PowerPoint Presentation - The Rise and Slide of Managed Care

advertisement

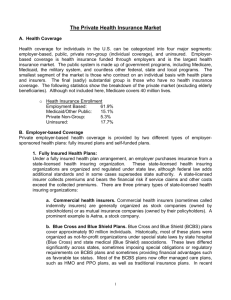

Private Health Care Coverage LHCO 215 Oct. 13, 2011 Robert Kaplan Goals for this class are to understand: Private Health Care Coverage and their effects on the delivery of health care Different Models of Private Health Coverage Regulations of PHCC State and Federal Pre-1940s Financing of Health Care Fee For Service Private Pay and Charity Care Organization of Health Care Delivery Solo practice Public, religious and private non-profit Hospitals A few alternative systems: Multi-specialty Group Practices Community Health Centers Transformation of out-of-pocket into third-party payment Growth of private insurance Blue Cross/Blue Shield during Great Depression Non-profit organizations, closely tied to state hospital associations (BX) and state medical societies (BS) Employer-sponsored insurance in WW II and beyond Medicare and Medicaid enacted in 1965 Out-of-pocket Payments as a Share of Health Expenditures, 1960-2005 70% 60% 50% 40% 30% 20% 10% All health services Physicians Hospitals 05 20 03 20 01 20 99 19 97 19 95 19 93 19 91 19 89 19 87 19 85 19 83 19 81 19 79 19 77 19 75 19 73 19 71 19 69 19 67 19 65 19 63 19 19 61 0% Why do so many people highly value health insurance? Protect against financial risk Need for health care is unpredictable (20/80 rule) As a result of risk aversion, most people would rather spend $4,000 every year rather than face a 1 in 10 chance of a $40,000 loss Protect against health risk Some care may be so expensive that it would be unobtainable in the absence of insurance Status Quo Ante, 1980 Insurers paid any licensed doctor or hospital for all the care the patient received No selective contracting BX/BS were creatures of hospital/physician associations Paid for any services that were ‘medically necessary’ Exclusions for ‘experimental’ therapy, but virtually no utilization review Insurers had little influence on the practice of medicine Status Quo Ante, 1980 (cont.) Physicians were paid at ‘Usual, Customary, and Reasonable’ rates (UCR) by Blue Shield Hospitals were paid at cost by Blue Cross Medicare payment methods, 1965-1982 When enacted in 1965, Medicare was designed to mimic prevailing BX/BS plans, both in benefit design and payment methods Contracted with intermediaries and carriers (mostly BX/BS associations) to make payments to MDs and hospitals UCR method for physicians; cost-based payments for hospitals Results of Well-Insured FFS Hospitals competed for doctors in a medical arms race New technology is attractive to physicians, and resulted in higher revenues Little financial reward to physicians for fee restraint Physicians were not rewarded for using fewer rather than more resources to get patients better Specialists performing newly developed procedures were able to make much more money than primary care physicians because they had substantial flexibility in establishing UCR amounts Results of Well-Insured FFS (cont.) Emphasis on episodic care for acute problems; limited ability to provide coordinated care for chronic conditions Large variations across geographic areas in how care was delivered, with no organization having authority, responsibility, or accountability to figure out which rate is right Few financial rewards for improvements in quality or patient safety Concerns about Open-ended FFS Payment Expenditures increasing at an unsustainable rate Payment for quantity, not for value Quality Little accountability for quality Underinvestment in management of chronic disease Underinvestment in primary and preventive care Types of insurance products Conventional FFS Preferred Provider Organizations (PPO) Point-of-Service (POS) Health Maintenance Organization (HMO) Types of Insurance Products Conventional FFS Any MD or hospital in town; no UR Deductibles and co-payments Preferred Provider Organization (PPO) Contracted list of MDs and hospitals Lower deductibles and co-payments when using ‘in-network’ providers e.g., $500 deductible and 80/20 in-network; $1,000 deductible and 60/40 out-ofnetwork (plus balance billing) Minimal utilization review, although pre-admission approval for inpatient care and high cost procedures/imaging typically required Types of Insurance Products (cont.) Health Maintenance Organization (HMO) Care paid for only if provided by doctors or hospitals under contract Differences for patients from FFS/PPO coverage: Minimal co-payments and out-of-pocket liability Restricted to a panel of MDs and hospitals Referrals must be authorized by PCP Point-of-Service (POS) Combination of HMO and PPO -- HMO-style benefits and restrictions, plus the option of using other physicians with relatively high co-payments and deductibles Quick History Lesson Multi-Speciality Group Practice (1900) Mayo Clinic, Meninger, Palo Alto Foundation Prepaid Group Practice & HMOs (1929-30) Ross-Loos – D of Water & Power Kaiser – Dr. Sidney Garfield – Grand Coulee Dam Richmond, CA – Kaiser Industries/ PMPM UMW, Group Health Cooperative of PS Quick History Lesson Conitnued First generation – HMOs Vertical Integrated KFHP, KF Hospital, Permanente Medical Group Second Generation HMOs/ IPA – Virtually Integrated San Joaquin Foundation for Medical Care (1954) Alternative to Kaiser Rapid growth conversion to for- profit Paul Ellwood HMO Act Pres. Nixon(1973) Federal Qualification an HMO must be offered + FFS Types of HMOs Kaiser – vertically integrated health plan Hospitals and medical group providing service only to Kaiser members Clinical autonomy within a system of constrained resources ‘Managed’ fee-for-service Insurance company contracts with providers on a FFS basis 1-800-RN-MAY-I utilization review Managing prices more than care Types of HMOs (cont.) CA HMOs – Virtually Integrated-the Delegated Model Capitated payments to medical groups and hospitals; financial risk and utilization management delegated to medical groups In theory, provided physician groups with flexibility to use resources more efficiently Distribution of Health Plan Enrollment for Covered Workers, by Plan Type, 1988-2009 Basis of competition among private insurers in the employer market Almost entirely self-insured and experience rated – employer determines product design Administrative costs and customer service (including, to a limited extent, provider satisfaction) Success at negotiating lower unit prices (primarily a result of leverage, although in this decade, providers have more leverage than insurers in most markets) To a limited extent, ability to lower claims costs through selective contracting with high quality/low cost providers, innovative disease management programs, and utilization review/hassle factor Regulation of Private Health Care Coverage -Federal ERISA (1974) Preempts state laws especially on benefit plan No mandate on benefit or coverage level Fiduciary Manager Summary plan description, claim and appeal info Annual reporting requirements IRS/DOL Remedies and enforcement but no “pain” Continuation Coverage-COBRA (1985) Federal - Continued HIPAA (1996) Privacy rule for personal health information Pre-exisitng conditions 12 mos/63 days Access to coverage employers 2-50 State High Risk Pool’s Renewability guarantee but no control of price Federal - Continued Women’s health and coverage Act Newborns and Mothers HPA Mental Health Parity Pregnancy Discrimination Act ADA Regulation of Private Health Coverage – State McCarran – Ferguson Act (1945) CA- Dept Managed Health Care – HMOs DOI – Insurance Prodcuts Financial standards Market conduct, Access Stds & benefits, Forms Premium Increase- Input - Approval State - Continued Network Adequacy UR Practices Credentialing Quality Assessment and Improvement Appeal and Grievance Sue Only under Malpractice Summary Physicians and hospitals receive most of their revenue from public and private insurers Most revenue is from fee-for-service payment FFS payment systems pay more for more service, regardless of the value produced by that service Summary - Continued Flailing about for some method of controlling expenditure growth: Medicare limits price increases, but has few tools for limiting volume increases Private insurers attempt to limit price increases, with some success from 1993-99, but little success from 2000 and beyond Private insures hassle physicians and hospitals, and these hassles somewhat restrain volume growth Discussion Divide by Healthcare Coverage types Present Pro’s and Con’s of each type Does a “gatekeeper” Model work? Hold costs down? Lessons Learned by being a consumer of healthcare

![[source]](http://s2.studylib.net/store/data/015396650_1-f1acc7042a9d63c06dcb7c0729147336-300x300.png)