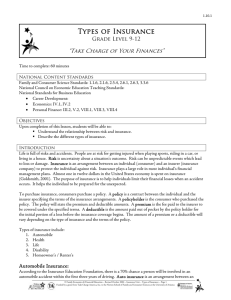

Understanding Insurance and Types of Insurance

advertisement

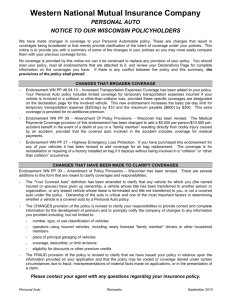

Understanding Types of Insurance What is Insurance? An arrangement between an individual (consumer) and an insurer (insurance company) to protect the individual against risk. Insurance is… Insurance should play a large role in an individual’s financial management plan. 1 in 12 dollars in the US economy is spent on insurance. Purpose of Insurance Limits financial loss. Prepares for the unexpected. Transfers part of the risk of financial loss to the insurance company. Insurance Terminology Policy – contract between individual and insurer specifying terms of insurance arrangement. Premiums –fee paid to the insurer to be covered under the specified terms. Terminology Cont… Deductible –amount paid out of pocket by policy holder for portion of a loss before insurance coverage begins. Policyholder –consumer who purchased policy. Types of Insurance: Automobile Health Life Disability Homeowner’s/Renter’s 1. Automobile Insurance Purpose of auto insurance is to help individuals limit their financial losses when an auto accident occurs. Insurance Education Foundation (IEF) states there is 70% chance a person will be involved in an auto accident within the first three years of driving. Four Types of Auto Coverage 1. Liability Insurance Covers the insured if injuries or damages are caused to other people or their property. Minimum amount of insurance required by law for automobiles. Types of Auto Coverage cont… 2. Medical Payment Insurance Covers injuries sustained by the driver of the insured vehicle or any passenger regardless of fault. Covers insured family members injured as passengers in any car or if they are injured while on foot as a pedestrian or while riding a bicycle. Types of Auto Coverage cont… 3. Uninsured or Underinsured Motorists Insurance Covers injury or damage to the driver, passengers, or the vehicle caused by a driver with insufficient insurance. Does not cover the other driver. Types of Auto Coverage cont… 4. Physical Damage Insurance Covers damages caused to the vehicle. Collision – covers a collision with another object, car, or from a rollover. Comprehensive – covers all physical damage losses except collision and other specified losses. Types of Auto Coverage cont… Comprehensive and Collision Coverage Often carries a deductible. • Example, suppose collision damage to your car costs $1,200 to fix. Your deductible is $500. You would have to pay the first $500, and the insurance company would pay the remaining $700. Factors Affecting Auto Premium 1. Driver Classification Age, gender, marital status • Statistics prove that young males have more accidents than young females under the age of 21. Young males pay more for insurance. • Married people have fewer accidents than single people. Single people pay more for insurance. Factors Affecting Auto Premium cont… 2. Rating Territory • Might be cities, parts of a city or rural areas. • If you live in a territory that generates more claims than others, than you will pay more for insurance. • Example: More accidents take place in urban than rural areas. • A basic insurance policy in rural Nebraska can be purchased for less than $500 a year. The same policy in Boston, Washington, D.C. or Los Angeles costs more than $1,200. Factors Affecting Auto Premium 3. Driving Record Your driving record is an official list of your accidents and traffic violations. Points will be added to your record. • 1 point - increase premium 10% • 2-3 points – increase premium 25-100% • Accumulation of too many points can cause insurance company to drop policy; • Trouble reinsured; high risk – high premium. Factors Affecting Auto Premium cont… 4. Type of Car Some cars are more expensive to repair or replace than others. Thieves tend to steal expensive sports cars and luxury cars more often than other types of cars. Premiums reflect this risk. 5. Claims History More claims make premiums higher 2. Health Insurance Health care costs are extremely high. Large medical expenses can wipe out savings. Health insurance provides protection against financial losses resulting from injury, illness, and disability. Purpose is to provide coverage for medical expenses, emergency and routine. 2. Health Insurance Health Coverage Hospital Surgical Dental Vision Long-term care Prescription Major expenditures Health Insurance cont… Coverage depends on terms of policy. Policy Purchased Individual Family Employer-Based 61% of Americans through employer 3. Life Insurance 70% of American adults have life insurance. Life insurance provides money for family members or dependents when a wage earner dies. Dependent is a person who relies on someone else financially. Life Insurance Terminology Contract – policy which states the amount to be paid to beneficiary upon death of insured. Beneficiary –recipient of policy proceeds if the insured person dies. Who Needs Life Insurance? Not necessary if a person is single with no dependents. Necessary for people who have a dependent spouse, dependent children, an aging or disabled dependent relative, or business owners. 4. Disability Insurance One out of ten people will become disabled before age 65. Disability insurance replaces a portion of one’s income if he/she becomes unable to work due to illness or injury. 4. Disability Insurance cont… Benefit Package Pays between 60%-70% of one’s full time wage. Never pays 100% of the wages because there is no incentive to return to work. Disability Insurance cont… Factors that Influence Benefit Package Length or severity of a disability will impact the percentage of income a person will receive. Employers may offer a portion of the benefits package. 5. Homeowner’s/Renter’s Insurance Property and liability insurance policy will protect a home from damage costs due to perils. Peril is an event which can cause a financial loss. Fire Falling trees Lightning Others 5. Homeowner’s/Renter’s Property Insurance Protects from financial losses due to destruction or damage to the property or possessions. Liability Insurance Protects the insured from financial losses due to being held liable for other’s losses Homeowner’s Insurance cont… •Insurance should cover the replacement cost to rebuild the home if it is completely destroyed. 5. Renter’s Insurance Protects insured from loss to contents rather than the dwelling itself. Covers major perils. Liability protection. Additional living expenses. Landlord’s insurance policy on the dwelling does not cover the renter’s personal possessions. Resources: Southwestern Publishers, Economic Education for Consumers 2000 Glenco McGraw-Hill Publishers, Consumer Education and Economics 2003 www.ConsumerReports.org www.quicken.com www.farmersinsurance.com