Measuring Interest Rates

advertisement

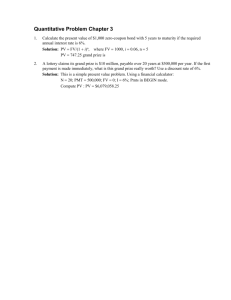

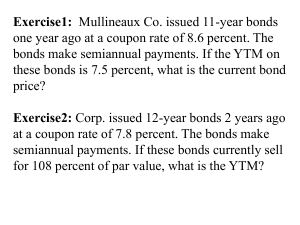

Measuring Interest Rates Bond Interest Rate is more formally called its Yield to Maturity Yield to Maturity -- the interest rate which equates the present value of all future payments with the current bond price Present Value Present Value – an equation that converts future payments into their current dollar equivalent Example 1 – Find the present value of payment received one year from now. Given P dollars today, with interest rate i, how much will you have one year from now (F)? Answer to Example 1 F = Repayment of principal + Payment of Interest F = (P) + (i)(P) = (P)(1 + i) To obtain the present value of the future payment, solve for P P = F/(1 + i) -- Present value of payment (F) received one year from now Example 2 -- Present Value of Fixed Payment (F) Received n Years From Now After One Year: F = P(1 + i) Two Years: F = [P(1 + i)](1 + i) F = P(1 + i)2 Three Years: F = P(1 + i)3 … n Years: F = P(1 + i)n Obtaining The Present Value To convert to current dollars, solve previous equation for P P = F/(1 + i)n Present Value of Payment Received n Years From Now Example 3 -- Present Value of Annual Stream of Payments Suppose one receives a payment of A1 at the end of year 1, A2 at the end of year 2, A3 at the end of year 3, …, and An at the end of year n. What is the present value (current dollar equivalent) of that series of payments? Answer to Example 3 Present Value = Sum or the present values of each payment P = A1/(1 + i) + A2/(1 + i)2 + A3/(1 + i)3 + … + An/(1 + i)n Present Value -Applications Consider formula (for simplicity, let A1 = A2 = A3 = … = An = A) P = A/(1 + i) + A/(1 + i)2 + A/(1 + i)3 + … + A/(1 + i)n Given any 2 variables, we can solve for the third. Application #1 -Given A and i, Solve for P Examples -- Multiyear Contracts, Lottery Winnings Example -- You win $100,000 for year 1 $125,000 for year 2 and $150,000 for year 3, with i = 0.08. P = $100,000/(1 + 0.08) + $125,000/(1 + 0.08)2 + $150,000/(1 + 0.08)3 = $318,834.78 Application #2 -Given P and i, Solve for A Computing Annual Loan Payments P = Amount Borrowed i = Interest rate on the loan An Example You take out a 5 year loan of $20,000 to buy a car, at a loan rate of 9% (0.09). What is your annual payment? Answer to Car Loan Problem $20,000 = A/(1 + 0.09) + A/(1 + 0.09)2 + A/(1 + 0.09)3 + A/(1 + 0.09)4 + A/(1 + 0.09)5, Solve for A A = $5141.85 Computing Monthly Loan Payments Example -- Car Loan Problem Same Present Value Formula -Minor Adjustments i = 0.09/12 = 0.0075 (monthly interest rate) n = 5 x 12 = 60 months Monthly Loan Payment $20,000 = A/(1.0075) + A/(1.0075)2 + A/(1.0075)3 + … + A/(1.0075)60 Solve for A (ugh!!) A Compressed Formula for Computing Loan Payments Consider again the present value formula. P = A/(1 + i) + A/(1 + i)2 + A/(1 + i)3 + … + A/(1 + i)n. For loan payment, given P and i, solve for A. Solution for A Based upon the solution to a geometric series, one can show that the equation solves as: A = (i)(P)/[1 – 1/(1 + i)n]. Monthly loan payment: A = (0.0075)($20,000)/[1 – 1/(1.0075)60] A = $415.17 Application #3 -Given P and A, Solve for i Example: Yield to Maturity (interest rate) on Bonds Apply present value equation to determine bond interest rates Based upon the series of future payments and the current bond price (PB) Yield to Maturity: Long-Term Bonds Information printed on the face of the bond -- Coupon rate (iC) -- Face value (F) Structure of Repayment: Long-Term Bond Series of Future Payments: Coupon (interest) payment each year equal to C = (iC)(F) along with the face value (F) (or par value) at maturity. These payments are fixed, no matter what the bond sells for. Long-Term Bonds: Bond Price and Interest Rate Bond price (PB) -- determined by market conditions, constantly fluctuating. PB < F -- the bond sells at a discount PB > F -- the bond sells at a premium PB = F -- the bond sells at par Interest Rate (Yield to Maturity) -solution to the present value equation, given future payments and bond price A General Formula Yield to Maturity: Long-Term Bond PB = C/(1 + i) + C/(1 + i)2 + C/(1 + i)3 + … + C/(1 + i)n + F/(1 + i)n Solve for i (ugh!!) An Example Find the yield to maturity for a 20 year Corporate Bond, with a coupon rate of 7% (0.07), a face value of $1000, which sells for $975. Coupon payment: C = (0.07)($1000) = $70 per year Bond also pays $1000 at maturity (year 20). Solving the Problem $975 = $70/(1 + i) + $70/(1 + i)2 + $70/(1 + i)3 + … 20 + $70/(1 + i) 20 + $1000/(1 + i) Solve for i (ugh!!) The Yield to Maturity and the Coupon Rate One can show the following properties. If PB = F (coincidentally) then i = iC. If PB < F, then i > iC. If PB > F, then i < iC. Important Property: Bonds Bond Prices and Bond interest rates are inversely related, by definition. In other words, PB i Key reason: future payments are fixed, no matter what price the bond sells for. Special Cases: Yield to Maturity, Long-Term Bonds Consol (Perpetuity) -- Pays fixed payment C each year, no maturity PB = C/(1 + i) + C/(1 + i)2 + C/(1 + i)3 + … , Solve for i PB = C/i, which implies that i = C/PB. Zero Coupon Bond -- No annual payment, just face value (F) at maturity PB = F /(1 + i)n, Solve for i i = (F/PB)1/n - 1 Yield to Maturity -Money Market Bonds Method of repayment -- Holder just receives face value at maturity Formula -- One year bond PB = F /(1 + i), Solve for i i = (F - PB)/PB Bonds With Maturities of Less Than One Year Simple Adjustment: Multiply the formula for the 1 year one by an annualizing factor. Formula: i = [(F - PB)/PB][365/(# of days until maturity)] An Example Suppose that a 90-day Treasury-Bill has a face value of $100000 and 59 days until maturity. It sells on the secondary market for $99800. Find the Yield to Maturity (i). i = [($100000 - $99800)/($99800)] x [365/59] = 0.0124 = 1.24% Other Measures of Yield or Return on Financial Assets Current Yield (iCUR), iCUR = C/PB Yield on a Discount Basis (iDB), or Discount Yield i = [(F - PB)/F][360/(# of days until maturity)] Rate of Return Rate of Return (RET) -- Annual return based upon financial asset’s current value (bonds sold before maturity, stock) Formula for Rate of Return (bond) RETt = [C + (PBt - PB,t-1)]/PB,t-1 Rate of Return: An Example Suppose that a long-term bond has a coupon rate of 5% and a face value of $1000. It sold for $990 last year and currently sells for $975. Find the Rate of Return (RET). C = (0.05)($1000) = $50 RET = [$50 + ($975 - $990)]/$990 = 0.0354 = 3.54% Implications: Rate of Return Investors can lose money (RET < 0) holding bonds. Formula also applies to stocks. Bonds and stocks are substitutes, existence of bond traders. The possibility of unknown capital gains or losses introduces uncertainty. Another Inconvenience: Market Risk Market (Asset Price) Risk -- Uncertainty due to bond prices (and interest rates) changing, affecting rate of return Market Risk i Factors affecting Market Risk Maturity Interest rate volatility (σB), or degree of interest rate fluctuation Real Versus Nominal Interest Rates Nominal Interest Rate -- Observed, unadjusted yield to maturity Real Interest Rate -- Interest Rate adjusted for inflation Key issue -- Must align interest rate and inflation measure so that they cover the same time span. The Ex-Post Real Interest Rate Ex-Post Real Interest Rate (r) r = iPAST - , iPAST = past interest rate = actual measured inflation rate (from past period to now) The Ex-Ante Real Interest Rate Ex-Ante Real Interest Rate (re) r e = i - e, i = current interest rate e = expected inflation rate (from now through the maturity of the bond) The most commonly used measure of the real interest rate The Fisher Effect Fisher Effect -- The current nominal interest rate is constantly 2%-4% above the inflation rate expected over the life of the bond. Crude initial theory of interest rate determination, shows important role of expected inflation in affecting nominal interest rates Application: Inflation-Indexed Bonds Inflation-Indexed Bonds (I-Bonds) -- T-Bonds or Savings Bonds that pay a base rate (e.g. 2%) plus an adjustable interest rate based upon the existing rate of inflation (over a the given period from the most recent past). Seeks to approximate a constant real interest rate, even though it’s actually neither the ex-ante nor ex-post measure.