here

advertisement

732G29 Time series analysis

Fall semester 2009

• 7.5 ECTS-credits

• Course tutor and examiner: Anders Nordgaard

• Course web: www.ida.liu.se/~732G29

• Course literature:

• Bowerman, O’Connell, Koehler: Forecasting, Time Series and

Regression. 4th ed. Thomson, Brooks/Cole 2005. ISBN 0-53440977-6.

Organization of this course:

• (Almost) weekly “meetings”: Mixture between lectures and

tutorials

• A great portion of self-studying

• Weekly assignments

• Individual project at the end of the course

• Individual oral exam

Access to a computer is necessary. Computer rooms PC1-PC5 in

Building E, ground floor can be used when they are not booked for

another course

For those of you that have your own PC, software Minitab can be

borrowed for installation.

Examination

The course is examined by

1.Homework exercises (assignments) and project work

2.Oral exam

Homework exercises and project work will be marked Passed or

Failed. If Failed, corrections must be done for the mark Pass.

Oral exam marks are given according to ECTS grades. To pass the

oral exam, all homework exercises and the project work must have

been marked Pass.

The final grade will be the same grade as for the oral exam.

Communication

Contact with course tutor is best through e-mail: Anders.Nordgaard@liu.se.

Office in Building B, Entrance 27, 2nd floor, corridor E (the small one close to

Building E), room 3E:485. Telephone: 013-281974

Working hours:

Odd-numbered weeks: Wed-Fri 8.00-16.30

Even-numbered weeks: Thu-Fri 8.00-16.30

E-mail response all weekdays

All necessary information will be communicated through the course web.

Always use the English version. The first page contains the most recent

information (messages)

Assignments will successively be put on the course web as well as information

about the project.

Solutions to assignments can be e-mailed or posted outside office door.

00

ma

j-0

2

no

v-0

1

ap

r-0

1

ok

t-

ma

r- 0

0

au

g-9

9

feb

-9 9

jul98

jan

- 98

jun

- 97

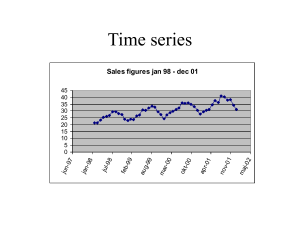

Time series

Sales figures jan 98 - dec 01

45

40

35

30

25

20

15

10

5

0

2001-01-15

2000-01-15

1999-01-15

1998-01-15

1997-01-15

1996-01-15

1995-01-15

1994-01-15

1993-01-15

1992-01-15

1991-01-15

1990-01-15

1989-01-15

1988-01-15

1987-01-15

1986-01-15

1985-01-15

1984-01-15

1983-01-15

1982-01-15

1981-01-15

1980-01-15

Tot-P ug/l, Råån, Helsingborg 1980-2001

1000

900

800

700

600

500

400

300

200

100

0

Characteristics

• Non-independent observations (correlations

structure)

• Systematic variation within a year (seasonal

effects)

• Long-term increasing or decreasing level

(trend)

• Irregular variation of small magnitude

(noise)

Where can time series be found?

• Economic indicators: Sales figures,

employment statistics, stock market indices,

…

• Meteorological data: precipitation,

temperature,…

• Environmental monitoring: concentrations

of nutrients and pollutants in air masses,

rivers, marine basins,…

Time series analysis

• Purpose: Estimate different parts of a time

series in order to

– understand the historical pattern

– judge upon the current status

– make forecasts of the future development

• Methodologies:

Method

This course?

Time series regression

Yes

Classical decomposition

Yes

Exponential smoothing

Yes

ARIMA modelling (Box-Jenkins)

Yes

Non-parametric and semi-parametric analysis

No

Transfer function and intervention models

No

State space modelling

No

Modern econometric methods: ARCH, GARCH,

Cointegration

No

Spectral domain analysis

No

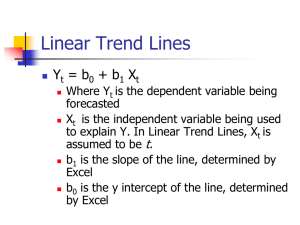

Time series regression?

Let

yt=(Observed) value of times series at time point t

and assume a year is divided into L seasons

Regession model (with linear trend):

yt=0+ 1t+j sj xj,t+t

where xj,t=1 if yt belongs to season j and 0 otherwise, j=1,…,L-1

and {t } are assumed to have zero mean and constant variance

(2 )

The parameters 0, 1, s1,…, s,L-1 are estimated by the Ordinary Least

Squares method:

(b0, b1, bs1, … ,bs,L-1)=argmin {(yt – (0+ 1t+j sj xj,t)2}

Advantages:

• Simple and robust method

• Easily interpreted components

• Normal inference (conf..intervals, hypothesis testing) directly applicable

• Forecasting with prediction limits directly applicable

•Drawbacks:

•Fixed components in model (mathematical trend function and constant

seasonal components)

•No consideration to correlation between observations

Example: Sales figures

Sales figures January 1998 - December 2001

45

40

35

30

25

20

15

10

5

-0

2

M

ay

01

ov

N

r-0

1

Ap

O

ct

-0

0

-0

0

M

ar

9

g9

Au

b99

Fe

8

l-9

Ju

n98

Ja

Ju

n97

0

month

jan-98

feb-98

mar-98

apr-98

maj-98

jun-98

jul-98

aug-98

sep-98

okt-98

nov-98

dec-98

20.33

20.96

23.06

24.48

25.47

28.81

30.32

29.56

30.01

26.78

23.75

24.06

jan-99

feb-99

mar-99

apr-99

maj-99

jun-99

jul-99

aug-99

sep-99

okt-99

nov-99

dec-99

23.58

24.61

27.28

27.69

29.99

30.87

32.09

34.53

30.85

30.24

27.86

24.67

jan-00

feb-00

mar-00

apr-00

maj-00

jun-00

jul-00

aug-00

sep-00

okt-00

nov-00

dec-00

26.09

26.66

29.61

32.12

34.01

32.98

36.38

35.90

36.42

34.04

31.29

28.50

jan-01

feb-01

mar-01

apr-01

maj-01

jun-01

jul-01

aug-01

sep-01

okt-01

nov-01

dec-01

28.43

29.92

33.44

34.56

34.22

38.91

41.31

38.89

40.90

38.27

32.02

29.78

Construct seasonal indicators: x1, x2, … , x12

January (1998-2001):

x1 = 1, x2 = 0, x3 = 0, …, x12 = 0

February (1998-2001):

x1 = 0, x2 = 1, x3 = 0, …, x12 = 0

etc.

x1 = 0, x2 = 0, x3 = 0, …, x12 = 1

December (1998-2001):

sales

time

x1

x2

x3

x4

x5

x6

x7

x8

x9

x10

x11

x12

20.33

1

1

0

0

0

0

0

0

0

0

0

0

0

20.96

2

0

1

0

0

0

0

0

0

0

0

0

0

23.06

3

0

0

1

0

0

0

0

0

0

0

0

0

24.48

4

0

0

0

1

0

0

0

0

0

0

0

0

I

I

I

I

I

I

I

I

I

I

I

I

I

I

32.02

47

0

0

0

0

0

0

0

0

0

0

1

0

29.78

48

0

0

0

0

0

0

0

0

0

0

0

1

Use 11 indicators, e.g. x1 - x11 in the regression model

Analysis with software

Minitab®

Regression Analysis: sales versus time, x1, ...

The regression equation is

sales = 18.9 + 0.263 time + 0.750 x1 + 1.42 x2 + 3.96 x3 + 5.07 x4 + 6.01 x5

+ 7.72 x6 + 9.59 x7 + 9.02 x8 + 8.58 x9 + 6.11 x10 + 2.24 x11

Predictor

Coef

SE Coef

T

P

Constant

18.8583

0.6467

29.16

0.000

time

0.26314

0.01169

22.51

0.000

x1

0.7495

0.7791

0.96

0.343

x2

1.4164

0.7772

1.82

0.077

x3

3.9632

0.7756

5.11

0.000

x4

5.0651

0.7741

6.54

0.000

x5

6.0120

0.7728

7.78

0.000

x6

7.7188

0.7716

10.00

0.000

x7

9.5882

0.7706

12.44

0.000

x8

9.0201

0.7698

11.72

0.000

x9

8.5819

0.7692

11.16

0.000

x10

6.1063

0.7688

7.94

0.000

x11

2.2406

0.7685

2.92

0.006

S = 1.087

R-Sq = 96.6%

R-Sq(adj) = 95.5%

Analysis of Variance

Source

DF

SS

MS

F

P

Regression

12

1179.818

98.318

83.26

0.000

Residual Error

35

41.331

1.181

Total

47

1221.150

Source

DF

Seq SS

time

1

683.542

x1

1

79.515

x2

1

72.040

x3

1

16.541

x4

1

4.873

x5

1

0.204

x6

1

10.320

x7

1

63.284

x8

1

72.664

x9

1

100.570

x10

1

66.226

x11

1

10.039

Unusual Observations

Obs

time

sales

Fit

SE Fit

Residual

St Resid

12

12.0

24.060

22.016

0.583

2.044

2.23R

21

21.0

30.850

32.966

0.548

-2.116

-2.25R

R denotes an observation with a large standardized residual

Predicted Values for New Observations

New Obs

1

Fit

SE Fit

32.502

0.647

95.0% CI

(

31.189,

95.0% PI

33.815)

(

29.934,

35.069)

Values of Predictors for New Observations

New Obs

time

x1

x2

x3

x4

x5

x6

1

49.0

1.00

0.000000

0.000000

0.000000

0.000000

0.000000

x7

x8

x9

x10

x11

0.000000

0.000000

0.000000

0.000000

0.000000

New Obs

1

Sales figures with predicted value

45

40

35

30

25

20

15

10

5

month

What about serial correlation in data?

-0

2

M

ay

01

ov

N

r-0

1

Ap

O

ct

-0

0

-0

0

M

ar

9

g9

Au

b99

Fe

8

l-9

Ju

n98

Ja

Ju

n97

0

Positive serial correlation:

Values follow a smooth pattern

Negative serial correlation:

Values show a “thorny” pattern

How to obtain it?

Use the residuals.

11

ˆ

et yt yˆ t yt 0 ˆ1 t ˆs , j x j ,t ; t 1,...,48

j 1

Residual plot from the regression analysis:

2

Smooth or thorny?

1

0

-1

-2

10

20

30

Month number (from jan 1998)

Durbin Watson test on residuals:

n

d

2

(

e

e

)

t t 1

t 2

n

2

e

t

t 1

Thumb rule:

If d < 1 or d > 3, the conclusion is that residuals (and original data)

are correlated.

Use shape of figure (smooth or thorny) to decide if positive or

negative)

(More thorough rules for comparisons and decisions about positive or

negative correlations exist.)

Durbin-Watson statistic = 2.05

(Comes in the output )

Value > 1 and < 3 No significant serial correlation in residuals!

What happens when the serial correlation is substantial?

Estimated parameters in a regression model get their special properties regarding

variance due to the fundamental conditions for the error terms {t }:

• Mean value zero

• Constant variance

• Uncorrelated

• (Normal distribution)

If any of the first three conditions is violated Estimated variances of estimated

parameters are not correct

• Significance tests for parameters are not reliable

• Prediction limits cannot be trusted

How should the problem be handled?

Besides DW-test, carefully perform graphical residual analysis

If the serial correlation is modest (DW-test non-significant, and

graphs OK) it is usually OK to proceed

Otherwise, amendments to the model is need, in particular by

modelling the serial correlation (will appear later in this course)

Classical decomposition

• Decompose – Analyse the observed time series in its

different components:

– Trend part

(TR)

– Seasonal part

(SN)

– Cyclical part

(CL)

– Irregular part

(IR)

Cyclical part: State-of-market in economic time series

In environmental series, usually together with

TR

• Multiplicative model:

yt=TRt·SNt ·CLt ·IRt

Suitable for economic indicators

Level is present in TRt or in TCt=(TR∙CL)t

SNt , IRt (and CLt) works as indices

Seasonal variation increases with level of

yt

16

14

12

10

8

6

4

2

2

4

6

8

10

12

14

16

• Additive model:

yt=TRt+SNt +CLt +IRt

More suitable for environmental data

Requires constant seasonal variation

SNt , IRt (and CLt) vary around 0

10

9

8

7

6

5

4

3

2

1

2

4

6

8

10

12

14

16

Example 1: Sales data

Observed (blue) and deseasonalised (magenta)

Sales figures jan 98 - dec 01

Observed (blue) and theoretical trend (magenta)

02

ma

j-

1

no

v-0

1

ap

r-0

t-0

0

ok

00

ma

r-

9

au

g-9

-99

feb

98

jul-

45.00

40.00

35.00

30.00

25.00

20.00

15.00

10.00

02

ma

j-

1

no

v-0

1

ap

r-0

t-0

0

ok

00

ma

r-

9

au

g-9

-99

feb

98

jul-

-98

5.00

jan

-97

-98

Observed (blue) with estimated trendline (black)

45.00

40.00

35.00

30.00

25.00

20.00

15.00

10.00

5.00

0.00

jun

jan

jun

ma

j-0

2

no

v -0

1

ap

r -0

1

00

ok

t-

ma

r- 0

0

au

g -9

9

feb

-9 9

jul98

jan

- 98

jun

- 97

-97

45.00

40.00

35.00

30.00

25.00

20.00

15.00

10.00

5.00

0.00

45.00

40.00

35.00

30.00

25.00

20.00

15.00

10.00

5.00

0.00

0.00

mar-97

jul-98

dec-99

apr-01

sep-02

Example 2:

Estimation of components, working scheme

1.

Seasonally adjustment/Deseasonalisation:

•

•

SNt usually has the largest amount of variation among the components.

The time series is deseasonalised by calculating centred and weighted Moving

Averages:

M

( L)

t

yt ( L / 2) yt ( L / 21) 2 ... yt 2 ... yt ( L / 21) 2 yt ( L / 2)

L2

where L=Number of seasons within a year (L=2 for ½-year data, 4 for

quaerterly data och 12 för monthly data)

– Mt becomes a rough estimate of (TR∙CL)t .

– Rough seasonal components are obtained by

• yt/Mt in a multiplicative model

• yt – Mt in an additive model

– Mean values of the rough seasonal components are calculated for

eacj season separetly. L means.

– The L means are adjusted to

• have an exact average of 1 (i.e. their sum equals L ) in a multiplicative

model.

• Have an exact average of 0 (i.e. their sum equals zero) in an additive

model.

– Final estimates of the seasonal components are set to these

adjusted means and are denoted:

sn1 ,, snL

– The time series is now deaseasonalised by

•

yt* yt / snt

in a multiplicative model

•

yt* yt snt

in an additive model

where

snt

is one of

sn1 ,, snL

depending on which of the seasons t represents.

2.

Seasonally adjusted values are used to estimate the trend

component and occasionally the cyclical component.

If no cyclical component is present:

•

•

Apply simple linear regression on the seasonally adjusted values

Estimates trt of linear or quadratic trend component.

The residuals from the regression fit constitutes estimates, irt of

the irregular component

If cyclical component is present:

•

Estimate trend and cyclical component as a whole (do not split

them) by

tct

yt*m yt*( m1) yt* yt*1 yt* m

2 m 1

i.e. A non-weighted centred Moving Average with length 2m+1

caclulated over the seasonally adjusted values

– Common values for 2m+1: 3, 5, 7, 9, 11, 13

– Choice of m is based on properties of the final

estimate of IRt which is calculated as

*

ir

y

•

t

t /(tct )

•

irt yt* (tct )

in a multiplicative model

in an additive model

– m is chosen so to minimise the serial correlation

and the variance of irt .

– 2m+1 is called (number of) points of the

Moving Average.

Example, cont: Home sales data

Minitab can be used for decomposition by

StatTime seriesDecomposition

Choice of model

Option to choose

between two

models

Time Series Decomposition

Data

Sold

Length

47,0000

NMissing

0

Trend Line Equation

Yt = 5,77613 + 4,30E-02*t

Seasonal Indices

Period

Index

1

-4,09028

2

-4,13194

3

0,909722

4

-1,09028

5

3,70139

6

0,618056

7

4,70139

MAPE:

8

4,70139

MAD:

0,9025

9

-1,96528

MSD:

1,6902

10

0,118056

11

-1,29861

12

-2,17361

Accuracy of Model

16,4122

Deseasonalised data have been stored in a column with head DESE1.

Moving Averages on these column can be calculated by

StatTime seriesMoving average

Choice of 2m+1

TC component with 2m +1 = 3 (blue)

MSD should be kept as small as possible

By saving residuals from the moving averages we can calculate MSD

and serial correlations for each choice of 2m+1.

2m+1

MSD

Corr(et,et-1)

3

1.817

-0.444

5

1.577

-0.473

7

1.564

-0.424

9

1.602

-0.396

11

1.542

-0.431

13

1.612

-0.405

A 7-points or 9-points moving average seems most reasonable.

Serial correlations are simply calculated by

StatTime seriesLag

and further

StatBasic statisticsCorrelation

Or manually in Session window:

MTB > lag ’RESI4’ c50

MTB > corr ’RESI4’ c50

Analysis with multiplicative model:

Time Series Decomposition

Data

Sold

Length

47,0000

NMissing

0

Trend Line Equation

Yt = 5,77613 + 4,30E-02*t

Seasonal Indices

Period

Index

1

0,425997

2

0,425278

3

1,14238

4

0,856404

5

1,52471

6

1,10138

MAPE:

7

1,65646

MAD:

0,9057

8

1,65053

MSD:

1,6388

9

0,670985

10

1,02048

11

0,825072

12

0,700325

Accuracy of Model

16,8643

additive

additive

additive

Classical decomposition, summary

Multiplicative model:

yt TRt SNt CLt IRt

Additive model:

yt TRt SNt CLt IRt

Deseasonalisation

• Estimate trend+cyclical component by a

centred moving average:

CMAt

yt ( L / 2) yt ( L / 21) 2 ... yt 2 ... yt ( L / 21) 2 yt ( L / 2)

L2

where L is the number of seasons (e.g. 12, 4, 2)

• Filter out seasonal and error (irregular)

components:

– Multiplicative model:

yt

snt irt

CMAt

-- Additive model:

snt irt yt CMAt

Calculate monthly averages

Multiplicative model:

sn m

1

nm

nm

( snl irl )

Additive model:

sn m

1

nm

for seasons m=1,…,L

nm

( snl irl )

Normalise the monhtly means

Multiplicative model:

snm

sn m

1

L l 1 sn l

L

L

L

l 1

sn l

Additive model:

snm sn m

1

L

L

l 1

sn l

Deseasonalise

Multiplicative model:

yt

dt

snt

Additive model:

dt yt snt

where snt = snm for current month m

Fit trend function, detrend (deaseasonalised) data

trt f (t )

Multiplicative model:

dt

clt irt

trt

Additive model:

clt irt dt trt

Estimate cyclical component and separate from error

component

Multiplicative model:

clt

irt

(cl ir )t k (cl ir )t ( k 1) ... (cl ir )t ... (cl ir )t k

2 k 1

(cl ir )t

clt

Additive model:

clt

(cl ir )t k (cl ir )t ( k 1) ... (cl ir )t ... (cl ir )t k

irt (cl ir )t clt

2 k 1