Lesson 5 - Financing

advertisement

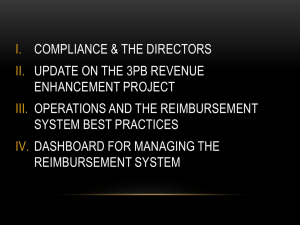

U.S. Health Care Delivery Financing & Reimbursement Objectives • Learn about U.S. health care financing • Identify different payers for health care – Private insurance – Public insurance – Employers – Citizens • Discuss insurance, reimbursement methods, and their effects on health care U.S. Health Care Financing • Financing: includes two functions – Payment for delivery of services – Purchase of health insurance • U.S. health care delivery financing is very complex – Health insurance is the most common avenue for receiving care • Health care financing through various public and private sources ultimately aggregates into national health care expenditures Who Pays for Health Care? • Employers? The U.S. Government? – Employers and the government are the primary financiers of health care in the U.S. – Private and government insurance plans pay the bulk of health care costs • Patients? American Citizens? – Patients often directly pay a relatively small portion of the costs of services received – Americans indirectly finance health care through employment and taxes • Payment to providers of care is handled in numerous ways An Illustration of Financing = The Sandwich Guy I’ve started a sandwich shop! My sandwiches cost me $4.50 to make on average I’ll charge $5 for each sandwich to cover my costs and wages You Guys Are In the Mood For a Great Sandwich! Everything is going okay… Folks are buying sandwiches, and I’m making 50₵ on each sandwich But things could be better… Some of you don’t have $5 to spend on a sandwich! Some of you would like to eat sandwiches more often, but your budget limits the number of times you can eat out Health Insurance: Basic Concepts • Insurance is a mechanism for protection against risk – Risk = possibility of substantial financial loss – Insured = individual protected against risk by insurance • Also referred to as enrollee or beneficiary – Insurer = insuring agency that assumes risk • Also referred to as underwriter – Underwriting = technique for evaluating, selecting, classifying, and rating risks – Premium = amount charged for insurance coverage Health Insurance: Four Principles • Four fundamental principles underlying the concept of insurance – Risk is unpredictable for the individual insured – Risk is generally predictable for a group or population – Insurance provides a mechanism to transfer or shift risk from the individual to the group by pooling resources – Actual losses are shared on some equitable basis by all members of the insured group Health Insurance & Cost Sharing • Cost sharing = insured assumes part of the risk – Three types of cost sharing • Premium cost sharing – Insured workers pay 15% for single plans, 26.5% for family – Payroll deductions • Deductible – Amount insured pays before plan benefits are payable – Usually paid on an annual basis – May have separate deductibles for hospitalization, outpatient • Copayment – Amount paid out of pocket each time health service provided – Includes co-insurance, which is the ratio of cost sharing – Marginal vs. Total Cost Health Insurance & Cost Sharing • Cost sharing example – Bob pays $400 each month in insurance premiums – His plan requires a $500 deductible – His plan also offers 80:20 coinsurance • The ratio of cost sharing = coinsurance • The dollar amount paid = copayment – Stop-loss provision of $1,500 • Maximum out-of-pocket liability incurred per year Health Insurance & Cost Sharing • Why do we have cost sharing? – Reduces misuse of insurance benefits – Control utilization of health care services – Addresses moral hazard by making the insured more responsible for health care costs – Promotes responsible behavior in health care utilization Private Insurance • Recall the history of health insurance • Five types – Group insurance – Self-insurance – Individual private insurance – Managed care plans – High-deductible health plans Group Insurance • Obtained through employers, unions, or professional organizations – Sponsors purchase insurance for participants • Spreads out risk and costs of health care across a substantial number of people Change is in the Air… A number of you work for TU… …RIGHT NEXT to The Sandwich Guy! You sure would love to eat the sandwiches there more often during lunchtime. Trinity wants to keep you as good employees, and they know you love sandwiches. They worry you’ll start thinking about working elsewhere. Here Comes Mr. Private Insurance He’s got a special deal to offer TU “If your employees just pitch in $20/month, they’ll receive a “membership” into the Healthy Appetite Club!” …sounds like a “premium”… …what’s the catch? The Healthy Appetite Club In addition to your $20/month premium… You pay for your first sandwich (…$5 deductible) After that, you pay only 20% of retail price on sandwiches! (…$1 copayment) After you eat 6 sandwiches in a month, the rest of your sandwiches that month are FREE (…$30 maximum out-of-pocket liability) It would have cost $30 for 6 sandwiches With a membership, you start saving LOTS of money once you’ve eaten 7 or more sandwiches Your incentive is to EAT MORE SANDWICHES!!! (…sounds like moral hazard…we’ll revisit that…) Behind the Scenes… Mr. Private Insurance approaches me: “Here’s the deal Sandwich Guy… I’ve got these TU employees signed up as members, and they’re ready to eat sandwiches. I’ll include you in my “club” so they get a great deal by eating sandwiches at YOUR shop… …BUT instead of paying you $5 for a sandwich, I’m going to pay you $4.75 each time I pay for one of my members’ sandwiches. Don’t like it? I’ll be happy to go across the street and make The Sandwich Dude a participating restaurant of my club.” (my biggest competitor!) …how can I refuse??? Now I’ve Got a Problem… I was making 50₵ for each sandwich Now I’m only getting $4.75 for a lot of the sandwiches being purchased… …I’m not making as much per sandwich! But I have an incentive to sell more If I have the power, I might increase the price of my sandwiches for other customers to make sure I earn income to provide for my family. But think about what this implies. Self-Insurance • Some employers are big enough they can selfinsure by budgeting a certain amount of money to pay for employees’ medical claims • Provides employers with greater degree of control • Protected from risk of high losses by purchasing reinsurance from private insurance companies • Exempts them from many state insurance regulations Individual Private Insurance • Rather than spread out risk across a group of participants, premium price and eligibility is determined based upon individual health status and demographics – Barrier for high-risk individuals • Who pays for individual private insurance? – Self-employed – Employees whose employer doesn’t offer insurance – Early retirees • ACA – Public insurance exchanges or Marketplace? How Can I Get In On This??? A few of you are getting annoyed…your friends keep bragging about the deals they get on sandwiches, and you want in! You call up Mr. Private Insurance and ask if he’ll help you get a discount on your sandwiches… How Can I Get In On This??? To one of you, he says: “Okay, can I get a list of your favorite foods and how often you eat out at local restaurants?” He figures there’s NO WAY he’ll have to pay much for sandwiches, so he lets you in on the deal by paying $25/month for his bargain rates How Can I Get In On This??? To another, he says: “Okay, can I get a list of your favorite foods and how often you eat out at local restaurants?” But this time he’s worried he might have to pay more than he’d like based on his prediction of your eating habits He’ll let you in on the deal too, but you have to pay $30/month… …AND you’ll pay $1.50/sandwich after the 1st sandwich… …AND you won’t get free sandwiches until the 10th sandwich. How Can I Get In On This??? To the third one of you, he says: “Okay, can I get a list of your favorite foods and how often you eat out at local restaurants?” But he KNOWS you love sandwiches and will eat at The Sandwich Guy all the time… …so he refuses to let you in on his deal. You’ve been denied coverage! Managed Care Plans • Like health insurance, they assume risk in exchange for insurance premiums • Contract with a network of providers to assume responsibility for delivering care to enrollees – Patients expected to stay in-network for care – Higher out-of-pocket expenses incurred for going outof-network • Monitor utilization, adopt a variety of different reimbursement methods High Deductible Health Plans • Also referred to as consumer-driven health plans • Link personal savings account to insurance – HDHP/Health Reimbursement Arrangement (HRA) • HRA funded by employer • Funds reimburse insured for qualified medical expenses, including premiums – HDHP/Health Savings Account (HSA) • Employers may contribute, but are not required • Funds belong to account holder and accumulate • Benefits of tax exemption & tax-deductible contributions Public Insurance • Recall the creation of Medicare & Medicaid • Public insurance financed by government; services purchased from private providers – Some exceptions – for example, V.A. – Medicare Part A – Medicare Part B – Medicare Part C – Medicare Part D – Medicaid – SCHIP Medicare • Finances care for: – Persons 65 years and older (84%) – Disabled individuals entitled to Social Security benefits (regardless of age) – Persons with permanent kidney failure (end-stage renal disease, regardless of age) • Administered by Centers for Medicare and Medicaid Services (CMS) • “Of all government programs, Medicare poses the single greatest future challenge to taxpayers” (p. 139) Medicare • Economic Rational – Because employer-provided insurance isolated retirees, Adverse Selection was a real threat – Can think of Medicare (and Medicaid) as a response to market failure – Cost based reimbursement lead to increased utilization, DRG prospective payment rearranged incentives – a form of capitation Medicare • Elderly spend an average of 22% of annual income on out-of-pocket health expenses – Deductibles, copayments, noncovered services • 20% of beneficiaries qualify for Medicaid – Picks up expenses not covered by Medicare • 25% of beneficiaries privately pay for supplemental insurance policies – “Medigap” policies, covering all or a portion of Medicare deductibles & copayments Medicare Part A • Hospital Insurance – Inpatient hospital services, skilled nursing facilities, home health, hospice • Funded by a tax of 2.9% of earnings paid by employers and workers (1.45 each) • ACA increases payroll tax by .9 percentage points for high income taxpayers (more than $200,000 for an individual) • Accounts for about 36% of total Medicare spending • About 46 million enrollees Medicare Part B • Supplemental Medical Insurance – Physician, outpatient, home health, and preventative services – Funded by general revenues and beneficiary premiums – set to cover 25% of spending in the aggregate. Higher income pay higher premiums – Accounts for about 27% of total spending – About 42.4 million enrollees Medicare Part C • Medicare Advantage (formerly Medicare+Choice) – Allows beneficiaries to enroll in a private insurance plan – These plans receive payment from Medicare – Accounts for about 24% of spending – 11.5 million enrollees – Evidence suggests these plans have achieved cost savings over traditional plans – Less “cream-skimming” than under Medicare +Choice – ACA lowers payment to these payers Medicare Part D • Recently implemented (2006) • Voluntary program, requiring monthly premium • Two types of private plans – Stand-alone prescription drug plans (PDPs) – 17.7 million or 28% of enrollees • Offer only drug coverage • Available to those staying in the original Medicare fee-for-service program – Medicare advantage prescription drug plans • 9.9 million or 21% of enrollees • Available to those who want to obtain all health care services through MCOs participating in Medicare Advantage (Medicare Part C) • ACA removes “doughnut hole” and puts in place income-related premium similar to the Part B premium Services Not Covered By Medicare • • • • • • • Vision care Eyeglasses Dentures Hearing aids Routine physical exams Many preventive services Long Term Care Medicare Medicaid • Jointly financed by federal and state governments – Federal government provides matching funds to states based on per capita income in each state • Administered by each state – Eligibility criteria, covered services, payments to providers vary by state • Means-tested program Medicaid • Finances care for: – Indigent • But does not provide medical assistance for all poor persons • Certain low-income people required for coverage by federal law (many elderly, blind, disabled receiving Supplemental Security Income, some pregnant women) – Eligibility criteria established by each state according to threshold levels for income and other resources and assets • Most states defined “medically needy” categories (e.g., institutionalized in nursing or psychiatric facilities) – Instrumental in providing health insurance to children in low-income families SCHIP • State Children’s Health Insurance Program • Offers additional federal matching funds to states to expand Medicaid eligibility to enroll children under 19 years of age – Also provides coverage to qualifying pregnant women, parents, and caretaker relatives • Participating states have three options: – Expansion of Medicaid – Establishment of special child-health assistance program – Combination of the two approaches Reimbursement • Third-party payers – Insurance companies, MCOs, BC/BS, Government – Join the patient & provider as “third party” – Payment by third-party payers to providers for patient care is reimbursement • Various methods Fee for service Package pricing RBRVS Managed care reimbursement Retrospective Prospective (DRGs) Fee for Service Reimbursement • Based on assumption that services are provided in a set of identifiable and individually distinct units of services – Each service is separately billed – Initially set by providers and passively paid for by insurers, later limited to “usual, customary, and reasonable” amounts determined by payers • Resulted in “balance billing” – asking patients to pay for the difference in actual charges and payments received Fee for Service Reimbursement • Are there problems with this arrangement? • Incentives? • Induce demand and deliver additional nonessential services • Cost escalation Package Pricing • Also referred to as bundled charges – Related services included in one price • The Patient Protection and Affordable Care Act of 2010 called for a pilot project on bundled payments – Provides acute care provider with single payment for patient’s entire episode of care – Provider is responsible to distribute payments to other participating providers during the episode Resource-Based Relative Value Scale • Reimburses physicians according to a “relative value” assigned to each physician service • Based on time, skill, and intensity required for each service • Reimbursement calculated from a complex formula – Published in the Medicare Fee Schedule under current procedural terminology (CPT) codes – Adjusted for geographic area Managed Care Reimbursement • Three approaches – PPOs • Establishes fee schedules based on discounts negotiated with in-network providers – HMO physicians • Have salaried physicians on staff – HMO capitation • Provider paid a set monthly fee per enrollee, regardless of whether or how often enrollee received care • Removes incentive for provider-induced demand • Encourages provision of only necessary services Retrospective Reimbursement • Medicare and Medicaid established per diem (or daily) reimbursement rates for hospitals, nursing homes, home health, and inpatient facilities • Based on actual costs incurred by providers during previous year • Rates set after evaluating costs retrospectively Retrospective Reimbursement • Are there problems with this arrangement? • Based on costs directly tied to length of stay, services rendered, and service costs • Incentives? • No incentive to control costs – Increase revenue by increasing costs • No incentive to discriminate services • No incentive to manage length of stay Prospective Reimbursement • Has largely replaced retrospective reimbursement, doesn’t use historical costs • Determines payment amounts in advance using pre-established criteria – Inpatient: Diagnosis Related Groups (DRGs) – Outpatient: Ambulatory Payment Classifications (APCs) – Skilled Nursing: Resource Utilization Groups (RUGs) • Determined by case mix (severity of patients’ condition) – Home Health: Home Health Resource Groups (HHRGs) • Pays fixed rate for 60-day episode of care So What? • What are the effects of all these different types of financing and insurance arrangements? – Access to health care – Payment to providers – Unintended consequences Negative Effects of Financing • Insurance desensitizes patients to price – Excessive demand from insured patients who want to use their benefits …consumers are driven to utilize more services when covered under insurance than if they paid out of pocket… moral hazard • Insurance desensitizes providers to price – Services with more liberal reimbursement are favored by providers …providers are driven to encourage demand to deliver additional and more expensive services, regardless of health benefits… provider-induced demand Negative Effects of Financing • To control the growth of health care demand and health care expenditures, rationing measures are implemented • Supply-side rationing – Restricts supply of services through central health planning (limiting availability of expensive care) – Experienced in national health care programs • Demand-side rationing – Does not extend health insurance to all residents – Experienced in the U.S. What We’ve Learned • Financing is a critical part of the U.S. health care delivery system – Insurance coverage for patients – Reimbursement for provider services • Private and public forms of insurance • Methods of reimbursement • The effects of financing on the U.S. health care delivery system Areas of Focus • Important terms relating to the concept of insurance • Private and public forms of insurance • Methods of reimbursement • The effects of financing on the U.S. health care delivery system