PREDICTING MARKET DIRECTIONS: THE MYTH OF

advertisement

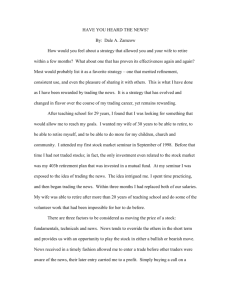

INVESTMENT NEWSLETTERS PREDICTING MARKET DIRECTIONS: THE MYTH OF THE FIVE-DAY INDEX By Mark Hulbert Many bullish advisers today are advancing the argument that because the market produced a sizeable gain over the first five trading days of this year, 2002 as a whole will be bullish. But these arguments do not appear to be grounded in historical fact. A cautionary tale of how, over time, certain beliefs take on a life of their own. The stock market rally that began last fall must be on its last legs. Bullish advisers are scraping the bottom of the barrel in their attempts to come up with rationales as to why investors should continue betting on it. Consider one of the arguments that is currently widely cited among the bullish newsletters that I monitor: Because the stock market produced a sizeable gain over the first five trading days of this year, 2002 as a whole will be smartly bullish too. For example, John McGinley, the editor of Technical Trends, writes that when the market goes up during the first five days, “it almost always indicates that the market will go up” during the year. And Donald Rowe, editor of Wall Street Digest, asserts that “if the first five trading days of the year are up, the market will be up for the entire year.” Now, the market did indeed do well over the first five trading days of January—for instance, the Dow Jones industrial average advanced 1.3% and the Nasdaq composite index was up over 5%. But as far as I can tell, these editors’ arguments are not based in historical fact. No significant correlation exists between the stock market’s behavior over the first five days of January and its direction for the year as a whole. This is a cautionary tale of how, over time, certain beliefs take on a life of their own and therefore become immune to the historical scrutiny that would show them to be false. THE GENESIS OF A MYTH How could so many investment advisers have come to believe in this pattern that some refer to as the “five-day index”? As best as I have been able to determine, their belief is derived from a theory that first began circulating around Wall Street a few decades ago—the idea that the entire month of January is a reliable predictor of the stock market’s direction for the entire year. However, it has only been in more recent years that advisers advanced the notion that the first five days of January were a good harbinger of the entire month’s direction, and by virtue of the original theory that had by now become an established part of Wall Street folklore, that was extended to a forecast of the year as a whole. Unfortunately, however, neither the original theory nor its more recent amendment can withstand scrutiny. Consider first the ability of the entire month of January to foretell the remainder of the year. Over the last 105 years, as measured by the Dow Jones industrial average, there were 67 years in which January’s direction correctly foretold the stock market’s direction over the subsequent 11 months—a success rate of 64% (Figure 1). Because this success rate is above 50%, this may appear to be impressive. But it is not. Because the stock market goes up over the long run, we know that the market will rise during the majority of Januarys as well as during most years. This may create the illusion that January’s direction is predicting Mark Hulbert is editor of the Hulbert Financial Digest, a newsletter that ranks the performance of investment advisory newsletters. It is published monthly and is located at 5051B Backlick Rd., Annandale, Va. 22003; 703/750-9060; www.hulbertdigest.com. This column appears quarterly and is copyrighted by HFD and AAII. 34 AAII Journal/February 2002 INVESTMENT NEWSLETTERS to subject their arguments to even a modicum of historical 70% scrutiny. But perhaps 60% the biggest 50% reason why these false 40% notions 30% continue to persist in 20% investors’ 10% minds is the mere fact that 0% they have First 5 days of January Month of January Percent of time market been repeated correctly foretell market correctly foretells market rises from February so many direction for rest of month direction for rest of year through December times for so many years. Investors, therefore, have come to assume that these the full year’s course. But we also only 49 occasions did the stock notions are solidly based in historical know—if you stretch back to your market’s direction during the first fact, and thus they never get around educational years and Philosophy five trading days correctly foretell to demanding proof that they are. 101—that when two events appear equities’ direction over the rest of to be acting in constant conjunction the month. You would have done THE PLAUSIBILITY RULE with each other it does not necessarbetter simply by flipping a coin. ily mean that one is causing the So the five-day index is a dismal The lesson for investors to draw is other. Otherwise, as Scottish phipredictor of a month that itself to adopt an attitude of healthy losopher David Hume reminded us possesses no genuine forecasting skepticism toward all the truisms several centuries ago, the fact that ability. that get repeated daily without day always follows night would How could these notions that are question. mean that night is the cause of day. so palpably false have gained such While it may not be practical to To be genuinely impressive, currency? subject every last thing we hear to a January would have to do even One factor is sloppy statistics. full and complete statistical scrutiny, better than a simple bet every Several of the studies that have been there is at least one helpful rule of February 1 that the market would be cited over the years in their support thumb: Always ask yourself if there higher in 11 months’ time. And it were guilty of a simple error: They is a plausible explanation for why an does not: Over the last 105 years correlated the direction of the alleged pattern should exist in the you would have been right 68 times market during January with the first place. And you should give the by making such a simple bet, one direction of the market over the greatest scrutiny to those notions more than if you had bet according entire 12 months from New Year’s that seem least plausible. to January’s direction (see Figure 1). through December 31. That is about The five-day index definitely fails as fair as allowing you to continue such a plausibility test. Why should THE FIRST FIVE TRADING DAYS placing bets at the racetrack even the first five trading days of the year after the race has started. possess any special forecasting That is devastating enough to the Another factor that accounts for ability? The lack of any plausible bull’s current argument, but now the popularity of these patently false explanation for why this should be consider the notion that January’s notions is advisers’ desire to believe would have raised a red flag in any first five trading days are a good in this rally. That need to believe is case, and now we know that this predictor of the full month’s direcso strong that they have suspended tion. Over the last 105 years, on their skepticism and therefore failed skepticism is completely justified. ✦ FIGURE 1. THE DOW’S SUCCESS RATES FOR PREDICTING THE MARKET’S DIRECTION THE DOW JONES INDUSTRIAL AVERAGE: 1897 TO 2001 AAII Journal/February 2002 35