FBS Insurance Power Point. 2015

advertisement

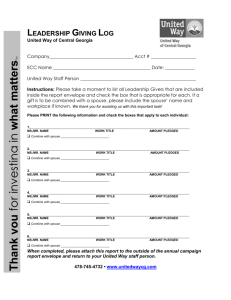

Where Benefits Meet Technology Changing the Game The content of this Power Point is designed only for communication purposes and is not to be considered a contract, nor does it guarantee or imply coverage. Consult your plan booklet or Administrator for detailed coverage or pre-existing limitations. Frenship Independent School District 2015 Benefit Open Enrollment Plan Overview Section 125 Cafeteria Plan There are special rules and requirements to receive the pre-tax benefit election plan privileges: ― Frenship ISD must set a plan year. The district’s plan year is January 1 to December 31 of each year. ― Although coverage is voluntary, every employee is required to review their current elections, make changes if desired and *sign a Section 125 Benefit Election Form. ― Any pre-tax elections will remain in effect unless you have a qualified change in family status. Changes must be made within 31 days of the event. ― Any pre-tax elections will remain in effect and cannot be revoked or changed during the plan year unless you have one of the following: Marriage, Divorce, Birth/Adoption, Death, Change in Dependent Eligibility, etc. Medical Gap Insurance · American Public Life Designed to cover your out-of-pocket expenses such as co-payments, deductibles and co-insurance. In-Hospital Benefit: pays up to the maximum amount chosen for Covered Charges incurred when a Covered Person is confined in a Hospital for 18 hours. $1,500 or $2,500 in-patient benefit available. Outpatient Benefits: pays a $200 benefit for Covered Charges incurred for treatment in a Hospital Emergency Room, outpatient facility or a freestanding outpatient surgery center. *Same condition must be separated by 90 days. Physician Benefit: pays for a physician visit up to $25 per visit, for up to five visits per family, per calendar year for treatment received outside of a Hospital as an outpatient. Also includes treatment at your Physician’s Office, Emergency Room or Clinic. Must participate in Districts Medical Plan to be eligible for this Benefit. Medical Gap Rates · $1,500 Ages Under 55: Ages 55-59: Employee Only $21.50 Employee & Spouse $39.50 Employee Only $32.00 Employee & Spouse $59.00 Employee & Children $36.50 Family $54.50 Employee & Children $47.00 Family $74.00 Family $18.36 Ages 60+: Employee Only $49.00 Employee & Spouse $88.00 Employee & Children $64.00 Family $103.00 Medical Gap Rates · $2,500 Ages Under 55: Ages 55-59: Employee Only $28.00 Employee & Spouse $51.50 Employee Only $44.50 Employee & Spouse $81.50 Employee & Children $45.50 Family $69.00 Employee & Children $62.00 Family $99.00 Family $18.36 Ages 60+: Employee Only $68.50 Employee & Spouse $122.50 Employee & Children $86.00 Family $140.00 Telehealth · Healthiestyou Telehealth is 24/7 access to a doctor via phone, video and email for the diagnosis and treatment of illness, second opinions and common conditions. An estimated 80% of primary care, urgent care and emergency room visits can be avoided using Healthiestyou's telehealth services. Improved patient outcomes, better access to care and tremendous time and cost savings can be achieved through healthiestyou. Telehealth can deliver medical services where they are needed most, and remove barriers of time, distance, and provider scarcities. Plan is $9.00 for the Family. Telehealth · Healthiestyou Dental Statistics 92% of adults 20 to 64 have had dental caries in their permanent teeth. 12% of Adults 20 to 64 have not been to the dentist within the past 5 years. 42% of children 2 to 11 have had dental caries in their primary teeth. 23% of children 2 to 11 have never been to the dentist. Direct Reimbursement Dental Plan You are covered at 100% of the 1st $100 You are covered at 80% of the next $250 You are covered at 50% of the next $1,400 Employee Only $26.00 Employee & Spouse $52.00 Employee & Children $55.00 Employee & Family $81.00 Annual maximum benefit per covered person is $1,000 Orthodontia is covered for participants and has a lifetime EXPERTISE benefit of $1,000. Benefits are paid just like they are on dental. Exclusions: cosmetic dentistry, implants, TMJ Use of the NBS Flex Card is prohibited with dental claims; you must file a paper flex claim. Vision Statistics About 2.5 billion people see poorly but don’t have corrected vision. 80% of those vision problems are preventable! Poor vision not only affects a child’s eyesight, it can also affect his/her health, school progress, and societal integration. The risk of a child failing one grade is more than 3 times higher for children who have worse than 20/20 vision. Vision Insurance · Superior Vision Employee Only $7.28 Employee & Spouse $13.80 Employee & Children $13.98 Employee & Family $21.46 Eye Exam Co-Pay $10 Eyewear Co-Pay $20 Contact Lens Fitting Co-pay $25 Frame allowance $125 Retail (in-network). Lenses allowance Paid In Full (in-network). Contact Lenses allowance up to $150 (in-network). Vision examination allowed once every 12 months. Frames allowed once every 12 months. Lenses allowed once every 12 months. Contact Lenses allowed once every 12 months. Contact Lenses fitting fee once every 12 months. Disability Statistics The Long Term Disability Claims Review: Disability continued to be the leading cause of bankruptcies and mortgage foreclosures in the United States, causing nearly 50% of all foreclosures compared to 2% from death. Two-thirds of American families live paycheck-to-paycheck, and 70% can’t afford to be without a paycheck for just one month or less. More than 90 percent of disabling accidents and illnesses are not work-related, which means they aren’t covered by worker’s compensation insurance. Long-Term Disability Insurance · Aetna Coverage is Guarantee Issue, no health questions asked! Coverage is guaranteed up to $7,500 of monthly benefit based on your annual income. New coverage and increased benefits amounts are subject to a 12 month pre-existing condition exclusion. Benefits can last while you are under a doctor’s care to age 65 due to illness or injury. You may choose waiting periods in days of: 0/7, 14/14, 30/30, 60/60, 90/90 and 180/180, based on your individual needs. Disability benefits are received tax free. Claims are processed Telephonically. Cancer Statistics 1,665,540: The number of new cancer cases expected to be diagnosed in 2014. 585,720: The number of Americans expected to die of cancer in 2014, about 1,600 people per day. 232,670: Number of women expected to be diagnosed with invasive breast cancer in 2014; about 2,360 cases are expected in men. 20%: The decline in the cancer death rate for men and women combined from 1991 to 2010. More than 1.3 million cancer deaths have been averted as a result of this decline. Group Cancer Insurance · Loyal American Very Competitive Rates. Two options are available on the cancer plan: High Option and Low Option. Annual Cancer Screening Benefit: $50 per calendar year. First Occurrence Benefit: High Option $2,000, Low Option $500. Daily Radiation/Chemotherapy Benefit: High Option $400, Low Option $200. Daily Hospital Confinement Benefit: High Option $200/Day, Low Option $100/Day. Optional ICU Benefit: $1,000/Day for the 1st 30 days of ICU Confinement. Optional Specified Disease Benefit: Available with ICU Benefit. Transportation and Lodging: $0.50 per mile and up to $75/Day for Lodging. 2015 Cancer Rates · Low Plan Low Option W/ICU & Specified Disease Riders Low Option Employee Only $11.56 Single Parent Family $13.03 Employee Only $16.70 Family $18.36 Family $29.65 “Stand UP to Cancer” Single Parent Family $21.85 2015 Cancer Rates · High Plan High Option W/ICU & Specified Disease Riders High Option Employee Only $19.92 Single Parent Family $22.56 Employee Only $25.06 Family $31.97 Single Parent Family $31.38 Family $43.26 “Stand UP to Cancer” Accident Statistics Every 12 minutes, one person dies because of a car accident. Every 14 seconds, a car accident results in an injured victim. For those in the age group of 1 to 30 years, the leading cause of death is due to being involved in a car accident. More than 3.4 million children experience an unintentional household injury every year and 2,300 children under 15 die from these unintentional injuries. More than 662,000 of adults who suffered from falls in 2014 were hospitalized due to non-fatal fall injuries. Accident Insurance · American Public Life Benefits are paid directly to you! Pays regardless of any other medical coverage. Protects you 24 hours a day on or off the job. Issue ages for employee and spouse are 18-64. Policy is guaranteed renewable up to age 70. Benefits are available from 1 to 4 units. There is no limit on the number of accidents covered. + + 2015 Accident Rates · 1-2 Units 2 Units 1 Units Employee Only $10.80 Employee & Children $21.20 Employee & Spouse $19.40 Family Family $29.80 $29.80 Employee Only $17.10 Employee & Children $34.90 Employee & Spouse $29.80 Family $18.36 Family $47.60 2015 Accident Rates · 3-4 Units 3 Units 4 Units Employee Only $21.50 Employee & Spouse $38.90 Employee Only $24.50 Employee & Spouse $44.90 Employee & Children $45.20 Family $62.60 Family Employee & Children $52.00 Family $72.40 $62.60 Employer Paid Base Life Insurance Frenship ISD provides a $20,000 Basic Life and AD&D policy at No Cost to the Employee! For Employees working 30 hours or more per week. ++ Voluntary Group Life Insurance · Aetna Employees may elect additional coverage in $10,000 increments up to $500,000 not to exceed 5 times annual salary. Employees may elect up to 50% of the employee’s amount on their spouse. Children may be insured for $10,000 for $1.00 with one rate for all children. Any increases in coverage does require an evidence of insurability to be completed. Employees can elect AD&D coverage on a stand alone basis. AD&D is available for both employee or for the employee and family. Individual Life Insurance · TexasLife Permanent life is an individual life policy that provides a specified death benefit to your beneficiary at the time of death. The advantage of having a permanent life insurance plan as opposed to a group supplemental term life plan is that the permanent life insurance is guaranteed renewable, portable and premiums remain the level to age 121. Refund of Premium - Unique in the marketplace, purelife-plus offers you a refund of 10 years’ premium, should you surrender the policy if the premium you pay when you buy the policy ever increases. (Conditions apply.) You can cover yourself, and or your spouse, minor children (15days-18 / 19-26 if a full-time student), even your grandchildren without covering yourself. Plan includes an accelerated death benefit due to terminal illness. If you pass prior to age 65 due to an accident the face amount of your policy doubles. Health Savings Account Information H.S.A. Eligible Participants: Employees that contribute to an H.S.A. account are restricted to a limited-purpose Health F.S.A., for reimbursement for dental and vision care expenses only. Flex Plan Admin · National Benefit Services Plan Year: January 1, 2015 to December 31, 2015. Plan Maximum: $2,550 Annually. Flex funds are fronted to you at beginning of plan year on a MasterCard. Services must be incurred in plan year. 2 ½ month grace period to incur claims following plan year. 90 day grace period to file claims following plan year. Can be used for all IRS Classified Dependents. “Use it or lose it” + + Medical Reimbursement Account · NBS Tax Free Account for Out-of-Pocket Medical Expenses on a Pre-Loaded Visa Card Plan Maximum: $2,550 Annually. Examples are: Doctor Office Co-Payments Prescription Co-Payments Dental Expenses Vision – Glasses, Contacts, etc. Dependent Care Reimbursement Account · NBS Tax Free Account for eligible Dependent/Child Care Expenses. Tax Free Deduction via payroll vs. deduction on income tax. Annual Maximum: $5,000 for married couple filing jointly or head of household or $2,500 if filing single. Statistic Sources www.cancer.org www.aao.org www.ada.org www.disabilityfunders.org www.cdc.gov Thank You