Total-factor Input Productivity Growth, Technical Progress, and

advertisement

Forthcoming in Journal of Banking & Finance

Sources of Bank

Productivity Growth in

China:

A Disaggregation View

Tzu-Pu Chang

Jin-Li Hu (http://jinlihu.tripod.com)

Ray Yutien Chou

Lei Sun

July 15, 2011

Outlines

Introduction

Methodology

Empirical results

Conclusions

2

Introduction (1/4)

In the past three decades, the Chinese banking

system has reformed gradually and gained

remarkable successes in many respects.

The

total assets of Chinese banking industry have

been more than 60 trillion RMB and increased about

300 times than that in 1978.

On November, 2009, the capital adequacy ratio and

the provision coverage of Chinese banking industry

has been larger than 10% and 150%, respectively.

Industrial and Commercial Bank of China (ICBC),

China Construction Bank (CCB), and Bank of China

(BOC) are the largest three listed banks in the world.

3

Introduction (2/4)

The financial reforms also make efficiency and

productivity improvements in the banking sector (Chen et

al., 2005; Matthews et al., 2009).

This application aims to investigate how the total-factor

productivity (TFP) changes and to disaggregate the

sources of productivity change in Chinese banking

industry from 2005 to 2009.

It is worthy that the ‘Big Four’ state-owned banks (SOBs)

have partially privatized to take on minority foreign

ownership since 2005.

4

Introduction (3/4)

Previous studies focused on productivity

change in banking typically adopt the

Malmquist TFP index or Luenberger TFP

index approach.

However, these indices are aggregative

indices, meaning that it might lack some

insights if we want to see the change of

each factor.

5

Introduction (4/4)

Therefore, this paper tries to overcome the

disadvantage of total factor productivity

index and traditional partial productivity

measures .

This paper proposes a total-factor input

productivity index (TIPI) to deal with the

above concerned. The productivity growth

of each factor under total factor concerns

can be calculated.

6

Methodology (1/4)

We first assumed that the production technology

Ft models the transformation of multiple

t

M

inputs, x R , into multiple outputs, yt RS , for

each time period t

The Luenberger productivity index relies on

directional distance functions. Following

Chambers et al. (1998), the directional distance

functions could be defined at t as:

D(t ) (xt , yt ; g x , g y ) max{ : (xt g x , yt g y ) Ft }.

S

M

R

R

where (gx, gy) is a nonzero vector in × .

7

Methodology (2/4)

The Luenberger productivity index is measured

as follows:

L(xt 1 , y t 1 , xt , y t )

1

D (t ) (xt , y t ) D (t ) (xt 1 , y t 1 )

2

D (t 1) (xt , y t ) D (t 1) (xt 1 , y t 1 ) ,

if the Luenberger productivity index is less than,

equal to, or greater than zero, then it

respectively stand for productivity regress, no

change, or progress between period t and t+1.

8

Methodology (3/4)

Briec (2000) introduces a Färe-Lovell efficiency measure

that has the advantage to select a strong efficient vector

onto the frontier.

1

D (t ) (x , y ) max

( 1

M

t

t

M )

N

s.t.

t

t

x

x

j ij io (1 i ), i 1,..., M ,

j 1

N

t

t

y

y

j rj ro , r 1,..., S ,

j 1

j 0, i 0,

j 1,..., N ; i 1,..., M ; r 1,..., S .

9

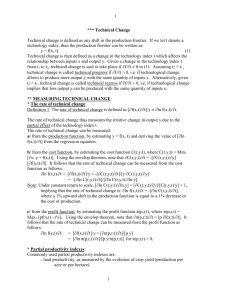

Methodology (4/4)

The TFP change can be decomposed into the

productivity change of the M individual inputs as

follows:

1

TFPCH TIPI1 TIPI 2 TIPI M

M

1

1

EFFCH1 EFFCH M TECHCH1 TECHCH M

M

M

EFFCH TECHCH

10

Data and variables’ descriptions

Based on intermediation approach, this article

specifies two outputs and three inputs to

investigate the total-factor input productivity

change of banks in China.

The

output variables include total loans, and other

earning assets.

In input variables, labors, capitals, and funds are the

conventional inputs in previous researches. Funds

defined as the total deposits; capital is measured by

the total fixed assets; labor is the total number of

employees of a bank.

11

Data and variables’ descriptions

This application collects a balanced panel data covering

2005-2009 from 21 Chinese commercial banks, including

Big Four state-owned banks, national shareholding

commercial banks, and major city commercial banks in

China.

The financial data, including the items of the balance

sheets and income statements, are taken from

Bankscope. The information on the numbers of

employees is quite incomplete in Bankscope. Therefore,

this variable is complemented through each bank’s

annual report.

All nominal prices are transferred using GDP deflator

with 2009 as the base year.

12

13

Productivity analysis at the

industry level

14

Figure 1 Cumulative changes of TFP and its components

15

Figure 2 Annually change of TFP and total-factor input productivity

16

17

Productivity analysis at the

group level

18

Note: SOB is state-owned banks; JSB is joint-stock banks; CCB is city commercial banks.

19

Change of total-factor input productivity

20

Empirical results - firm level

Innovators: 5 banks; only Bank of Beijing (#2) is the

innovator which shifts the frontiers of all inputs.

Negative growth of TFP: Bank of China

TFP growth is driven by efficiency improvement: 2

banks

TFP growth is driven by technical progress: 4 banks

Technological gains transcend the efficiency

regressions and results in TFP growth: 9 banks

21

Conclusion

There’re two advantages of TIPI

TIPI

can calculate productivity change of particular

input factor under total-factor framework

TIPI measures TFP change as the arithmetic mean of

the productivity change of each input

Thus, we can find out what is the main driver for TFP

growth

In China’s bank industry, the TFP gains are

principally driven by technical progress,

especially for capital usage.

22

The End

23