Risk

advertisement

Lecture 10: Testing Market Efficiency

• The following topics will be covered:

– Different forms of MEH

– Random walk tests

– Variance ratio tests

– Autocorrelation

• Also, review “economic-tricks” on:

– Asymptotic distribution

– Maximum likelihood estimator: efficient estimator

– Method of moment estimator: consistent estimator

– Least square estimator

L10: Market Efficiency Tests

1

Efficient Market Hypothesis

• Reference: Fama (1970, 1991), CLM Ch 1.5

• Definition: asset prices fully reflect available information, to the extent

that no economic profits can be made by trading on the information (see

CLM page 20)

• Three forms:

– Past price, return, or volume

• Sequences and reversals, runs, variance ratio, technical analysis,

momentum and contrarian

– Publicly announced news

• Event studies, accounting stock-selection models

– Private information

• Insider trading, mutual/hedge fund performance*

L10: Market Efficiency Tests

2

Martingale Hypothesis

• E[Pt+1|Pt, Pt-1,…]=Pt or, equivalently, E[Pt+1-Pt|Pt, Pt-1,…]=0

• If Pt represents one’s cumulative wealth at date t from playing some game,

then a fair game is one for which the expected wealth next period is simply

equal to this period’s wealth.

• Another aspect is that nonoverlapping price changes are uncorrelated at all

leads and lags.

• Martingale is considered as a necessary condition for an efficient market

• Does the hypothesis consider risk?

– No

– By considering risk, asset returns should be positive. Thus the martingale

property is not necessary nor sufficient

– Risk-adjusted Martingale

L10: Market Efficiency Tests

3

Issues

• Joint Hypothesis Problem

– any test of market efficiency must assume an asset pricing paradigm. If

we assume a wrong asset pricing model, it may lead to false rejection

of acceptance of market efficiency. Alternatively, the rejection of a

joint-hypothesis test may either be due to market inefficiency or a

wrong asset pricing model used.

L10: Market Efficiency Tests

4

Testing Weak-form EMH

•

Which of the following does weak-form EMH imply?

1.

2.

3.

•

f(rt+k| rt, It ) = f(rt+k|It), or Cov[g(rt+k),h(rk)] = 0 for any g, h

E(rt+k|rt) = u, or Cov[rt+k, h(rt)] = 0 for any h

Or a simple put as Cov(rt+k, rt) = 0

Alternatively, consider stock price Pt+1 = u + Pt + et+1

1.

2.

3.

Random Walk 1 (iid increments): et iid (strongest)

Random Walk 2 (independent increments):

Cov[g(et+1), h(et)]=0

Or (weaker) Cov[et+1, h(et)] = 0

Random Walk 3 (uncorrelated increments): Cov(et+1, et)=0

(weakest), but Cov(et+12, et2) ne 0

L10: Market Efficiency Tests

5

Early Nonparametric Tests

• Early tests (for iid):

– Spearman rank correlation test, Speamn’s footrule test,

Kendall τ correlation test

•

•

•

•

Sequences and Reversals

Runs

See CLM 2.2

Nonparametric tests, using signs of returns, no

distributional assumption for returns required

• Can be used to test both RW1(iid) and RW2

(independence)

L10: Market Efficiency Tests

6

Sequences and Reversals

Assume yt follows an IID random walk without drift. Denote It as the following:

1 if rt pt pt 1 0

It

0 if rt pt pt 1 0

The number of sequence is Ns and the number of reversal is Nr.

n

N s Yt , where Yt I t I t 1 (1 I t )(1 I t 1 )

t 1

Ns n Ns

For any pair of consecutive returns, a sequence and reversal are equally probable. Thus

the Cowles-Jones ratio CJ=Ns/Nr should be approximately equal to one.

When there is a drift in stock return,

1 with probability

It

0 with probability 1

Pr( rt 0) ( )

2 (1 ) 2

CJ

2 (1 )

L10: Market Efficiency Tests

7

Runs

• Use the number of consecutive positive and negative returns

• 1001110100 versus 0000011111

L10: Market Efficiency Tests

8

Tests of RW2: Independent Increments

• Testing for independence without assuming identical

distributions is quite difficult.

• Filter rule

– An asset is purchased when its price increases by x%, and short (short)

when its price drops by x%

– Compare the profit of this dynamic trading portfolio with that of a buyand-hold portfolio

– Need consider transaction costs

• Technical analysis/charting

– Filter rule is an example

– Trading on patterns

L10: Market Efficiency Tests

9

Test of Serial Correlations (RW3)

• Under RW3, the increments of the random walk are

uncorrelated at all leads and lags.

– Therefore, to test RW3, look at the returns and

construct tests based on:

• Autocorrelations at a given order

• Joint test of autocorrelations at multiple orders (BoxPierce test, Ljung-Box test).

• Variance ratios (linear combinations of the

autocorrelations).

L10: Market Efficiency Tests

10

Autocorrelation Coefficients

• With a covariance-stationary time series of continuously

compounded returns, we can define the

– kth order autocovariance, γ(k) (k ) Cov[rt ,rt k ]

– kth order autocorrelation, ρ(k)

Cov[rt ,rt k ] Cov[rt ,rt k ]

– Sample counterparts: (k )

r r

Var (rt )

t

T

t k

1

( rt rT )(rt k rT )

T t 1

ˆ (k )

ˆ

(k )

ˆ (0)

ˆ (k )

1 T

rT rt

T t 1

L10: Market Efficiency Tests

11

Sampling Theory for Autocorrelations

• If rt is iid (RW1), and finite first 6 moments,

T k

O(T 2 )

T (T 1)

T k

2

Cov[ ˆ (k ),ˆ (l )]

O

(

T

) if k l 0

2

T

O(T 2 ) otherwise.

E[ ˆ (k )]

• Negative bias (E(ρ) is negative) in sample autocorrelations

– This is follows because of the estimation procedure.

– You have to estimate the sum of the cross products of deviations from

a mean (that is itself estimated).

– Deviations from the sample mean are zero by construction so positive

deviations must eventually be followed by negative deviations.

– When you multiply these deviations together, the result is a negative

bias.

L10: Market Efficiency Tests

12

Asymptotic Distribution

• If rt is iid (RW1), and finite first 6 moments, sample

autocorrelations are asymptotically ( T ∞ ) normal:

a

ˆ (k ) ~ N (0,1)

T

• Joint tests:

– Box-Pierce Statistic

m

Qˆ m T ˆ 2 (k ) ~ m2

k 1

m

– Ljung-Box Statistic Qˆ m T (T 2)

'

k 1

2 (k )

T k

~ m2

• Can be extended beyond RW1

L10: Market Efficiency Tests

13

Variance ratio test

• Intuition

VR (2)

Var[rt (2)] Var[rt rt 1 ]

2Var[rt ]

2Var[rt ]

2Var[rt ] 2Cov[rt ,rt 1 ]

2Var[rt ]

1 (1)

• Under the RW null VR(2) = 1

• With positive (negative) first-order autocorrelation VR > (<) 1.

q 1

k

Var

[

r

(

q

)]

t

• To Generalize, VR (q)

1 2 1 (k )

q

k 1

– Why?

– VR(q) is a particular linear combination of ρ(k)

– Linearly declining weights

qVar[rt ]

• Under all three RW nulls, VR(q) = 1, but the asymptotic

distributions for sample VR(q) are different

L10: Market Efficiency Tests

14

Under RW1

• We estimate VAR(r (1)) a2 VAR(r (2)) b2

2

• Variance ( b ) estimated using non-overlapping data:

• Asymptotic distributions for sample variances:

a

2n (ˆ

2

a

) ~ N (0,2 4 )

2n (ˆ

2

b

) ~ N (0,4 4 )

2

2

a

• Question: how about asymptotic distributions for

2

2

2

ˆ

b

ˆ a ˆ b

ˆ a2

L10: Market Efficiency Tests

15

Results from Hausman’s Specification Test

• θe : asymptotically efficient estimator; θc : consistent estimator

• Among all consistent estimators, the efficient estimator has

the lowest variance

• Hauseman (1978): Cov [θe , θc - θe ] = 0

• Otherwise, let Cov [θe , θc - θe ] = γ, there exists w such that,

Var [ θe + w (θc - θe )] < Var (θe) contradicts efficiency of

θe

• Applied to ˆ a2 ˆb2

Var[ 2n (ˆ b2 ˆ a2 )] Var ( 2nˆ b2 ) Var ( 2nˆ a2 )

or

a

2n (ˆ ˆ ) ~ N(0, 2 4 )

2

b

2

a

L10: Market Efficiency Tests

16

ˆ

• How about

ˆ

2

b

2

a

Delta Method

?

• Take 1st order Taylor expansion:

ˆ b2

2 2

1

2

2

2

2

4 (ˆ a ) 2 (ˆ b ) 2

2

ˆ a

• Therefore,

ˆ b2

1

1

2

Var ( 2n 2 ) 4 Var ( 2nˆ a2 ) 4 Var ( 2nˆ b2 ) 4 Cov( 2nˆ a2 , 2nˆ b2 )

ˆ a

244 2

or

a

ˆ b2

2n ( 2 - 1) ~ N(0,2)

ˆ a

• Delta method is discussed on page 118, Greene (2000)

L10: Market Efficiency Tests

17

Generalization: VD(q) and VR(q)

• Data is nq+1 observations of log prices {p0,…,pqn) where q is an integer

greater than 1. Consider the following estimators:

• Asymptotic distributions under RW1:

L10: Market Efficiency Tests

18

Refinements

• Using overlapping observations to estimate q-period variance:

• Bias adjustment:

• (nq)1/2VD(q) N( 0, 2(2q-1)(q-1)/(3q) σ4 )

• (nq)1/2 [VR(q) -1] N( 0, 2(2q-1)(q-1)/(3q) )

L10: Market Efficiency Tests

19

Testing RW3

• Under RW3, rt no longer iid. heteroskedasticity.

• Properties that still hold:

– VD(q) 0, VR(q)

1 q 1

_

a

k

VR (q) 1 2 1 ˆ (k )

– And,

q

k 1

– Further, sample autocorrelations at different orders are

uncorrelated. E( ˆ k ˆ m ) 0 , for k m

– Therefore, variance of VR(q) remains of the form:

• Properties that no longer hold:

– Asymptotic variances ˆk of sample autocorrelations ˆ k

– Asymptotic variances ˆ(q) of VR(q)

L10: Market Efficiency Tests

20

Long-Horizon Returns

Basic Structure (page 56-57, CLM):

pt wt yt ; wt wt 1 t ; yt= any zero-mean stationary process

wt is the “fundamental” component that reflects the efficient markets price, and yt is a

zero-mean stationary component (mean reversion) that reflects a short-term or transitory

deviation from the efficient-market price wt, implying the presence of “fads” or other

market inefficiency.

We have rt pt pt 1 t yt yt 1

q1

q 1

j 0

k 0

rt (q) rt j q t k yt yt q

Var[rt (q)] q 2 2 y (0) 2 y (q) , where γ is the autocovariance function of y.

Var[rt (q)]

VR (q)

qVar[rt ]

Var[rt (q)]

Var[y]

VR (q)

1

qVar[rt ]

Var[p]

W

e

c

a

n

s

h

o

w

:

L10: Market Efficiency Tests

21

Empirical Evidence

• Autocorrelations

– Daily (1962-1994) equal-weighted CRSP index has a firstorder autocorrelation of 35.0% (with a standard error of

1.11%). Implies that 12.3% of the daily variation is

explainable by lagged return (page 66 CLM).

– Box-Pierce Q statistic for 5 autocorrelations has value

263.3. The 99.5-percentile for 25 is 16.7.

– Weekly and monthly returns exhibit similar patterns for the

indexes

L10: Market Efficiency Tests

22

Empirical Evidence

• Variance Ratios

– As the autocorrelations suggest the variance ratios are

greater than one.

– The equal-weighted index has VR’s that are highly

significant, larger in the 1st half of the sample (a common

pattern). VR’s increase in q suggesting positive serial

correlation for multiperiod returns.

– VR’s of the value-weighted index are greater than one but

insignificant in full sample and both subsamples. Suggests

that firm size is an interesting issue.

– Rejection of RW stronger for smaller firms. Their returns

more serially correlated.

L10: Market Efficiency Tests

23

Empirical Evidence

• Individual Securities

– Variance ratios suggest small negative serial correlations.

– Insignificance likely due to fact that with so much

nonsystematic risk any predictable components are hard to

find.

L10: Market Efficiency Tests

24

Evidence of Cross-Correlation

• The contrast with the indexes is suggestive: large positive crossautocorrelations across individual securities across time

• In addition to evidence of significant autocorrelations, there are also evidence

of significant cross-autocorrelations (account for a half of the return

predictability). This is another source of return predictability.

• Lo and MacKinlay (1990) argue that cross-autocorrelation is the main source

of profits for short-term contrarian strategies. Therefore, contrarian profits

may not necessarily be evidence of market overreaction.

• Notations:

Rt : vector of returns; E( Rt ) = u

k-th order autocovariance Matrix: Γ(k) = Cov[ Rt-k , Rt ]

k-th order autocorrelation matrix: Ŷ(k)

L10: Market Efficiency Tests

25

Evidence from Long-Horizon Returns

• Negative serial correlation in multi-year index returns

• Fama and French (1988), Poterba and Summers (1988)

• There is a substantial mean revision in stock market prices at

longer horizons

• Caveat: small sample size makes inference less reliable

– Only 12 nonoverlapping five-year returns

L10: Market Efficiency Tests

26

Economic-Trick Review

(1) Asymptotic Distributions

See Greene (2000, Chapter 4, Statistical Inference).

d

If n( xn ) /

N0,1, then approximately, or asymptotically,

a

xn

N , 2 / n, which we write as

a

xn

N , 2 / n ,

Extending this definition to the multivariate case, suppose that θˆ n is an

estimator of the parameter vector θ . The asymptotic distribution of the vector

θˆ n is obtained from the limiting distribution:

d

n (ˆn )

N 0, V , which implies that

a

ˆθ ~ N , 1 V

n

n

The covariance matrix of the asymptotic distribution is the asymptotic

covariance matrix, denoted as

1

Asy .Var [ˆn ] V

n

L10: Market Efficiency Tests

27

(2) Maximum Likelihood Estimator

This material is from Chapter 4, Greene 2000

The principle of maximum likelihood provides a means of choosing an asymptotically

efficient estimator for a parameter or a set of parameters. Each observation is considered

as a realization from a random sample:

n

f (x 1 , x 2 ,...,x n , θ) f (x i ,θ) L(θ | X)

i 1

n

ln L(θ | X) ln f (x i , θ)

i 1

The necessary condition for maximizing ln L(θ | X) is:

ln L(θ)

0 -- known as “likelihood equation”

θ

L10: Market Efficiency Tests

28

MLE Example

Likelihood for the Normal Distribution

In sampling from a normal distribution with mean and variance 2 , the log-likelihood

function and the likelihood equations for and variance 2 are

n

n

1 n ( xi ) 2

2

ln L( , ) ln(2 ) ln [

]

2

2

2 i 1

2

ln L

1 n

2 ( xi ) 0

i 1

2

ln L

n

1

2

2 2 2 4

n

ˆ ML

1

n

ˆ

1 n

( xi x n ) 2

n i 1

2

ML

x

i 1

i

n

(x

i 1

i

) 2 0

x n

L10: Market Efficiency Tests

29

Properties of MLE

M1: Consistency: p limˆML

a

M2: Asymptotic normality: ˆML

N , I ( ) 1 , , where I ( ) E[ 2 ln L / ],

M3. Asymptotic efficiency: ˆ is asymptotically efficient and achieves the Cramer-Rao

ML

lower bound for consistent estimators, given in M2, Theorem 4.2, (4-12), and (4-13).

M4: Invariance: The maximum likelihood estimator of c( ) is c(ˆML ) .

2 ln L( ) 1

]} , also known as

Asymptotic Covariance Matrix of MLE: [ I ( )] { E[

the information matrix. It is evaluated at ˆML .

Suppose y2 f ( x2 , , E[ y1 | x1 ,1 ])

1

FIML estimation: estimating the joint distribution f(y1,y2)

LIFL estimation: estimating y1 first, then maximize a conditional log-likelihood function

n

^

using the estimates from step1: LnL f ( y12 | xi 2 , 2 , ( xi 2 ,1 )])

i 1

L10: Market Efficiency Tests

30

(3) Consistent Estimator: MOM

The idea is that to estimate K parameters, 1 ,..., k , we compute K statistics, m1, …, mk.

Consider random sampling from a distribution f ( x 1 ,, k ) with finite moments E[ x k ] .

The sample consists of n observations, x1 ,, xn . The kth “raw” or uncentered moment is

1 n k

mk xi

n i 1

By sustituting z i xik , we obtain the following results. By (3-14) and Theorem 4.1,

E[mk ] k E[ xik ]

1

1

Var [mk ] Var [ xik ] ( 2 k k 2 )

n

n

p lim mk k E[ xik ]

d

n (mk k )

N[0, 2 k k 2 ]

L10: Market Efficiency Tests

31

MOM

1 E[ xi ]

In general, k will be a function of the underlying parameters. By computing K raw

moments and equating them to these functions, we obtain K equations that can be solved

to provide estimates of the K unknown parameters.

g is from the sample, gamma is the parameter. The following is called the K moment

equations.

g 1 1 (1 ,..., k ) 0

g 2 2 (1 ,..., k ) 0

.

.

.

g k k (1 ,..., k ) 0

L10: Market Efficiency Tests

32

MOM Estimator of N(μ,σ2)

In random sampling from N[, 2 ] ,

1 n

p lim xi p limm1 E[ xi ]

n i 1

1 n 2

p lim xi p limm2 Var[ xi ] 2 2 2

n i 1

Note: the variance of MOM estimator of μ is 2 / n

2

T

h

e

v

a

r

i

a

n

c

e

o

f

M

O

M

e

s

t

i

m

a

t

o

r

o

f

i

s

w

h

a

t

L10: Market Efficiency Tests

e

v

e

r

l

.

i

s

t

e

d

i

n

G

r

e

e

n

e

’

s

b

o

o

k

33

.

(4) Assumptions of Linear Regression Models

(1)

(2)

(3)

(4)

(5)

Linear functional form of the relationship

X is an nxK matrix with rank K

E ( | X) = 0

Var( | X) 2 -- Spherical disturbances

nonstochatic regressors

(6) normality: ε | X =N[0,σ2I]

L10: Market Efficiency Tests

34

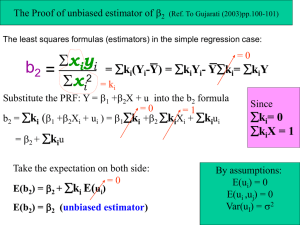

(5) Least Square Estimation

yi x'i β i

This is an unknown relation between x and y. In other words, E[ yi | x i ] x 'i β

^

The estimate of E[ yi | x i ] is denoted y i x 'i b

yi x'i b ei

One way to estimate this is the least square estimator:

min (y Xβ 0 )' (y Xβ 0 )

β0

We get X' Xb X' y

b (X' X) 1 X' y

For finite samples, b follows any distribution with a mean of β and variance of

2 (X' X) 1 . For large samples, when the regression model has normally distributed

disturbance, b has the minimum variance.

L10: Market Efficiency Tests

35

Generalized Least Squares

^

(X ' X ) X ' y

1

1

1

When Ω is unknown, feasible generalized least squares (FGLS)

approach can be used. To be specific, we can assume a specific

form of variance-covariance matrix, either autocorrelation or

heteroscedasticity, then estimate it. See page 465 to 470 of

Greene (2000).

There are other ways to estimate beta here, such MLE and

MOM.

SAS Procedure: Proc Model

L10: Market Efficiency Tests

36

Exercises

• 2.4; 2.5 CLM

• Use monthly data to make Table 2.8 and 2.9, page 75, CLM

• Exercises regarding MLE, MOM and GLS

L10: Market Efficiency Tests

37