Foundations Strategies

advertisement

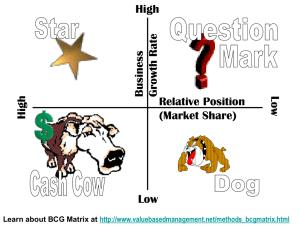

Foundation Business Simulation Strategy Strategy Strategy and Tactics differ mainly around time scale. In Foundation®, a 5-8 year Strategy is supported with annual tactical decisions. Strategic Plan should consist of: 1. Vision and Mission Statement 2. S.W.O.T. Analysis (or Environmental and Internal scans) 3. Tactical and Functional Area Plans Introduction A strategy is one of four organizational time drivers. Mission Statement (timeless) Strategy (3-5 years) Operational Intents (1 year) Tactics (Day to day) Time In Years Strategy From where in the organization strategy should emerge? Michael Porter argues for a top-down view. Strategy is designed at the top of the organization, with the goal of positioning resources and building relationships in a unique way. Porter's Generic Competitive Strategies Advantage Target Scope Low Cost Product Uniqueness Broad (Industry Wide) Cost Leadership Strategy Differentiation Strategy Narrow (Market Segment) Focus Strategy Focus Strategy (low cost) (differentiation) Cost Leadership Objective Create a sustainable cost advantage over competition to either: 1. Under-price competitors to gain market share 2. Earn higher profit margin by selling at market price Characteristics: Uses knowledge gained from past production to lower production costs Reduce costs versus competitors by efficiently performing value chain activities Low level of differentiation – standardized product Add new product features only after the market demands them Aim for average customer Tight control of overhead and R&D State of the art facilities Cost Leadership Advantages: Cost advantage protects from new entrants. Can reduce price to protect from competition Risks: Overly aggressive in price cutting (reduced prices not offset by increased sales) Fixation on reducing costs at expense of responding to changing market Technological breakthroughs - competitors may leapfrog the technology, nullifying the firm's accumulated cost reductions. Competitors may imitate the technology Differentiation Objective Incorporate differentiating features that influence buyers to prefer firm’s product or service: 1. Create value for buyers that are not easily matched or cheaply copied 2. Spend less on differentiation than the price premium that can be charged Characteristics: Include unique features Key is perceived quality (whether real or not). Actual product quality Service after sale Rapid innovation thru R&D Differentiation Advantages: Perceived quality and brand loyalty insulate company Price increases from powerful suppliers can be passed on to customers Buyers have only one source of supply. Brand loyalty protects from substitutes. Brand loyalty is a barrier to new entrants. Risks: Charging a price premium that buyers won’t support Adding features customers don’t value - customer tastes may change Imitations are a threat today because of production technology How long can the firm sustain a particular differentiation advantage? Focus (Cost or Differentiation) Objective Concentrate attention on a narrow segment of the total market: 1. Choose niche where buyers have distinctive preferences or unique needs 2. Develop unique capabilities to service target segment Characteristics: Firm must build competitive advantage into specific, difficult to mass produce value chain segment Superior service Greater selection to specific niche Focus (Cost or Differentiation) Advantages: Power over buyers since focuser may be only source of supply. Customer loyalty protects from new entrants and substitute products. Easier to stay close to customer and monitor his needs. Risks: The firm may be at mercy of powerful suppliers since focuser buys in small quantities. Small volume means higher production costs Change in consumer tastes or a technological change could cause a focuser's niche to disappear. Cost leaders or big differentiators may produce products that satisfy customers' needs - the focuser is subject to constant attack. Porter Curve High ROI Low High Market Share Porter Curve ROI High Low Market Share • Firms with High ROI / Low Overall Market Share would likely have a clearly defined focused strategy • High Overall Market Share / High ROI firms would likely have a strong position in both market segments –risky, but effective when executed properly High Porter Curve High ROI • Firms in the middle have a less definable identity, and a hard time competing. They might have a number of “sofa-bed” product lines: Not great sofas – not great beds. Low High Market Share BCG Growth/Share Matrix Market Share High Low Market Growth High Low • The Boston Consulting Group Growth-Share Matrix was developed in the 1960’s as a tool to assess a firm’s Strategic Business Unit (SBU) or product • Long-term success is achieved by having a mix of high-growth potential products that require lots of cash, and low-growth products that generate the required $$ High Low Market Growth BCG Growth/Share Matrix Market Share • Star products occupy High strong positions in high growth markets Low ? • Cash Cows occupy strong positions in low growth markets • Question Marks have low market share in segments with strong growth • Dogs are low market share products positioned in low potential markets Capstone Strategies STRATEGY Mission Statement INDUSTRY AND MARKET ANALYSIS S.W.O.T Analysis Competitor Analysis Competitive Analysis PERFORMANCE ASSESSMENT Success Measurements Analyst Report Round Analysis - Star Summary FUNCTIONAL PLANNING R&D Marketing Production HR Finance TQM Strategies are declared in corporate mission statements Foundation firms may develop and execute any strategy (or none at all - though that isn’t advisable). Basic strategies include: Overall Cost Leader Cost Leader with Focus (Low Tech or Product Life-Cycle) Differentiator Differentiator with Focus (High-Tech or Product Life-Cycle) Overall Cost Leader An overall cost leader will attempt to be the low-cost producer in both segments of the market. They will have good profit margins on all sales while keeping prices low. Firm Profile: More likely to re-position products than introduce new ones to the market Capacity improvements are unlikely to be undertaken (may run overtime instead) Automation may be pursued to increase margins Investments will be financed with debt and/or stock issues Tend to spend less on promotion and sales Focus on Market Share, Profits, and Stock Price Cost Leader With Low-tech Focus A low-tech focused cost leader seeks to dominate the low-tech market segment. Their aim is to set prices below all competitors and still be profitable. Firm Profile: Multiple product lines in the low-tech segment Invest heavily in automation Spend heavily on Promotion (less on Sales as staff has more than one product to pitch to prospects) Investments financed with debt and/or stock issues Focus on ROS, ROE, and Profits Cost Leader With Product Life-cycle Focus A product life-cycle focused cost leader will seek to minimize costs through efficiency and expertise. Products will be allowed to age and change in appeal from high-tech to low end buyers. Firm Profile: Low R&D spending (very little re-positioning, introduce new product every 2-3 years) Invest in automation early in the product’s life-cycle High spending on promotion and sales Focus on ROE, ROS, and Profits Differentiator A Differentiator will seek to create maximum awareness and brand equity. They want to be well known as makers of high quality/highly desirable products. Firm Profile: High R&D spending to keep products fresh Maintain a presence in both market segments Spend heavily on advertising and sales to create maximum awareness and accessibility Prices tend to be higher Focus on Market Share, Profits, and Stock Price Differentiator With High-tech Focus A high-tech differentiator seeks to be known far and wide as the top producer of the best performing state-of-the-art products. Firm Profile: Multiple product lines in high-tech segment Minimum focus in low-tech segment High promotion and sales investments to create maximum awareness and accessibility High R&D expenditures to continually introduce new product lines and keep existing products fresh Unlikely to invest in increased automation or production capacity Focus on ROA, Asset Turnover, and ROE Differentiator With Product Life-cycle Focus A product life-cycle differentiator seeks to be well-known as a top producer of good performing products in each of the targeted segments. Firm Profile: Multiple product lines in both segments High promotion and sales investments to create maximum awareness and accessibility High R&D expenditures to continually re-position product lines as they transition from high-tech to low-tech Unlikely to invest in increased automation or production capacity Focus on ROA, Stock Price, and Asset Turnover Strategies Evolve Today’s shift is tomorrow’s nightmare • Poor tactics undermine a good strategy • Good tactics can overcome a poor strategy Summary There is no "magic bullet," guaranteed winning strategy. Each simulation has a unique competitive dynamic. Successful firms will focus on: Planning Strategic alignment Teamwork Competitor analysis Tactical adjustments.