“Asset Prices, Financial Stability and Monetary Policy” by F.Allen

advertisement

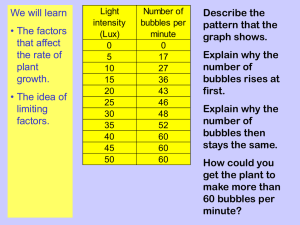

“ASSET PRICES, FINANCIAL STABILITY AND MONETARY POLICY” BY F.ALLEN AND K.ROGOFF Discussion by J.C. Rochet (Zürich) Prepared for the Riksbank Workshop, Stockholm November 12, 2010. What the paper does Very clear and thorough presentation of the debate on “what should central banks do about real estate bubbles?” Discusses facts and theory: Reinhart and Rogoff (2009): new evidence that house price bubbles are frequent and often provoke banking crises when they burst. Allen and Gale (2000,2003,2007): agency theory models showing how a risk shifting problem in the banking system can provoke asset bubbles and ultimately banking crises. Empirical evidence on house prices IMF (2004) 18 countries 1971-2003: Positive autocorrelation (not true for stock prices). Fundamental factors for rise: income growth, short term rates, credit growth, population growth (also country specific factors). Reinhart and Rogoff (2010) explore behavior of house prices during banking crises: On average, house prices fall by 36% and do not recover before 5 years (15 crises :1898-2001). Theories of Bubbles (1) Almost incompatible with rational expectations hypothesis. However can occur in OLG models (money is a bubble!). But are OLG models relevant for house prices and monetary policy? Of course bubbles can be due to irrational behavior. Theories of Bubbles (2) Most convincing story: Moral hazard. Allen and Gale (2000,2003,2007). Three phases: 1. 2. 3. Bad regulation/supervision or too low refinancing rates leads banks to lend too much and fuels increase in asset prices . Bubble bursts due to some exogenous event (bad news). Wave of defaults by borrowers, propagates to banks and leads to contraction of credit and deflationary spiral. Examples: Japan (1980-2000), Nordic countries (1985-1992), USA(2000) How to prevent bubbles (1) “Orthodox” view : (Bernanke Gertler 2001): “aggressive” inflation targeting is enough to stabilize output and inflation when asset prices move up and down. Reasoning based on simulations of a DGSE model with informational frictions in credit markets+ exogenous bubble on stock prices. BG argue that attempts by CB to influence asset prices undermine its credibility (unintended consequences on “market psychology” ). CB should respond to movements in asset prices only in so far that they impact expected inflation or output. How to prevent bubbles(2) ”Pragmatic” view If coordination with Treasury and macro- prudential supervisor does not work well, monetary policy can be useful to limit bubbles. In that case “leaning against the wind”, might be justified, provided decision is well explained to market participants ( Ingves, 2007). How to prevent bubbles(3): “Optimistic” view No need to use monetary policy to prevent bubbles if : Appropriate macro-prudential instruments (LTV ratios, countercyclical buffers, leverage ratios,…) are in place. Fiscal policy also goes in same direction: limited deficit, proper real estate taxes, no tax deduction on mortgage payments,… No excessive capital inflows from abroad. My comments(1) The authors give a well balanced account of the different views but they do not take a clear stand in the debate. Which macro-prudential tools are the most appropriate? Can « leaning against the wind » be justified? How to guarantee good coordination between Central Bank, Financial Supervisor and Treasury? My comments(2) Isn’t it dangerous to use DGSE models with exogenous bubbles and no banking sector to guide monetary policy decisions? Need to develop calibrated models with a banking sector and endogenous crises in order to provide quantitative thresholds for use of macroprudential tools. Need to elaborate a precise doctrine for the financial stability mandate of Central Banks.