Monetary Theory and Business Cycles

advertisement

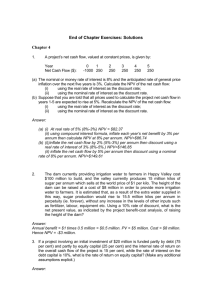

Monetary Theory and Business Cycles • From the very beginning of the option theory, it was considered as a part of much larger foundation. • I like the beauty and symmetry in Mr. Treynor’s equilibrium models so much that I started designing them myself. I worked on models in several areas: • • Monetary theory • Business cycles • Options and warrants • • For 20 years, I have been struggling to show people the beauty in these models to pass on knowledge I received from Mr. Treynor. • In monetary theory --- the theory of how money is related to economic activity --- I am still struggling. In business cycle theory --- the theory of fluctuation in the economy --- I am still struggling. In options and warrants, though, people see the beauty. (p. 93) • • Fischer Black may not realize that his breakthrough in options is much more fundamental. It extended CAPM from one period to continuous time. With such a continuous time framework slightly modified, the problem of business cycles can be understood very easily. • So is the monetary theory. • By applying the production theory. • We will use some examples to illustrate the applications to monetary theory and business cycles. Discount rate and economic structure Suppose in three different markets in countries A, B and C, annual sales capacity is 1 million dollars. Uncertainty is 50% per annum. Decision makers will attempt to maximize the net present value of investment project. If discount rates are 5%, 10% and 15% per annum in country A, B, C respectively, how much will be the desired fixed costs and how long will be the expected project durations? What are NPV of three projects? What conclusion we can draw from the calculations? Solving the problem S 1 K 1.590832 R 0.15 T 6.591449 sigma 0.5 d1 1.050402 d2 -0.23329 c 0.611885 NPV 0.967405 • In Excel, Click Tools. Select solver, maximize NPV, by changing fixed cost and duration. Solution Discount rate fixed investment duration NPV 15% 1.6 6.6 0.97 10% 2 9.2 1.66 5% 2.6 13.8 2.94 Pattern • Lower the discount rate, higher fixed investment, longer duration, higher NPV. • Calculation also shows that marginal profit stays roughly constant. Variable costs are around 60% for all three projects. Discussion • In other classes, we have discussed how the level of interest rate affect investment decisions. • The advantage of this theory is that the parameters here, such as the fixed cost, duration, NPV and profit margins are determined endogenously. They are not set up in an ad hoc manner. Unexpected change • Continued from the last problem. Suppose after five years, market conditions change unexpectedly and as a result, all three projects have to close down. What are the realized value of three projects? Realized values are defined as (S-C)T – K, where T is the number of years a project actually operates. What conclusion you can draw? Solution realized value 1 0.349741 realized value 2 -0.00256 realized value 3 -0.56495 percentage change from realized value over expected value project 1 -0.64 project 2 -1.00 project 3 -1.19 Discussion • When unexpected changes are few or unexpected changes are mostly in the positive direction, production systems do better in low discount rate environments. • In the past, with the increasing consumption of fossil fuels, economy grows most of the time. Low discount rate policy benefit economy most of the time. Discuss (Continued) • When negative unexpected changes occur, the production systems in higher discount rate environment perform better. • Production systems in high discount rate environments are less volatile. • In the future, higher discount rate policy may serve economy better. How high discount rate should go? • Reduce the effort from the central banks so financial institutions will be more sensitive to market risks. This will increase the prevailing discount rates in the market. • Gradually increase the weight of market discount rate and reduce the weight of government power. Critiques of current monetary theory • Policy makers try to maneuver discount rate to adjust level of economic activities. • From our theory, the level of discount rate affect not only current economic activities, but also future economic activities. • Low discount rate policy have especially long term impacts on future economic activities. • Low discount rate policy induce individuals and firms to borrow to consume or to invest, which stimulate economy. At the same time, policy makers warn against “excessive” borrowing. • Policy makers take credit for short term economic stimulus, but blame the long term negative impacts to the public. This is the heart of problem in many different areas. Stability is destabilizing • Hyman Minsky: “Stability is destabilizing” • What does it mean? • In countries A and B, annual outputs are 1 million dollars each. Discount rates are 10% per annum each. Common uncertainty is 55% per annum. However, the government in country A, through various measures, reduce the uncertainty level to 15%. Decision makers in A and B will attempt to maximize the net present value of investment project. How much will be the desired fixed costs and how long will be the expected project durations in A and B? What are the net present value of the two projects? If uncertainty level in country A returns to 55% per annum due to reasons unforeseen by policy makers and business decision makers, what is the net present value of the project? What conclusion we can draw from the calculations? Country B, uncertainty: 55% S 1 K R T sigma 1.67641 0.1 8.344168 0.55 d1 d2 0.994381 -0.59436 c NPV 0.639017 1.335689 Country A, uncertainty: From 15% to 55% sigma= 15% sigma from 15% to 55% S 1 S 1 K 6.467525 K 6.467525 R 0.1 R 0.1 T 18.0339 T 18.0339 sigma 0.15 sigma 0.55 d1 0.218962 d1 1.140678 d2 -0.41803 d2 -1.19497 c 0.226577 c 0.749353 NPV -1.94737 NPV 7.48031 Discussion • When uncertainty goes up, the original project with high NPV make heavy losses. • We will examine how different discount rates affect the results. We set discount rate to be 3% and recalculate all the results. S 1 K R T sigma 2.334121 0.03 14.39269 0.55 d1 d2 0.843987 -1.24259 c NPV 0.63847 2.869267 sigma= 15% sigma from 15% to 55% S 1 S 1 K 15.85935 K 15.85935 R 0.03 R 0.03 T 67.7881 T 67.7881 sigma 0.15 sigma 0.55 d1 0.026315 d1 2.102939 d2 -1.20869 d2 -2.4254 c 0.275173 c 0.966397 NPV 33.27527 NPV -13.5815 Discussion • In a low discount rate environment, the effects are more dramatic. • The fixed cost becomes higher, duration longer and NPV larger. • When unexpected change occurs, the magnitude of loss is larger. • In current economic policy making, low interest rate is often regarded as the cure for recession. Question • If low interest rate policy have so many potential problems, why it is still so popular? • This is due to low interest rate policy is good for periods of economic growth. • In the past several hundred years, economic output has been increasing due to the low cost non-renewable resources. Economic growth and investment decisions • When the expected economic growth rates are different, investment decision will be different. Example • Suppose in a market, current annual sales capacity is 1 million dollars. Uncertainty is 55% per annum. Discount rate is 5% per annum. Decision makers will attempt to maximize the net present value of investment project depending on the estimation of expected growth rate. If expected growth rates are 1%, 3% and 5% per annum respectively, how much will be the desired fixed costs and how long will be the expected project durations? What conclusion we can draw from the calculations? Solution • Suppose the annual growth rate is x. Market size of the first year is normalized to 1. Then the total market size over n years (n can be a fractional number) is (1 x) n 1 x S 1 K R T sigma 2.316646854 0.05 13.09291999 0.55 c growth rate total market size 0.650024306 0.01 13.91460306 NPV 2.553126011 S 1 K R T sigma 2.925933454 0.05 16.00274304 0.55 c growth rate total market size 0.690290768 0.03 20.16121852 NPV 3.318182052 S 1 K R T sigma 4.1546 0.05 21.5144 0.55 c growth rate total market size 0.7608 0.05 37.1354 NPV 4.7294 Discussion • When the growth rate is higher, fixed investment and duration increases and NPV of the projects increases. • Calculations show that when discount rates are lower and uncertainty is lower, the levels of increase of fixed investment and duration are more dramatic. This shows when our projections are more optimistic, we invest more for more distant future, which could bring more disappointment if the projected future scenarios are not fulfilled. Summary • In the future, with non-renewable resources more expensive to process, the earlier advantages of low interest rate policies will no more valid while the potential disadvantages that cause business cycles will be more prominent.