DEBT INSTRUMENTS - Learning Financial Management

advertisement

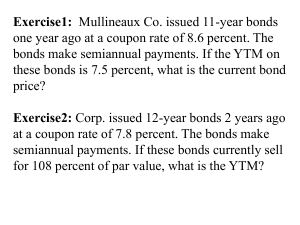

CONTENTS • KEY LEARNINGS • BOND YIELD • BOND VALUATION AND PRICING • CREDIT RATING • RISKS • YIELD CURVE • MALKEIL’S PROPERTIES KEY LEARNINGS Debt instruments Issuers of Bonds Features of Bonds Types of Debt Instruments DEBT INSTRUMENTS • A bond is a debt security, in which the issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest (the coupon) and/or to repay the principal at a later date, termed as maturity. • Bonds provide the borrower with external funds to finance long-term investments, or, in the case of government bonds, to finance current expenditure. ISSUER OF BONDS Bonds are generally issued by • Public authorities • Credit institutions • Companies • The most common process of issuing bonds is through underwriting. FEATURES OF BOND • • • • • • • Nominal, Principal or Face amount Issue price Maturity date Coupon rate Indentures and Covenants Coupon dates Optionality i.e. callability, putability, call dates and put dates • Security Types of Debt Instruments • Secured and unsecured debentures • Convertible and Non-convertible debentures • Zero interest fully convertible debentures • Secured Premium Notes • Callable and Putable Bond Floating Rate Bonds • Coupon rate of these bonds is tied to some benchmark • Eg coupon rate =Bank rate +2% • Not popular in India Deep Discount Bonds • Type of zero interest bond • Non convertible • Redeemed after expiry of specific period at face value • Return on these bonds is difference between issue price and maturity value • No coupon rate and no interest during life of the DDB Junk Bonds • • • • High risk bonds High yield bonds No or low credit rating Favourable for speculators Municipal Bonds • Issued by civic authorities of a city • Objective is to raise funds for development • Tax benefits may or may not be available • Coupon rate is low • Credit rating of issuing municipiality BOND YEILD • Percentage rate of return on the amount invested. • Benchmark for evaluating investment instruments. • It may or may not be same as coupon rate. 12 Bond Yield Depends on:1. PAR VALUE – The principal amount of a bond. Issue price and Redemption value may be > or < face value. 2. COUPON RATE (Normal yield) – Rate at which fixed annual monetary amount is payable to lender by borrower. 3. MATURITY – Period after expiry of which redemption repayment is made to investor. 4. MARKET PRICE – Return depends on the price paid for debt. 13 TYPES OF YIELD BOND YIELD 1. NORMAL YIELD 2. CURRENT YIELD 3. YIELD TO MATURITY 4. YIELD TO CALL 5. REALISED YIELD PURPOSE 1. 2. 3. 4. 5. Coupon rate. Current year rate of return. Annual rate of return till maturity. Annual rate of return till call Total return over the holding period 14 YIELD TO MATURITY • • 1. 2. 3. 4. It is market rate of return on market rate of interest. CONDITIONS – Bond is purchased today at current market price. Bond is held by investor till maturity. Interest received are reinvested at YTM itself. No interest default by the company. 15 YIELD TO MATURITY • P = Interest * PVAF(YTM,n) + RV * PVF(YTM,n) P = Market Price PVAF = Present Value Annuity Factor PVF = Present Value Factor YTM = Yield to Maturity N = Life of the Bond in years RV = Redemption Value 16 BOND PRICING AND VALUATION 17 QUESTION Investors are generally faced with the question “To invest in a particular bond or not” 18 ANSWER • Compare the security’s market price with its “value” • The security could be Over priced Under priced 19 VALUE OF A BOND • The value of a bond is defined as the sum of the present values of the future interest payments plus the present value of the redemption repayment. • It is discounted at the required rate of return called the market interest rate 20 VALUATION OF A ZERO COUPON BOND Market price of = bond Face value of bond (1+r )n Where, r = yield to maturity n = maturity period of the bond 21 VALUATION OF FIXED INTEREST RATE BONDS Market price = Interest * PVAF(r,n) + RV *PVF (r,n) Where, RV = Redemption value 22 CREDIT RATINGS • Each of the agencies assigns its ratings based on an in-depth analysis of the issuer's financial condition and management, economic and debt characteristics, and the specific revenue sources securing the bond. Credit Ratings Credit Risk Moody's Standard and Poor's Fitch Prime Aaa AAA AAA Excellent Aa AA AA Upper Medium A A A Lower Medium Baa BBB BBB Speculative Ba BB BB Very Speculative B, Caa B, CCC, CC B, CCC, CC, C Default Ca, C D DDD, DD, D Debt Instruments Type Typical Features Central Government Securities Medium – long term bonds issued by RBI on behalf of GOI. Coupon payment are semi annually State Government Securities Medium – long term bonds issued by RBI on behalf of state govt. Coupon payment are semi annually Government – Guaranteed Bonds Medium – long term bonds issued by govt agencies and guaranteed by central or state govt. Coupon payment are semi annually PSU Medium – long term bonds issued by PSU. 51% govt equity stake Corporate Short - Medium term bonds issued by private companies. Coupon payment are semi annually Risk Associated with Investing in Bonds • Interest Rate Risk • The price of the bond will change in the opposite direction from the change in interest rate. As interest rate rises the bond price decreases and vice versa. • Reinvestment Income or Reinvestment Risk • The additional income from such reinvestment called interest on interest, depends on the prevailing interest rate levels at the time of reinvestment. • Credit Risk • If the issuer of a bond will fail to satisfy the terms of the obligation with respect to the timely payment of interest and repayment of the amount borrowed. • Inflation Risk • Purchasing power risk arises because of the variation in the value of cash flow from the security due to inflation. • Exchange Rate Risk • Risk associated with the currency value for nonrupee denominated bonds. Eg: US treasury bond • Liquidity Risk Trading in bonds is very thin. Risk that the investor may not be able to sell the bond when he wants. Term Structure Of Interest Rates • It depicts the relationship between maturity and interest rates. • Graphical representation known as the YIELD CURVE. • The curve deals with the YTM and there is an implied assumption that all the interest received will be reinvested at a rate equal to the YTM. NORMAL YIELD CURVE YIELD MATURITY INVERSE YIELD CURVE YIELD MATURITY YIELD MATURITY FLAT YIELD CURVE YIELD MATURITY MALKIEL’S PROPERTIES REQUIRED RATE OF RETURN (YIELD TO MATURITY) As interest rate changes , the bond value also changes. The change in bond value due to change in interest rates is known as Interest Rate Risk. Bond value Yield to maturity Coupon Rate, YTM, Bond Value, and Par Value •If YTM =Coupon Rate ,then Bond value = Par Value •If YTM < Coupon Rate,then Bond value > Par Value •If YTM > Coupon Rate,then Bond value< Par Value Bond Valuation and Time to Maturity • The value of the bond approaches its par value as the time to maturity approaches its maturity date. •Values of long-term bonds are more sensitive to interest rate variations than the short-term bonds. BY:Akanksha Ailawadi Akanksha Sawant Akansha Agarwal Akshat Gupta Himanshi Sachdeva Pawan Agarwal Saahil Thukral Tarandeep Singh Sethi Vaishali Jaiswal