Multivariate VAR Models II:

Vector Error Correction Models

Johansen FIML Approach

The first part of this lecture draws from K. Juselius online lecturenotes at: http://www.econ.ku.dk/okokj

The second part is from Favero Chapter 2

A VECM is more appropriate to model macro and several financial data. It distinguishes between stationary variables with transitory (temporary) effects and nonstationary variables with permanent (persistent) effects.

The dynamics part of the model describes the SR effects;

The CI relation describes the LR relation between the variables.

US CPI inflation (yoy percent change in the CPI)

Source: Global Financial Data

Since 1975:

.14

.12

.10

.08

.06

.04

.02

.00

1975 1980 1985 1990 1995

USCPIINFL

2000 2005

Since WWII

.20

.16

.12

.08

.04

.00

-.04

45 50 55 60 65 70 75 80 85 90 95 00 05

USCPIINFL

For the last century

.3

.2

.1

.0

-.1

-.2

1825 1850 1875 1900 1925 1950 1975 2000

USCPIINFL

In this lesson, we will look at:

Derivation of the VECM for VAR

Johansen FIML procedure

Testing for the number of CI relations

Decomposition of the components of CI models

Identification problem in the CI relation.

Johansen Full Information Maximum Likelihood (FIML) procedure and higher order systems

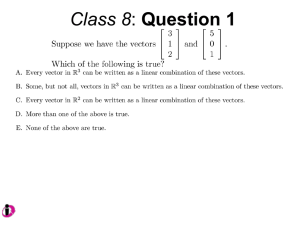

Consider a system of equations where y represents a vector of variables with k=n and p=4. y t

A

1 y t

1

A

2 y t

2

...

A

4 y t

4

u t

Reparameterize the VAR:

Add and subtract y t y t

A

1 y t

1

A

1 y t

1

A

2 y t

2

A

2 y t

2

A

4 y t

3

A

3

( A

3

from RHS: y t

3

(

A

4

A

4

) y t

3

A

4

A

4

) y t

3

y t

3

A

4 y t

4 u t

u t

Add and substract y t y t

A

1 y t

1

A

1 y t

1

(

A

2

A

2 y t

2

A

3

(A

3

(

A

3

A

4

)

A

4

)y t

2

A

4

) y t

2 y t

3

(

A

3 from RHS

(

A

3

A

4

A

4

)

)

y t

2 y t

2

( A

3

A

4

y t

3

A

4

u t

) y t

2

A

4

y t

3

u t

Add and subtract y t

A

1 y t

1

( A

2

A

3

( A

2

A

4

)

A

3 y t

2

A

4

)

( A

2 y t

1

from the RHS

A

3

A

4

) y t

1

( A

2

y t

( A

1

A

2

A

3

A

4

) y t

1

( A

2

A

3

A

4

)

y t

1

( A

3

A

3

A

4

)

y t

2

A

4

)

y t

1

A

4

y t

(

3

A

3

u t

A

4

)

y t

2

A

4

y t

3

u t

Subtract y t

1

from LHS and RHS

y t

( I

A

1

A

2

A

3

A

4

) y t

1

( A

2

A

3

A

4

)

y t

1

( A

3

A

4

)

y t

2

A

4

y t

3

u t

Sum the Ai’s:

y t

4 j

1

( I

A j

) y t

1

4 j

2

A j

y t

1

4 j

3

A j

y t

2

4 j

4

A j

y t

3

u t

y t

y t

1

1

y t

1

2

y t

2

3 y t

3

u t

Substitute n=4 and sum the y’s:

(1)

y t

y t

1

i n

1

1

i

y t

i

u t where

I

n i

1

A i

and

i

n j

i

1

A j

= -A*(L)

If we had started the substitutions from y t

1

we would have a slightly different expression:

y t

y t

n

Here

is placed at y t

n

i n

1

1

i

y t

i

u t

(e.g. Favero)

. This changes the interpretation of

coefficients (they i measure the cumulative LR effects instead of pure transitory effects as in (1)) but the definition of

remains unchanged.

Estimation of the VECM (equation (1))

The rows of this matrix are not linearly independent if the variables are cointegrated.

Each variable appearing in VECM is I(0) either because of first-differencing or to taking linear combinations of variables, which are stationary.

Geometric interpretation

The Johansen approach is based on the relationship between the rank of a matrix and its characteristic roots.

The rank of a matrix = #characteristic roots 0 (i.e.

1

All

All

Some s s

s

1

1

(roots=0)

1

s )= # of cointegrating vectors.

Three cases:

1.

Rank (

) =0: There are no cointegrating variables, all rows are linearly dependent, and the system is nonstationary.

n i

A i

I . First-difference all the variables to remove nonstationarity, then standard inference applies (based on t, F and

2 ). We can thus write the VECM as a simple VAR in first differences:

y t

i n

1

1

i

y t

i

u t

2.

Rank (

) =k (# variables), full rank, hence is nonsingular: all rows (columns) are linearly independent (all variables are stationary, i.e., y t

~I(0)), all roots are in the unit circle with modulus<1, and hence the system is stationary and the levels of variables have stationary means. Estimating with unrestricted OLS the level VAR and the VECM will give identical results.

3.

Rank (

) = r < k. The system is nonstationary but there are r cointegrating relations among the variables (r rows are linearly independent, thus r linearly independent combinations of the { y it

} sequence are stationary). The y vector may be I(1) or higher and the CI relation is determined by

' , o

=a (k x r) matrix of weights, the loading matrix , which measures the average speed of convergence towards LR equilibrium o

= a (k x r) matrix of parameters determining the cointegrating

' y t

1 vectors.

0 is the long-run equilibrium error. The RHS of the VECM contains r cointegrating variables.

Geometric representation---

Example

Consider a bivarite process with 2 lags again. y t

A

1 y t

1

A

2 y t

2

D t

u t

( I p

A

1

L

A

2

L 2 ) y t

y t

D t

u t where D is an exogenous dummy or exogenous variable.

Reparameterize it and express it as an ECM: y t

y t

1

( A

1

A

2

I p

) y t

1

A

2

( y t

2

y t

1

)

D t

u t

y t

y t

1

1

y t

1

D t

u t

If the characteristic polynomial

J. LN, Multiv Models I--

(

)

I p

1

2

2

( 1

) I p

1

( 1

)

(or the companion matrix) has unit root, then

--see ex. 2 in

(

)

0 for

1 and

( 1 )

'

And the ECM model becomes:

y t

' y t

1

1

y t

1

D t

u t

A VECM or a CVAR models several effects:

ij coefficients show the LR equilibrium relationships between levels of variables.

ij coefficients show the amount of changes in the variables to bring the system back to equilibrium.

ij coefficients show the SR changes occurring due to previous changes in the variables.

ij coefficients show the effect on the dynamics of external events.

Testing the number of CI vectors (rank of )

First estimate the parameters of the matrix and then get the associated eigenvalues.

Order the eigenvalues of

( 1 ) as

1

2

..

k

and determine the number of characteristic roots that are significantly different than zero.

Ex:

If rk (

)

0 , then all characteristic roots=0, ln( 1

i

)

If rk (

)

1 , then 0

1

1

ln( 1

1

)

0 and ln( 1

2

)

0

i

ln( 1

3

)

1

i .

...

0 .

Etc.

Two test statistics are used to test the number of cointegrating vectors, based on the characteristic roots. For both the null is at most r cointegrating vectors:

The trace statistics :

trace

( r )

T

k i

r

1 ln( 1

ˆ i

) . The alternative: at most k CI vectors.

It looks at the trace of A(1) = the sum of eigenvalues. If there is no cointegration, then all 1

ˆ i are zero and trA(1)=0. Run the test in sequence: start from the null

of at most 0 CI vectors upto at most k CI vectors against the alternative.

Lambda max statistics : max

( r , r

1 )

T ln( 1

ˆ r

1

) . The alternative: at most r+1 CI vectors. It tests rank r+1 by testing if ˆ r

1 is zero.

Critical values are provided by Johansen.

Note: If the results of the two test statistics are not consistent, go with the trace statistics.

Sample (adjusted): 1959M12 1996M03

Included observations: 436 after adjustments

Series: LOG(RGDP) CPIINFY LOG(M2SAREAL) M2OWN TBILL3

Unrestricted Cointegration Rank Test (Trace)

Hypothesized Trace

No. of CE(s) Eigenvalue Statistic

None *

At most 1 *

0.248081

0.189194

133.7973

73.06545

At most 2

At most 3

0.111896

0.013944

28.39365

3.117806

0.05

Critical Value

69.81889

47.85613

29.79707

15.49471

Prob.**

0.0000

0.0000

0.0719

0.9613

At most 4 0.000595 0.126846 3.841466 0.7217

The VAR model and the MA representation: Duality between CI and common trends

Consider again the ex: y t

A

1 y t

1

A

2 y t

2

D t

u t

( I p

A

1

L

A

2

L

2

) y t

y t

D t

u t

.

Take

0 for simplicity: ( I p

A

1

L

A

2

L

2

) y t

y t

u t

When the characteristic polynomial has a unit root, it is of reduced rank and the determinant

0 for

1 , so it cannot be inverted to express it as a MA.

We can express in two components:

(

)

( 1

)

* (

) where

* is now stationary (no unit root).

We can now write the VAR as:

( I p

L )

* ( L ) y t

u t

( 1

L ) y t

[

* ( L )]

1 u t and express

[

* ( L )]

1 as a MA

[

* ( L )]

1

C

0

C

1

L

C

2

L

2

....

C ( L )

The Beveridge-Nelson decomposition says that C ( L )

C ( 1 )

( 1

L ) C * ( L ) . So we can rewrite the VAR as

y t

C ( 1 ) u t

C * ( L )( 1

L ) u t

.

Integrate both sides (divide by (1-L))

y t

C ( 1 ) z t

C * ( L ) u t

y

0 where z t

u t

and y

0 is the initial conditions of integration that we can set =0.

Y is decomposed into a stationary stochastic component C*(L)u and a stochastic trend

C(1)z (common trends=TR). y t

C

t i

1 u i

C * ( L ) u t

.

The nonstationary component involves restrictions due to CI. We can write it as: y t

C * ( L ) u t

(

α'

β

)

1

(

'

z t

)

Note: an important concept for reduced rank matrices such as

and

is that they have orthogonal complements

and and

'

0 . The

and

such that

'

0 matrices are (p x p) with full rank p.

The deterministic components in the CI model: intercepts in CI relations and

growth rates (H-J. LN II)

When two or more series have the same stochastic and deterministic trends, we can find a linear combination that is trend-free even though the variables are trending.

Include a trend in the cointegration space ( detrending a series). The same argument can be made about major changes e.g. policy or exogenous shocks, which can be captured by “intervention” dummies.

Caution with dummies: in each case, the asymptotic distributional properties of the tests are modified. The Johansen procedure provides different critical values for deterministic trends, but not for the dummies. Must generate the critical values yourself (procedure in RATS).

Consider the VAR(1) system:

(2)

y t

' y t

1

1

y t

1

y

0

u t

We will decompose the intercept y

0 into the mean of the CI relation and a growth component.

' y t

1

is I(0) since it has r cointegrating relations, each with a constant mean:

E [

' y t

1

]

. This describes an (r x 1) vector of intercepts in the CI relations.

y t

is I(0) and therefore it has a constant mean:

E [

y t

]

. This describes a (p x 1) vector of growth rates.

Take the expectations of (2) and replace the means:

( I p

( I p

1

) E (

y t

)

1

)

E (

' y

0

y t

1

)

y

0

y

0

( I p

1

)

growth component mean of CI relation

So, the constant term in the VAR has both components: linear growth rates in the data and the mean values (=intercepts) of the CI relations.

Substitute the two components into the VAR:

Trends and intercepts in a CVAR model

Rewrite (2) with an explicit trend component assuming

1

= 0

(3)

y t

' y t

1

y

0

t

u t

Decompose

(

,

) y and

into two vectors each related to the mean value of the CI relation

0 and the growth rates (

,

) : y

0

(constant) growth rate of y

(constant) growth rate of trend

Substitute them back into (3):

y t

' y t

1

t

t

u t we can write the model with the decomposition of the deterministic terms as:

y t

(

' y t

CI

'

relation ( EC term )

' )

determinis outside

(

tict

) the CI terms relation

u t

' y t

1

y

0

t

u t where y

0

and

and u t

~ NIID ( 0 ,

)

Case 5:

y t

y

0

(

' and unrestricted (no restrictions on y t

1

'

' t )

(

t )

,

,

,

),

Linear trends in the CI relations (I(0) components) and quadratic trends in the level data y t

(the I(1) components). Linear trends in the differenced series quadratic trends in the level y t

. Unless there is a good theoretical reason to include quadratic trends, such as to capture population growth, it is not advisable to include this case. Instead, you should change the model, include more lags, etc.

Case 4:

0 , No restrictions on

,

,

,

y t

(

' y t

1

'

' t )

Both the CI relations and the level data y t

have linear trends. The model excludes quadratic trends. The model contains trend-stationary variables, or an equilibrium relation including a linear trend.

Case 3:

0 No restrictions on

,

,

y t

(

' y t

1

' )

Linear trend in the data but no trends in the CI regressions.

Case 2:

0 ,

y t

(

' y t

1

' )

because

0

t

t .

No linear trends in the level data nor in the CI relations. The only deterministic components=intercepts in the CI relations.

Case 1:

0 ,

y t

' y t

1

No deterministic components in the level data y t

, all intercepts in the CI relations are zero. Too restrictive, don’t use unless there are good reasons.

Identification problem :

The matrices and are not unique, there are many such matrices that contain the cointegration relation(s). Only the cointegration space is estimated consistently but not the cointegration parameters.

To see this, consider a nonsingular matrix B. We can get a new loading matrix

B

1 cointegrating matrix B '

that still gives the same LR relationship: and a

B

1

B

' =

'

The new version of the model is simply a linear transformation of the original model.

This means that it has the same time series properties. But the CI vector that we get may or may not have any economic meaning. See Wickens (1996 EJ). To define

and

uniquely we need to add more information (restrictions on the CI vector).

1. Assigning an identity matrix to the first part of (default in softwares):

'

[ I r

:

'

( K

r ) x r

] . For r=1 , this means normalizing the first coefficient to 1. Economic theory should guide this choice. You cannot choose an arbitrary variable to normalize, since it may not be in the CI vector. This type of restrictions does not change the CI relations and does not affect the value of the likelihood function.

2. Drawing identifying restrictions from theory: these change the value of the likelihood function.

(i) Same restrictions to all equations (ex: whether the dummies are significant or not). These are not identifying restrictions.

(ii) Over-identifying restrictions.

Example: The MD equation (Favero Ch 2): m t

a

0

a

1 m t

1

a

2 m t

2

a

3 y t

1

a

4 y t

2

a

5

R m , t

1

a

6

R m , t

2

a

7

R b , t

1

a

8

R b , t

2

u t where m=ln M/P, Rm, Rb=nominal returns on money and bonds.

In a VAR(2) framework with k=4

m t y

R

R t m b , t

, t

A

0

A

1

m t

1 y

R

R t m b

1

, t

, t

1

1

A

2

m t

2 y

R

R t

m b

,

, t

2 t

2

2

u u u

1 , t

2 u

3 ,

4

, t t

, t

or: x t

A

0

A

1 x t

1

A

2 x t

2

u t

, where x t

'

( m t

, y t

, R m , t

, R b , t

) .

Reparameterized as VECM:

x t

A

0

A ( 1 ) x t

1

A

2

x t

2

u t or:

x t

0

x t

1

1

x t

2

u t

Assume that there are two cointegration relationships drawn from theory:

m-y (velocity of circulation of money from the QTM)

R m

bR b

(banks’ markup on safe asset yield).

Since there are two CI vectors, the rk( )=2. One CI vector = (1,-1) and the other is

(1, -b):

' thus

'

1

0

1

0

0

1

0 b

.

We want to have non zero elements for the money market equilibrium condition and the interest rates. Income elasticity should be 1. Everything else can be random. Thus the LR matrix should look like:

0

0

0

11

11

0

0

0

13

0

0

33

0

14

33

0

0

0

0

11

11

0

0

0

12

0

32

0

12

0

0 b

32 b

To see how we get this we need to answer the following questions:

1. How do we impose the CI restrictions?

Consider the general representation of the CI vector

11

21

31

41

12

22

32

42

,

which in our case is

0

0

11

21

0

0

32

42

with specific values for the betas.

Given our constraints, we want to test whether the null hypothesis is

H

0

:

11

1 ,

21

1 ,

32

1 ,

42

b and

12

22

31

41

0 .

Thus the CI matrix has the form:

'

1

0

1

0

0

1

0 b

.

2. How do we specify the loading matrix alpha?

We know that

11

21

31

41

12

22

32

42

1

0

1

0

0

1

0 b

11

21

31

41

11

21

31

41

12

22

32

42

12 b

22 b

32 b

42 b

. Comparing this (4x4) matrix with

we get:

21

22

31

41

42

0 .

Thus, the loading matrix can be specified as:

0

0

0

11

0

12

32

0

Interpretation of the loadings:

Get back to the VECM model:

m y t t

R m , t

R b , t

0

11

0

0

0

0

0

12

32

1

0

1

0

0

1

0 b

m y t

1

R m , t

1

R t b

1

, t

1

u

1 , t

u u u

3

2 , t

4 , t

, t

0

0

0

0

11

0

12

32

0

m

R m , t t

1

1

y t bR b

1

, t

1

u

1 , t

u u u

3

2 , t

4 , t

, t

We have two CI vectors and the specification of the loading matrix says that if

11

<0 and

12

>0 (a hypothesis we can test)

(i) money demand adjusts to deviations from the velocity of money (first

CI relation) by

11 and to deviations from interest spread (second CI relation) by

12

. It increases with deviations from equilibrium when velocity is too high (m<y) and when the opportunity cost of holding money is too low (Rb<Rm)

(ii) Interest rates on bonds and income do not react to disequilibrium in the velocity of money or interest rate spread.

(iii) Interest rate on money reacts to disequilibrium in the spread by an amount

32

.

An Application: Leeper, Sims, Zha, Hall, Bernanke (BPEA, 1996)

Data file: Favero, lszusa.xls

We will see the interaction of variables from a typical macro model with the US data:

All data is monthly.

Endogenous variables log(M2SAreal): log of real money supply S.A.

CPIinf: yoy CPI inflation rate (%)

Log(RGDP): log of real GDP

M2own: nominal own return to money

Tbill3: 3-month Treasury bill rate.

Exogenous variables:

Constant, trend, PCMinf (PPI for crude materials inflation), break dummies for various periods, taking the value 1 for that period and zero elsewhere.

Objective: specify a VAR model, specify and test for LR CI vectors, specify and test for LR restrictions.

1. Specification of the standard VAR model (no CI)

Decide on the variables that enter the VAR : need a model for this. If the VAR is misspecified because of missing variables, it will create an omitted variable(s) problem and be reflected in serially correlated error terms.

Number of lags . We need to include the optimal number of lags.

Note : increasing the number of lags does not solve the residual correlation if there are omitted variables.

Even if there is no omitted variables and we include the optimal number (or reasonable #) of lags, residuals can still reflect a problem caused by structural breaks . At this stage we will control for them by determining the break dates exogenously.

Note: inclusion of any dummies requires generation of new critical values for the dummies. But we will not do it here.

(We will talk more about the specification issues in the section on VARs)

1. VAR Specification

We start estimating a VAR(15) with a constant and trend: x t

a

0

a

1 t

14 i

1

A i

L i x t

u t where x ' t

{ y t

,

t

, m t

, R t m

, R t b

} .

Although the sample is 1959.7-2001.12 we use the 1960.1-79.6 subsample because after that the Fed changed the implementation of monetary policy from money targeting to interest rate targeting. This would introduce substantial instability in the system.

Run the UVAR with lag length = 15, set of exog variables = {c, trend}. var varbaseline.ls 1 15 log(rgdp) cpiinfy log(m2sareal) m2own tbill3 @ c @trend

VAR Stability Condition Check (lag structure-AR roots):

No roots lie outside the unit circle but there are two quasi-unit roots (modulus>0.98).

Residuals from the baseline VAR: VAR-Residuals-Graph

LOG(RGDP) Residuals CPIINFY Residuals

.024

.020

.016

.012

.008

.004

.000

-.004

-.008

-.012

.8

.6

.4

.2

.0

-.2

-.4

-.6

-.8

62 78 62 64 76 78 64 66 68 70 72 74 76

LOG(M2SAREAL) Residuals

66 68 70 72 74

M2OW N Residuals

.3

.006

.004

.002

.000

-.002

-.004

-.006

-.008

.2

.1

.0

-.1

-.2

62 64 76 78 62 64 66 68 70 72 74 76 78 66 68 70 72 74

TBILL3 Residuals

.8

.6

.4

.2

.0

-.2

-.4

-.6

62 64 66 68 70 72 74 76 78

Many outliers. Normality test is rejected. Misspecification? If so, we need to improve the model. Check first if variables are mismeasured, model is misspecified. Other potential problems are:

Potential Omitted Variables :

Many outliers around the 1 st

oil price shock.

(i) Include a PPI for crude materials (PCM) as an exogenous variable since none of the endog variables is likely to affect it. Include contemporaneous and 6 lags of

PCM.

(ii) Monthly dummies for periods around the oil price increases: 1 for the month of a year, 0 elsewhere.

Generate a series D70 that takes the value 1 for all observation from 1970:1: series d70=0 d70.fill(o=1970:1,l) 1

The first command line generates a series d70 that is filled with zeros. The second is the fill command objectname.fill(options) . We use the option to fill o=[date,integer] , where date is 1970:1, the starting date from which the program starts filling the series, and l is the command to loop over the list of values as many times as it takes to fill the series. The number 1 shows what the program should fill the series with.

You do the same thing for all the dummies you want to create. Then estimate the

VAR (var01), with 15 lags, the dependent variables and the series of independent variables, which start after the @ sign, including the constant, trend, lagged oil price inflation, and all the dummies: var var01.ls 1 15 log(rgdp) cpiinfy log(m2sareal) m2own tbill3 @ c @trend pcminfy(0 to -6) d7306 d7307 d7308 d7310 d7311 d7312 d7402 d7403 d7407 d7408 d7409 d7501 d7505 d7806 d7808 d7811 d7904

Two more points to check:

Parameter constancy

Are there structural shocks to the system due to war, major policy change, oil price changes?

We truncated the sample to avoid breaks due to policy change.

We included control dummies to account for breaks caused by oil price changes.

Increase lag length

We already started with a large lag length.

Residuals from VAR01

LOG(RGDP) Residuals CPIINFY Residuals

.020

.015

.010

.005

.000

-.005

-.010

-.015

-.2

-.4

-.6

.6

.4

.2

.0

62 78 62 64 76 78 64 66 68 70 72 74 76

LOG(M2SAREAL) Residuals

66 68 70 72 74

M2OWN Residuals

.004

.002

.000

-.002

-.004

-.006

-.008

.10

.08

.06

.04

.02

.00

-.02

-.04

-.06

62 64 76 78 62 64 66 68 70 72 74 76 78 66 68 70 72 74

TBILL3 Residuals

.6

.4

.2

.0

-.2

-.4

-.6

62 64 66 68 70 72 74 76 78

There are considerably fewer outliers and the fluctuation bands are smaller. Normality tests are still rejected (though less strongly) but now it is due to kurtosis. Skewness of the series is not significantly different from a normal distribution.

Statistical inference is sensitive to parameter instability, serial correlation in residuals and residual skewness. It is somewhat robust to residual kurtosis and heteroscedasticity.

Thus we have acceptable results with this model.

Lag length

Run a LR test to compare between different lengths of lags (more on this on the lesson on

VARs). Preferably select 15 vs 12 for ex., 12 vs 8, etc.

Following Favero and LSZ we select lag=6

2. VECM Specification

Johansen (1996) tabulated different critical values depending on the specification of the deterministic components.

(i) Rank of

Eviews:

View-Cointegration Test

Specify the model you would like to estimate based on deterministic components.

Specify the exogenous variables (except c and trend).

Here: choose 4 because level data has linear trends and CI may have too.

For #lags: use #(lags for VAR)-1. Here it should be 5 since the VAR is in first-difference.

Output:

You get the results for Trace Test and Maximum Eigenvalue (lambda-max) Test.

Sample (adjusted): 1959M12 1996M03

Trend assumption: Linear deterministic trend

Series: LOG(RGDP) CPIINFY LOG(M2SAREAL) M2OWN TBILL3

Exogenous series: PCMINFY(0 TO -6) D7306 D7307 D7308 D7310 D7311 D7312 D7402 D7403 D7407 D7408 D7409

D7501 D7505 D7806 D7808 D7811 D7904

Warning: Critical values assume no exogenous series

Lags interval (in first differences): 1 to 5

Unrestricted Cointegration Rank Test (Trace)

Hypothesized

No. of CE(s) Eigenvalue

None *

At most 1 *

0.248081

0.189194

Trace

Statistic

133.7973

73.06545

At most 2

At most 3

0.111896

0.013944

28.39365

3.117806

At most 4 0.000595 0.126846

Trace test indicates 2 cointegrating eqn(s) at the 0.05 level

0.05

Critical Value

69.81889

47.85613

29.79707

15.49471

3.841466

* denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

Unrestricted Cointegration Rank Test (Maximum Eigenvalue)

Hypothesized Max-Eigen

No. of CE(s) Eigenvalue Statistic

None * 0.248081 60.73185

At most 1 *

At most 2 *

At most 3

0.189194

0.111896

0.013944

44.67180

25.27584

2.990960

0.05

Critical Value

33.87687

27.58434

21.13162

14.26460

At most 4 0.000595 0.126846 3.841466

Max-eigenvalue test indicates 3 cointegrating eqn(s) at the 0.05 level

* denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

Unrestricted Cointegrating Coefficients (normalized by b'*S11*b=I):

LOG(RGDP) CPIINFY LOG(M2SAREAL) M2OWN

-16.17005

38.66775

-1.407204

0.744846

2.187633

-22.60465

3.314965

6.195358

4.651794

-15.68292

0.616725

0.353712

-4.988204

-0.768622

-1.418077

3.128172

0.911053 26.27699 0.083358

Unrestricted Adjustment Coefficients (alpha):

-13.25400

Prob.**

0.0000

0.0000

0.0719

0.9613

0.7217

Prob.**

0.0000

0.0001

0.0123

0.9473

0.7217

TBILL3

2.460214

-2.872095

0.789988

-0.489658

-0.873680

D(LOG(RGDP))

D(CPIINFY)

D(LOG(M2SAREA

L))

D(M2OWN)

0.000153

0.078769

-0.000217

-0.007806

-0.001046

-0.007659

0.000416

-0.006534

-0.001295

-0.023121

-0.000350

0.000286

D(TBILL3) -0.038561 0.030892 -0.015293

1 Cointegrating Equation(s): Log likelihood 2398.550

Normalized cointegrating coefficients (standard error in parentheses)

LOG(RGDP)

1.000000

CPIINFY

0.087025

LOG(M2SAREAL)

-0.135289

(0.01226) (0.09442)

Adjustment coefficients (standard error in parentheses)

D(LOG(RGDP))

D(CPIINFY)

D(LOG(M2SAREA

L))

D(M2OWN)

D(TBILL3)

-0.002471

(0.00653)

-1.273703

(0.28751)

0.003505

(0.00213)

0.126221

(0.03585)

0.623528

M2OWN

-0.205007

(0.06191)

(0.27049)

2 Cointegrating Equation(s): Log likelihood 2420.886

Normalized cointegrating coefficients (standard error in parentheses)

LOG(RGDP)

1.000000

0.000000

CPIINFY

0.000000

1.000000

LOG(M2SAREAL)

-0.712307

(0.06597)

6.630462

(1.55543)

Adjustment coefficients (standard error in parentheses)

D(LOG(RGDP)) -0.042927 -0.000994

D(CPIINFY)

D(LOG(M2SAREA

L))

(0.01656)

-1.569873

(0.74480)

0.019596

(0.00063)

-0.116549

(0.02829)

0.000615

D(M2OWN)

(0.00535)

-0.126423

(0.09039)

(0.00020)

0.006118

(0.00343)

M2OWN

0.264042

(0.04189)

-5.389799

(0.98773)

0.000261

-0.017939

-2.29E-05

-0.002289

-0.007610

TBILL3

-0.152146

(0.02114)

TBILL3

-0.052140

(0.01135)

-1.149161

(0.26769)

1.77E-05

0.001529

-1.90E-05

-5.22E-05

0.004174

D(TBILL3) 1.818045 0.077272

(0.69365) (0.02635)

Trace test indicates 2, rank test 3 CI vectors. We will go with the trace test results.

We need to impose and test our own restrictions.

Testing of the theories:

In each CI relation, we will look for two sets of relations to test inflation targeting: by controlling MS growth and interest rates.

(i) The money demand equation + the markup of nominal rates over T-bill rates.

(ii) Interest rate reaction function (where authorities adjust nominal interest rates according to inflation and real money balances) + markup of nominal rates.

'

Leave unrestricted. Impose restrictions on

1 st set of identifying restrictions: Money market

Theoretical model:

A traditional money demand and a relation between interest rate on money and bond and inflation (Inflation targeting via the control of money growth).

11 y t

13

R t m

14

R t b

( m

p )

16

T

0

22

Inf t

23

R t m

R t b

0

11 y t

0 y t

0 Inf t

22

Inf t

13

R t m

23

R t m

14

R t b

R b t

( m

0 ( m

p )

16

T p )

0 T

0

0

Remember the CI matrix with 2 CI vectors:

11

12

13

14

15

21

22

23

24

25

We test whether the null hypothesis

H

0

:

12

0 ,

15

1 ,

21

25

26

0 ,

24

1 thus the CI matrix has the form:

'

11

0

0

22

13

23

1

14

1

0

2 nd set of identifying restrictions: interest rate reaction function

Inflation targeting via control of interest rates: nominal rates respond to inflation, output, and a linear trend + relation between interest rates and inflation.

11 y t

Inf t

R t b

16

T

0

22

Inf t

23

R t m

R t b

0

11 y t

0 y t

Inf t

22

Inf t

0 R t m

23

R t m

14

R b t

R b t

0 ( m

0 ( m

p )

p )

16

T

0 T

0

0

We test whether the null hypothesis (ignore trend)

H

0

:

12

1 ,

13

0 ,

15

0 ,

21

25

0 ,

24

1 and thus the CI matrix has the form:

'

0

11

1

22

0

32

14

1

0

0

Application

Run the VECM model with 2 CI relations:

Estimate:VEC, lags 5-Cointegration:#CI vectors 2, model 4-VEC restrictions : impose restrictions :

Restrictions may be placed on the coefficients B(r,k) of the r-th cointegrating relation:

B(r,1)*LOG(RGDP) + B(r,2)*CPIINFY + B(r,3)*M2OWN +

B(r,4)*TBILL3 + B(r,5)*LOG(M2SAREAL)

Enter the first set of identifying restrictions in Eviews:

B(1,2)=0, B(1,5)=1, B(2,1)=0, B(2,4)=1,B(2,5)=0

Sample: 1961M10 1979M06

Included observations: 213

Standard errors in ( ) & t-statistics in [ ]

Cointegration Restrictions:

B(1,2)=0, B(1,5)=1, B(2,1)=0, B(2,4)=1,B(2,5)=0

Convergence achieved after 61 iterations.

Restrictions identify all cointegrating vectors

LR test for binding restrictions (rank = 2):

Chi-square(1) 0.082124

Probability 0.774440

<3.84 hence not reject the null H

Cointegrating Eq:

LOG(RGDP(-1))

CPIINFY(-1)

M2OWN(-1)

TBILL3(-1)

LOG(M2SAREAL(-1))

@TREND(59M07)

C

Error Correction:

CointEq1

CointEq2

D(M2OWN)

0.145519

(0.07717)

[ 1.88563]

-0.009180

(0.00425)

[-2.15916]

[ 5.27202]

1.000000

0.000000

-0.028931

(0.00684)

[-4.23064]

-7.980040

D(CPIINFY)

1.232691

(0.63262)

CointEq2

0.000000

-0.686935

(0.09151)

[-7.50642]

3.079197

(0.58406)

[ 1.94854]

0.157233

(0.03485)

[ 4.51127]

[-7.17853]

0.062989

(0.01104)

[ 5.70367]

1.000000

-0.002725

(0.00086)

[-3.17698]

1.122244

D(LOG(RGDP))

0.036138

(0.01416)

CointEq1

-0.816764

(0.23149)

[-3.52830]

0.000000

-0.268589

(0.03742)

[ 2.55195]

0.001014

(0.00078)

[ 1.29978]

D(LOG(RGDP(-1))) -0.154737 2.348891 0.482651 2.134618 0.008240

Not reject the null hypothesis about the constraints on all variables.

Estimates highly significant.

The 1 st

CI relation is consistent with the traditional MD equation. Income elasticity close to 1, semi-elasticities of interest rates are also consistent with the theory.

Weights of the CI vector: very small reaction by MS to a deviation from the LR in the 1 st

CI relation, although highly significant. The Tbill rate reacts much more strongly to disequilibrium but it has a larger variance.

D(TBILL3)

-1.069758

(0.59866)

[-1.78692]

-0.074209

(0.03298)

[-2.24995]

D(LOG(M2SAREA

L))

-0.019164

(0.00450)

[-4.25777]

-0.000834

(0.00025)

[-3.36202]

2 nd

set of identifying restrictions:

B(1,2)=-1, B(1,3)=0,B(1,5)=0, B(2,1)=0, B(2,4)=1,B(2,5)=0

Standard errors in ( ) & t-statistics in [ ]

Cointegration Restrictions:

B(1,2)=-1, B(1,3)=0,B(1,5)=0, B(2,1)=0, B(2,4)=1,B(2,5)=0

Convergence achieved after 25 iterations.

Restrictions identify all cointegrating vectors

LR test for binding restrictions (rank = 2):

Chi-square(2)

Probability

10.69273

0.004765

>3.84 Reject the null