Click here to presentation

advertisement

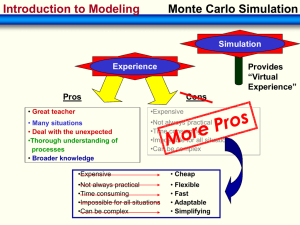

Monte Carlo Simulation A powerful approach to assess uncertainty July 08, 2013 Ravi Saraogi | IFMR Investment Adviser Structure Approach to Uncertainty Introduction to Monte Carlo (MC) Simulations When to use and when not to use MC Simulations Impediments, Benefits and Pitfalls Stylized example Recent criticisms of MC Simulations 2 Approach to Uncertainty Non Probabilistic • Point estimate – one value as the ‘best guess’ for the population parameter • E.g. Sample mean is a point estimate for Population mean Probabilistic • Interval estimate – Range of values that is likely to contain the population parameter • E.g. Sample mean lies within [a.b] with 95% confidence (i.e. a confidence interval) Population Parameter Point Estimate or Interval Estimate Sample Statistic 3 Three types of probabilistic approach Scenario Analysis • Best case, most likely, worst case • Multiple scenarios • Discrete outcomes Decision tree • Discrete outcomes • Sequential decisions Monte Carlo Simulation • Combines both scenario analysis and decision trees • Continuous outcomes 4 Manhattan Project - First electronic computation of Monte Carlo simulation • John Von Neumann, Stanislaw Ulam, and Nicholas Metropolis were part of the Manhattan project during World War II • Solving the chain reaction in highly enriched uranium was too complex with algebraic equations • Hence, they used simulations- plugging many different numbers into the equations and calculating the result. • Systematically plugging in and trying numbers would have taken too long • So they created a new approach -- plugging in randomly chosen numbers into the equations and calculating the results. • Analysing the results with statistics, they were able to make very good predictions which were instrumental in designing of an atomic bomb. 5 Birth of Modern Monte Carlo Simulation “…….The question was what are the chances that a Canfield solitaire laid out with 52 cards will come out successfully? After spending a lot of time trying to estimate them by pure combinatorial calculations, I wondered whether a more practical method than ‘abstract thinking’ might not be to lay it out say one hundred times and simply observe and count the number of successful plays…..” -Eckhardt, Roger (1987). Stan Ulam, John von Neumann, and the Monte Carlo method, Los Alamos Science Stan Ulam Nicholas Metropolis, named it such as Stan’s Uncle would borrow money by saying “I just have to go to Monte Carlo” 6 What is Monte Carlo Simulation? • Uncertain inputs are represented by probability distributions instead of one most likely value • Random sampling is used to select input values from the defined probability distributions, and the model is run over and over again (the idea is to capture all valid combinations of possible inputs) to simulate all possible outcomes Uncertainty in model outputs Uncertainty in model inputs (1) Input Distributional Assumptions (4) Output distribution X (2) (3) Functional relationship (f) + Random sampling Y A Z 7 When is a simulation ‘Monte Carlo’? • The defining characteristic of Monte Carlo simulation is sampling techniques that are entirely random in principle • Monte Carlo sampling satisfies the purist's desire for an unadulterated random sampling method. • Historical simulation is not Monte Carlo simulation – – – – • Past is not prologue – non stationary data All historical path get equal probability Tail risk may not be captured New assets/market To avoid clustering, stratified random sampling can be used – Latin Hypercube sampling 8 Application of Monte Carlo Simulation • Can be solved mathematically – do not use simulation – Probability of Heads/Tails in tossing of an unbiased coin – The likelihood of getting Heads 7 times out of 10 coin tosses • Cannot be solved mathematically- use simulation – Suppose your commute to work consists of the following: • Drive 3 kms on a highway, with 90% probability you will be able to average 20 KMPH the whole way, but with a 10% probability that a free road will result in average speed of 80 KMPH. • Come to an intersection with a traffic light that is red for 10 minutes, then green for 3 minutes. • Travel 1 km, averaging 50 KMMPH with a standard deviation of 10 KMPH. • Come to an intersection with a traffic light that is red for 1 minutes, then green for 30 seconds. • Travel 1 more km, averaging 30 KMMPH with a standard deviation of 5 KMPH. • You want to know how much time to allow for the commute in order to have a 75% probability of arriving at work on time. 9 When to use Monte Carlo Simulation • Not possible to solve mathematically the functional relationship between input and output • You can't work out what the distribution of the output variable or you don't want to do integrals numerically, but you can take samples from input distribution. • Simulation should be used when there are complex interactions that requires input from multiple variables "Calculate when you can, simulate when you can't!” 10 Steps of MC Simulations Select variables o Unlike scenario analysis and decision trees, there is no constraint on how many variables can be allowed to vary in a simulation Specify probability distributions of these variables o This is the key and the most difficult step in the analysis. o Three ways of defining probability distributions o Historical data – Suitable only in the case of stationary data/no structural shifts o Cross sectional data o Pick a statistical distribution that best captures the variability in the input and estimate the parameters for that distribution. Sample randomly from the defined distributions and run the inputs past the Model to get the output Analyze the distribution of the output variable 11 Impediments to Simulation Estimating distributions of input variables o It is far easier to estimate an expected growth rate of 8% in revenues for the next 5 years than it is to specify the distribution of expected growth rates – the type of distribution, parameters of that distribution. Simulation ban be time and resource intensive 12 Benefits and Pitfalls Benefits • Simulation gives a way out when stuck against a complicated intractable mathematical dilemma • Output is a distribution rather than a point estimate – Investment with a higher expected return may have a fat tailed distribution Pitfalls • Garbage in, garbage out: For simulations to have value, the distributions should be based upon analysis and data, rather than guesswork • Benefits that decision-makers get by having a fuller picture of the uncertainty may be more than offset by misuse of simulation 13 Stylized Example 14 Risk in a portfolio of assets • VaR for a single asset – Assume normality – Mean of Rs 120 lakhs and an annual standard deviation of Rs 10 lakhs – With 95% confidence, you can say that the value of this asset will not drop below Rs 100 lakhs (two standard deviations below from the mean) or rise above Rs 140 lakhs (two standard deviations above the mean) over the next year. • VaR for a portfolio of assets – Assume normality – Portfolio mean will be weighted mean of individual assets – For getting variance of the portfolio, co-variances will have to be estimated • In a portfolio of 10 assets, there will be 45 co-variances that need to be estimated, in addition to the 10 individual asset variances Portfolio with three assets- 15 Evaluating risk in a portfolio of assets P(d)) Bond 1 Structure P(d)) Bond 2 P(d)) Bond 3 Costs Interest Received Investor Payouts Investor Return Repayments Reinvestments P(d)) Bond 10 16 Inputs • • • • • • • Cumulative default probabilities will be used as cut offs in a uniform distribution for a binary outcome – default or no default – 5yr: 15% 3yr: 10% 2yr: 5% 1yr: 2% Special case: Use correlated random numbers (r=0.33) Point of default in a bond’s maturity is random Recovery rate is 20% Interest rate assumptions across the time of the investment Semi annual interest payout: 1% (building a default cushion) Surplus cash reinvested as per automated algorithm Bonds give quarterly coupon and bullet principal repayment IRR, Redemption Premium Randomizer Amount Bond (Rs Lakhs) Bond 1 15 Bond 2 5 Bond 3 10 Bond 4 5 Bond 5 15 Bond 6 5 Bond 7 10 Bond 8 5 Bond 9 20 Bond 10 10 Pricing 10.00% 12.00% 8.00% 9.00% 9.00% 10.00% 11.00% 12.00% 12.00% 10.00% Tenure (years) 5 3 5 3 5 3 5 3 5 3 Default (Yes/No) Timing of Default x1 x2 x3 Cash flow model x4 Interest Received Repayments Reinvestments x5 x6 x7 17 Simulation Methods • • • • Set up cash flows and randomizer in Excel, recalculate (F9) and store the value of output variable. Repeat for number of trials. Excel macros Dedicated software/Add ins Data table Multi way data table in Excel 18 Results Without correlation With correlation (r=0.33) Value at Risk (VAR)We can say with 95% confidence that after meeting all interest payments the redemption premium will be at least Rs 2.3 lakhs With correlation (r=0.33) We can say with 95% confidence that after meeting all interest payments the loss on principal will not exceed Rs 11 lakhs 19 Recent criticisms These models were supposed to help quantify and manage the risks of mortgage-backed securities, credit-default swaps and other complex instruments. But given the events of the past couple of years, it appears that the models often gave big institutions, as well as small investors, a false sense of security. Also controversial is that many Monte Carlo simulations assume that market returns fall along a bell-curve-shaped distribution. Critics emphasize that the problem isn't Monte Carlo itself, but the assumptions that go into it. Since no standard approach exists, one user might plug in a range of assumptions on interest rates, inflation or volatility that is different from another user. 20 Thank you 21