slides by Yun Xu

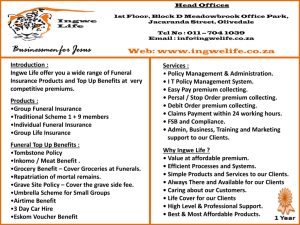

advertisement

Equity Premium

Yun Xu

11/14/2013

The Magnitude and Concept of the Equity Premium

in 150 Textbooks

Pablo Fernandez

Pricewaterhouse Coopers Professor of Corporate Finance

IESE Business School

July 16, 2011

Predicting the Equity Premium with Dividend Ratio

Amit Goyal • Ivo Welch

Goizueta Business School, Emory University • Yale School of

Management, Yale University

Management Science, Vol. 49, No. 5 (May, 2003), pp. 639-654

May 2003

Contents

1

INTRODUCTION OF EQUITY PREMIUM

2

2

OVERVIEW OF THE EQUITY PREMIUM PREDICTION

11

3

IN-SAMPLE FIT

14

4

OUT-OF-SAMPLE FORECAST & ALTERNATIVE SPECIFICATIONS 17

5

FURTHER RESEARCH ON DIVIDEND RATIO

24

6

CONCLUSIONS

29

7

SUMMARY

31

1

Part I

INTRODUCTION OF EQUITY

PREMIUM

2

Four Concepts of Equity Premium

• The equity premium is one of the most important parameters in

finance. The term equity premium is used to designate four different

concepts:

• Historical equity premium (HEP): historical differential return of the

stock market over treasuries.

• Expected equity premium (EEP): expected differential return of the

stock market over treasuries.

• Required equity premium (REP): incremental return of a diversified

portfolio (the market) over the risk-free rate required by an investor. It is

used for calculating the required return to equity.

• Implied equity premium (IEP): the required equity premium that arises

from assuming that the market price is correct.

3

Assumptions and recommendations of the

150 textbooks

4

Assumptions and recommendations of the

129 textbooks that assume REP=EEP

5

Review of the recommendations

• Figure 1 contains the evolution of the Required Equity Premium (REP) used or recommended by

150 books with average is 6.5%.

• Figure 2 shows that the 5-year moving average has declined from 8.4% in 1990 to 5.7% in 2008

and 2009.

6

Comments on the four concepts of the equity

premium

• The HEP: easy to calculate and is equal for all investors, provided they

use the same time frame, the same market index, the same risk-free

instrument and the same average (arithmetic or geometric).

• Different stock index chosen will make HEP different:

7

Comments on the four concepts of the equity

premium(cont’d)

• The EEP: Some authors try to find the Expected Equity Premium by

conducting surveys because investors and professors do not share

“homogeneous expectations,” do not hold the same portfolio of risky

assets and may have different assessments of the expected equity

premium.

8

Comments on the four concepts of the equity

premium(cont’d)

• The REP: is the answer to such a question: what incremental return do

investors require for investing in a diversified portfolio of shares over the

risk-free rate. Different investors and companies use different REPs.

• The IEP: is the implicit REP used in the valuation of a stock that

matches the current market value. The most widely used model to

calculate the IEP is the dividend discount model.

• P0 = d1 / (Ke - g), which implies: IEP = d1/P0 + g - RF

Where:

P0: the current price per share

Ke: the required rate of return

D1: the dividend (equity cash flow) per share expected to be received at time 1

d1: the expected long term growth rate in dividends per share

• The estimates of the IEP depend on the particular assumption made for

the expected growth. Even if market prices are correct for all investors,

there is not an IEP common for all investors: there are many pairs (IEP,

g) that accomplish equation.

9

Author’s conclusion & discussion

• The recommendations regarding the equity premium of 150 finance and

valuation textbooks published between 1979 and 2009 range from 3% to

10%. Several books use different equity premia in different pages and

most books do not distinguish among the four different concepts that

the phrase equity premium designates: Historical equity premium,

Expected equity premium, Required equity premium and Implied

equity premium.

• There is not a generally accepted equity premium point estimate and

that there is not either a common method to estimate it, even for the

HEP.

• Which equity premium is used to value companies and investment

projects by the author?

• for Europe, REPs between 3.8% and 4.3%

• for the U.S., given the yields of the T-Bonds, an additional 4%

compensates the additional risk of a diversified portfolio.

10

Part II

OVERVIEW OF THE EQUITY

PREMIUM PREDICTION

11

Abstract

• The use of aggregate dividend ratios to predict equity premium has a

long tradition in finance.

• Dividend ratios:

• Dividend yield: D(t)/P(t-1) & Dividend-price ratio: D(t)/P(t)

• A typical regression specification:

Where: D(t) = dividends paid by all stocks at the end of year t

P(t) = total stock market capitalization at the end of year t

Rm(t) = return on the stock market

Rf(t) = return on a short-term risk –free treasury bill

• Do dividend ratio have the predictive ability of equity premium?

• The paper suggests a simple, recursive residuals (out-of-sample)

graphical approach to evaluate the predictive power of popular equity

premium and stock market time-series forecasting regressions.

12

Data(value-weighted CRSP index)

Rm(t)is the log of the total return on the value-weighted stock market from year t-1 to t.

EQP(t) subtracts the equivalent log return on a three-month treasury bill.

DP(t)is the dividend-price ratio, i.e., the log of aggregate dividends D(t) divided by the

aggregate stock market value P(t). DY(t),the dividend-yield ratio, divides by P(t- 1)

instead. ΔD(t)is the change in log dividends from year t - 1 to t. All variables are in

percentages. JqBr is the Jarque-Bera test for normality. The critical level to reject

normality is 5 .99 at the 95% level, 9.21 at the 99% level. ADF is the Augmented DickeyFuller test for the absence of a unit root. An A DF value of -3.5 rejects the presence of a

unit root at the 1% level( -2.9% at the 5% level;-2 .6% at the 10% level).

13

Part III

IN-SAMPLE FIT

14

In Sample Univariate Regression

Explanation. All series are described in

Table 1. This table presents the results of

the following regression:

EQP(t) =a + β x(t- 1) + ε (t).

The first row of each regression is the

coefficient, the second line it’s OLS

t-statistic, and the third line it’s Newey West adjusted t-statistic. Data frequency

is annual; s.e. is the standard error of the

regression residuals, and N is the

number of observations. The sample

period refers to the dependent variable,

EQP(t)

Interpretation: Panel A confirms the findings in Fama and French(1988, Table 3).

Prior to the 1990s, the dividend yield (DY(t)) had significant forecasting power, the

dividend-price ratio (DP(t)) had acceptable forecasting power.

However, when the sample is extended into 2002, the in-sample predictive ability

declines. The dividend-price ratio misses conventional statistical significance levels,

while the dividend-yield ratio retains good statistical significance

15

Fama and French (1988)

16

Part IV

OUT-OF-SAMPLE FORECAST &

ALTERNATIVE SPECIFICATION

17

Out-of-Sample Forecast

• Even a sophisticated trader could not use the regression in Table 2 to

predict equity premium. What can be used is only the prevailing data.

• Dividend-ratio coefficients show remarkably different patterns.

• The beta using dividend-price ratios has high s.e., but low variability. It crosses

Zero in our sample.

• The beta using dividend yields is always positive, economically larger, but also

continuously declining.

18

Other Illustrations of the changing dividend

model coefficients

By estimation subsamples

Estimated coefficients vary widely across

subperiods, casting some doubt on the

stability on the specified model

By estimation only with

prevailing data

dividend yield underperformed the prevailing mean.

dividend-price ratio sometimes outperformed the

prevailing mean out-of-sample but statistically and

economically insignificant and non-stability.

19

Main Contribution—simple graphical

diagnostic

20

Interpretation:

• Plotting the cumulative sum-squared error form the unconditional

model minus the cumulative sum-squared error from the dividend-ratio

model.

• A positive value indicates that the dividend ratio has outperformed the

unconditional model. A positive slope indicates that the dividend ratio

had lower forecasting error than the unconditional moving average

equity premium in a given year

• Relative to the simple prevailing equity premium mean, the dividend

yield shows poor predictive performance out-of-sample in the 1960s.

Both the dividend yield and the dividend-price ratio show poor

performance in the 1990s.

• Prior to the 1990s, both dividend ratios had only two very good years,

1973 and 1974.

21

Alternative Specifications

• Numerous variations:

• Reinvest the dividends, instead of summing them;

• Change in dividend ratio, because the dividend ratio is close to

stationary;

• Use simple returns and yields, instead of log returns and yields;

• Predict on different horizons(monthly, quarterly, multiyearly);

• Reconcile definitions to match exactly those of Fama and French(1988)

including using only NYSE firms, predicting stock returns rather than

premia, and 30-year estimation window;

• Use different “fixed number of years” estimation windows;

22

Alternative Specifications (Cont’d)

• Use regression prediction standard error to normalize forecast errors;

• Try convex combination of the dividend-yield model prediction and the

unconditional prediction;

• Forecast with Stambaugh(1999) correction for high serial correlation in

the dividend yield;

• Use Earnings-price, earnings-payout ratios(Lamont 1998) or more

complex measures based on analysts’ forecast(Lee et al. 1999);

• Try a similar experiment for forecasts of the equity premium using the

risk-free rate.

• In sum, none of these variations impact the conclusion that outof-sample performance has always been poor.

23

Part V

FURTHER RESEARCH ON DIVIDEND

RATIO

24

Instrumenting the changing dividend-yield

process

• If theory is correct, changes in the dividend-yield autocorrelation and in the dividend

yield’s ability to predict changes in dividend growth could themselves imply changes in the

dividend-yield ability to predict the equity premium

•

•

•

•

Rm(t) have low correlation (recently almost no correlation with DP(T-1)).

Δ𝐷(t) used to be strongly negative correlated with DP(t-1) but it is i.i.d. today.

DP(t) had only mild autocorrelation in post-WW2 period, it is a random walk today.

Reason: prices continued to be random walk with high variance, while dividends have

remain stationary and low variance.

25

Campbell-Shiller instrumented dividendratio regressions

Assume {DP(t)} follows a stationary process with

mean 𝐷𝑃(𝑡)= d − p. Then using Taylor expansion

we can get

Define 𝛋 =

1

1+𝑒 𝐷𝑃 𝑡

, k = -log 𝛋 − (1 − 𝛋)log(1/𝛋-1)

• Take covariance with DP(t) and divide by variance of DP(t) of equation (4)

26

The forecasting ability does not improve using

Campbell and Shiller (1988) identities.

The source of poor predictive ability

• Puzzle: to WHAT dividend-price ratio really predicts?

• Rearrange the terms in Equation (4) and recurse forward,

• 𝐷𝑃 𝑡 = 𝑅𝑚 𝑡 + 1 − Δ𝐷 𝑡 + 1 + 𝛋 ∗ 𝐷𝑃 𝑡 + 1 − 𝑘

𝑖

•

= ∞

𝑖=0 𝛋 [Rm(t+1-i) - Δ𝐷(t+1+i)] + constant

• It seems that dividend-price ratio must predict the next-period stock

return, the next-period dividend growth rate, the next period dividendprice ratio.

• However, Table 6 shows:

• DP(t) is primarily forecasting itself over horizons up to about 5 years. It

is a partial forecaster of itself over 5 to 10-year horizons, and does not

forecast itself over 20-year horizons. DP(t) is primarily forecasting

future market returns(and some dividend growth) over horizons greater

than 10 years. It does not forecast market returns or dividend growths

over horizons less than 5 years.

27

Decomposition of Dividend-Yield

Components over different horizons

28

Part VI

CONCLUSIONS

29

Conclusions

Conclusions & Suggestions

• A figure that graphs comparative sum-squared model residuals out-of-sample(like

Figure 3) can act as a powerful diagnostic for equity premium and stock price

prediction.

• For simple dividend-yield models prediction equity premium, the diagnostic

suggests that good in-sample performance is no guarantee of out-of-sample

performance.

• The diagnostic further suggests that any remaining explanatory predictive ability

of the dividend ratios in the post-war period prior to the 1990s was due to two

years only, 1973 and 1974.

Explanations

• The primary source of poor predictive ability is parameter instability.

• The dividend yield has failed to forecast one-year-ahead returns or

dividend-growth rates, because it primarily forecast its own change.

• Instrumenting the model to account for the time-varying properties of the

dividend yield and dividend growth process does not aid the dividend

ratio in predicting the stock market levels.

30

Part VII

SUMMARY

31

Summary

Good points

• Fernandez documents the range of advice on equity premium in the textbooks,

which provides a reference that people can consider to apply in the practical

investment decision or valuation.

• Goyal and Welch looked at statistical techniques for predicting the risk premium

on the market, which reminds us that a market trader who just assumed that the

equity premium was “like it has been” would typically have outperformed a trader

who employed dividend-ratio forecasting regressions.

• The alternative specification section in the second paper especially gives a broader

idea on researching or verifying models which could also be useful to practice.

Questions

• The first paper gives us a general range for the equity premium but does

not show the reason for why professors use this number of equity

premium.

• The second paper tells us the weak power of the dividend ratios to predict

the equity premium with out-of-sample data or in a longer horizon but

does not provide more thoughts on which ratio might be useful to predict

the equity premium.

32

Recommendations

A Comprehensive Look at The Empirical

Performance of Equity Premium Prediction

Amit Goyal • Ivo Welch

• This paper comprehensively reexamine the performance of variables

that have been suggested by the academic literature to be good

predictors of the equity premium

• Numerous variables: Dividend ratio, Earnings Price Ratio, Dividend

payout ratio, Stock variance, Cross-sectional premium, Book-to-market

ratio, Investment-capital ratio, The consumption, wealth and income

ratio, Inflation rates, aggregate net or equity issuing activity and various

interest rates and spreads.

• Conclusion: NO models predict the equity premium well out-ofsample.(except 1973 and 1974)

33

Thank you!

34