Presentation - The 21st Century Indian City

advertisement

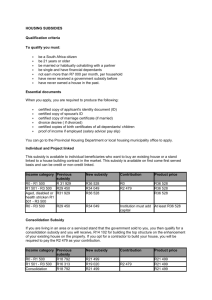

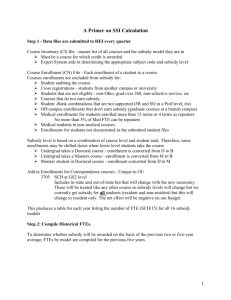

The 21st Century Indian City -Developing an Agenda for Urbanization in India March 23-25, 2011 Panel 5: The Politics and Economics of Land and Housing (March 24, 2011) R. V. Verma National Housing Bank India Indian Mortgage Market • Steady growth • Served by specialised HFCs & Commercial Banks - synergies • Proactive and Risk based Regulation • Conservative lending practices; Originate to hold • NPAs well contained • Shift from high-end market to Affordable housing • Market segmentation – diversified risk • Broad based stakeholding – induces stability 2 Housing Finance Market Financial Market NHB HFCs Fiscal and Credit Policy Support Affordability Banks MFIs Capital Market Financial Sector Real Sector Informal Sector Housing Market Public Agencies Private Developers Land & Construction Infrastructure 3 Outstanding Housing Loans ( Rs. / Billion) 4691 4038 3670 Total 3212 Banks HFCs 2653 3159 1973 2770 2578 1444 2310 1791 983 586 746 254 332 328 418 2001 2002 1268 853 491 492 591 705 2003 2004 2005 862 902 1092 1268 2006 2007 2008 2009 1532 2010 4 Trends in Housing Finance 3,500 Disbursals (INR in billion) 3,000 2,500 1,520 1,327 2,000 Total 1,197 Banks HFCs 1,017 1,500 860 764 944 1,000 843 537 784 700 414 504 500 182 56 126 0 2000-01 232 236 328 86 146 2001-02 178 2002-03 586 209 2003-04 260 2004-05 274 2005-06 317 2006-07 413 2007-08 484 2008-09 575 2009-10 5 Trends in Housing Finance • Housing Loans outstanding 7.9% of GDP • Supportive Regulatory/Fiscal Policies • Financial Deepening • Supply Responses: Demand Driven • Main beneficiaries - salaried class, professionals and tax payers • Challenge for Low Income Housing – “Accessibility” and “Affordability” 6 Financial Environment • Financial Sector and Capital Markets - Development • Interest rates deregulation • Growing Disintermediation • Shift towards Market Oriented Resource Mobilisaiton • Level Playing Environment • Market Determined Cost Bearing on Affordability Availability Accessibility 7 Issues in Low Income Housing • Rapid growth in housing sector has bypassed LowIncome Households • Demand Identification • Risk Perception • Price Rise, Interest Rates - Impact on Low Income Housing • Market/Subsidy based Approach 8 Issues in Financing • Limited access to housing credits • Cannot contract debts on terms of the financial market • Unstable income and unstable cash flows • High risk & high cost - to - service customers • Role of Guarantee/Risk Fund • Role of Government & Financing Institutions in Market Environment • Leveraging effect of Subsidy 9 Supply Constraints • Competing Demand on Land and Finance • Land supply is constrained: Land availability Land use rules • Efficient use of Land • Title and Tenure • Finance Flow Constrained Stability Growth Risk Perception Need for ‘Integrated Approach’ 10 Affordability Issues Real Sector • Land Supply Financial Sector • Project Finance • Cost of Land • Land market functioning • Infrastructure provision • Construction & Delivery • Individual Loans • Supply of Funds • Cost of Funds • Whether market based solution? • Role of Public & Private Sector Role of Incentives Subsidized Housing Credit Subsidized House Prices 11 In Other Words Supply Side Land Acquisition Infrastructure Provision Sale of Land Housing Construction Housing Sale Role of Public Agencies/ Developers • Credit Delivery • • • • • • Demand Side • • • • • • • • Purchase Price Income Level Affordability Loan eligibility Subsidy component Risk Mitigation Role of NGOs/MFIs Demand Aggregation Ensuring access to housing with infrastructure at affordable prices 12 Challenges • Formal sector accounts for only 25% of the total investments in housing; skewed distribution of credit • Affordability and security; perceived higher risk • Financial assistance through informal sector at nascent stage • Subsidized housing programmes: limitations • Targeting and sustainability of such programmes 13 Challenges • Market’s limitations / Subsidy Limitation • Private Capital and Public Objective • Formal & informal sectors compartmentalized • Demand aggregation, demand registration, intermediation and risk mitigation • Incentives for Savings • Policy Reforms 14 Where is the Disconnect? • Not enough supply at lower prices. Impact of lowering prices on the stock of housing, the flow of housing and housing finance • Price – Supply relationship. Profit on Value or Volume Profitability to excite the suppliers/builders. Price/cost structure • Demand sensitive to price but supply not forthcoming • Measures to convert the investor’s market into consumer’s market 15 Search for Synergies • Partnership Approach : Public/Private/Community • Innovative instruments for benefit of All • Incentives for Low Income Housing Credit • Demand led • Incentives for Low Income Housing Construction 16 Sector Profile – Wide Stakeholding Central Real Sector Government Policy & Programmes Facilitator State/Local & Enabler Governments Formal Sector Policy & Programmes PUBLIC PRIVATE Partnership Financial Sector Financial Institutions Instns & Products Informal Sector Affordable Housing for All and Financial Inclusion –Mutually Consistent Themes 17 Institutional Support • Government Support Liquidity Pricing Risk Mitigation Targeting - Low Income Housing • Guarantee Fund / Subsidy Subsidy support to EWS/LIG housing Leverage institutional finance 18 Policy Issues GOVERNMENT INTERVENTION The Government could consider enabling legal and regulatory reforms and create an enabling environment through efficient functioning of the land market Streamlining of all approval processes provision of efficient infrastructure e-governance viz. introducing electronic record for land and bringing in more transparency in the record of land and houses 19 Growth of Housing Finance Sector • Specialized Institutions vs. Universal Institutions • Augmenting funds for the sector • Resource Mobilization & Deployment • Facilitating the growth of Secondary market • Lending Discipline & Quality of Assets • Tapping Overseas Market – Lendings & Investments 20 Policy Reforms • Housing Policy at National & Regional level • Integrated with Financial Sector • Fiscal & Financial Sector Policy • Institution-Building & Product Innovation (Supply & Demand Side) • Deregulation with closer Supervision (Finance & Construction Sector ) • Flow of Funds & Efficient Housing Market 21 Market Segments • Identify subsidy-based and market-based segments and nature of interventions • Complementarities • Ensure adequate and sustained funding for both segments • Ensure adequate supply of land and housing for both segments • Market-based approach and state/local level policy interventions 22 Policy Prescriptions • De-risk the segment through suitable risk mitigants both in the financial segment and the real sector segment (demand and supply side) • Develop a role for the government in low income housing, consistent with the market orientation of the rest of the segments (without conflicting) • Develop securitisation for funding • Revisit the fiscal and credit regime to ensure that housing gets its fair share of financing from the system • Develop policies so that housing is able to compete fairly with other sectors for funds 23 Institutional Stakeholders Individual Loans Banks/ HFCs/ MFIs Borrowers Enabling Fiscal and Credit Policy Subsidy/ Guarantee Fund/ Credit Enhancement SPV Project Construction Finance Specialized Funding Agency State Govt./ Builders Enabling Land Policy for Construction Land Tenure First / Second Loss Facility 24 Summing Up • No Broad-brush Approach • Need for Segmented Intervention • Role of State Governments & Public Agencies • Supportive Fiscal & Credit Policy • Market/Subsidy based Approach • Developing innovative products and institutional mechanism 25 Summing Up • Identify land for construction • Liberalize construction finance for low income housing • Project approach and economies of scale • Price determination – a critical consideration • Develop mechanism for Demand Registration • Tap Savings potential – building borrowers’ equity • Actively involve supply side agencies, private and public 26 Going Forward • Widening stakeholders’ base • Broadening Institutional infrastructure • Securitisation through Government support • Risk Mitigation Vehicle • Funding Source and Delivery Channels • Construction and Finance Delivery 27 Conclusion • Affordable House Price • Affordable Credit • State Govt./Municipal Bodies to provide land and infrastructure • Public/Private builders to construct • Pricing & Credit critical • Credit Risk Mitigation • Credit Guarantee Fund INCLUSIVE GROWTH WITH STABILITY 28 Thank You