Interest, Rent, and Profit

advertisement

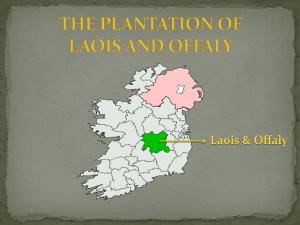

Interest, Rent, and Profit Interest • It is the price for credit or loanable funds. • It is also called the return earned by capital as an input in the production process. Demand and Supply of Credit • The equilibrium interest rate is determined by the demand for and supply of credit (loanable funds). • The Demand for loanable funds is composed of the demand for consumption loans, the demand for investment loans, and government’s demand for loanable funds. • The supply of loanable funds comes through people’s saving and newly created money. Credit Market • Supply: The higher the interest rate, the greater the quantity supplied of loanable funds, and vice versa. Demand For Loanable Funds • Roundabout Method of Production: When firm directs its efforts to produce capital goods (i.e. R&D), then uses those goods to produce consumer goods. • To finance the roundabout method of production, firm demands capital (credit). This is known as investment credit. Credit Market • The sum of the demand for consumer credit and investment credit represents the credit demand. • The interest rate and quantity demanded of credit are inversely related The Credit Market Credit Market Vs. Investment Market • The price of credit (interest) and the return on investment (capital goods) tend to equalize. • Assume: the return on capital is 10% and the price for credit is 8%. • Firm behavior: Firms will borrow in the credit market and invest in capital goods. Potential Problems on Credit Market • Risk • Length of the term of the loan • Transaction and Administrative Effect of Problems on the Price of the Credit • Higher risk Higher Interest Rate, viceversa. • Long term loan Higher the interest rate; vice versa. • Higher administrative and Transaction Costs Higher interest rates; vice-versa. Nominal Vs. Real Interest Rates • Nominal interest rate is the current interest rate (determined by the forces of supply and demand in the credit market). • Nominal Interest rate changes whenever there is disequilibrium in the credit market. Effect of Expected Inflation in the Credit Market • Individuals’ expectations of inflation are one of the factors that can change both the demand for and supply of loanable funds. Expected Inflation and Interest Rates Nominal Vs.Real Interest Rate • The Real Interest Rate is the nominal interest rate adjusted for the expected inflation rate. • Real interest rate=nominal interest rate – expected inflation rate • The real interest rate, not the nominal interest rate, matters to borrowers and lenders. Present Value • Present Value refers to the current worth of some future dollar amount. • PV=An/(1+i)n Deciding Whether to Purchase A Capital Good • Business firms often compute present values when trying to decide whether or not to buy a capital good. • As the interest rate decrease, present values increase and firms will buy more capital goods; as interest rates increase, present values decrease and firms will buy fewer capital goods, all other things held constant. Q&A • What is the present value of $1,000 two years from today if the interest rate is 5%? • A business firm is thinking of buying a capital good. The capital good will earn $2,000 a year for the next four years and will cost $7,000. The interest rate is 8%. Should the firm buy the machine? Explain your answer. Rent • Economic Rent is a payment in excess of opportunity costs. • Pure Economic Rent is a payment in excess of opportunity costs, when opportunity costs are zero Land . The total supply of land is fixed. . The payment for the services of this land is determined by the forces of supply and demand. . The payment is for a factor in fixed supply so it is refereed to as pure economic rent. Pure Economic Rent and the Total Supply of Land Economic Rent and Other Factors • The concept of economic rent applies to economic factors besides land. An example is labor. Economic Rent and the Supply of Land (Competing Uses) . A particular parcel of land, as opposed to the total supply of land has competing uses, or positive opportunity costs. (i.e. to obtain land to build a shopping mall, the developers must bid high enough to attract existing land away from competing uses.) . Thus, the supply curve of land is upward sloping. Economic Rent and the Supply of Land (Competing Uses) Artificial and Real Rents • Individuals and firms will compete for both artificial rents and real rents. • An artificial rent is an economic rent that is artificially contrived by government; it would not exist without a government. • Competing for real rents is different: if the rent is real and there are no barriers to competing for it, resources are used in a way that is socially productive. Profit • For a layperson “profits” are accounting profits, not economic profits. • Because, Economic profit is the difference between total revenue and total cost, where both explicit and implicit costs are included in total cost. Theories of Profit 1. Profit and Uncertainty. 2. Profit and Arbitrage Opportunities. 3. Profit and Innovation. Profit and Uncertainty • Risk exists when the probability of a given event can be estimated. • Uncertainty exists when a potential occurrence is so unpredictable that a probability cannot be estimated. Profit and Uncertainty • Risks can be insured against, while uncertainties cannot. Anything that can be insured against can be considered “a cost of doing business.” • The investor-decision maker who is adept at making business decisions under conditions of uncertainty makes a profit. Profit and Arbitrage Opportunities • • Buy factors in one set of markets at the lowest possible prices,( may combine the factors into a finished product), then sell the factors (product) for the highest possible price To make profit, investor (firm) must buy low, and sell high. Profit and Innovation • Profit is the return to the entrepreneur as innovator. Profit Vs. Loss Signals • Profit and loss signal how a market may be changing: 1. Resources follow profit. 2. Resources turn away from losses.