29 Public Choice _ Taxation

advertisement

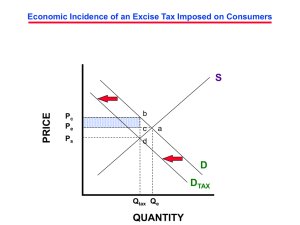

Ch 29. Public Choice Theory & the Economics of Taxation A. Public choice theory – economic analysis of gov’t decision making, politics, & elections. -- How/when/how much should gov’t intervene w/ externalities? -- Candidates offer alternative packages and voters choose. Public Choice Theory Inefficient Voting Outcomes Inefficient Majority “Yes” Vote Benefit; Tax Benefit; Tax -- Majority voting can produce inefficient decisions. -- (a) Majority voting leads to rejection$300 of a public good that produce a greater public 0 benefit than cost. -- (b) Results in accepting a public good with a higher cost than benefit. Inefficient Majority “No” Vote $700 Adams $250 Benson $350 $350 Benson Conrad “YES” “YES” $300 $200 $100 Conrad Adams “YES” “NO” “NO” “NO” 0 “NO” Wins! Inefficient Since MSB > MSC $1,150 > $900 “YES” Wins! Inefficient Since MSB < MSC $800 < $900 B. Gov’t failure 1. Special interest effect 2. Rent seeking 3. Limited & bundled choice 4. Bureaucracy -- Failure due to inefficiency from certain characteristics of the public sector. -- Special interests: small group trying to get specific outcomes. -- Rent: payment beyond what’s necessary to keep a resource supplied; securing favorable gov’t policies that result in rent (higher profit or income) than normal. -- Bundled choice deals with Congress passing an Appropriations Bill that has many amendments (many w/ nothing to do with the bill); vote yea or nay. C. The tax burden 1. Benefits-received principle 2. Ability-to-pay principle -- Benefits-received of taxation asserts businesses & households should purchase the goods & services of gov’t in same way as other commodities like a gas tax for road repairs. But, could the unemployed pay a tax for job training? -- Ability-to-pay taxation asserts that taxes are based on income & wealth. -- No scientific way to determine how much a person is able to pay in taxes. 16th Amendment (Congress to levy the Income Tax, 1913) • Applied to mostly the rich when ratified in 1913. • Extended to nearly everyone to finance WWII. • 1943, withholding system adopted to ensure collections. D. Taxes: 1. Progressive – rate w/ income. 2. Proportional – rate stays same. 3. Regressive - rate w/ income. -- The Federal tax system is Progressive. -- Overall U.S. tax system is only slightly Progressive (small redistribution of wealth). -- Many state & local tax systems are Regressive. -- In 1999, the lowest 20% of households paid an average of 4.6% Federal taxes. -- 1999, the top 10 % paid 30.6%. “…nothing can be said to be certain except death and taxes.” -- Ben Franklin Types of Taxes: -- Personal income tax -- Corporate income tax -- Payroll tax -- Property tax -- Sales tax -- Excise tax (sin tax on alcohol or cigarettes) -- California’s ‘Proposition 13’ passed in 1978 capped the amount of property tax. Tax Incidence Incidence of an Excise Tax P S’ Price (Per Bottle) -- An excise tax of a specified amount, here $2 per unit, shifts the supply curve upward by the amount of the tax per unit: the vertical distance between S & St. -- This results in a higher price ($9) to consumers and a lower after-tax price ($7) to producers. -- Thus, consumers & producers share the tax burden (equally @ $1). 14 S 12 Tax $2 10 8 6 4 D 2 0 5 10 15 20 Quantity 25 (Millions of Bottles Per Month) Q Tax Incidence Demand Elasticity and the Incidence of an Excise Tax -- (a) if demandP is elastic in the relevant price range, price rises Pe modestly P1 (P1 to Pe) with an excise tax. Pa -- Producer bears most of burden. -- (b) If demand 0 is inelastic, the price to the buyer rises drastically (P1 to Pi), most of tax on consumer. P St Tax St Tax S S a Pi a b P1 Pb De c b c Dt Q2 Q1 Tax Incidence and Elastic Demand Q 0 Q2Q1 Tax Incidence and Inelastic Demand Elastic demand: product or resource demand whose price elasticity is greater than 1. Inelastic demand: coefficient is less than 1. Q Tax Incidence Supply Elasticity and the Incidence of an Excise Tax -- With elastic P supply, an excise tax results in a large price Pe increase P1 (P1 to Pe), Pa tax paid mostly by consumers. -- (b) If supply 0 is inelastic, the price rise is small (P1 to Pi), and seller bears most of tax. P Tax St S Tax St a S Pi P1 b a b c Pb c D Q2 Q1 Tax Incidence and Elastic Supply D Q 0 Q2Q1 Tax Incidence and Inelastic Supply Elastic supply: product or resource supply whose price elasticity is greater than 1. Inelastic supply: coefficient is less than 1. Q Tax Incidence Efficiency Loss of a Tax P S’ 14 Tax Paid by Consumers 12 Price (Per Bottle) -- The levy of a $2 tax per bottle of wine increases the price per bottle from $8 to $9 and reduces the equilibrium quantity from 15 to 12.5 million. -- Tax revenue to the gov’t is $25 million (area efac). -- The efficiency loss of the tax arises from the 2.5 million decline in output, the amount of that loss is shown as triangle abc. S Tax $2 10 8 6 4 2 0 Efficiency Loss (or Tax Paid by Deadweight Loss) Producers 5 10 15 20 Quantity D 25 (Millions of Bottles Per Month) Q Incidence of U.S. Taxes Taxes on Goods and Services as a Percentage of Total Tax Revenues GLOBAL PERSPECTIVE -- A number of industrialized nations rely on a goods & 0 5 10 15 20 25 30 35 services tax United Kingdom 32.7 – sales tax, 30.8 value-added taxes, Netherlands and specific excise Germany 29.2 taxes – than the Italy 26.9 U.S. does. Sweden 26.4 -- A value-added tax only 26.3 applies to the difference Canada France between the value of a 25.4 firm’s sales and the Japan 20.1 value of its United States 17.6 purchases from other firms. Source: Organization for Economic Cooperation and Development, 2002 Facts About Income Inequality • Lorenz Curve and Gini Ratio e 100 Lorenz Curve Percentage of Income The Lorenz Curve 80 (Actual Distribution) Perfect Equality 60 d A B 40 c 20 Complete Inequality b 0 a 20 40 60 80 Percentage of Households Gini Ratio = f 100 Area A Area A + Area B Facts About Income Inequality • Effect of Gov’t Redistribution 100 Percentage of Income 80 60 Lorenz Curve After Taxes and Transfers 40 20 0 Lorenz Curve Before Taxes and Transfers 20 40 60 80 100 Percentage of Households Impact of Government Taxes and Transfers