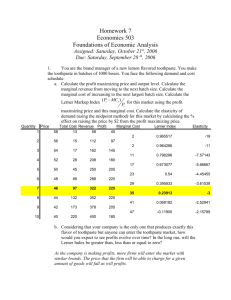

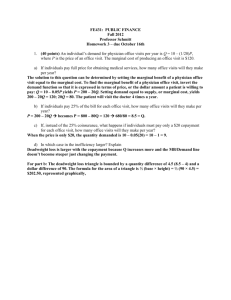

Document

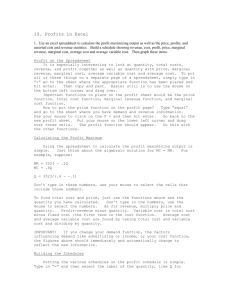

advertisement

THE FIRM’S BASIC PROFIT MAXIMIZATION PROBLEM What Quantity of Output should the Firm Produce and Sell and at What Price? The Answer depends on Revenue and Cost Predictions. The Solution is Found using Marginal Analysis. Expand an Activity if and only if the Extra Benefit exceeds the Extra Cost. Chapter 2 slide 1 MAXIMIZING PROFIT FROM MICROCHIPS Write profit as = R - C Price ($ 000) 2.2 A1. Focus on a single Product, A2. whose Revenues and Costs can be predicted with Certainty. Revenue can be predicted using the Demand Curve. 170 P = 170 - 20Q 130 or equivalently, Q = 8.5 - .05P 90 50 0 2 4 6 8 Quantity in Lots THE FIRM’S OPTIMAL OUTPUT DECISION R, C 2.3 The Firm determines Output where MR = MC. C = 100 + 38Q 300 R = 170Q - Q2 200 M = 0 100 0 -100 0 2 3.3 4 6 8 Q MAXIMIZING PROFIT ALGEBRAIC SOLUTIONS Start with Demand and Cost Information P = 170 - 20Q and C = 100 + 38Q Therefore, R = 170Q - 20Q2 so MR = 170 - 40Q and MC = 38 Setting MR = MC implies 170- 40Q = 38 or 132 = 40Q Q* = 132/40 = 3.3 lots P* = 170 - (20)(3.3) = $104 K * = 343.2 - 225.4 = 117.8 2.4 2.5 MAXIMIZING PROFIT USING MARGINAL GRAPHS There is always a tradeoff. Set MR = MC. 170 P* Demand Maximum Contribution MC 38 MR Q* 2.6 SENSITIVITY ANALYSIS Considers changes in: Fixed Costs, Marginal costs, or Demand Conditions 170 A change in fixed cost has no effect on Q* or P* (because MR and MC are not affected). P* Demand MC 38 Q* 2.7 SENSITIVITY ANALYSIS Considers changes in: Marginal costs An increase in MC implies a fall in Q and an increase in P. 170 Demand MC’ MC 38 Q’ Q* SENSITIVITY ANALYSIS 2.8 Finally, consider a change in Demand Conditions. 170 P P* Shift in Demand 38 MC Q* Q