOQ=4,140, then the overall total cost, OTC, which includes total inventory cost and total item cost, would be higher than that associated with the EOQ. (why?) If order quantity is higher than EOQ=4,140 but lower than the next discount break point 5,000, then the overall total cost would also be higher. (why?) But we need to check the overall total cost at the next discount break point, 5,000, and compare it with the overall total cost associated with EOQ=4.140. (why?) Suppose order quantity is set at EOQ=Q=4,140 units per order. The unit cost would be $2.80, and H would be $0.84 per unit per year. The overall total cost would be: D Q OTC Q 4140 S H C * D where C = unit item cost Q 2 7 240,000 4,140 30 0.84 2.80 * 240,000 4,140 2 1,739.13 1,738.8 672,000 $675,477.93 Suppose order quantity is set at the next discount break point 5,000. That is, Q=5,000 units per order. The unit cost would be $2.70, and H would be $0.81 per unit per year. The overall total cost would be: D Q OTC Q 5000 S H C * D Q 2 240,000 5000 30 0.81 2.70 * 240,000 5,000 2 1,440 2,025 648,000 $651,465 No more discount break point above 5,000. We now can see that setting the order quantity at Q=5,000 is the better choice since its overall total cost, $651,465 is lower than $675,477.93 that is associated with Q=4,140. Therefore, the order quantity should be set at Q=5,000 if using Supplier A. (b) For Supplier B. The given price policy with volume discount is: Unit Price Quantity $ 1 – 1999 3.50 2000 – 2999 3.15 3000 – 3999 2.85 4000 – 4999 2.75 5000 or more 2.60 (b-1) We start with the lowest possible price, which is $2.60. Suppose unit price is $2.60. So, holding cost is H=$2.60*30% = $0.78/unit/year. 2DS 2 * 240,000 * 30 4,297 (units/ord er) . H 0.78 Since Q=4,297 is less than 5,000, the unit price $2.60 is not feasible, and this Q is not feasible. Q EOQ (b-2) Try next lowest possible price, which is $2.75 per unit. Now, holding cost is H=$2.75*30% = $0.825/unit/year. 8 2DS 2 * 240,000 * 30 4,178 (units/ord er) . H 0.825 Since Q=4,178 is within the price bracket of unit price $2.75 as we assumed, this solution is feasible. Q EOQ (b-3) If ordering quantity is lower than the EOQ=4,178, then the overall total cost, OTC, which includes total inventory cost and total item cost, would be higher than that associated with the EOQ. (why?) If order quantity is higher than EOQ=4,178 but lower than the next discount break point 5,000, then the overall total cost would also be higher. (why?) But we need to check the overall total cost at the next discount break point, 5,000, and compare it with the overall total cost associated with EOQ=4.178. (why?) Suppose order quantity is set at EOQ=Q=4,178 units per order. The unit cost would be $2.75, and H would be $0.825 per unit per year. The overall total cost would be: D Q where C = unit item cost OTC Q 4178 S H C * D Q 2 240,000 4,178 30 0.825 2.75 * 240,000 4,178 2 1,723.31 1,723.43 660,000 $663,446.74 Suppose order quantity is set at the next discount break point 5,000. That is, Q=5,000 units per order. The unit cost would be $2.60, and H would be $0.78 per unit per year. The overall total cost would be: D Q OTC Q 5000 S H C * D Q 2 240,000 5000 30 0.78 2.60 * 240,000 5,000 2 1,440 1,950 624,000 $627,390 No more discount break point above 5,000. We now can see that setting the order quantity at Q=5,000 is the better choice since its overall total cost, $651,465 is lower than $675,477.93 that is associated with Q=4,140. Therefore, the order quantity should be set at Q=5,000 if using Supplier B. (c) The table below shows that results we have derived in parts (a) and (b). 9 If using Supplier A If using Supplier B Best order quantity 5,000 units / order 5,000 units / order Lowest overall total cost $651,465 $627,390 Between Supplier A and Supplier B, using Supplier B would be more economical since the overall total cost with it is lower. 10