Forecasting - Troy J Wishart

advertisement

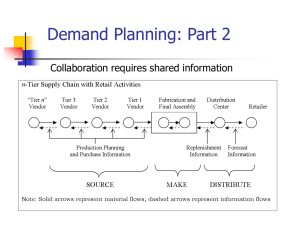

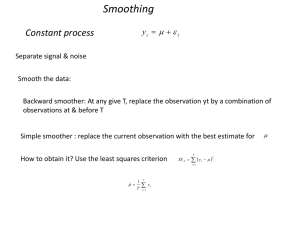

Forecasting MNG221 - Management Science Lecture Outline • • • • • Forecasting basics Moving average Exponential smoothing Linear trend line Forecast accuracy Forecasting Forecasting Basics Forecasting Basics • A Forecast – is a prediction of something that is likely to occur in the future. • A variety of forecasting methods exist, and their applicability is dependent on the: –time frame of the forecast (i.e., how far in the future we are forecasting), Forecasting Basics • A variety of forecasting methods exist, and their applicability is dependent on the: –the existence of patterns in the forecast (i.e., seasonal trends, peak periods), and –the number of variables to which the forecast is related. Forecasting Forecasting Components Forecasting Components • Time Frames of Forecast: –Short Range - encompass the immediate future and are concerned with the daily operations rarely goes beyond a couple months into the future. Forecasting Components • Time Frames of Forecast: –Medium Range - encompasses anywhere from 1 or 2 months to 1 year. –More closely related to a yearly production plan and will reflect such items as peaks and valleys in demand Forecasting Components • Time Frames of Forecast: –Long Range - encompasses a period longer than 1 or 2 years. –It is Related to management's attempt to plan new products for changing markets, build new facilities, or secure long-term financing. Forecasting Components • Forecasts can exhibit patterns or trend: –A trend is a long-term movement of the item being forecast –Random variations are movements that are not predictable and follow no pattern (and thus are virtually unpredictable). Forecasting Components Forecasts can exhibit patterns or trend: A cycle is an undulating movement in demand, up and down, that repeats itself over a lengthy time span (i.e., more than 1 year). A seasonal pattern is an oscillating movement in demand that occurs periodically (in the short run) and is repetitive. Seasonality is often weather related. Forecasting Components: Forecast Patterns Forms of forecast movement: (a) trend, (b) cycle, (c) seasonal pattern, and (d) trend with seasonal pattern Forecasting Forecasting Methods Forecasting Methods The forecasting component determines to a certain extent the type of forecasting method that can or should be used. • Time Series - is a category of statistical techniques that uses historical data to predict future behavior. Forecasting Methods • Regression (or causal) methods attempt to develop a mathematical relationship (in the form of a regression model) between the item being forecast and factors that cause it to behave the way it does. Forecasting Methods • Qualitative methods - use management judgment, expertise, and opinion to make forecasts. • Often called "the jury of executive opinion," • They are the most common type of forecasting method for the long-term strategic planning process. Forecasting Methods Time Series Analysis Time Series Methods •Time series methods tend to be most useful for short-range forecasting, (although they can be used for longer-range forecasting) and relate to only one factor time. Time Series Methods • Two types of time series methods: 1. The Moving Average a)Simple Moving Average b)Weighted Moving Average 2. Exponential Smoothing. Time Series – Moving Average Moving Averages • The moving average method uses several values during the recent past to develop a forecast. • The moving average method is good for stable demand with no pronounced behavioral patterns. Time Series – Moving Average Moving Averages • Moving averages are computed for specific periods, such as 3 months or 5 months, depending on how much the forecaster desires to smooth the data. Time Series – Moving Average Simple Moving Averages • Moving average forecast may be computed for specified time period as follows: n MA i , t Di i 1 where n n = number of periods in the moving average D = data in period i Time Series – Moving Average Simple Moving Averages - Delivery Orders for 10-month period Month Orders Delivered per Month January 120 February 90 March 100 April 75 May 110 June 50 July 75 August 130 September 110 October 90 Time Series – Moving Average Simple Moving Averages Example • The moving average from the demand for orders for the last 3 months in the sequence: Time Series – Moving Average Simple Moving Averages Example • The 5-month moving average is computed from the last 5 months of demand data, as follows: Time Series – Moving Average Simple 3- and 5- month Moving Average Time Series – Moving Average Simple 3- and 5- month Moving Average Longer-period moving averages react more slowly to recent demand changes than do shorter-period moving averages. Time Series – Moving Average Weighted Moving Average • The major disadvantage of the Simple Moving Average method is that it does not react well to variations that occur for a reason, such as trends and seasonal effects (although this method does reflect trends to a moderate extent). Time Series – Moving Average Weighted Moving Average • The Simple Moving Average method can be adjusted to reflect more closely more recent fluctuations in the data and seasonal effects. • This adjusted method is referred to as a Weighted Moving Average method. Time Series – Moving Average • Weighted Moving Average - is a time series forecasting method in which the most recent data are weighted. • It may be computed for specified time period using the following: Time Series – Moving Average • Weighted Moving Average - Where: Wi = the weight for period i, is between 0% and 100% ∑Wi =1.00 Di = data in period i Time Series – Moving Average Weighted Moving Average For example, if the Instant Paper Clip Supply Company wants to compute a 3-month weighted moving average with a weight of 50% for the October data, a weight of 33% for the September data, and a weight of 17% for August, it is computed as. Time Series – Moving Average Weighted Moving Average - Table Time Series – Exponential Smoothing • The Exponential Smoothing forecast method is an averaging method that weights the most recent past data more strongly than more distant past data. • There are two forms of exponential smoothing: 1. Simple Exponential Smoothing 2. Adjusted Exponential Smoothing (adjusted for trends, seasonal patterns, etc.) Time Series – Exponential Smoothing Simple Exponential Smoothing • The simple exponential smoothing forecast is computed by using the formula: F t 1 D t (1 ) F t Time Series – Exponential Smoothing Simple Exponential Smoothing F t 1 D t (1 ) F t where Ft+1 = the forecast for the next period Dt = the actual demand for the present period Ft = the previously determined forecast for the present periods α = a weighting factor referred to as the smoothing constant Time Series – Exponential Smoothing Simple Exponential Smoothing • The smoothing constant, α, is betw. 0 & 1. • It reflects the weight given to the most recent demand data. »For example, if α = .20, »Ft+1 = .20Dt + .80Ft • This means that our forecast for the next period is based on 20% of recent demand (Dt) and 80% of past demand. Time Series – Exponential Smoothing Simple Exponential Smoothing • The higher α is (the closer α is to one), the more sensitive the forecast will be to changes in recent demand. • Alternatively, the closer α is to zero, the greater will be the dampening or smoothing effect. Time Series – Exponential Smoothing Simple Exponential Smoothing • The most commonly used values of α are in the range from .01 to .50. • However, the determination of α is usually judgmental and subjective and will often be based on trial-and-error experimentation. Time Series – Exponential Smoothing Simple Exponential Smoothing Example Period Month Demand 1 January 37 2 February 40 3 March 41 4 April 37 5 May 45 6 June 50 7 July 43 8 August 47 9 September 56 10 October 52 11 November 55 12 December 54 •A company - PM Computer Services has accumulated demand data in table for its computers for the past 12 months. •It wants to compute exponential smoothing forecasts, using smoothing constants (α) equal to 0.30 and 0.50. Time Series – Exponential Smoothing Simple Exponential Smoothing Example • To develop the series of forecasts for the data i, start with period 1 (January) and compute the forecast for period 2 (February) by using α = 0.30. • The formula for exponential smoothing also requires a forecast for period 1, which we do not have, so we will use the demand for period 1 as both demand and the forecast for period 1. Time Series – Exponential Smoothing Simple Exponential Smoothing Example • Thus the forecast for February is: –F2 = αD1 + (1 - α)F1 –= (.30)(37) + (.70)(37) = 37 units Time Series – Exponential Smoothing Simple Exponential Smoothing Example • The forecast for period 3 is computed similarly: F3 = α D2 + (1 - α)F2 = (.30)(40) + (.70)(37) = 37.9 units • The final forecast is for period 13, January, and is the forecast of interest to PM Computer Services: F13 = α D12 + (1 - α)F12 = (.30)(54) + (.70)(50.84) = 51.79 units Time Series – Exponential Smoothing Simple Exponential Smoothing Example Period Month Demand Forecast, Ft + 1 a = 0.30 a = 0.50 1 January 37 2 February 40 37.00 37.00 3 March 41 37.90 38.50 4 April 37 38.83 39.75 5 May 45 38.28 38.37 6 June 50 40.29 41.68 7 July 43 43.20 45.84 8 August 47 43.14 44.42 9 September 56 44.30 45.71 10 October 52 47.81 50.85 11 November 55 49.06 51.42 12 December 54 50.84 53.21 13 January 51.79 53.61 Time Series – Exponential Smoothing Simple Exponential Smoothing Example • In general, when demand is relatively stable, without any trend, using a small value for α is more appropriate to simply smooth out the forecast. • Alternatively, when actual demand displays an increasing (or decreasing) trend, as is the case, a larger value of α is generally better. Time Series – Exponential Smoothing Adjusted Exponential Smoothing • The adjusted exponential smoothing forecast consists of the exponential smoothing forecast with a trend adjustment factor added to it. • The formula for the adjusted forecast is: AFt+1 = Ft+1 + Tt+1 where T = an exponentially smoothed trend factor Time Series – Exponential Smoothing Adjusted Exponential Smoothing • The trend factor is computed much the same as the exponentially smoothed forecast. • It is, in effect, a forecast model for trend: Tt+1 = β(Ft+1 - Ft) + (1 - β)Tt where Tt = the last period trend factor β = a smoothing constant for trend Time Series – Exponential Smoothing Adjusted Exponential Smoothing • Like α, β is a value between 0 and 1. • It reflects the weight given to the most recent trend data. • Also like α, β is often determined subjectively, based on the judgment of the forecaster. Time Series – Exponential Smoothing Adjusted Exponential Smoothing • A high β reflects trend changes more than a low β. • It is not uncommon for β to equal α in this method. • The closer β is to one, the stronger a trend is reflected. Time Series – Exponential Smoothing Adjusted Exponential Smoothing Example • PM Computer Services now wants to develop an adjusted exponentially smoothed forecast, using the same 12 months of demand. • The adjusted forecast for February, AF2, is the same as the exponentially smoothed forecast because the trend computing factor will be zero (i.e., F1 and F2 are the same and T2 = 0). Time Series – Exponential Smoothing Adjusted Exponential Smoothing Example • Thus, we will compute the adjusted forecast for March, AF3, as follows, starting with the determination of the trend factor, T3: – T3 = β (F3 - F2) + (1 β)T2 = (.30)(38.5 - 37.0) + (.70)(0) = 0.45, and – AF3 = F3 + T3 = 38.5 + 0.45 = 38.95 Time Series – Exponential Smoothing Adjusted Exponential Smoothing • Period 13 is computed as follows: –T13 = β(F13 - F12) + (1 β)T12 –= (.30)(53.61 - 53.21) + (.70)(1.77) = 1.36 and • AF13 = F13 + T13 = 53.61 + 1.36 = 54.96 units Time Series – Exponential Smoothing Trend (Tt +1) Adjusted Forecast (AFt +1) Period Month Demand Forecast (Ft +1) 1 January 37 37.00 2 February 40 37.00 0.00 37.00 3 March 41 38.50 0.45 38.95 4 April 37 39.75 0.69 40.44 5 May 45 38.37 0.07 38.44 6 June 50 41.68 1.04 42.73 7 July 43 45.84 1.97 47.82 8 August 47 44.42 0.95 45.37 9 September 56 45.71 1.05 46.76 10 October 52 50.85 2.28 53.13 11 November 55 51.42 1.76 53.19 12 December 54 53.21 1.77 54.98 13 January 53.61 1.36 54.96 Time Series – Exponential Smoothing Simple Exponential Smoothing Example Time Series – Linear Trend Line Linear Trend Line • Linear regression is most often thought of as a causal method of forecasting in which a mathematical relationship is developed between demand and some other factor that causes demand behavior. Time Series – Linear Trend Line Linear Trend Line • However, when demand displays an obvious trend over time, a least squares regression line, or linear trend line, can be used to forecast demand. • A linear trend line is a linear regression model that relates demand to time. Time Series – Linear Trend Line Linear Trend Line • The linear regression takes form of a linear equation as follows: where y a bx a = intercept b = slope of the line x = the time period y = forecast for demand for period x Time Series – Linear Trend Line Linear Trend Line • The parameters of the trend line may be calculated as follows: xy n x y b x nx 2 where x x n and a y bx 2 and y n y Time Series – Linear Trend Line Linear Trend Line Example x (period) y (demand) xy x2 1 37 37 1 2 40 80 4 3 41 123 9 4 37 148 16 5 45 225 25 6 50 300 36 7 43 301 49 8 47 376 64 9 56 504 81 10 52 520 100 11 55 605 121 12 54 648 144 78 557 3,867 650 Time Series – Linear Trend Line Linear Trend Line Example • Using these values for ẋ and ӯ the values, the parameters for the linear trend line are computed as follows: Time Series – Linear Trend Line Linear Trend Line Example Therefore, the linear trend line is y = 35.2 + 1.72x •To calculate a forecast for period 13, x = 13 would be substituted in the linear trend line: y = 35.2 + 1.72(13) = 57.56 • A linear trend line will not adjust to a change in trend as will exponential smoothing. Time Series – Linear Trend Line Linear Trend Line Example Time Series – Seasonal Adjustments Seasonal Adjustments • Many demand items exhibit seasonal behavior or pattern, that is, a repetitive up-and-down movement in demand. • It is possible to adjust the seasonality of a normal forecast by multiplying it by a seasonal factor. • A seasonal factor, which is a numerical value is multiplied by the normal forecast to get a seasonally adjusted forecast. Time Series – Seasonal Adjustments Seasonal Adjustments • One method for developing a demand for seasonal factors is dividing the actual demand for each seasonal period by the total annual demand, according to the following formula: • The resulting seasonal factors are between 0 and 1 • These seasonal factors are thus multiplied by the annual forecasted demand to yield seasonally adjusted forecasts for each period. Time Series – Seasonal Adjustments Seasonal Adjustments Example Demand (1,000s) Year QUARTER 1 QUARTER 2 QUARTER 3 QUARTER 4 TOTAL 2003 12.6 8.6 6.3 17.5 45.0 2004 14.1 10.3 7.5 18.2 50.1 2005 15.3 10.6 8.1 19.6 53.6 Total 42.0 29.5 21.9 55.3 148.7 Next, multiply the forecasted demand for the next year, 2006, by each of the seasonal factors to get the forecasted demand for each quarter. Time Series – Seasonal Adjustments Seasonal Adjustments Example Demand (1,000s) Year QUARTER 1 QUARTER 2 QUARTER 3 QUARTER 4 TOTAL 2003 12.6 8.6 6.3 17.5 45.0 2004 14.1 10.3 7.5 18.2 50.1 2005 15.3 10.6 8.1 19.6 53.6 Total 42.0 29.5 21.9 55.3 148.7 • However, to accomplish this, we need a demand forecast for 2006. • In this case, because the demand data in the table seem to exhibit a generally increasing trend, we compute a linear trend line for the 3 years of data in the table to use as a rough forecast estimate: y = 40.97 + 4.30x = 40.97 + 4.30(4) = 58.17 or 58,170 turkeys. Time Series – Seasonal Adjustments Seasonal Adjustments Example Demand (1,000s) Year QUARTER 1 QUARTER 2 QUARTER 3 QUARTER 4 TOTAL 2003 12.6 8.6 6.3 17.5 45.0 2004 14.1 10.3 7.5 18.2 50.1 2005 15.3 10.6 8.1 19.6 53.6 Total 42.0 29.5 21.9 55.3 148.7 Using this annual forecast of demand, the seasonally adjusted forecasts, SFi, for 2006 are as follows: Forecasting Forecast Accuracy Forecast Accuracy • It is not probable that a forecast will be completely accurate. • Forecasts will always deviate from the actual demand resulting in a Forecast error • A Forecast Error is the difference between the forecast and actual demand. • There are different measures of forecast error: – – – – – Mean Absolute Deviation (MAD), Mean Absolute Percent Deviation (MAPD), Cumulative Error (E), Average Error or Bias (Ē), Mean Squared Error (MSE). Forecast Accuracy Mean Absolute Deviation (MAD) – average absolute difference between the forecast and actual values. where: Mean Absolute Percent Deviation (MAPD) – absolute error between forecast and actual values. Forecast Accuracy Cumulative error – sum of the forecast error. E e t Average error – is the per-period average of cumulative error. Mean Squared Error (MSE) Forecast accuracy – Worked Example Forecast Accuracy Mean Absolute Deviation • MAD is the average, absolute difference between the forecast and the demand and is computed by the following formula: Forecast Accuracy Mean Absolute Deviation Example Period Demand, Dt Forecast, Error Error2 Ft (a = .30) (Dt-Ft) |Dt-Ft| (Dt-Ft)2 1 37 37.00 2 40 37.00 3.00 3.00 9.00 3 41 37.90 3.10 3.10 9.61 4 37 38.83 1.83 1.83 3.35 5 45 38.28 6.72 6.72 45.15 6 50 40.29 9.71 9.71 94.28 7 43 43.20 0.20 0.20 0.04 8 47 43.14 3.86 3.86 14.90 9 56 44.30 11.70 11.70 136.89 10 52 47.81 4.19 4.19 17.56 11 55 49.06 5.94 5.94 35.28 12 54 50.84 3.16 3.16 9.98 520[*] 49.31 53.41 376.04 PM Computer Services, forecasts were developed using exponential smoothing (with a = 0.30 and with a = 0.50), adjusted exponential smoothing (a = 0.50, b = 0.30), and a linear trend line for the demand data. The company wants to compare the accuracy of these different forecasts by using MAD. Forecasting Regression Methods Regression Methods • In contrast to times series techniques, regression is a forecasting technique that measures the relationship of one variable to one or more other variables. • The simplest form of regression is linear regression. • Simple Linear Regression relates one dependent variable to one independent variable in the form of a linear equation: Regression Methods Simple Linear Regression • To develop the linear equation, the slope, b, and the intercept, a, must first be computed by using the following least squares formulas: • Where Regression Methods Correlation • Correlation in a linear regression equation is a measure of the strength of the relationship between the independent and dependent variables. The formula for the correlation coefficient is: • The value of r varies between -1.00 and +1.00, with a value of ±1.00 indicating a strong linear relationship between the variables. Regression Methods Correlation Example We can determine the correlation coefficient for the linear regression equation determined in our State University example by substituting most of the terms calculated for the least squares formula (except for Sy2) into the formula for r: Regression Methods Coefficient of Determination • Another measure of the strength of the relationship between the variables in a linear regression equation is the coefficient of determination. • The coefficient of determination is the percentage of the variation in the dependent variable that results from the independent variable. • It is computed by simply squaring the value of r. • For our example, r = .948; thus, the coefficient of determination is: