Cost classification systems

advertisement

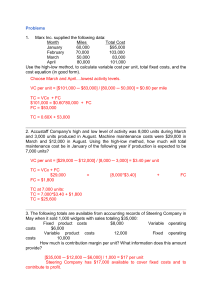

Chapter 2 Cost Analysis and Classification Systems What is cost? 'the resources consumed or used up to achieve a certain objective' Cost classification systems Cost analysis involves classifying costs according to their common characteristics. There are a number of different classification systems, each differing according to the purpose to which the cost data is to be used. Cost classification by element. Cost classification for control (direct and indirect). Cost classification by cost centre. Cost classification by behaviour. Classifying costs by element Cost classification for control One of the responsibilities of management is to ensure costs are minimised without a loss of quality to the product or service provided. To control costs, one must be able to trace costs to either a product line or a department. This can help management identify where cost over-runs have occurred, identify the problems and decide on appropriate solutions. The process of tracing costs to departments or product lines involves classifying costs according to whether they are direct costs or indirect costs. Direct cost ‘expenditure that can be attributed to a specific cost unit’ CIMA Official Terminology Indirect cost ‘expenditure on labour, materials or services that cannot be economically identified with a specific saleable cost unit’. CIMA Official Terminology Direct v indirect cost Example - Hotel Example 2.1: Calculation of direct material cost Example 2.1: Solution Example 2.2: Calculation of direct labour cost Example 2.2: Solution Example 2.3: Calculation of direct expenses Example 2.3: Solution Prime cost The prime cost can be established as follows: Cost classification by cost centre This is an extension of cost classification for control purposes. A cost centre is a location or person or item of equipment for which costs may be ascertained, and for which an individual is responsible. Cost classification by cost centre Cost classification by behaviour Cost classification by behaviour is primarily used for management planning decisions. It is a crucial classification in that it allows an insight into how costs react to different circumstances. In trying to predict and plan for the future, it is essential to understand costs and what drives and creates costs. In particular, this classification looks at the relationship between costs and sales volume / production output. When planning to increase output (sales volume), it is important to understand and appreciate how costs will react to this. Cost classification by behaviour 'the way in which cost per unit of output is affected by fluctuations in the level of activity'. Variable cost Fixed cost Example 2.4: Cost behaviour Example 2.4: Solution Variable cost Variable costs are costs that increase as sales or production volume increases. Examples would include direct materials (cost of food or beverages for a restaurant or toys in a toyshop) Variable costs in total change in response to changes in activity levels. Variable cost per unit will remain constant in relation to changes in sales activity. The graph illustrates the variable cost of producing a meal in a restaurant is €2 and, as sales volume increases, the variable costs increase. The variable cost graph shows that the variable cost of producing 2,000 meals is €4,000 and the variable cost of producing 4,000 meals is €8,000. Fixed cost Fixed costs are costs that are a function of time rather than sales activity and thus are not sensitive to changes in sales volume. Examples of fixed costs would include rent, rates, insurance and management salaries. Fixed costs in total do not change in response to changes in sales activity levels. Fixed cost per unit will change in relation to changes in sales activity. The graph shows that fixed costs are €2,000 per week. Relevant range In some situations increases in activity (volume) can affect the cost structure. For example a significant increase in volume could result in an increase in fixed costs, if the activity increases to a level where additional fixed resources are required then there will be can be a significant increase in fixed cost. Step cost Some costs are called step costs due to the fact that they are fixed for a given level of activity but they eventually increase by a significant amount at some critical point. Examples include renting an additional warehouse unit or hiring an additional supervisor when activity reaches a critical point. The graph shows that fixed costs are €2,000 up to an activity level of 2,000 meals. At this point the fixed costs increase significantly. Again at 4,000 meals another critical point is reached and fixed costs increase again. Semi-variable cost This graph shows the fixed and variable elements of a typical landline telephone charge as described above. This graph shows the fixed and variable elements of a mobile phone charge where the user pays a fixed charge for a required level of usage (number of minutes) after which the user pays for each phone call. Separating semi-variable cost Accounts analysis method High-low method Scatter-graph method Linear regression Accounts analysis method Under this method each cost is examined and, using judgement and experience, classified into fixed, variable and semi-variable categories. The semi-variable category is further apportioned individually into its fixed and variable components, normally on a percentage basis. This method is based mainly on experience and personal judgement and thus can be quite subjective. Management can however, reduce this level of subjectivity as follows. Asking a person associated with the cost item who knows its behavioural pattern and can give a best estimate of the variable and fixed components to the cost. Analysing how the cost item has responded to sales volume levels in past periods before categorising the cost. Accounts analysis method The main advantages of the accounts analysis method is that it is quick and inexpensive, however the subjectivity involved can lead to inaccuracies. Where the cost item is immaterial and is largely fixed or variable, then the accounts analysis method is acceptable. However if this is not so, other more scientific methods should be used with the accounts analysis method providing the first stage of a more analytical approach to cost behaviour analysis. High-low method The high-low method is a statistical method that establishes a cost to sales volume relationship based on past observations of how the cost reacted to changes in sales volume. This relationship is expressed in terms of the cost function y = a + b (x). The high-low method focuses on the highest and lowest levels of activity (sales volume) within the relevant range over a period of time. The total cost at these two extreme levels of activity is recorded and the difference is attributed to the behaviour of the variable cost element, which changes as activity levels change. The process seeks to calculate this variable element. The fixed element can then be calculated to complete the cost function. High-low method – the steps 1. Identify the high and low activity levels and record the cost at each level. 2. Calculate the difference in activity levels and the difference in costs. 3. Divide the cost difference by the difference in activity levels. This gives us the variable cost per room sold (b). 4. Take either the high or the low activity level and input the data including (b) as calculated in step 3 and solve the equation by finding the fixed cost element. Example 2.5: High-low method Example 2.5: Solution Scatter-graph method The scatter-graph approach is a statistical method that uses historical data to determine cost behaviour. The scatter-graph approach plots on a graph, all the historic observations of the cost items in relation to the activity levels of the business, within the relevant range. A line of best fit is then drawn visually through the data on the graph. As with the high-low method, the form of the line is assumed linear. The angle or gradient of the line represents the variable cost per unit and the fixed cost is the point where the fitted line intersects the vertical axis. Example 2.6: Scatter-graph method Example 2.6: Solution The data is plotted on the graph and a line of best visual fit is drawn and extends down to the Y (total cost) axis. The point of intersection with the Y axis represents the estimated fixed costs in this cost equation, which amounts to €2,900. The variable costs can be calculated by inputting the fixed cost and the total cost figures into a cost function based on any activity point on the line of best fit. Linear regression – least squares method This method is a statistical approach to determine the line of best fit for a given set of data. It is an extension of the scatter-graph approach and is based on the principle that the sum of the squares of the vertical distances from the regression line to the plots of the data points is less than the sum of the squares of the vertical distances from any other line that may be determined. In other words a truly objective line of best fit is calculated which minimises the squared deviations between the regression line and the observed data. Linear regression – least squares method Example 2.7: Linear regression Example 2.7: Linear regression Example 2.7: Linear regression Separating semi-variable cost Each method will give a different cost function. Of the three methods, the linear regression model is considered to have the least number of limitations. The cost function can be used in the intelligent prediction of future costs based on forecast sales activity