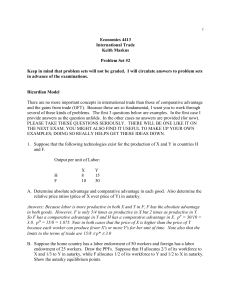

Comparative-Advantage-022014

advertisement

International Trade: Comparative Advantage Prof. Christopher Balding February 20, 2014 Absolute Advantage Absolute Advantage cont. Can We Trade under Absolute Advantage? Absolute Advantage Trade in Pictures What Happens to Total Productivity? The Purpose of DFS “The distinguishing feature of the Ricardian approach emphasized in this paper is the determination of the competitive margin in production between imported and exported goods. The analysis advances the existing literature by formally showing precisely how tariffs and transport costs establish a range of commodities that are not traded, and how the price-specie flow mechanism does or does not give rise to movements in relative cost and price levels.” Equation (1) (1) A(z) = a*(z)/a(z) A '(z) < 0 Equations (2’) and (4) The home country will efficiently produce all those commodities for which domestic unit labor costs are less than or equal to foreign unit labor costs. Accordingly, any commodity z will be produced at home i (2') ω< A (z) • It follows that for a given relative wage ω the home country will efficiently produce the range of commodities (4) 0 < z < z(ω) • Summarizing Section 1 • In summarizing the supply part of the model we note that any specified relative real wage is associated with an efficient geographic specialization pattern characterized by the borderline commodity z(w) as well as by a relative price structure. (The pattern is "efficient" in the sense that the world is out on, and not inside, its production-possibility frontier.) Equation 8 • We therefore prescribe for the continuum case a given b(z) profile: • (8) b(z) = P(z)C(z)/Y > 0 b(z) = b*(z) ∫b(z) dz = 1 Equation 9 • • • • Next we define the fraction of income spent (anywhere) on those goods in which the home country has a comparative advantage: (9) ν(z) = ∫b(z)dbz > 0 ν’(z)= b(z) > 0 where again (0, 2) denotes the range of commodities for which the home country enjoys a comparative advantage. The Demand Side • To interpret the B( ) schedule we note that it is entirely a representation of the demand side; and in that respect it shows that if the range of domestically produced goods were increased at constant relative wages, demand for domestic labor (goods) would increase as the dividing line is shifted -at the same time that demand for foreign labor (goods) would decline.' A rise in the domestic relative wage would then be required to equate the demand for domestic labor to the existing supply. Demand • We assume (i) constant expenditure share • (ii) identical tastes for the two countries. • We specify a fraction of income spent on the commodities in the range i.e. the commodities in which home has a comparative advantage. • Similarly the fraction of income spent on foreign produced is: Equilibrium Relative Wages and Specialization • Equilibrium requires that: • Domestic labour income = World spending on domestic commodities i.e. • So the eqm wage is: Commodities produced by home Commodities produced by foreign •The B( ) Schedule is a locus of trade balance equilibria i.e. Value of imports = Value of Exports Equilibrium Relative Wages and Specialization Commodities produced by home Commodities produced by foreign • The B schedule is upward sloping as any trade imbalance at constant relative wages will be met by a change a in the relative wage to restore balance. • If the home capacity to produce the range of commodities increases at given relative wages will lower our imports and increase our exports. • The resulting imbalance is corrected by an increase in the relative wage which will increase our import demand for goods and reduce our exports and thus restore balance. Equation 11 • • • Substituting (5) in (10') yields as a solution the unique relative wage 5, at which the world is efficiently specialized, is in balanced trade, and is at full employment with all markets clearing: (11) z = A(z) = B(-;L*/L) The equilibrium relative wage defined in (11) is represented in Figure 1 at the intersection of the A( ) and B( ) schedules.2 Summarizing Section II • Among the characteristics of the equilibrium we note that the equilibrium relative wages and specialization pattern are determined by technology, tastes, and relative size (as measured by the relative labor force)…. We note that with identical homothetic tastes across countries and no distortions, the relative wage Z- is a measure of the wellbeing of the representative person-laborer at home relative to the well-being of the representative foreign laborer. Size Matters • Consider first the effect of an increase in the relative size of the rest of the world. An increase in L*/L by (10) shifts the B( ) trade balance equilibrium schedule upward in proportion to the change in relative size and must, therefore, raise the equilibrium relative wage at home and reduce the range of commodities produced domestically. It is apparent from Figure 2 that the domestic relative wage increases proportionally less than the decline in domestic relative size. Income Share and Wages • • • We observe, too, that from the definition of the home country's share in world income and (10), we have: (12) wL/(wL + w*L*) =ν(z) It is apparent, as noted above, that a reduction in domestic relative size in raising the domestic relative wage (thereby reducing the range of commodities produced domestically) must under our Cobb-Douglas demand assumptions lower the home country's share in total world income and spendingeven though our per capita income rises. Technological Progress • An alternative form of technical progress that can be studied is the international transfer of the least cost technology. Such transfers reduce the discrepancies in relative unit labor requirements-by lowering them for each z in the relatively less efficient country-and therefore flatten the A (z) schedule in Figure 1. It can be shown that such harmonization of technology must benefit the innovating low-wage country, and that it may reduce real income in the high-wage country whose technology comes to be adopted. In fact, the high-wage country must lose if harmonization is complete so that relative unit labor requirements now become identical across countries and all our consumer's surplus from international trade vanishes. Not Everything is Tradable • • • To introduce nontraded goods into the analysis we assume that a fraction k of income is everywhere spent on internationally traded goods, and a fraction (1 - k) is spent in each country on nontraded commodities. With b(z) continuing to denote expenditure densities for traded goods, we have accordingly (14) k = ∫ b (z) dz < 1 where z denotes traded goods. As before the fraction of income spent on domestically exportable commodities is O(z), except that t now reaches a maximum value of (1)= k. Wages and Non-Tradables • • • The equilibrium relative wage again depends on conditions. In this case demand conditions explicitly include the fraction of income spent on traded goods: (11’) ω = ν(z)/[k – ν(z)] L*/L = A(z) This nicely generalizes our previous equilibrium of (11) to handle exogenously given nontraded goods Icebergs The home country will produce commodities for which domestic unit labor cost falls short of foreign unit labor costs adjusted for shrinkage, and we modify (2') accordingly: • (17) wa(z) < (1/g)w*a*(z) or w < A(z)/g • Who Produces What? • In Figure 3 we show the adjusted relative unit labor requirement schedules A (z)/g and A (z)g. It is apparent from (17) and (18) that for any given relative wage the home country produces and exports commodities to the left of the A (z)g schedule, both countries produce as nontraded goods commodities in the intermediate range, and the foreign country produces and exports commodities in the range to the right of A (z)/g. Wages, Traders, and Tariffs • • (26) ω = ω (L*/L, t, t*) From (26) and (23) it is apparent now that the range of nontraded goods will be a function of both tariff rates. It is readily shown that an increase in the tariff improves the imposing country's relative wage and terms of trade. Furthermore, as is well known, when all countries but one are free traders, then one country can always improve its own welfare by imposing a tariff that is not too large. Money, Exchange Rates, and Trade • • • • We return to the assumption that a fraction (1 - k) of spending in each country falls on nontraded goods, and accordingly equations (32)- and (33) become: (32') WL = ν(ω) VG + (1 - k) γVG (33') eW*L* = [k – ν(ω)]VG + (1 - γ)(1 - k)VG These hold both in final equilibrium, and in transient equilibrium where specie is flowing. Equations (32') and (33') imply that the equilibrium relative wage does depend on the distribution of the world money supply. Solving for Money… • • • Solving these equations for the equilibrium relative wage we have: (35) ω = ω(γ) ∂ω/∂γ > 0 An increase in the home country's initial share in the world money supply γ raises our relative wage. Accounting for Money • We note, however, that now W and W* are endogenous variables whose levels in the short run do depend on the distribution of the world money supply. A redistribution of money toward the home country would raise our spending and demand for goods, and reduce foreign spending and demand. As before, spending changes for traded goods offset each other precisely so that the net effect is an increase in demand for nontraded goods at home and a decline abroad. As a consequence our wages will rise and foreign wages decline. Means…. • • • Therefore, starting from full equilibrium, a redistributi on of money toward the home country will create a deficit equal to: (36) dM/dM= -V(1 - δ) 0 <δ <1 where δ is the elasticity of our nominal wages with respect to the quantity of money and is less than unity. Equation (36) implies that the price-specie flow mechanism is stable. Implies… • It is interesting to observe in this context that the presence of nontraded goods in fact slows down the adjustment process by comparison with a world of only traded goods (contrary to J. Laurence Laughlin's turn. Of the century worries). As we saw before, with all goods freely tradeable, wages are independent of the distribution of money, and accordingly 6 = 0. Further we observe that the speed of adjustment depends on the relative size of countries. Thus the more equal countries are in terms of size, the slower tends to be the adjustment process. Turning to Bernhofen Why The Case of Japan? • • • Comparative Advantage, Trade, and Payments… by Dornbusch, Fischer, and Samuelson is the advanced theoretical version of comparative advantage A Direct Test…The Case of Japan is the empirical test of whether or not the theory is actually valid The two papers are complementary What is the Framework Here? • • • A natural experiment for a country when there is not free trade and when there is free trade Since most countries trade with the world in varying degrees there is not good natural experiments for when countries open up Japan provides a perfect natural experiment because it opened up very rapidly which allows us to test prices and consumption for a range of goods with and without free trade Laying the Groundwork • This paper provides a direct test of the theory of comparative advantage in its autarky price formulation. It exploits Japan’s dramatic 19th century move from a state of near complete isolation to one that was fully exposed to the forces of international competition and argues that the case of Japan provides a natural experiment to explore the empirical validity of the theory. Specifying the Test • We test the correlation version of the law of comparative advantage developed by Deardorff (1980). It asserts that an economy’s net export vector evaluated at autarky prices is negative.1 In a world with just two goods (see fig. 1), this is equivalent to the proposition that the economy will export the good with the lower relative opportunity cost….The theory asserts that, on average, a country will import what is dear and export what is cheap, with the valuation taking place at autarky prices. How Do You Test Comparative Advantage? • An empirical test of this proposition requires only data on a country’s autarky prices and its international trade flows. Autarky prices incorporate all relevant information about a country’s intrinsic supply and demand conditions. The trading vector contains all the necessary information about its trading partners. Consequently, the value of a country’s trade at autarky prices is a sufficient basis for a comparative advantage proposition. Beyond History, Why is this a Good Test? • In contrast to the often complex and sophisticated product characteristics of goods traded internationally today, the commodities that initially entered into Japanese trade after it opened up were predominantly agricultural or simple manufactured goods. They can be reasonably characterized as homogeneous goods. Since the historical evidence suggests that these goods were priced under fairly competitive market conditions, the observed autarky prices appear to be excellent measures of Japan’s relative opportunity costs at the time. Building the Model • Consider a competitive economy with n goods, and denote by pi the n-vector of equilibrium goods prices, xi the n-vector of equilibrium production outputs, and ci the n-vector of equilibrium consumption levels. The superscript a is used to denote a variable under autarky, and the superscript f denotes a variable under free trade (i.e., i p a, f). The subscript t pertains to one of the two time periods (i.e., t p 1, 2). In each period, production points are constrained to lie in a technologically feasible production set Ft (t p 1, 2). The Model and Autarky • While the equilibrium prices under autarky, pa (t p 1, 2), are determined solely by domestic supply t and demand conditions, the equilibrium price vector under free trade, pf , is exogenous to the domestic economy. We are Observing… • • The subsequent analysis 2 pertains to three competitive equilibria: (autarky) regime A: (pa , xa , ca), xa F (autarky) regime B: (pa , xa , ca), xa F (free-trade) regime C: (pf , xf , c f), xf F The discussion above implies that the law of comparative advantage involves a comparison of Japan’s historical path under free trade with its historical path if it had continued to operate under autarky (i.e., regime C vs. regime B). The absence of information on the unobservable autarky regime B will require an assessment of the conditions under which what is observed in autarky under regime A permits inferences about the validity of the law of comparative advantage. Assumption #1 • • First, it assumes that competitive producers maximize the value of production on a production possibility set Ft, pixi ≥ pix for all x F (i = a, f; t = 1, 2). Assumption #2 • • Second, we assume that aggregate consumer preferences in period 2 are in accord with the weak axiom of revealed preference, that is, pf c f ≥ pf ca ⇒ pa c f > pa ca meaning that if c f was preferred to ca at pf , then c f must not have been affordable to the economy at pa Assumption #3 • • Finally, we need to rule out any trade surplus, that is, pfT ≤ 0, where T denotes the net export vector, defined as T p xf c f .7 Given these conditions, we can state the law of comparative advantage. Fourth Assumption The final assumption posited that had it remained closed, Japanese growth would not have been biased toward importable goods during the 1859-1868 period (Identification condition, εT≤0 holds.) • • Historical record of ongoing shift of land and labor out of rice into tea and raw silk (key exports) Lack of land with suitable climate constrained increased production of another key import, sugar • Absence of sheep ruled out the domestic production of woolen goods • Limited technological expertise and skill precluded rapid adoption of foreign technologies 45 Lemma and the Proof • • Lemma. Law of comparative advantage.—The value of net exports in period 2, evaluated at the (unobserved) autarky prices in period 2, is negative: paT < 0. Proof. Expressions (1) and (3) imply that pf c f p pf xf ≥ pf xa p =pf ca. From (1) and (2), we then obtain pa c f 1 pa ca p pa xa ≥ pa xf ⇒paT ! 0. The Historical Example • In his survey on the empirical literature of international trade, Deardorff (1984, p. 470) argued that tests of the theory of comparative advantage remain virtually impossible to carry out because “almost all countries have engaged in trade throughout history, so that there is no experience with autarky from which to draw data.” Japan’s economic history offers a remarkable exception. As a well-developed market economy, which experienced over two centuries of autarky, it generated a rich record of price data. Identifying the Data • For the construction of the autarky price vector, we identified three groups of commodities. The first group of commodities includes exportables and importables for which we could identify reasonably close domestic substitutes and for which we could obtain autarky price information. Identifying More Data • • A second group of commodities includes goods (primarily woolens) that were not produced in Japan under autarky. Finally, the calculation of the inner product required estimating the prices of a third group: the one-twentieth of exports and one-sixth of imports for which there were domestic substitute, but for which price information could not be found in Japanese or contemporary European sources. Appendix I Comparative Advantage Dornbusch, Fischer, and Samuelson What is Comparative Advantage? A country is said to have a comparative advantage in the production of a good if the opportunity cost of producing that good in terms of other goods is lower in that country compared to the other countries. What is Opportunity Cost in the Ricardian Model? • • • • • Opportunity cost in the Ricardian model is described by the relative unit labor requirements. Unit labor requirements are the number of hours of labour taken to produce the good. For a two good model: if or equivalently It implies that Home can produce x with a lower oppurtunity cost i.e. has a comparative advantage in x. Foreign can produce y with a lower oppurtunity cost i.e. has a comparative advantage in y. A Simple Model of Comparative Advantage Lets assume: • In the US, the opportunity cost of 10 million roses is 100,000 computers. • Whereas in South America, with the resources used to produce 10 million computers, only 30,000 computers can be produced. • What will happen if US decides to specialize in Computers and South America decides to specialize in Roses. • Roses Computers United States - 10 Million + 100,000 South America +10 Million - 30,000 Total 0 + 70,000 The world production increases, as each country specializes and trades the good it has a comparative advantage in. Example taken from: International Economics: Theory and Policy (Paul Krugman) Technical Progress Assume: Technical progress in foreign: • uniform decrease in the unit labour requirements in foreign i.e. a*(z) falls •A(z) shifts down •The loss of comparative advantage due to lower foreign unit labour requirements means the range of commodities at home decreases. •Causes a trade deficit •The relative wage decreases to restore to equilibrium and offset the fall in comparative advantage. Demand Shifts Assume: Demand shifts from high z commodities to low z commodities i.e. demand shifts towards goods with weaker comparative advantage •Trade imbalance •Relative wage increases •Home now produces a lower range of goods but consumes them more intensely •Foreign produces more goods which is each consumed less intensely. Unilateral Transfers Assume: A continual unilateral transfer from Foreign to Home. •No change in any curve •Assumption of homothetic tastes means that we spend the transfer exactly as foreigners would have spent. •Home incurs a recurring trade deficit, but terms of trade remains unchanged. Transport Costs •We assume that transport costs are categorized as shrinkage i.e. a fraction g(z) of the shipment arrives. •g(z) is identical for all commodities and for both countries. The home country produces commodities which have a lower unit labour cost adjusted for shrinkage i.e. The Foreign country produces commodities which have a lower unit labout cost adjust for shrinkage i.e. Is the home country’s borderline commodity Is the foreign country’s borderline commodity Flexible Exchange Rates • We assume trade balance equilibrium and therefore the equality of income and spending is assured in each country i.e. • We denote e as the exchange rate and hence foreign wages can be measured in terms of domestic currency and relative wage is given as: • So the equilibrium exchange rate under the equilibrium relative wage can be written as: Appendix II Bernhofen Slides The Theory of Comparative Advantage [With Two Goods] Under autarky Economy’s production point coincides with its consumption point : xa=ca International trade Economy has a comparative advantage in good 2 Trade vector evaluated at autarky prices is negative : paT <0 60 Autarky versus Free Trade Two comparative histories of an economy in Japan:Regime C vs Regime B Regime A : Actual path under autarky (pa1,xa1,ca1), xa1 Є F1 Regime B : Putative path under autarky (pa2,xa2,ca2), xa2 Є F2 Regime C : Actual path under free trade (pf2,xf2,cf2), xf2 Є F2 Regime A 1850 Regime B 1858 1868 1875 Regime C Pti: n-vector of equilibrium goods prices Xit: n-vector of equilibrium production outputs Cit: : n-vector of equilibrium consumption level i= a(under autarky),f(under free trade), t = time period 1 (1850-1858) and period 2 (1868-1875) 61 Identification Condition I. Assumptions: Competitive producers maximize the value of production on Ft pti xti ≥ pti xt for all xt Є Ft (i = a, f : t =1, 2) I. Weak axiom of revealed preference holds: pf2 cf2 ≥ pf2 c2a II. pa2 cf2 > pa2 c2a No trade surplus pf2 T ≤ 0, T: net export vector, T = xf2 - cf2 Theory: Law of comparative advantage: pa2 T < 0 Proposition: pa2 = pa1+ ε , Then Pa1T < 0 As long as the identification condition ε T ≤ 0 holds, pa2T < 0 Empirical Findings Empirical Findings Approximate Inner Product In Various Test Years (Millions of Ryo) Components Year of Net Export Vector 1868 1869 1870 1871 1872 1873 1874 1875 1. Imports with observed autarky prices -2.24 -4.12 -8.44 -7 -5.75 -5.88 -7.15 -7.98 2. Imports of woolen goods -0.98 -0.82 -1.29 -1.56 -2.16 -2.5 -1.56 -2.33 3. Imports with approximated autarky prices (Shinbo index) -1.1 -0.95 -0.7 -0.85 -1.51 -2.08 -1.6 -2.65 4. Exports with observed autarky prices 4.07 0.4 4.04 5.16 4.99 4.08 5.08 4.8 5. Exports with approximated autarky prices (Shinbo index) 0.09 0.03 0.07 0.07 0.15 0.07 0.11 0.10 Total inner product (sum of rows 1-5) -.18 -2.47 -6.31 -4.17 -4.28 -6.31 -5.11 -8.06 Empirical Finding • The autarky price prediction of the law of comparative advantage holds in all the eight trading years. Note that the result holds in years of current account surplus as well as during a deficit. • With eight negative entries in a sample size of eight, the p-value=0.004 , so we can reject the H2. Conclusion • The case of Japan provides a natural experiment that occurs in an environment that is transparent by any reasonable measure. • The testable hypothesis derived from this approach places no restriction on what accounts for comparative advantage whether factor endowments, technologies, tastes, or a combination of them. • The robustness of this paper’s findings suggests that the autarky price formulation of comparative advantage is a coherent and insightful theory that can also be validated empirically.