FIN 331 Chapter 8

advertisement

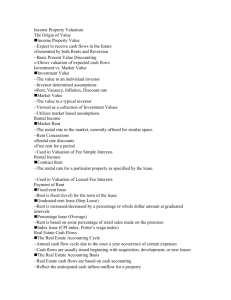

Chapter 8 Valuation Using the Income Approach Real Estate FIN 331 Fall 2014 The Income Approach to Appraisal A. Rationale: Value = present value of future income 1. Income capitalization: converting future income into a present value 2. The present value is a function of the capitalization rate 3. The capitalization rate reflects investor requirements for return on investments 4. ROIs are adjusted for riskiness of investment B. Two Approaches To Income Valuation 1. Direct capitalization using a single overall cap rate 2. Discount all expected future cash flows (CFs) at a discount rate The Income Approach to Appraisal C. Direct capitalization 1. Find value as a multiple of first year net income (NOI) 2. “Multiple” is obtained from sales of comparable properties 3. Similar in spirit to valuing a stock using a price/earnings multiple D. Discounted cash flow (DCF) 1. Project net CFs for a standard holding period (say, 10 years). 2. Discount all expected future CFs at required return (IRR) 3. DCF valuation models require: a. Estimate of typical buyer’s expected holding period b. Estimates of net (annual) CFs over expected holding period, including net income from expected sale of property c. Appraiser to select discount rate (required IRR) Rental Property Operating Statement + = - PGI VC MI EGI OE Potential Gross Income Vacancy & Collection Losses Miscellaneous Income Effective Gross Income Operating Expenses = CAPX NOI Capital Expenses Net Operating Income Estimating Net Operating Income A. Potential gross income (PGI) 1. Rental income assuming 100% occupancy 2. Sometimes referred to as potential gross revenue (PGR) 3. Should forecast of PGI be based on contract rent (signed leases) or current market rents? B. Types of Commercial Leases 1. Straight lease: “level” lease payments 2. Step-up or graduated lease: Rent increases on a predetermined schedule 3. Indexed lease: Rent tied to an inflation index; ex., consumer price index 4. Percentage lease: rent includes percentage of tenant’s sales Estimating Net Operating Income C. Effective Gross Income 1. VC-vacancy & collection loss is based on: a.Historical experience of subject property b.Competing properties in the market c.“Natural vacancy” rate: Vacancy rate that is expected in a stable or equilibrium market 2. Miscellaneous income a.Garage rentals & parking fees b.Laundry & vending machines c.Clubhouse rentals Estimating Net Operating Income D. Operating Expenses 1. Ordinary & regular expenditures necessary to keep a property functioning competitively 2. Fixed: Expenses that do not vary with occupancy (at least in the short-run) a. hazard insurance, b. local property taxes 3. Variable: Expenses that tend to vary with occupancy a. Utilities b. Maintenance & supplies 4. OE do not include: mortgage payments, tax depreciation, capital expenditures Estimating Net Operating Income E. Net Operating Income equals Effective Gross Income minus Operating Expenses 1. NOI is property's "dividend“: Why is it not investor’s dividend? 2. Projected stream of NOI is fundamental determinant of property’s value 3. NOI must be sufficient to: 4. service the mtg debt and 5. provide equity investor with an acceptable return on equity 6. Be careful of NOI vs. NCF (net cash flow) Estimating Net Operating Income F. Sources Of Industry Expense Data 1. Institute of Real Estate Management www.irem.org 2. Building Owners and Managers Association www.boma.org 3. International Council OF Shopping Centers www.icsc.org 4. Urban Land Institute www.uli.org First Income Valuation Method: Direct Capitalization A. Basic Value Equation: V = NOI ÷Ro 1.Where: Ro is a capitalization rate NOT a discount rate 2.A Cap Rate is defined simply as: Net Operating Income1 ÷ Sale Price 3.See Exhibit 8-5 for an example of how cap rates are estimated 4.Note that the NOI is the expected or anticipated first year net operating income First Income Valuation Method: Direct Capitalization B. Effective Gross Income Multiplier 1.EGIM = sale price ÷ effective gross income 2.Quick indicator of value for smaller rental properties 3.Requires no operating expense information 4.Critical assumptions a. Roughly equal operating expense percentages across subject and comparable properties b.Assumes market rents are paid 5.Best used for properties with short-term leases (apartments & rental houses) First Income Valuation Method: Direct Capitalization C. Problems with Valuation by Direct Capitalization 1. Inadequate data on comparable sales due to: a. b. c. d. Above- or below-market leases Differing length of leases and rent escalations Comparable vs. subject Differing distributions of operating expenses between landlord and tenant 2. Differing prices between institutional and private investors for similar properties 3. Result: Discounted cash flow (DCF) analysis can be preferable Terminal Cash Flow Analysis A. Selling an income property at the end of the investment horizon 1. 2. 3. 4. 5. Sales Price (SP) - Selling Expenses (SE) = Net Sale Proceeds (NSP) Year N cash flows = rental income + NSP Value analysis best handled using the PV methodology. (see Example 8-3 page 207) PV = S CFn / Cap rate for all n =1 to N Appraisal Work Requires Analytical and People Skills A. Developed a network of data contacts B. Collect, read, interpret, and organize data and reports C. Be skilled in data analysis and report production D. Be able to meet tight deadlines Homework Assignment A. Key terms: Capital Expenditures, Direct capitalization, effective gross income, effective gross income multiplier, capitalization rate, natural vacancy rate, net operating income, operating expenses B. Study Questions: 1, 4 - part a, 5, 6, 8 (Some calculations are required for 4a, 5, & 6.)