Harousseau Presentation - Alliance for Health Reform

advertisement

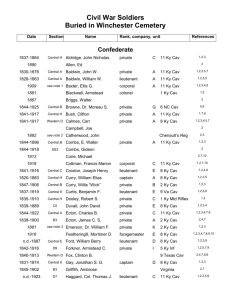

Control of Pharmaceutic Costs in France Prof. Jean-Luc Harousseau Chair of the Board Haute Autorité de Santé, France Washington DC, 7th November 2011 The French Healthcare system in a nutshell • • Universal care coverage National Health Insurance (NHI) – – – • Supplementary Health Insurance: – • Statutory, coverage > 90% of the population Three major funds: salarees, rural workers, self-employed Universal Medical Coverage (CMU) since 2000: for uninsured patients and supplementary coverage under threshold income 92 percent of the population subscribe to supplementary health insurance Which medical services are covered ? – – Hospital care, ambulatory care, prescription drugs For prescription drugs:Coinsurance level depends on the therapeutic value 2 General rules for drug reimbursement and pricing 1. All drugs have to be assessed by HAS before inclusion on the positive list of reimbursed products 2. Role of the HAS Commission (CT) : advice for reimbursement and pricing Reimbursement based on the Actual Benefit (SMR) - insufficient : 0% reimbursement ( to be confirmed by the law) - weak : 15% reimbursement ( currently debated) - moderate: 30% reimbursement - important: 60% reimbursement Pricing based on the Added Value (ASMR) - 5 levels 3. For 30 chronic diseases (ALD) 100% coverage by SHI of drugs on the positive list 13% of patients , 68% of spendings 4. Review every 5 year or when significant new information is available. 3 Access to innovative and expensive agents • • • • • • In addition to the positive list, Specific list for coverage of innovative drugs and devices (inpatient care) Fully covered by SHI outside the hospital activity-based financing system (T2A linked to DRG type information system) Mostly cancer and biotherapy drugs Off label use authorized (and reimbursed) if « good clinical use » according to available literature: to be restricted by the law currently discussed at the Parliament Annual Budget fied by the Parliament (ONDAM) Parliament : National Health Spending Objective (ONDAM) Parliament adopts every year a national health spending objective (ONDAM) ► sets targets to the spending made by the mandatory basic schemes ► indicative, not compulsory. HTA, Pricing and reimbursement procedures CEPS Economic Committee for Healthcare Products HAS Guidance Decision Ministry of Health, M. of Social Security NHI Union February 2011 Price L I S T I N G Copayment Level 5 Initial assessment: From HTA to decision making on price and reimbursement Dimensions Criteria Clinical aspects • clinical efficacy • clinical effectiveness Results Insufficient Actual Benefit No reimbursement Sufficient • relative effectiveness Other aspects • disease characteristics • target population • impact on public health Clinical added value • impact on healthcare organisation (qualitative) HTA: HAS Guidance No added value Reimbursement only if price inferior to comparators Added value Price may be higher than comparators P R I C I N G Decision: Ministry Pricing: Economic Committee 6 The pricing committee CEPS (Comité économique des produits de santé) 1999 Membership • Drug and medical devices industry trade unions • Representatives from ministries ( health, industry, finance) • Mandatory and voluntary sickness funds representatives Remit – Five year agreement with industry trade-unions (provisions for data access, good use and expenditure growth control) – Decision on drug pricing and annual individual price/volumes agreements with companies – monitoring trends in spending on drugs in relation to the annual budget targets (sanctions if overshooting volume targets) – Risk sharing agreements other than price/volumes agreement possible but very rarely used 7 Reforms on the drug market side • Incentives to participate in negotiations through a default clause for non participating firms • Incentives for generic prescribing by physicians and substitution right for pharmacists • Regular increases in advertising tax set up in 94. • Limits on the number of drugs reimbursed (around 600 drugs removed from the positive list) • As of 2011 decrease in the drug reimbursement rate (from 65 to 60 and from 35 to 30%) • As of 2001 severe HTA excluded from the ALD list (no longer 100% covered) Reforms in the ambulatory care sector: Professionals • Agreements on good use of care ( AcBus) defined by NHI • HPST Law: Evaluation of health care professionals’ competence (Continuous professional development) • NHI individual contracting with physicians: beyond collective negotiation of fees, introduction of NHI Individual contracting with physicians (CAPI -Contrat d’amélioration des pratiques individuelles), on a voluntary basis, starting in 2009 • To be extended with the recent contracting between NHI and GP: « French » P4P introcucing a list of « quality indicators » including generics prescription Patients • Slow introduction of gate-keeping : after several attempts, setting up of the ‘médecin traitant’ option (treating doctor !) reform in 2004. • Development of disease management and patient education Sales of reimbursable drugs - 2010 • • Total sales 2010: Euros 25.5 billion. 1.3% increase / 2009 (3% in average for the previous 5 years) – – • community pharmacies +0.5% Hospitals +6% Slowing down of growth due to : – – – – – lapsing of patents growing generic substitution Reduced number of new innovative drugs, impact of price management promotion of rational prescribing (“maîtrise médicalisée”) June 2009 10 HAS specialist Committees Chairman of the Board : Prof. Jean-Luc HAROUSSEAU Managing Director : Dominique Maigne Pharmaceuticals (Transparency Committee) Medical Devices, interventional and diagnostic procedures Economic and Public Health Evaluation (CEESP) Healthcare cover for long-term conditions Medical information quality and dissemination Accreditation of healthcare organisations Clinical Guidelines October 2010 11 From clinical relative effectiveness to collective added value Value based pricing has to rely on the explicit and quantitative assessment of all the individual and collective value determinants For the French pricing system to qualify as ‘value based pricing’, additional issues must be addressed, beyond the measurement of clinical added value (relative effectiveness): • efficiency • organization of care • Social values HAS may increasingly contribute to this assessement 12 HAS adoption of health economics • New remit by Law in 2008 • For HTAs and for public health and good practice guidelines • No cost-effectiveness analysis for new technologies: – Short time frame for CAV assessment – Price proposed by the firm not known at time of assessment • Mostly at time of reassessment (every five years) with possible impact on CEPS price revision Statins, Drug eluting stents, .. • For some technologies, full HTAs (inc. ethics and social values) Growth hormones for non-deficient children • Increasingly, financial impact included for first listing 13 Future changes to be expected at HAS • Recently, 6 independent official reports from various auditing boards recommended that HAS advice be more oriented towards documenting the collective added value of drugs/technologies, leaving the assessment of the individual clinical benefit/risk ratios to the French licensing body • HAS may have to carry out mini HTAs with economics for some new technologies, with a potential impact on prices • Reeavaluation after 2-3 years with post-inscription studies and real-life prescriptions • Currently debated in Parliamnet 14 8.7 8.5 8.5 8.4 8.1 7.8 United Kingdom Australia Norway Finland Japan Slovak Republic 6.0 5.9 Mexico 6.5 Turkey Korea 6.9 8.7 Ireland Chile 9.0 OECD 7.0 9.0 Spain Poland 9.1 Italy 7.1 9.1 Iceland Czech Republic 9.4 Sweden 7.2 9.7 Greece Luxembourg 9.7 Denmark 7.3 9.8 New Zealand 1 Public expenditure on health Hungary 9.9 Portugal 10.2 Belgium 1 9.9 1. Current expenditure. Source: OECD Health Data 2010. Netherlands 10.4 Canada 0 10.5 2 Germany 4 10.5 6 Austria 8 10.7 10 Switzerland 11.2 12 France 16.0 16 United States Health expenditure as a share of GDP, 2008 (or latest year available) % GDP 18 Private expenditure on health 14 15 Pharma expenditure per capita (USD) France Germany UK HAS : an independent scientific public body Broad scope of missions and an integrated global approach to improve quality and safety of healthcare: – assessment of health technologies (drugs, devices, diagnostic and interventional procedures) for pricing and reimbursement, – clinical practice guidelines, – public health guidance, – chronic disease management models and guidance, – guidance and recommendations on the most effective strategies (prescriptions, care pathways...) – Certification and continuing professional development, – hospital accreditation, – labeling of patient information websites. HAS Guidance Content for a new drug 1. Eligibility to reimbursement (SMR) – Full indication or restricted to situations or subpopulations 2. Assessment of clinical added value (ASMR) – What is the added value and for what population? 3. Target population – Quantitative estimate 4. Uncertainty – and need for additional data collection 5. Recommendations – for use in clinical practice October 2010 18 HTA and prices: are we changing our minds? 19 CEPS pricing rules Decision tree / Clinical added value (CAV) • High CAV (I, II, III): eligible for faster access at a European price (Price notification instead of negotiation) • No CAV (Level V): price lower than comparators (by Law) • Minor CAV (IV): negotiation Additional criteria • Competitors’ prices in same therapeutic indication • Forecast or recorded sales volumes • Expected and/or actual conditions of use Price review • « automatic » at the end of a « price stability period » for innovative drugs • « Volumes clauses » (higher volumes than expected) • « Daily treatement cost » clause (e.g. higher dosages used) 20 Thank you for your attention http://www.has-sante.fr 21