Macroeconomic Policies (VP Chap.8)

advertisement

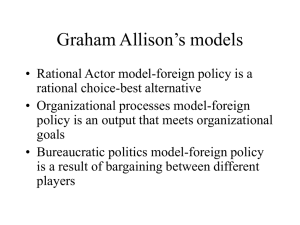

MACROECONOMIC POLICIES VETO PLAYERS, CHAPTER 8 Alessandro Magri February 12th 2013 Results shown in this chapter • The importance of the relation between policy stability and outcomes. • The veto players theory enables research not only on single dimension phenomena, but also on multidimensional ones. Topics 1. Budget deficits. 2. Composition of budgets. 3. Effects of veto players on growth, taxation, inflation. 1. Budget deficits: collective action vs. inertia explanation • Why do some countries “stabilize” their policies and reduce their deficits faster than others? Collective action approach: the more parties participated in government, the higher the budget deficits Reasons: • Sharing of the cost of over-spending between all the ministries. • Incentives for each ministry to spend more. • n-person prisoners dilemma. Possible solution: • Completely centralized decision making authority. Collective action approach: the more parties participated in government, the higher the budget deficits Empirical support: • Kontopoulos and Perroti (2000). • Roubini and Sachs (1989). • Von Hagen and Harden (1995). • Hallerberg and von Hagen (1999). Policy inertia approach: more government partners find it more difficult to change (reduce) the size of the deficit and stabilize • No consensus to change the status quo. • Alesina and Drazen (1991): “war-of-attrition” model of delayed stabilization. • Spolaore (1993): “war-of-attrition” model extended to coalition governments. Policy inertia approach: more government partners find it more difficult to change (reduce) the size of the deficit and stabilize Empirical support: • Roubini and Sachs (1989). • Poterba (1994), Alt and Lowry (1994). • Krause (2000). Franzese’s analysis: an empirical contradiction to the collective action literature • Franzese (1999) presents different political economy theories: the government composition and the delayed stabilization theories (“influence theory” and “veto-actor” theories); the wealth and age distributions and the inter-/intra- generational transfer of debt; the electoral and partisan political budget cycles; the strategic manipulation of debt to alter future government policies; the multiple constituencies and distributive politics; the tax structure complexities and fiscallyalluded voters; the central bank autonomy and reduction of debt financing. Franzese’s analysis: an empirical contradiction to the collective action literature • Then he uses J-tests to compare their predictive power. • “The procedure for J-tests is the following: for two models Z=f(X,*) and Z=g(Y,*) one estimates first Z=f(X,*) and includes its predictions ̃ ^Z in the estimation of the second Z=g(Y, ^Z, *). If the coefficient of ^Z is non-significant, then the second hypothesis encompasses the first: there is no additional significant information covered by the first hypothesis. The procedure is repeated by reversing the two theories.” • Conclusion: “Tsebelis’ (1995) veto-actor conception of fractionalization and polarization clearly dominates the influence conception.” Franzese’s analysis: an empirical contradiction to the collective action literature • In the end, he studies the effects of fractionalization and polarization on the deficit, and he tests the size of the deficit as a function of the size of the debt. • Conclusion: multiple veto players delay changes to budget deficits regardless whether these deficits are high or low. 25% Debt as Percent of GDP seems to Be the threshold value Over 25% 1 more government party means more inaction, more deficit; Under 25% means more inaction less deficit 2. The structure of budgets Single dimension approaches: • Bawn: the German case between 1961 and 1989 • König and Tröger (2001) Multidimensional approach: • Tsebelis and Chang (2001) The structure of budgets: Tsebelis and Chang There are two different ways to alter budgets: • Deliberate • Automatic Control variables (needed to differentiate deliberate and automatic changes): • Inflation, unemployment, % of dependent population, rate of growth, country dummy variables. The structure of budgets: Tsebelis and Chang • Dependent variable: “changes in the structure of budgets in advanced industrialized countries”. • The budget of each country is conceptualized as a vector in a n-dimensional Euclidean issue space. It consists of a sequence of percentages allocated to different jurisdictions: (a1, a2,….., an). The difference between two budgets can be represented by the distance between the composition of the budgets of two successive years. • The dependent variable was derived from the Government Finance Statistics Yearbook of the IMF. The structure of budgets: Tsebelis and Chang • 2 dimensions: 1. Left – right. 2. “Pro friendly relations to USSR and anti” (Laver and Hunt, 1992). • Independent variables: ideological distance of the existing veto players (ID- average of the range of the coalitions in each dimension) and alternation (A- it can be calculated by the Pythagorean theorem). • Tsebelis and Chang tested whether the differences in the annual composition of the budget of each country were a decreasing function of ID and an increasing function of A. • They use the characteristics of the current governments. Negative effects of IDs on the change of budgets TABLE 8.1 Estimated Results on Budget Structure in 19 OECD Countries, 1973-1995 (simple model estimated by multiplicative heteroskedastic regression). MODEL 1 MODEL 2 Dependent Variable: The Expected Value of Budget Distance Constant Lagged BD Ideol. Distance .2746*** (.0198) .1503*** (.0349) -.0189 (.0168) Dependent Variable: The Error Term of Budget Distance Constant -2.5671*** (.0776) Ideol. Distance -.2087*** (.0883) N 338 Prob > ? 2 0.000 .2820*** (.0201) .1360*** (.0351) -2.524*** (.0769) 338 0.000 Note: Standard errors in parenthesis. * significant at 10%; ** significant at 5%; *** significant at 1%, all tests are one-tailed. Introduction of control variables Table 8.2 Estimated Results on Budget Structure in 19 OECD Countries, 1973-1995 (Complete Model Estimated by Fixed-Effect CrossSectional Time-Series Model with Panel Correction Standard Errors). MODEL 1 Coefficient MODEL 1 Stand. Coefficient MODEL 2 Lagged BD 0.0588 (0.0483) 0.0890 (0.0731) 0.0628 (0.0474)* Ideol. Distance -0.0615 (0.0277)** -0.1838 (0.0828)** -0.0620 (0.0278)** Alternation 0.0472 (0.0158)*** 0.1755 (0.0587)*** 0.0477 (0.0158)*** ? unemployment 0.0304 (0.0204)* 0.0849 (0.0570)* 0.0307 (0.0204)* ? age>65 0.0227 (0.1360) 0.0101 (0.0605) ?GROWTH 0.0018 (0.0042) 0.0261 (0.0609) ? INF 0.0060 (0.0067) 0.0416 (0.0465) Belgium 0.2615 (0.0884)*** 0.2871 (0.0838)*** Denmark 0.2783 (0.0514)*** 0.2934 (0.0473)*** Finland 0.2906 (0.0764)*** 0.3085 (0.0710)*** France 0.2053 (0.0971)** 0.2151 (0.0929)** German 0.1345 (0.0509)*** 0.1505 (0.0374)*** Ireland 0.1656 (0.0460)*** 0.1794 (0.0440)*** Italy 0.4881 (0.0904)*** 0.5102 (0.0807)*** Netherlands 0.2109 (0.0738)*** 0.2239 (0.0698)*** Portugal 0.5030 (0.1032)*** 0.5315 (0.0975)*** Spain 0.4638 (0.1912)*** 0.4751 (0.1883)*** Sweden 0.2515 (0.0607)*** 0.2731 (0.0512)*** UK 0.1397 (0.0602)*** 0.1572 (0.0566)*** N 336 336 336 R2 65.32% 65.32% 65.21% * significant at 10%; ** significant at 5%; *** significant at 1%, all tests are one-tailed. How the ID and A affect budget structure in a disaggregated level TABLE 8.3 Estimated Results for Each Budget Category BUDGET CATEGORY IDEOLOGICAL DISTANCE General Public Services -.0895 (.0526)** Defense -.0157 (.0245) Education -.1242 (.0735)** Health -.2550 (.1076)*** Social Security and Welfare -.2915 (.1082)*** Housing and C. Amenities .0224 (.0468) Other C. and S. Services -.0125 (.0130) Economic Services -.1574 (.1301)* Others -.2156 (.1728)* Note: Estimated coefficients for country dummies, change in unemployment rate and lagged dependent variable are surpassed to facilitate the presentation. Panel-correction standard errors are in parentheses. * p<0.1, ** p<0.05, *** p<0.01; all tests are one-tailed. ALTERNATION .0118 (.0334) .0176 (.0136)* .0433 (.0320)* .1566 (.0584)*** .0965 (.0724)* -.0193 (.0399) .0044 (.0060) .0602 (.0528) .0883 (.1014) The two-dimensional model outperforms the one-dimensional model 3. Other macroeconomic outcomes • Veto players theory: significant changes of outcome will be associated only with few and ideologically congruent VPs. Other macroeconomic outcomes: federalism and inflation • Treisman (2000) compared three different kind of theories about the relation between federalism and inflation: 1. Commitment: lower inflation is expected in decentralized countries. 2. Collective action: higher inflation is expected in federal countries. 3. Continuity: it’s the veto players theory. Lower changes in inflation are expected in federal countries (where, ceteris paribus, there is an increased number of VPs). • Conclusions: there is a “strong support for the continuity hypothesis”. Other macroeconomic outcomes: taxation and veto players • Hallerberg and Basinger (1998) tried to identify the cause of the reduction of taxes for both the highest income individuals and the enterprises (in OECD countries, during the 80s). • They tested variables: 1. From the economic literature: capital mobility, trade dependence, inflation, economic growth. 2. From the political science literature: veto players, partisanship. • Conclusions: the only two variables producing consistent results for both tax reduction were veto players and real growth. Other macroeconomic outcomes: growth and Veto Players • On the one hand, many veto players create a high level of commitment. This should encourage the growth. • On the other, a high number of veto players leads to the inability for political response. This could “lock” the system to a bad status quo and discourage the growth. • Hence, the relation between growth and veto players is not clear. Conclusions • The more veto players and/or the more distant they are, the more difficult is the departure from the status quo. • This indicates a high stability of outcomes. • The multidimensional analysis presented in this chapter produced better results than the one-dimensional analysis.