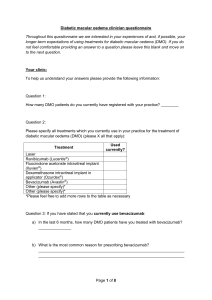

DMO Website User Survey

advertisement

Understanding user behaviors, perceptions and attitudes 2 Project Objectives 4 Methodology 5 Respondent Profile 6 The Role of the DMO Website 15 Travel Reviews and Video 27 Destination Information Sources 34 3 To understand the role of the DMO website in the destination travel planning process. To research and understand DMO user behaviors, perceptions and attitudes toward destination tourism websites. To identify DMO website user characteristics and demographics. To analyze and assess the potential for improved DMO website performance. 4 SMG selected five DMOs to participate in the survey ◦ ◦ ◦ ◦ ◦ Lake Tahoe Visitors Authority Pismo Beach Conference & Visitors Bureau Solvang Visitors and Convention Bureau Temecula Valley Convention & Visitors Bureau Ventura Visitors and Convention Bureau Each DMO agreed to email the SMG survey & cover letter to its own email list The survey was completed during a two week period in March with over 3,000 completed surveys 5 61% - Female 58% - Between 41-60 years 58% - Have a college education % 76% - Caucasian 69% - More likely to use Google as their search engine Were likely to watch surf the Internet daily, watch TV, email friends and family and listen to AM/FM radio 7 Overall 61% of survey respondents were female 49% 61% Male Female 8 Survey respondents tended to be older with the highest percentage between 51-60 years, followed by the 4150 age segment 22% 60+ 31% 51-60 27% 41-50 14% 31-40 6% 25-30 under 25 1% 0% 20% 40% 9 The highest concentration of survey respondents income levels was between $70,000 & $150,000 Fifteen percent had income levels above 16% 7% $200,000+ 9% $150-$199,999 $1000-$149,999 24% $70-$99,999 24% $60-$69,999 9% $50-$59,999 9% 8% $40-$49,999 $30-$39,999 6% $0-$29,999 6% 0% 10% 20% 30% 10 Overall 58% of survey respondents indicated they completed college, followed by 20% high school and 14% with a masters degree PhD 3% Masters 14% Other 5% High School 20% College 58% 11 Hispanic/Latino Native American 8% 1% Other N/A 3% 2% Asian/Asian American 8% African American 2% White 76% 12 Approximately 70% of those surveyed indicated they used Google as their primary search engine Other 5% Google 69% Yahoo 18% Bing/MSN 8% 0% 20% 40% 60% 80% 13 3% 6% 7% 8% Post video online Listen to podcast Write a comment or blog Post reviews online Note the online activities of survey respondents 18% 19% 26% 32% Listen to satellite radio Post photos online Watch online video Read a daily paper online 41% Participate in a social network 51% Read a daily paper 71% 74% Listen to AM/FM radio Email friends/associates 82% 83% Watch TV Surf the Internet daily 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 14 The Internet was the primary tool used to plan a personal vacation at 93% Search engines and DMO sites were most useful for researching a destination Visitors were most likely to visit a DMO website to obtain vacation information Survey respondents found general information, area maps and attractions most helpful information Respondents most frequently use a DMO site when learning about a destination 16 Other 2.9% Promotional email 7.3% Search engine 48.4% Online review 5.1% Online ad 2.9% Direct mail 2.6% Brochure 4.6% Visitor bureau 3.0% Referral 4.5% Newspaper/magazine article Radio Commercial 28% of respondents indicated they found about a DMO site via traditional media 3.5% 0.4% TV Commercial 2.1% Magazine/newspaper ad 7.4% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 17 Approximately 93% of those surveyed indicated they used the Internet to plan a personal vacation trip. Only 26% indicated they used magazines or TV. Other 6% Internet 93% Family/Friends 33% Brochure 34% Magazines 22% TV 4% Travel Agent 11% 800 Number 16% 0% Note: This result is expected because the survey consisted of DMO email lists. 20% 40% 60% 80% 100% The Internet is the single largest planning tool among this group! 18 Not at All Useful 2 Neutral 4 Very Useful Top Box Airline Site 12% 12% 24% 25% 28% 53% Travel Review Site 10% 12% 29% 28% 31% 59% Travel Search Engine 7% 10% 27% 33% 24% 57% Hotel Site 7% 11% 27% 33% 22% 55% Search Engine 2% 4% 16% 32% 45% 77% Online TA 35% 23% 28% 10% 4% 14% DMO Site 7% 8% 22% 32% 30% 62% 19 Other 5% Called office for information 18% Sent email request for information 36% Visited an office for information 38% Requested a visitor guide/brochure 75% Visited DMO website 82% 0% 20% 40% 60% 80% 100% 20 Other 3% Blogs Low % of video shows potential of added video content to DMO websites 10% Online video 24% Package deal information 54% Area photos 60% Special events 67% Activity information 74% Specific attractions 74% Area maps & attractions 82% General information 84% 0% 50% 100% 21 4% After my trip 14% During my trip After booking but 31% before traveling 44% When booking my trip Comparing travel Note how users primarily used a DMO site in the early stages of trip planning and less so during other parts of the trip planning and post trip behavior. 55% products & prices When learning about a 81% destination 0% 20% 40% 60% 80% 100% 22 Definite No Maybe 2% 13% -ly 8% Note the influence a DMO website has on a decision to take a trip to a specific area. Some what 54% 23 Prompted me to book a trip to a 28% destination Helped to make a decision to 61% visit a destination Helped learn more about a 83% destination 0% 20% 40% 60% 80% 100% 24 Not very Not at all helpful helpful 3% 1% Extremely helpful 40% Somewhat helpful 56% 25 Not at All Reliable 2 Neutral 4 Very Reliable Top Box Total Airline Website 4% 6% 28% 31% 30% 61% Travel Review Site 4% 9% 36% 38% 13% 51% Hotel Site 4% 8% 30% 39% 19% 58% Search Engine 1% 4% 23% 45% 27% 72% Online TA 9% 10% 34% 33% 13% 46% DMO Site 2% 4% 21% 43% 30% 73% 26 27 Travel reviews are influential Respondents are more likely to believe reviews by people like them Many have viewed a travel destination video online Find destination travel videos helpful Travel videos were much more helpful when thinking about or planning a trip than for specific activities 28 78% of survey respondents indicated that reviews and travel experiences by others did have an influence on their travel plans. No influence, 22% Yes made plans, 78% 29 Survey respondents indicated they tended to believe reviews done by people like them as opposed to travel experts. 28% 72% People Like Me Travel Experts 30 Fifty-four percent of survey respondents indicated that they had viewed a travel destination video online 46% 54% Yes have viewed No have not 31 Fully 81% of survey respondents indicated online videos were helpful in considering a destination to visit. 19% 81% Yes helpful No Not Helpful 32 Note the importance of online video when thinking about taking a trip and choosing a destination Videos were viewed much less frequently when considering activity ideas, lodging decisions and when booking a trip When booking a destination trip When deciding on lodging When looking for activity ideas When choosing a destination When thinking about taking a trip 5% 11% 14% 28% 42% 0% 20% 40% 60% 33 34 One quarter of survey respondents have “friended” or become fans of a destination 16% have accessed a destination website on a mobile hand held device Overall respondents tend to use a computer to access a destination website while on a vacation 47% have booked either part of all of a vacation online. 35 Twenty-seven percent of survey respondents indicated they had become a friend of a specific destination on Facebook or MySpace in the past 12 months 27% 73% Yes No 36 Sixteen percent of survey respondents indicated they had accessed a destination website with a handheld phone or device in the past 12 months 16% 84% Yes No 37 The overwhelming majority of survey respondents indicated they used their computer or laptop to find information online 9% Other 32% Ask a local resident 48% Local information center Website via laptop or 73% computer 15% Website via your phone 0% 20% 40% 60% 80% 38 Forty-seven percent of survey respondents indicated they booked a part or all of a trip online 47% 53% Yes No 39 The DMO website is a key link in the destination choice process Consumer awareness about site DMO website links vacation concept to reality Vacation Booking 40 • Planning tool Internet Find a DMO Site • Useful • Search engine • Influential • Traditional media • Reliable Book a trip • Decision to visit DMO site The DMO website plays an integral role in a visitor’s decision to visit; users view it as useful, influential and reliable in providing information with which to make a vacation destination decision. 41 Online SEO Social DMO Site Traditional Media 42 SEO strategy Information content strategy ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ General Information Area maps Specific attractions Activity information (recreation, cultural, historical) Special events/event calendar Area photos (in the moment, scenic, people) Blog Video Social 43 DMO websites play a critical role in the destination planning process in educating consumers about a destination The DMO website is the link between consumers’ interest in taking a vacation and booking a vacation The highest value of a DMO website is its usefulness, reliability, and influence 44